Author: Wu Wentao

When the domestic financial circle is popularizing the route from "golden rice bowl" to "iron rice bowl", American lawmakers have demonstrated their investment strength that looks down on Wall Street.

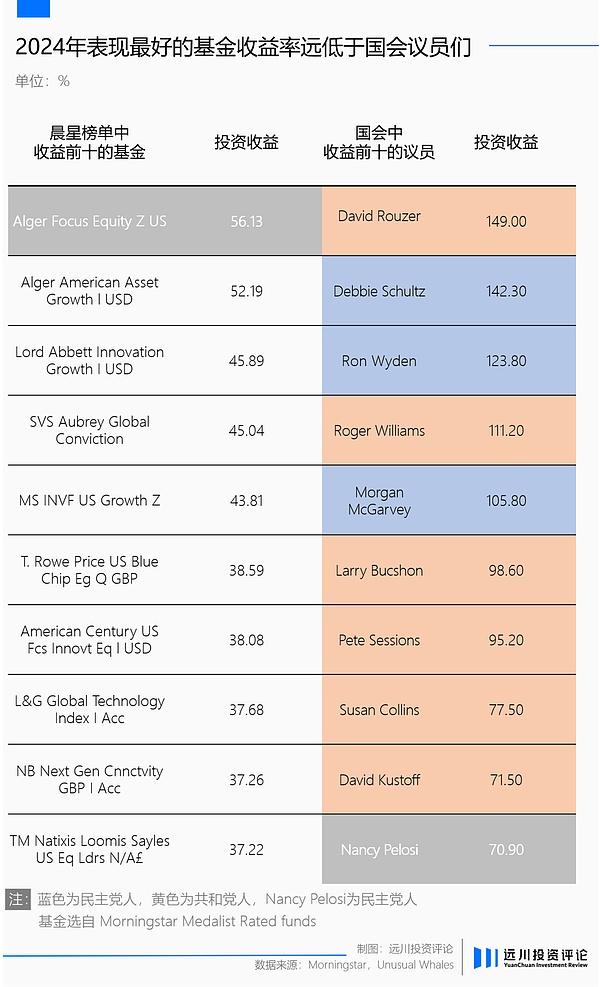

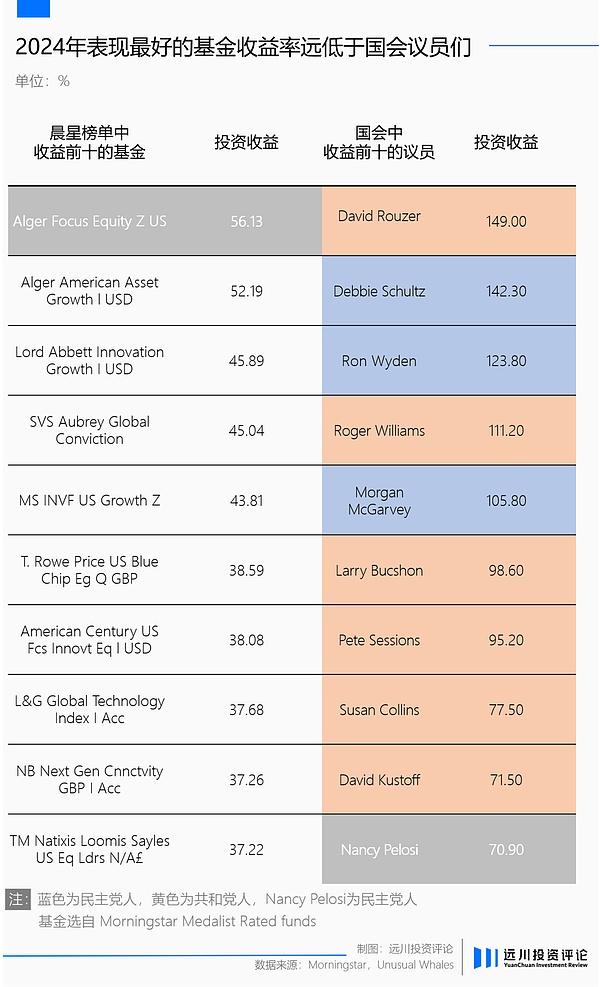

Former U.S. House Speaker Pelosi, who is known as the stock god on Capitol Hill, showed another wave of investment operations with a 70.9% return in 2024. Although it has a 40% excess over the "National Fortune Index" Nasdaq, it is only ranked tenth among all congressmen. Republican Congressman David Lauzer won the championship with an annual return of 149% thanks to his holdings in Nvidia.

In contrast, the top ten funds in the United States selected by Morningstar in 2024 have a return of only 56.13%. In the world of Capitol Hill, you can't even get your own number plate.

If the excellence of individual cases is not enough to portray the group portrait of Capitol Hill, then Unusual Whales also counted a set of averages. According to the 2024 Congressional Transaction Report they released, in 2024, the average return of Democratic members who are more inclined to hold technology stocks is 31%, while the average return of Republican members who are more inclined to hold financial and commodity stocks is 26%, which is slightly inferior. However, the average returns of both parties exceed the 24.9% increase of the S&P 500. "Beating the index" is a very challenging thing for Buffett. But in front of the members whose main business is legislation, they easily develop their sideline business of stock speculation to the point where professional institutions are ashamed.

Although the returns of the congressmen are also facing many controversies from public opinion questioning their "insider trading". But the situation has not only failed to reverse, but has moved towards a more dramatic scene in 2025.

In early April, when the entire US capital market was trembling in the face of the sudden "reciprocal tariffs", it was hard for Wall Street to imagine that President Trump would personally post the annual tweet on Truth Social on April 9 - "THIS IS A GREAT TIME TO BUY!!!", and then 4 hours later, officially announced the suspension of the implementation of "reciprocal tariffs" on 75 countries for 90 days. As expected, US stocks rose sharply.

Watching the financial center move from Wall Street to Washington, anxiety is something that only New Yorkers can do. After all, the higher the uncertainty in Washington, the greater the information gap among members of Capitol Hill.

Heart-touching "coincidences"

In the investment process of members of Capitol Hill in the United States, coincidences always happen inadvertently.

For example, Democratic Congresswoman Debbie Schultz's portfolio achieved a return rate second only to Rouzer. As a senior member of the House Military Construction Appropriations Subcommittee, the satellite operator Viasat she bought has received more than $2.7 billion in government contracts since fiscal 2020, with the Department of Defense as its main customer. For example, Republican Congressman and member of the Homeland Security Appropriations Subcommittee Dan Newhouse purchased shares of RTX, one of the government's largest contractors, in April 2024.

And Congresswoman Marjorie Taylor Greene's operation was even more precise. On April 8, 2025, she bought $11,000 to $165,000 worth of Amazon, Lululemon and other stocks that fell sharply due to the news of reciprocal tariffs; the next day she further bought $21,000 to $315,000 worth of technology stocks such as Nvidia. And all this happened before Trump posted "THIS IS A GREAT TIME TO BUY".

However, compared to what Senator Richard Burr did in 2020, the congressmen only made a limited information gap on the periphery of Capitol Hill.

On February 27, 2020, on the eve of the outbreak of the COVID-19 pandemic, US President Trump claimed that the virus might be seasonal. "It will disappear. Like a miracle, it will disappear one day," he then added, "Of course, it may get worse before it gets better."

US Senator Richard Burr obviously disagrees with this. On the 13th of that month, he sold personal stocks worth between $628,000 and $1.72 million through 33 separate transactions, including a large number of industries such as tourism and hotels that were greatly affected by the epidemic. On the eve of the market crash, the number of stocks he sold in a single day reached a nearly 14-month high.

It didn't stop there. On the same day that the president was calming the people, Richard Burr also attended a luncheon called the Capitol Hill Club. The guests attending the event represented companies and organizations from different industries in North Carolina, and they all had one thing in common: these companies or their political committees donated more than $100,000 to Burr's campaign in 2015 and 2016.

According to a secret recording of his remarks released by NPR, Richard Burr further elaborated on the severity of the COVID-19 pandemic at the luncheon. “It spreads much more aggressively than anything we’ve seen in modern history,” Richard Burr said. “It may be more similar to the pandemic of 1918[2].”

At the same time, Richard Burr made several predictions at the meeting:

1) Traveling to Europe may become dangerous;

2) Some community schools in North Carolina may be closed;

3) Military hospitals may be used to fight the epidemic.

Coincidentally, these predictions eventually became reality. 13 days later, the State Department began to warn against travel to Europe; 16 days later, North Carolina closed schools due to the threat of the coronavirus; 3 weeks later, the public began to know about the possibility of military hospitals being requisitioned.

If all the clues are connected, it is hard not to make such an association: Richard Burr not only sold his assets in advance after knowing the severity of the epidemic, but also informed his supporters who helped his campaign before the public knew the news.

Seeing the situation escalate, Richard Burr was finally forced to resign from the position of Chairman of the Senate Intelligence Committee on May 15, 2020 under pressure from public opinion.

For members of Congress, in order to get this job with an annual salary of $174,000 that has not changed in 15 years, they not only have to spend a lot of time and energy, but also have to raise millions of dollars in campaign funds, and finally get a chance to serve the American people. But from another perspective, the amount of cash Richard Burr realized from the stocks he sold during the epidemic is at least his salary income for 4 years. Although Richard Burr has now left Capitol Hill, Richard Burr's congressional investment laws are still being played out in every corner of Congress. Especially when the macro situation begins to drastically affect the expectations and valuations of the U.S. capital market, how can tariffs not be a variant of the "epidemic era"? Although in order to prevent insider trading by members of Congress, the United States has tried to introduce relevant bills, such as the STOCK Act enacted in 2012, which is a bill specifically designed to target members of Congress for profiting from insider information. But when legislators are about to vote on a bill that restricts themselves from making money from side jobs, the outcome is already doomed.

A bill that exists in name only

The culture of congressmen speculating in stocks is no secret in the United States. In 2011, a U.S. program called "60 Minutes" revealed to the public the inside story of "congressmen legally using non-public information obtained during their official duties to trade."

Peter Schweizer, a researcher at Stanford University, broke the news in his column:On the third day after the collapse of Lehman Brothers in 2008,the Secretary of the Treasury and the Chairman of the Federal Reserve gave a closed-door briefing on the economic situation to members of Congress, and members of Congress also launched a series of stock transactions after the meeting.

In particular, Spencer Backus, one of the members of the House of Representatives, bought options for a market decline the day after the meeting and ultimately made huge profits.

Faced with Peter Schweitzer's revelations, Bachus defended himself by saying, "I don't feel guilty about being a good investor. The reason I can make such a judgment is because I am one of the best investors around.[3]"

Spencer Bachus insisted that he had never used non-public information to trade, but this obviously did not convince the public. According to a poll at the time, only 9% of the public were satisfied with the performance of Congress, a record low in history.[4]

It was the time when the US Congress was re-elected. In order to gain the support of voters, the congressmen who were deeply involved in the insider trading scandal dug out the STOCK Act, which had been drafted as early as 2006 but never passed. It was officially signed by then-US President Obama on April 4, 2012.

It is worth mentioning that in the voting process, the majority of senators were in favor of passing the plan, and only three members voted against it. Richard Burr, the protagonist who made a fortune during the epidemic, is one of them. However, the core of the STOCK Act is not to prohibit transactions but to force disclosure, which explicitly requires members of Congress and their spouses to disclose transactions exceeding $1,000 within 45 days. On the other hand, the penalties of the STOCK Act are not severe. The first penalty faced by members who fail to disclose on time is only a fine of $200. In the actual implementation process, the punishment information of members of Congress will not be made public to everyone. According to an investigation by Business Insider, at least 78 members of Congress were found to have delayed submitting stock transactions between 2020 and 2022, but no one knows whether they were fined $200 for violations [5].

More importantly, even though members of Congress including Nancy Pelosi and Richard Burr have been widely questioned for suspected insider trading, since the STOCK Act was established, no member of Congress or senior member of the executive branch has actually been charged with violating the STOCK Act.

Chris Collins, one of the few congressmen convicted of insider trading, was also convicted because he knew the company's drug development results before the market while serving as a director of a pharmaceutical company, and let his son sell the relevant stocks in advance, violating US securities laws.

In July 2024, bipartisan senators jointly proposed a bill called ETHICS, whose full name is Ending Trading and Holdings in Congressional Stocks, which aims to prohibit members of Congress, their spouses and minor children from trading individual stocks.

The bill considerately makes a transitional arrangement, requiring current members of Congress to immediately stop purchasing new stocks and divest all personal stock assets at the beginning of the next Congress in March 2027. Violators of the ban must pay a fine equal to 10% of their monthly salary or 10% of the value of the illegal assets (whichever is higher).

However, the relatively mild STOCK Act was pending for 6 years from its proposal in 2006 to its passage in 2012. Now, before ETHICS, which was proposed in July last year, has had time to update the following, the stock gods on Capitol Hill have already iterated to a new version.

From the 2008 financial crisis, when lawmakers profited by trading before banks collapsed, to the 2020 coronavirus pandemic, when lawmakers sold off before the epidemic became uncontrollable, to the 2025 tariff shock, the president and lawmakers worked together in the stock market to make things happen. Nothing can better summarize the investment philosophy of Capitol Hill than “the bigger the storm, the more expensive the fish.”

Epilogue

Buffett once said that he had three investment principles: "First, don't lose money; second, don't lose money; third, always remember the first two." And for the members of Capitol Hill, preserving principal is also their first principle before facing major events.

TakeRichard Burr as an example. On the eve of the 2008 financial crisis, he told people not to panic and asked his wife to withdraw all their deposits from the bank, thus avoiding the stampede that might be caused by the financial crisis. On the eve of the outbreak in 2020, he also appeased voters while selling related stocks affected by the epidemic, thus avoiding losses caused by the subsequent stock market circuit breakers.

"Sticking to the circle of competence" is another principle of many congressmen.

For example, Rick Allen, a member of the House Education and Labor Committee who promoted the prescription drug pricing bill, would buy and sell stocks related to pharmaceutical companies; Cindy Axon, a Democratic congressman on the House Financial Services Committee, favored bank stocks; and Alan Lowenthal, a Democratic congressman who pushed for renewable energy-related legislation, had his family buy and sell solar energy company stocks 97 times between 2019 and 2021. [6]

In general, in terms of investment principles, the congressmen first do not lose money, and then stick to the operations within their circle of competence, which can be said to be a textbook-level investment guide comparable to Buffett's. However, the real stock gods rely on their ability to analyze public financial reports to gain the respect of investors around the world, while the congressmen are generally questioned for their loopholes of "be first, be smarter or cheat" in closed-door briefings.

Although Pelosi once confidently defended the congressional stock trading - "This is a free market economy, and congressmen should have the right to participate in it", in the eyes of ordinary people, Capitol Hill always has an unattainable advantage, that is, people have already got the answers before they even see the test papers.

References:

[1]Congressional Stock Trades Get Scrutiny, NPROne of Trump’s billionaire supporters has harsh words for the president about his trade war, CNN

[4]Game of Power and Money – Exposing Insider Trading of US Officials, Xinhuanet

Kikyo

Kikyo