Author: Tanay Ved Source: Coin Metrics Translation: Shan Ouba, Golden Finance

Key Points

The DYDX token plays a core role in the dYdX ecosystem: it is used for governance, secures the chain through staking, and incentivizes trading behavior through rewards denominated in DYDX.

dYdX's market order book has expanded rapidly, now covering 267 perpetual contract markets, covering blue chip assets and emerging tokens.

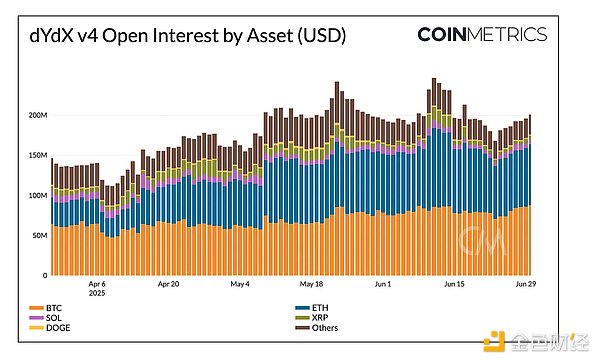

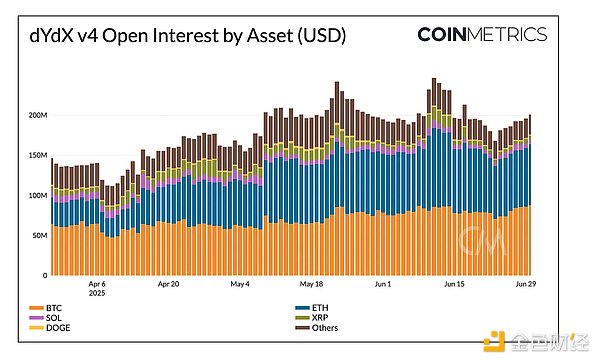

Open interest grew to $200 million in the second quarter, with Bitcoin and Ethereum markets accounting for 80% and the majority of trading volume.

Liquidity on dYdX remains deep, but more volatile than centralized platforms, showing differences in market-making models and user behavior.

Introduction

The crypto derivatives market continues to gain traction, and perpetual swaps are becoming one of the most popular trading tools.

Perpetual swaps provide continuous exposure to crypto assets without the need for expiration. With mature market mechanisms and good liquidity, they have become an important tool for users of centralized exchanges (CEX) and decentralized exchanges (DEX) for both speculation and hedging.

Today, weekly trading volume for Bitcoin perpetual swaps alone exceeds $65 billion, far exceeding the spot and options markets. Meanwhile, competition is heating up—Coinbase and Robinhood recently launched perpetual swaps, and major DEXs are vying for market share.

As adoption grows, on-chain order book DEXs are building specialized infrastructure to match the performance of centralized exchanges while retaining the transparency and self-custody benefits of on-chain systems. dYdX is a pioneer in this trend, launching dYdX Chain, an application chain designed specifically for perpetual swaps.

Building on our previous coverage of dYdX, this article further analyzes the evolving role of the DYDX token, the exchange’s market expansion, and recent dynamics in trading volume, liquidity, and funding rates.

The Role of the DYDX Token

With dYdX’s migration to an independent Layer-1 blockchain, dYdX becomes a decentralized blockchain network built specifically for perpetual swaps.

Its architecture combines off-chain order books and matching engines with on-chain settlement, providing high throughput while retaining the transparent and self-custodial features of decentralized exchanges.

The DYDX token has also evolved from an initial Ethereum-based utility token to the native asset of the dYdX Chain in the Cosmos ecosystem. Its core functions include governance, network security through staking, and alignment of trading incentives:

Governance: As a governance token, DYDX holders can stake their tokens to validators to gain voting rights on matters such as protocol software upgrades, fee adjustments, market additions, and treasury expenditures. Voting rights are proportional to the amount staked.

Staking: DYDX secures the chain through a delegated proof-of-stake (DPoS) mechanism. Delegators and validators who stake DYDX can receive rewards from protocol transaction fees (denominated in USDC).

Transaction Rewards/Incentives: Trading users can receive trading rewards denominated in DYDX, based on the net transaction fees they pay (denominated in USDC), with up to 90% of transaction fees refunded.

This model transforms DYDX from a simple governance token to a core asset that closely aligns validator and trader behavior with protocol growth, making it key to chain operations.

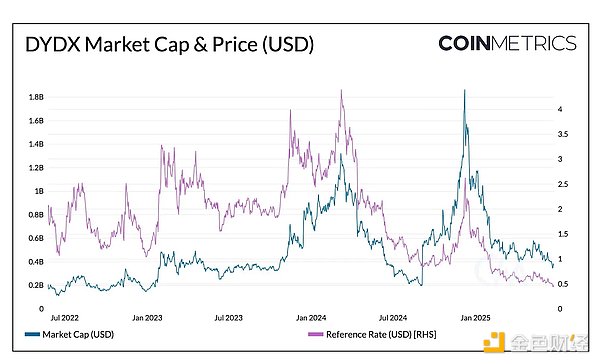

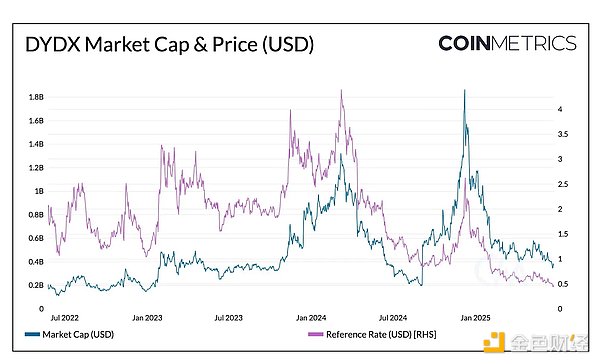

As of June 29, DYDX was priced at approximately $0.54, with a market cap of nearly $400 million. The price and market cap of DYDX have fluctuated with peak market activity, reaching a high of $4.3 in March this year.

However, despite a pullback in prices in late 2025, the market cap remains high, indicating an increase in the number of tokens in circulation. Based on the ratio of estimated market capitalization to base price, DYDX supply has grown to approximately 780 million, reflecting continued unlocking on the way to the maximum supply cap of 1 billion in July 2026.

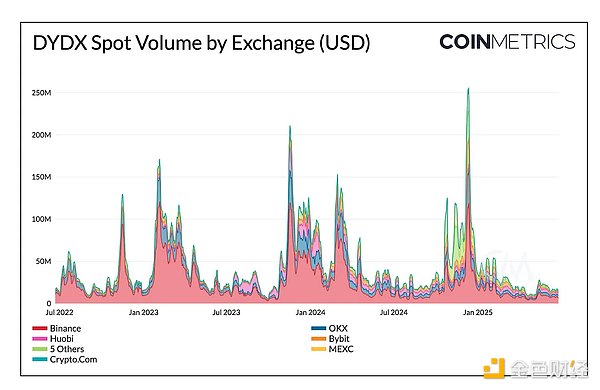

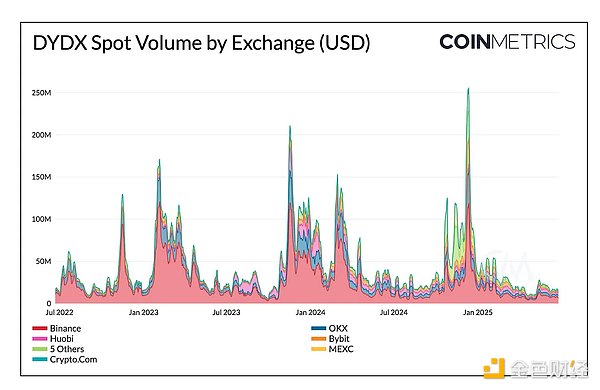

DYDX is still tradable on centralized exchanges (such as Binance, OKX, Huobi) and decentralized exchanges, with the majority of spot trading volume concentrated on these major CEXs. Spot trading volume periodically peaks, usually coinciding with protocol upgrades and broader market fluctuations.

dYdX Market Orders and Diversity

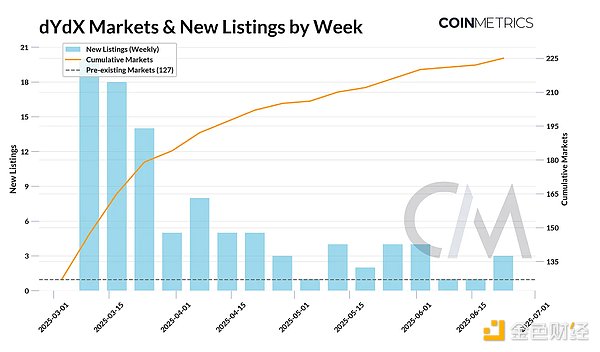

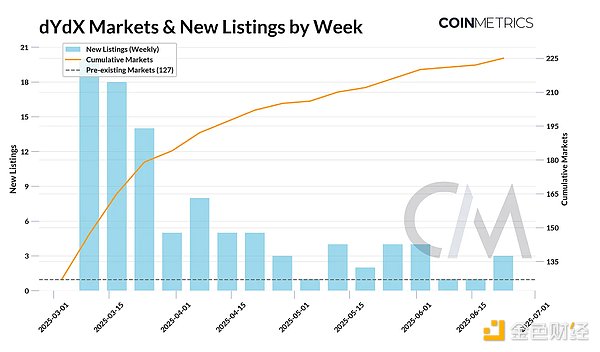

One of the core advantages of perpetual contracts DEX is the wide range of markets it offers and easy access. dYdX allows markets to be launched quickly, giving traders access to a wide range of crypto assets from large-cap tokens to emerging long-tail assets. As of June 30, 2025, dYdX supports 267 perpetual contract markets, a significant increase from the 127 markets that were previously launched.

This growth is due to the launch of the "dYdX Unlimited" feature at the end of 2024, which introduced the "Instant Market Listings" mechanism, allowing anyone to instantly create and trade perpetual contracts for any asset without governance approval. At the same time, dYdX also launched a new main USDC liquidity pool "MegaVault", where users can deposit USDC to provide liquidity for new markets on the first day of launch. Some of the new markets launched recently include SRYUP-USD, FLR-USD and DAI-USD, and the order extension will continue until late June.

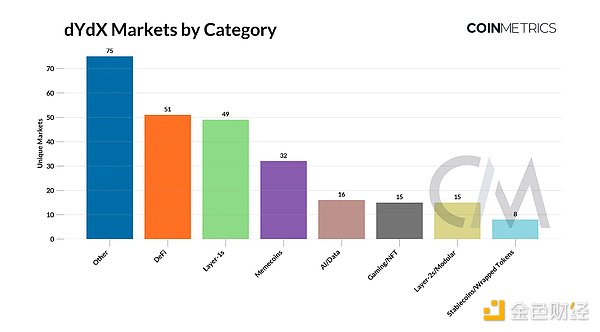

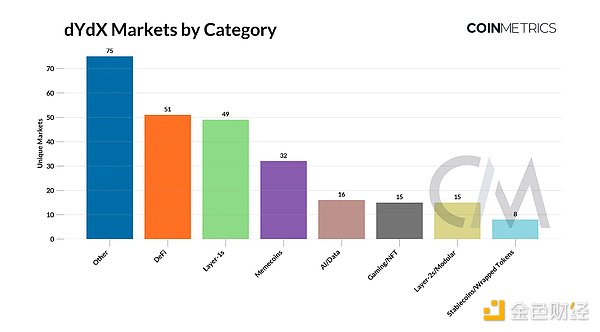

In addition to the fast launch speed, dYdX's market coverage is also very diverse, covering multiple thematic categories such as Layer-1 tokens, DeFi tokens, memecoins, and artificial intelligence (AI). This diversity allows traders to express their views in emerging narratives and niche sectors in a timely manner, and the trading process is relatively low-friction and more flexible than centralized exchanges, which often require longer approval or launch processes.

Volume and Open Interest Trends

Bitcoin and Ethereum markets continue to dominate trading activity on dYdX, accounting for the majority of daily perpetual contract volume in Q2 2025. These two assets also account for 80% of open interest on dYdX (about $163 million), up from 66% (about $93 million) at the end of Q1, when the share of "other" assets briefly increased.

While the number of long-tail markets continues to increase, most markets still have limited trading depth, and trading volume is more characterized by short-term or periodic bursts rather than sustained activity. This shows that dYdX usage remains highly concentrated in its most liquid core markets.

Funding Rates and Liquidity

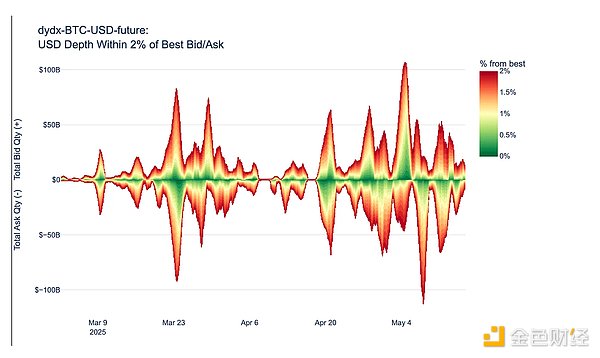

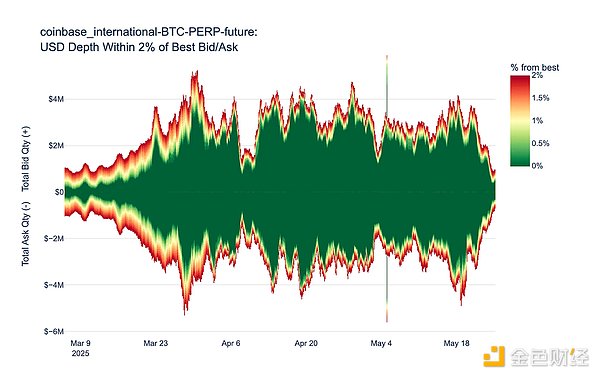

Market scope and open interest are only part of the story. For perpetual swap exchanges like dYdX, liquidity is a key metric for efficient trading and reduced slippage. To assess market quality and tradability, we need to analyze dYdX's liquidity and how its funding rates compare to other exchanges.

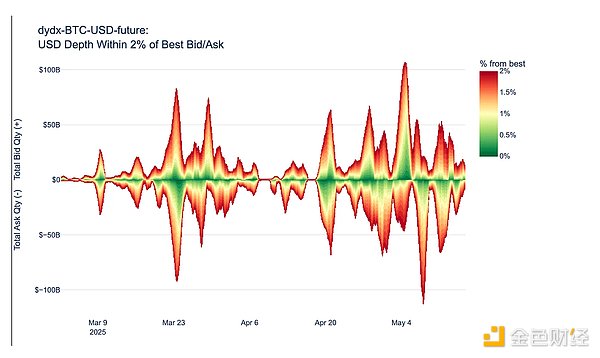

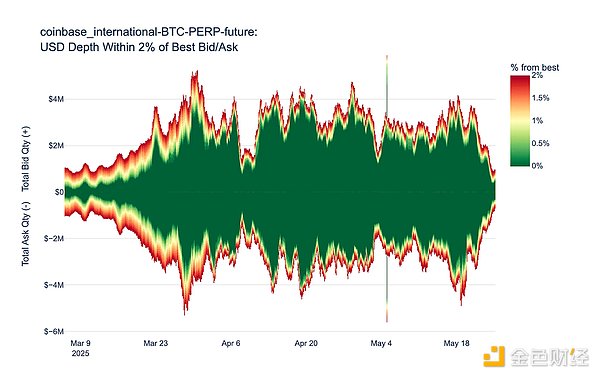

The BTC-USD order book data shown below shows the cumulative buy and sell depth of pending orders within ±2% of the mid-price from March to early May. Compared with centralized exchanges, dYdX's depth profile is more volatile, with both buy and sell depths experiencing periodic and dramatic changes. This may be due to passive liquidity provided by dYdX's MegaVault and more active market making activities as market conditions evolve.

In contrast, Coinbase International's BTC perpetual contract market, while having lower overall depth, has a more stable liquidity distribution near the mid-price. This difference between platforms reveals differences in market structure and participant behavior, which are important factors to consider when evaluating the liquidity quality of each platform.

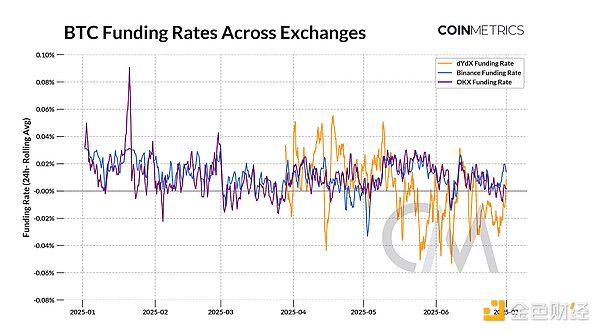

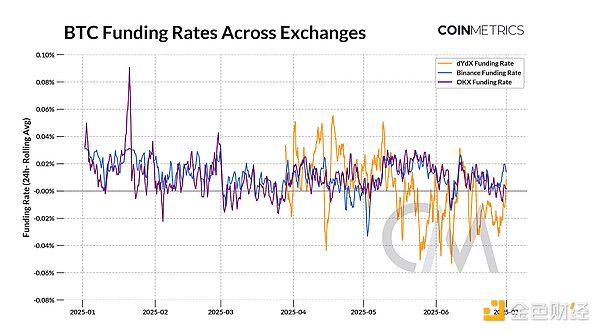

Funding rate is the core mechanism that anchors the perpetual contract price to the spot price. On dYdX, BTC's funding rate shows greater volatility and falls into negative territory more frequently than Binance or OKX. This indicates that there is periodic short position pressure on dYdX, or structural differences in participant behavior. Such funding rate differences may also provide signals for arbitrage opportunities between CEXs and DEXs.

Conclusion

As perpetual contracts become the most actively traded instrument in the crypto market, their influence continues to grow, and dYdX has become one of the leading on-chain platforms supporting this growth. Over the past year, dYdX has seen a steady increase in open interest, benefiting from the continued launch of new markets, while maintaining stable trading volumes as trading activity is mainly concentrated in BTC and ETH.

By combining a high-performance trading experience with on-chain transparency and diverse market access, dYdX continues to play a central role in shaping the future of on-chain derivatives infrastructure.

Miyuki

Miyuki