Author: Stacy Muur Source: substack Translation: Shan Ouba, Golden Finance

The biggest news in the past 24 hours is that Berachain mainnet will be launched on February 6. Does this mean that we have finally ushered in a new public chain that can shake the dominance of Ethereum and Solana?

Why is Berachain's launch called one of the most anticipated events in the history of the chain? Will it completely change the liquidity landscape? Can their innovative PoL (liquidity consensus mechanism) really bring about disruptive changes in the economic model?

Let me share my views.

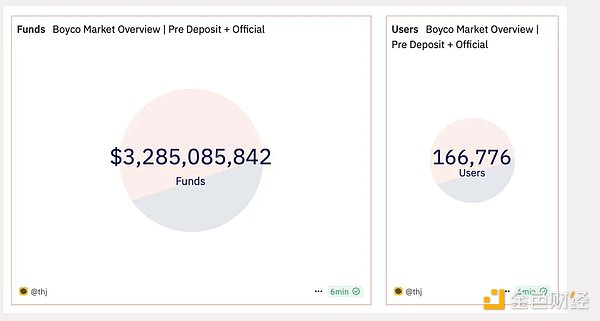

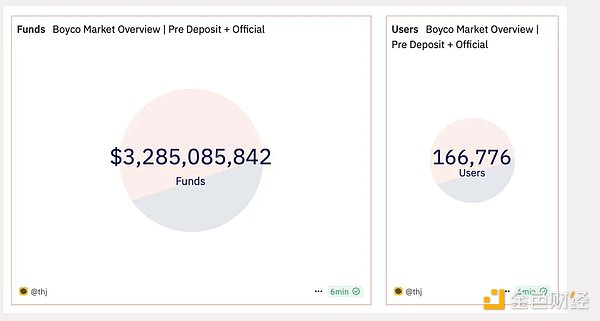

Berachain’s data

• Total financing: US$142 million (two rounds of financing), with a valuation of US$1.5 billion.

• Liquidity before mainnet launch: US$3.3 billion (data from Boyco + official Dune data), with a total of 166,000 independent wallets providing liquidity.

• Testnet data (from the launch of Bartio B2 to the end of 2024):

• 31.8 million independent addresses

• 513 million transactions

• 2.5M addresses deployed 201.2 million contracts

Even if only considering the liquidity before the mainnet launch, Berachain's TVL (total locked volume) when it entered the market has already surpassed ZKsync, Starknet, Linea and Blast.

$BERA's core innovation: Liquidity consensus mechanism (PoL)

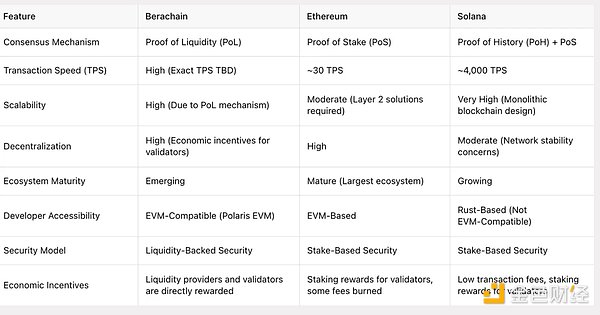

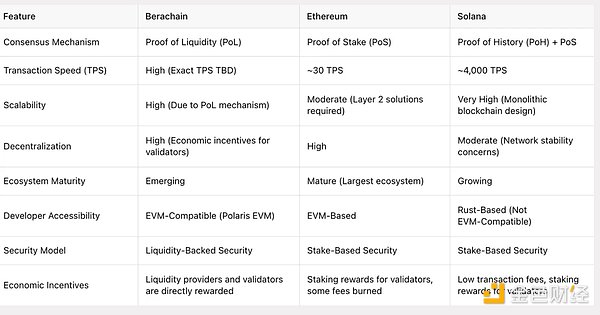

Before we delve into the potential of Berachain, we need to first understand its Proof of Liquidity (PoL) mechanism, which will be the key to comparing Berachain with modern L1.

Most blockchains (such as Ethereum, Solana) use PoS (Proof of Stake), where validators secure the network by staking native tokens.

However, Berachain pioneered the PoL (Liquidity Consensus) model, which directly integrates liquidity provision into the network security mechanism. Under the PoL mechanism, participants stake assets into the liquidity pool, which both secure the network and can be used for decentralized trading and lending. This dual function not only improves security, but also ensures that liquidity within the ecosystem is fully utilized, forming a more efficient and dynamic financial environment.

In other words, in Berachain's PoL system, liquidity providers, validators, and ordinary userscan actively participate in the network through economic incentives.

This model is in stark contrast to Ethereum's PoS, where most of Ethereum's transaction fees are destroyed or distributed in a way that cannot directly benefit active participants.

Token Economics: Key Pillars

Berachain’s token economics is built around three core tokens:

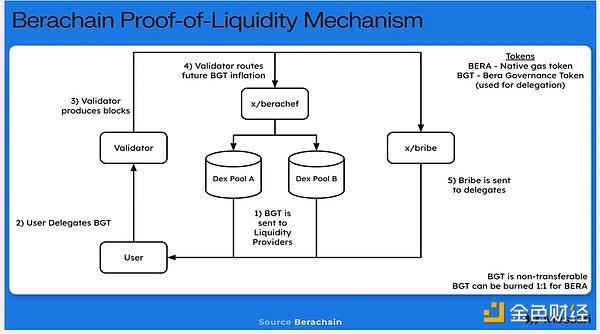

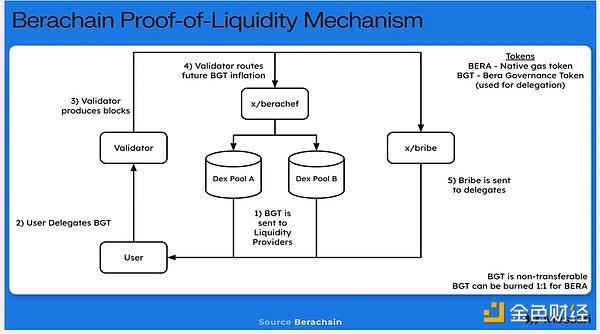

BGT (Berachain Governance Token)

A non-transferable governance token used for staking and protecting the chain.

When users provide liquidity to selected pools, they earn revenue through emissions.

Determine how new token issuance is allocated to different liquidity pools, similar to Curve's veTokenomics.

BERA (Berachain Gas Token)

Used to pay transaction fees within the network.

Created by irreversibly burning an equal amount of BGT, ensuring a deflationary mechanism tied to network usage.

HONEY (Berachain Stablecoin)

Pegged to USDC and used as the primary lending asset in Berachain's Bend lending protocol.

The currency is minted by exchanging it with USDC, generating fees collected by the blockchain.

How are they used in PoL?

Users delegate BGT to validators, who decide which liquidity pools receive emission rewards.

This creates a bribe market where DeFi projects incentivize BGT holders to direct emissions to their pools.

Liquidity providers (LPs) within the pool receive a share of BGT emissions and actively participate in governance.

Over time, governance rights are distributed to LPs, strengthening the core functionality of the chain: DeFi.

BEX (Berachain Exchange): A decentralized exchange (DEX) that rewards liquidity providers with BGT, aligning incentives with PoL.

Berps (Berachain Perpetuals): A perpetual contract trading platform using HONEY as the main collateral and liquidity token.

Bend (Berachain Lending): A lending protocol where users can borrow and lend assets, with HONEY as the main lending asset.

So how efficient is Berachain's model?

Pros:

High TVL Attraction:The model is designed to attract high Total Locked Value (TVL) early on, as LPs are incentivized to provide liquidity through BGT emissions.

Capital Efficiency:Unlike PoS chains where staked tokens sit idle, Berachain ensures that assets providing security remain liquid and available in the ecosystem.

EVM compatibility with Cosmos interoperability:Berachain’s Polaris EVM ensures Ethereum compatibility while benefiting from Cosmos’ cross-chain capabilities.

Deflationary BERA model:The irreversible BGT to BERA destruction mechanism provides a sustainable supply control method.

Disadvantages:

Governance centralization risk:Since BGT cannot be purchased but must be obtained through emission, governance rights may be concentrated in early large LPs.

Barriers to new protocols:Since Berachain includes core DeFi protocols (DEX, perps, lending), it may lose the incentive to launch new protocols.

Lack of Active Capital Flow:The model attracts passive LP capital but may struggle to generate significant revenue outside of emissions, reflecting Curve’s inefficiencies.

Final Thoughts

Berachain’s token economics is a well-thought-out system that directly ties liquidity provision to network security. While its PoL model is effective in attracting liquidity, its long-term sustainability depends on improvements in governance distribution, protocol diversity, and scalability.

If Berachain successfully scales and fosters a vibrant ecosystem outside of its established protocol, it has the potential to challenge dominant Layer-1 and Layer-2 solutions.

Jixu

Jixu