Author: Meng Yan; Source: Meng Yan's Blockchain Thinking

【Introduction】With the US Senate passing the voting motion for the US dollar stablecoin bill and the Hong Kong Legislative Council passing the Hong Kong dollar stablecoin bill, stablecoins have quickly become the hottest industry topic and have attracted wider attention. It is generally expected that with the implementation of the US dollar stablecoin bill, the blockchain digital economy will usher in a very exciting outbreak, and a new entrepreneurial window will emerge around the US dollar stablecoin and real world assets (RWA). Dr. Xiao Feng is a leader in Chinese blockchain research and practice, and has a very deep understanding of blockchain, stablecoins and RWA. In order to fully understand the opportunities of this era, I had the honor of having an in-depth exchange with Dr. Xiao Feng through video conferences and texts, and I sorted it out and published it, and discussed it with my peers. Due to the length of the original text, it is published in two parts. The first half has been published, mainly interpreting the significance of the US dollar stablecoin. This article is the second half, focusing on the stablecoin economy and the opportunities that RWA brings to Chinese entrepreneurs. The views in the article are only one person's opinion, and readers are welcome to communicate.

Upper part:Dialogue with Dr. Xiao Feng (Part 1): The US dollar stablecoin legislation is a victory for technological innovation, but the impact will be very complicated

Why? Because we have the world's strongest supply chain, engineering manufacturing capabilities and Internet operation capabilities, cross-border e-commerce has already reached scale, and e-commerce bosses are already good at traffic and efficiency. Once stablecoins are used, transaction costs will immediately decrease and settlement speed will be greatly improved. This is the starting point for the real combination with blockchain and the Chinese solution for the stablecoin economy stage.

This is not my imagination, but a reality that is happening. In the past few years, some small and medium-sized e-commerce companies that went overseas, as well as some foreign trade companies and voluntary export merchants, are now accepting stablecoins very quickly. Some of them are quite large in scale, and their ability to earn stablecoins is much stronger than many blockchain projects. This is just the beginning. I am sure that once the GENIUS Act is passed, platforms such as Amazon will immediately support stablecoin payments, and tens of thousands or hundreds of thousands of e-commerce merchants will soon become the protagonists of the stablecoin economy.

So I think it is time for Chinese Internet elites to embrace blockchain and stablecoin economy. As long as you stand firm and gather users, merchants and cash flow, you will naturally hatch a batch of high-quality RWA. For example, accounts receivable from cross-border orders and supply chain debts based on real logistics are natural on-chain assets. At that time, you don’t need to tell stories, and investors will naturally buy and sell your RWA.

So I suggest that you take the first step firmly. The stablecoin economy is the primary stage of RWA, and it is the bridgehead for blockchain to truly enter the industry and cash flow. Whoever stands firm at this stage will naturally belong to the RWA high ground in the next stage.

Meng Yan:Some people think that the RWA concept is popular and it is time to issue a coin. Create an RWA project and then issue an ICO. Is this possible?

Xiao Feng:This question should be viewed from two aspects.

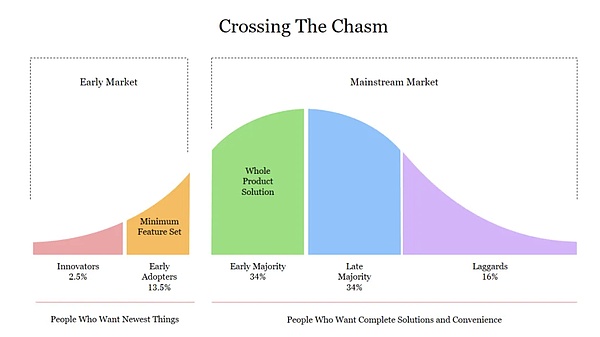

On the one hand, telling a chain story, making a protocol, and issuing a coin to get rich, this stage has passed, the wind has passed. In the past ten years, we have experienced the first growth curve of the blockchain industry, that is, the development stage dominated by infrastructure construction and coin issuance financing. At that stage, it was indeed "narrative-driven capital". Issuing a coin could drive an entire round of financing.

But looking at it again today, the marginal effect of coin issuance financing is rapidly declining. Investors in the currency circle are becoming more and more rational, and the market is becoming more and more competitive. Users have seen white papers that are not exaggerated. The key is whether you have real application scenarios and whether you can obtain users and cash flow. So I said that the energy of the first curve is already fading, and what we need is the second growth curve - the outbreak stage with applications as the core.

On the other hand, the United States did not take a one-size-fits-all approach to coin issuance financing. Instead, the United States is establishing a new legal framework for token financing through two paths. The first is the FIT21 Act, and the second is the regulatory exemption mechanism of "Token Safe Harbor". The combination of the two constitutes the prototype of a new token compliance financing system.

If you know a little about the history of US securities law, you will know that the status of FIT21 is similar to the Investment Company Act of 1933. It is a structural legislation for an economic entity, and it is parallel to the Securities Act of 1933 and the Exchange Act of 1934, and together they have laid the legal foundation for the prosperity of the US capital market for a century. Now we see that the SEC and CFTC are also constantly issuing explanatory documents to define whether tokens are securities, commodities or virtual commodities, and at the same time they are also defining regulatory responsibilities. This is the process of the gradual clarification of the entire framework.

I judge that if these two efforts can be sustained and combined, the US legislation today may "set a pattern" for token financing and token market supervision worldwide. If it develops smoothly, this may lay the foundation for a new century of prosperity in digital finance. In the past, we talked about stocks and bonds, and now we talk about RWA and Token. The form is changing, but the underlying logic of finance has not changed - that is, risk pricing, information transparency and legal protection.

I still say the same thing: Don't rush to issue coins now, first do a good job in the stable currency economic stage, build applications, and lay a solid foundation. Wait until your model is verified by the market and cash flow runs through, and then issue coins for financing according to the new US rules. Why worry about not being able to raise funds efficiently? Why worry about not being able to successfully go public? First make good products and good applications, the road to the rule of law is being opened, and the bridge of capital will naturally come to pick you up.

In the future, tokens can be traded on Nasdaq and NYSE, and conversely, exchanges like HashKey can also trade stocks. Recently, the US crypto exchange Kraken has taken the lead in announcing support for the trading of some US stock tokens. As Atkins, chairman of the US SEC, recently said, there will be some "super applications" in the future that trade all types of assets on one platform - stocks, bonds, tokens, stablecoins, RWA. This day will not be too long.

6. Chinese must be the protagonists of RWA innovation

Meng Yan:But I have communicated with many Chinese blockchain entrepreneurs and felt that they were generally lacking in confidence. The main question is that the center of this wave of stablecoins and RWA is in the United States. Due to the overall strategic competition between China and the United States, the idea of "decoupling and breaking the chain" is rampant, and nationalism is rising on both sides. Will Chinese entrepreneurs be treated differently and will they have a fair chance to compete?

Xiao Feng:If I say that this problem does not exist, it is certainly not objective. The geopolitical game between China and the United States will indeed have an impact on the entrepreneurial environment, especially in highly sensitive areas such as technology and finance. However, history has never been a single-line advancement, and reality is often more complicated and more tense than public opinion. Despite the friction, I am still very confident that Chinese entrepreneurs have not only opportunities but also unique advantages in this round of stablecoin economy and RWA.

The first reason is the huge stock advantage. In the past few years, even in the most difficult stages, China is still one of the regions with the most blockchain developers, the highest innovation and engineering quality, and the most active community activities in the world. We cannot be fooled by superficial phenomena. Behind many of the world's top projects, there are actually Chinese engineers' codes, algorithms and infrastructure. In an interview, I once bluntly suggested to the Ethereum Foundation: "Ethereum has fallen to this point today because you have lost China." From 2014 to 2016, China was the most solid base for Ethereum developers and users. Later, due to various reasons, Ethereum was absent from China, which was an important reason for its loss of momentum. This is true for Ethereum, and it is true for any global blockchain project. Whoever wins the Chinese wins the world. No one can ignore Chinese developers and communities.

The second reason is highly consistent real interests. The stablecoin economy and RWA are actually a brand-new globalization channel in the digital economy era. What does it mean to China? It means that we can bypass the traditional US dollar settlement system and centralized platforms and export Chinese goods, services and content in new ways. This will not only create jobs, drive growth and stimulate innovation, but more importantly, it can establish China's own competitiveness in the Web3 world. In other words, this is a new "digital overseas expansion".

The third reason is that the new system itself is diversified. The future stablecoin economy will not be a single structure, but a multi-level, multi-regional, spectral and granular global network. We will see an onshore dollar stablecoin economy and an offshore dollar stablecoin economy, similar to today's Eurodollar system, with broad space in Asia, Africa and Latin America. These regions have large innovation space and more flexible rules. With the enterprising spirit and vigor of Chinese entrepreneurs going overseas, these markets will become our home court.

The fourth reason is that the trend is irreversible. Once the United States completes the breakthrough, other major economies will inevitably follow suit. You see, Hong Kong has taken the lead and passed the Stablecoin Ordinance. I believe that sooner or later we will start discussing whether to develop offshore RMB stablecoins. I think this is a strategic issue that deserves serious discussion. If it can be promoted, Chinese entrepreneurs will have greater dominance and voice in these non-US dollar stablecoin ecosystems.

The fifth reason is my consistent long-term judgment-China will sooner or later embrace the trend of blockchain and digital assets. We are a country known for pragmatism. As long as this thing can promote development, serve the real economy, and create benefits, it will eventually be accepted. Once it is opened, with China's market size and entrepreneurial density, coupled with the diligence and pragmatic characteristics of the Chinese people, blockchain in China will surely usher in a blowout development and become the most prosperous innovation hotbed in the world.

Therefore, for Chinese entrepreneurs, you must not be blinded by a single leaf and miss the entire era because of local obstacles. The stablecoins and RWAs you see today are a big wave that only comes once every ten years. If you don't stand up, you will actively give up your voice. If you dare to go up, no matter how big the waves are or how strong the wind is, you will have a chance to occupy a place in this new world. I believe that Chinese entrepreneurs can do it. Five or eight years later, the stable currency economy may be worth two or three trillion US dollars. I believe that at that time, a large proportion of entrepreneurs standing at the top of the industry will be Chinese. 7. The most important innovation is the innovation of order. Meng Yan: No one doubts the ability of Chinese entrepreneurs to create high-quality products now. The market's doubts are focused on integrity. As a blockchain entrepreneur, I am very dissatisfied with the order formed in the current industry. When I decided to join this industry, I was inspired by the spirit of Satoshi Nakamoto. I felt that I could use blockchain, an open and transparent infrastructure, to build a more inclusive and fair large-scale collaborative mechanism outside of commercial companies. However, looking back over the past decade, it is not an exaggeration to say that the order established by this industry is "sowing dragon seeds and harvesting fleas." Our ideal was to oppose excessive centralized regulation, but the current order of the crypto market is worse than the one we originally wanted to replace. It is full of fraud, dishonesty, bullying, secret operations, and mutual harm without bottom line. To be honest, if it was ten years ago, the United States proposed to legislate and regulate stablecoins and crypto projects, I would probably jump out to oppose it. But now I think that since this industry cannot spontaneously generate a healthy order, it can only be imported from the outside.

Xiao Feng:Order is also a product, and it is the most important product.

You just said "sow dragon seeds and harvest fleas", I don't refute it. Over the past decade, everyone has indeed experienced the gap between ideals and reality. Starting from technological idealism, we once hoped that blockchain could spontaneously form an open, transparent and fair economic order that does not rely on traditional regulatory structures. But reality has proved that it is difficult for a market without basic rules to operate stably. This is the same as the US stock market in the 19th century. Human nature has not changed, and the results will not be different.

But the problem is not just our own fault. In the past decade, financial regulatory authorities in major jurisdictions have mostly adopted a "one-size-fits-all" approach to block the rapid development of blockchain, and have been slow to provide a clear compliance path. This has actually led to reverse selection in the market where the inferior survives the superior. Many entrepreneurs who were willing to innovate honestly and have the ability to do a good job in projects withdrew because they could not see the rules and hope. Many more radical and speculative people are left behind.

The FIT21 Act and Token Safe Harbor proposal proposed by the United States are positive signals that we have been waiting for for a long time. It is not to ban tokens completely, but to "set rules and leave a way out" for them. For example, in Token Safe Harbor, after the project party registers with the SEC, it can use tokens for financing. After three years, the regulatory agency will evaluate the degree of decentralization of the project: if it meets the standards, it can continue to operate without being treated as a security; if it does not meet the standards, it will be included in securities supervision according to law. This is the dynamic balance between supervision and innovation. It not only recognizes the high efficiency of token financing, but also establishes the bottom line and exit mechanism of supervision. In my opinion, this is a process of creating an order. It is not to cut off tokens in a one-size-fits-all manner, but to use the system to put it on the track of sustainable development.

More importantly, the establishment of this order is not only meaningful to the crypto industry. In the future, entrepreneurs in emerging industries such as AI, robotics, biomedicine, new energy, and carbon assets may also raise funds and govern in the form of tokens. This is not just a matter for Web3, but a new infrastructure issue for the entire innovation ecosystem.

So I am optimistic. The right people are willing to come in and do things according to the rules. As long as there is a clear order, they will eventually succeed. The market is not afraid of regulation, but it is afraid of no rules. As long as order can be established, innovation will naturally follow.

Meng Yan: Do you have any advice for Chinese entrepreneurs who have the courage to participate in this wave of stablecoins and RWA?

Xiao Feng:I have been asked this question quite often recently. I want to say that entrepreneurs who stand out today do need greater courage than in previous years. But just because the threshold has been raised, it also shows that this industry has begun to enter a real construction period. Some of my suggestions are also relatively simple, and I summarize them into five points for your reference.

First, go overseas. This wave is global, and you must go out and enter the eye of the storm of the times. Go to the United States, Hong Kong, Singapore, and Dubai, which are becoming the innovation frontiers of global stablecoins and RWA. If you want to participate, you can't worry about gains and losses, you must fight in the wind and waves and seize a position where the rules are being formulated.

The second is correctness. The rules of the game in the industry have changed. The path of getting rich by issuing a coin in the past is no longer feasible. Now is an era of competing for real user value and application capabilities. For every product you make and every model you design, you must ask: Can it really solve the user's problem? Can it create new efficiency? Only projects that truly create value for users will be retained by this era.

The third is learning. Not only learning technology and compliance, but also learning new ideas and new institutional frameworks. You can't use the thinking of Web2 to do Web3 things, nor can you use the thinking of issuing coins to cut leeks to speculate in the era of stablecoins and RWA. Behind this is a whole set of new paradigms. We must continue to learn and constantly break ourselves.

The fourth is grouping. In this new stage, Chinese entrepreneurs must work together, not only for self-protection, but also for resource integration, mutual learning, and even mutual supervision. This is also the beginning of building a new order in the industry. We have suffered from the "chaos in the currency circle" in the past, and those lessons cannot be repeated. Now is the starting point for rebuilding order, and we need everyone to work together to shape a healthy ecosystem.

Finally, it is openness. The essence of blockchain is an open, transparent, and fair collaborative network, which is the soul of blockchain. We must use the spirit of blockchain to participate in the stablecoin economy and RWA to innovate blockchain.

That's all, it's not a big truth, I hope it will be a little inspiring to entrepreneurs who are still thinking about whether to join this industry.

Weatherly

Weatherly

I think that

I think that