Author: UWEB Source: X, @UWEB_CN

Can ETFs, Fed rate cuts and election events help the crypto market usher in a bull market? Former Goldman Sachs Asia FICC Business Executive Director Herman analyzes the Web3 market and major events, with the following highlights:

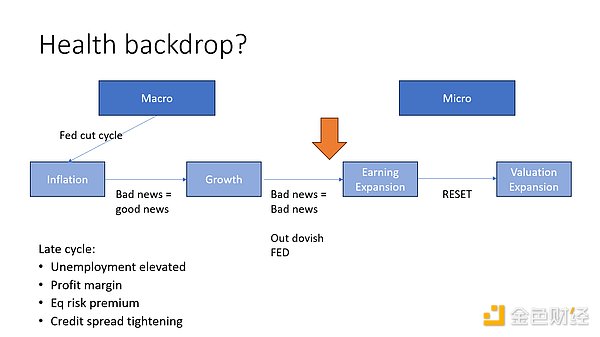

1. The market needs to pay attention to macro factors, and the Fed has not given a clear commitment to cut interest rates

As early as one and a half to two months ago, the interest rate cut had been fully priced in. The market generally expects two interest rate cuts this year. Although there was no interest rate cut in July, the market's expectation for a September interest rate cut exceeded 100%, which means that the interest rate cut may exceed 0.25 percentage points. Therefore, whether the Fed cuts interest rates or not has a very small impact on the market.

After the speech of Jerome Powell, the chairman of the Federal Reserve, we can think about macroeconomic regression, that is, re-emphasis on macroeconomic factors such as inflation and economic growth, in order to re-evaluate the possibility of the Federal Reserve's interest rate cut in September. Because J.Pow's speech emphasized data tracking, requiring data set dependent, that is, a series of data performance is good before considering interest rate cuts. This time he will give equal weight to inflation and growth, which is a positive signal. In the past, inflation was the priority, and growth was the second.

The Federal Reserve's shift to focusing on economic growth requires a high threshold: non-farm employment must be less than 125,000 before it may prompt the Fed to change its focus. This goal is difficult to achieve, so the Federal Reserve's focus is still on inflation. J.Pow mentioned that both are given equal weight in his speech, which means that inflation has been controlled to a certain extent and confidence in the future is stronger than in the past, but no clear commitment to a rate cut was given.

Compared with the European Central Bank (ECB)'s attitude towards rate cuts in March, the Fed's attitude did not give the market 100% confidence, but the market's pricing was more than 100%. The entire interest rate market may be over-interpreting the Fed's actions. Although there is a possibility of a rate cut in July, the market will experience repeated confusion and conviction in the process, which is also part of the macro uncertainty cycle.

From the beginning of the year to now, the market has experienced a shift from focusing on inflation to focusing on micro-company performance, but now it is necessary to return to macro factors. The Fed's state is worse than expected, but US stocks, including US bonds and gold, are rising. The pricing reflected by the Bitcoin market is correct.

2. The rise of US stocks is affected by Gamma hedging and CTA; the rise in long-term interest rates hits BTC liquidity assets, and the bull market is difficult to achieve this year

The logic of US stocks and Bitcoin is different: The rise of US stocks is mainly driven by Gamma hedging and CTA, and is not much affected by whether the Fed cuts interest rates. Once the uncertainty is resolved, US stocks tend to rise straight up. Rate cuts have a greater impact on Bitcoin liquidity assets, but it is not limited to this. Rate cuts affect short-term interest rates, while long-term interest rates have a greater impact on risky assets. For example, a 0.25 percentage point rate hike, if the 10-year interest rate rises by 25 basis points, will have a much greater impact than a single rate hike. The stocks of the seven major companies are not supported by liquidity, but by gravity. For example, Nvidia's PE has remained stable for a long time, mainly driven by earnings per share (EPS) and the growth of its AI business.

The risk-bearing assets in the market are divided into current assets and long-term risk assets. Current funds are invested in bank deposits, short-term bonds, etc., and long-term funds are invested in Bitcoin, stocks, long-term government bonds, etc. When the 10-year government bond yield is higher than the stock yield, investors are more inclined to buy government bonds rather than stocks. If this happens, it means that the market is in the late stage, and risky assets, especially Bitcoin, will be hit hard. The rise in long-term interest rates has a greater impact on all risky assets, especially liquid risky assets such as Bitcoin.

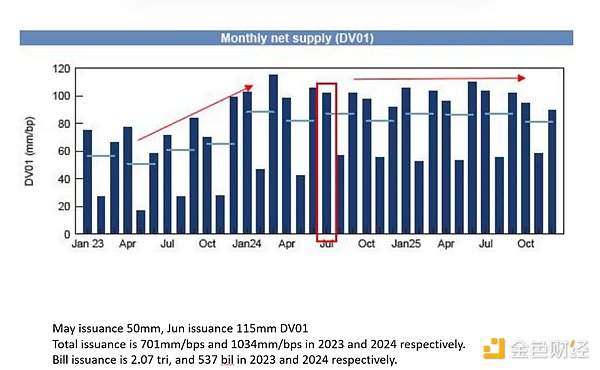

The United States began issuing bonds on a large scale last year, but the economy is still strong, with interest rates at 5.25-5.5%. Normally, interest rate hikes will lead to economic recession, but the nature of the growth of the US economy has changed. Economic growth depends on the weighted average of private sector and government debt. The U.S. government supports the economy by continuously issuing bonds, but this has also led to an intensification of the contradiction between market supply and demand. The DV01 of the U.S. bond market in 2023 is about $700 million, and it is expected to increase to $1 billion this year. The Treasury is forced to issue long-term bonds, and the buyers of long-term bonds in the market are mainly hedge funds such as Goldman Sachs, which earn interest rate spreads by purchasing long-term high-interest bonds with short-term low-interest funds. However, the current inversion of long-term and short-term interest rates and the lack of buyers have led to insufficient demand for long-term bonds. The 10-year long-term interest rate is expected to be close to 5%, which is a huge blow to non-yielding liquid assets such as Bitcoin and gold. Bitcoin currently relies on arbitrage to maintain, but in the case of reduced liquidity, altcoins may return to zero. Overall, it is difficult for liquid assets to enter a bull market. Only when long-term interest rates fall can the market usher in a turnaround, but it is difficult to see such a change this year.

3. Republican policies tend to be inflationary, which is a major negative for liquid assets Bitcoin

Republican rule is extremely unfavorable for liquid assets. For example, Bitcoin will face a major negative impact after Trump takes office. Trump's policies have led to rising inflation. One of the main measures is to impose a 60% tariff on China and a 10% tariff on other countries, which has led to a 1.1 percentage point increase in CPI and PCE, directly causing inflation to rise. When inflation rises, not only will interest rates not be cut, but they may be raised.

In addition, Trump's policy on immigration control has also affected inflation and the job market. There are two sources for employment data in the United States: Nonfarm Payroll (reflecting the real employment situation) and Household Survey (including illegal immigrants). There is an imbalance between nonfarm employment and unemployment, but the economy is still strong because of the demand brought by about 2.5 million immigrants each year and the reduction of basic wage costs. Trump's policy will reduce the entry of at least about 500,000 immigrants, which will lead to an increase in inflation. Trump's policy tends to maintain a high level of inflation in the hope that manufacturing will return to the United States, which is unlikely to happen. High inflation is extremely lethal to liquid assets, such as Bitcoin, which means that after Trump takes office, the bull market of liquid assets is impossible. 4. The continuous issuance of long-term bonds will lead to an increase in long-term interest rates, and the market will respond with penalties; the current position of the US dollar is solid, and if it is affected, it will lead to asset collapse. The United States will be forced to issue a large amount of long-term bonds, rather than selective issuance. The United States has strict guidelines and cannot rely entirely on short-term debt because it is equivalent to printing money. The guidelines only allow for a short-term debt ratio of about 25%, and although it can be slightly exceeded, it is impossible to exceed it significantly. The Bank of Japan holds 58% of its own bonds, maintaining a huge debt without affecting the financial system, but the United States must increase its bonds by 10% each year to maintain economic growth. If the increase in bonds is reduced, the economy will immediately have a hard landing. The continued increase in US bonds will inevitably lead to an increase in long-term interest rates, and the market will punish it. Trump's policies try to keep the dollar weak and promote inflation, but the market will respond by raising long-term interest rates. If long-term interest rates rise to 7%, 8%, or even 9%, all assets will be hit. Unlike China, the United States cannot control long-term interest rates, which are determined by the market. Bitcoin rose in early 2023 because it was mainly short-term bonds, not long-term bonds, and did not exceed the guidelines. But now the Ministry of Finance can no longer support it and must issue long-term bonds.

If the status of the US dollar is affected, global assets will face drastic deleveraging, and all assets will be worthless:The US dollar is the global settlement currency, and any economic crisis will eventually lead to a surge in the US dollar, and all assets, whether gold, Bitcoin or stocks, will be destroyed.

5. It is difficult to use Bitcoin as a reserve asset; if Trump is in power, the Bitcoin market may face a big market, and investment should be cautious

Crypto as a reserve asset needs to be approved by Congress, and this process is extremely complicated. Gold has a historical role as a currency, and oil is a strategic resource, but Bitcoin has no similar clear use. Using taxpayers' money to buy volatile Bitcoin requires sufficient reasons, which is extremely difficult to pass in Congress, and the proposal of Bitcoin as a national reserve asset is almost impossible to achieve. Bitcoin should be regarded as a macro asset, not a reserve asset. Trump's policy is biased towards inflation, which is not good for Bitcoin. There are emotional factors in market transactions. In the short term, it may be driven by good news, but in the long term, after Trump takes office, the Bitcoin market may face a big market. Investors should not rely too much on short-term positives.

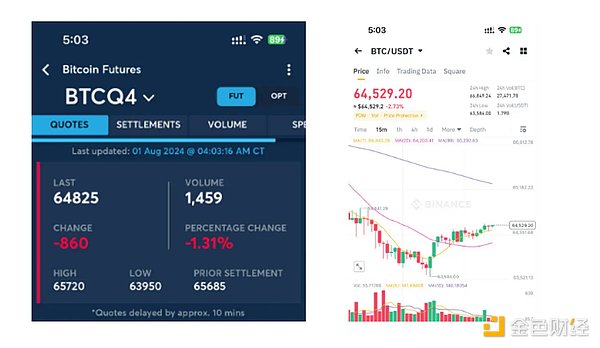

6. The current price of Bitcoin is mainly due to the arbitrage between spot ETFs and futures contracts. Once the price difference disappears, there is a risk of a sharp drop in Bitcoin in the short term

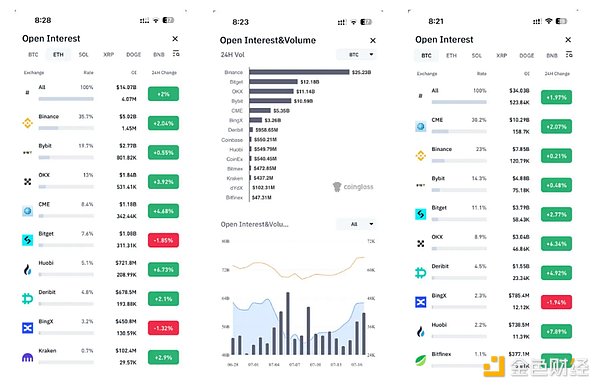

The current rise in the Bitcoin market is mainly driven by ETF expectations. During this round of rise, a total of about US$15-18 billion entered the market.

ETF buying sources include US$6-8 billion in arbitrage funds, and Bitcoin holders of about US$5 billion transfer Bitcoin to ETFs. The long-term holding part is about US$5-6 billion, and the remaining US$3 billion is active buying.ETFs are concentrated in Coinbase and are specially managed, which is equivalent to taking Bitcoin out of the circulation market, resulting in a reduction in supply. ETF arbitrage exploits the price difference between Bitcoin and futures. When the futures price is higher than the spot price, investors can buy Bitcoin in the spot market and short it in the futures market to profit.

Trading data from CME and Binance show that CME's open interest is high, reflecting that a large number of positions are not traded on a daily basis, but are used for arbitrage. High premiums trigger more arbitrage behavior, and arbitrageurs lock in risk-free returns by buying ETFs and shorting futures at the same time.

Arbitrage in the Bitcoin market drives prices up through the premiums of CEX and futures contracts. Arbitrageurs buy Bitcoin futures contracts, push up the futures premium, and then buy Bitcoin through arbitrage behavior, forming a cycle. However, these arbitrageurs make more profits when Bitcoin prices fall, because the futures price usually falls more than the spot price, and they can sell futures and spot at the same time to realize profits. At present, the premium of Bitcoin ETF is still around 10%, which attracts more arbitrage funds into the market and maintains the price of Bitcoin. However, this also brings risks. Once the premium disappears, arbitrageurs may quickly withdraw from the market and sell off ETFs and futures, causing prices to plummet.

7. Bitcoin ETFs in Hong Kong private banks are yet to be popularized, with great arbitrage potential, and ETF buying and arbitrage funds support BTC price stability

Bitcoin ETFs have not yet been accepted by most private banks in Hong Kong, and only a few top brokerages can conduct arbitrage transactions. If investors operate on their own, the arbitrage efficiency of Bitcoin ETF is very low, because it involves T+2 transaction settlement and requires frequent selling of ETF to cover positions. Effective arbitrage operations require the Prime Broker of investment banks to operate. The approval process for new products is long, and when new products such as ETH are first launched, there are limited arbitrage opportunities. As the bank's review and access procedures are completed, future arbitrage opportunities will increase, including Bitcoin ETF. Once private banks such as HSBC, JPMorgan Chase and Goldman Sachs allow trading, Bitcoin ETF will receive more buying support.

There is no bull market in BTC at present, and the price expectations of Bitcoin are divided into two situations. One is that the price of Bitcoin soars to $100,000 or $150,000, driving the bull market of other cryptocurrencies. The other is that the price of Bitcoin fluctuates between $50,000 and $70,000. The former is difficult to foresee, but ETF buying and arbitrage funds can support Bitcoin to remain in the latter range.

8.BTC is highly correlated with the U.S. stock market, and insufficient liquidity and high interest rates suppress the bull market in the altcoin market

BTC is highly correlated with the U.S. stock market, especially with U.S. bonds:It cannot be judged by the price fluctuations of the day alone, but should be analyzed from the nature of the asset and trading behavior. BTC is highly correlated with risky assets, especially liquid risky assets, which are significantly affected by the Fed's policies and the liquidity of the U.S. dollar.

Since 2021, the currency circle has undergone tremendous changes. The introduction of USDT has made it easier for funds to flow between the currency circle and the external market. Previously, the funds in the currency circle circulated internally, but now the popularity of the U.S. dollar stablecoin has changed this situation. The growth of mainstream currencies such as ETH has driven the rise of altcoins.

As a liquid asset, Bitcoin and other crypto assets are compared on the same level with the U.S. stock market due to the intervention of the U.S. dollar token. In the Bitcoin market this year, there is a lack of money-making effect, which is due to the lack of liquidity. The poor long-term interest rate of the US dollar has destroyed the previous capital circulation model. It is difficult for altcoins to form a bull market, mainly because insufficient liquidity and high interest rate environment have suppressed market activities. As a liquid asset, Bitcoin behaves similarly to lagging gold or unprofitable US stocks. Excluding the influence of the seven major technology giants, the performance of S&P 500 and S&P493 is similar to Bitcoin.

9. The US dollar interest rate remains high for a long period of time, suppressing the currency circle; a hard landing of the economy may cause the Fed to relax its policy, which is good for the currency circle

It is difficult for the currency circle to have a bull market in the short term. The US dollar interest rate will play a decisive role in the pricing of risky assets and market risk preferences. With such an increase in the scale of long-term bond issuance, interest rates will remain high for a long period of time. Pressure is put on liquid assets such as BTC.

Of course, if the US economy faces a hard landing risk, this expectation may change quickly. Although a hard landing will impact US stocks and cryptocurrency assets in the short term, it will give the Fed more reasons to intervene, which is beneficial to cryptocurrency assets. The Fed currently has a large number of tools to deal with recessions: from QT reduction, interest rate cuts, special lending, QE, etc.

10. Trump's policies or market expectations may trigger a major adjustment in US stocks. The Fed may cut interest rates or start QE. Bitcoin and other assets may usher in a bull market

There are two main reasons for the possibility of a major adjustment in US stocks: First, the US economy will have a hard landing. If Trump comes to power and implements inflation and deficit reduction policies, the issuance of treasury bonds will decrease. Once the issuance of treasury bonds, which economic growth depends on, decreases, it will inevitably lead to a hard landing and a decline in corporate profits. At present, the profits of AI companies depend on the four major cloud companies, and the income of these companies mainly comes from advertising. If the economy experiences a hard landing and advertising revenues decline, Meta and Google's earnings will fall sharply.

Second, market expectations will be adjusted. In the case of Nvidia, the market has extremely high expectations for its performance. If the performance fails to exceed expectations, the stock price will plummet. Similarly, although Microsoft's performance met expectations, its earnings slightly decreased, causing its stock price to plummet. This expectation adjustment may occur at the end of this year or the beginning of next year, triggering a substantial market adjustment.

Although the US stock market may experience a 20%-30% adjustment, it usually rebounds in the short term. If the US stock market plummets, the impact on Bitcoin will be a devastating blow. After that, the Federal Reserve may cut interest rates or launch QE, which may drive assets such as Bitcoin, Ethereum, BNB and Solana to a bull market.

11. The key to the valuation of new projects is whether they can attract investors and whether the project is unlocked after listing; large funds usually flow to BTC, ETH, BNB and Solana

The valuation of new projects mainly depends on whether they can attract the next round of investors. Most of the data of Web 3 projects are not real, so the evaluation focuses on two key points: whether they can attract new investors and whether the project is unlocked after listing. There is not much hope that Web 3 technology can change the market, and there are no projects that can be launched at present. The core is whether it can be listed on Binance. As long as it can be listed on Binance, there will be trading opportunities.

Altcoins will mostly return to zero, or at least fall by 90%. This is mainly due to liquidity problems and lack of activity in altcoins. A few altcoins such as Solana can continue the nesting game and complete the self-circulation.

The valuation model of the entire crypto market is similar to that of a casino. Mainstream currencies BTC, ETH, BNB and Solana are regarded as casino stocks. Belief is the key to supporting their value, and large funds usually flow to mainstream currencies. If you want to allocate assets, Solana is a good choice.

12. Bitcoin halving has less impact on the market, and prices are more affected by trading volume and macro factors

Bitcoin's four-year halving cycle has little impact on the market. Although halving will lead to a reduction in supply and increase deflation costs, miners, as price takers, have little bargaining power and have limited impact on Bitcoin prices. Market prices are more affected by trading volume, macro factors and other buyers and sellers. The impact of the halving cycle is gradually decreasing, and it is unrealistic that the halving cycle will inevitably bring a bull market.

*The opinions of the guests are not static. This article is only sorted out based on the live broadcast content of the day and is only for learning and sharing purposes. It does not constitute any investment advice.

JinseFinance

JinseFinance