On May 27, an unknown small stock set off a huge wave in the Nasdaq trading hall.

SharpLink Gaming (SBET), a small gaming company with a market value of only $10 million, announced that it had purchased approximately 163,000 Ethereum (ETH) through a $425 million private equity investment.

As soon as the news came out, SharpLink's stock price rocketed to the sky, with an increase of more than 500% at one point.

Buying coins may be becoming the new wealth code for listed companies in the US stock market to increase their stock prices.

The source of the story is naturallyMicroStrategy (now renamed Strategy, stock code MSTR), the company that first ignited the war and boldly bet on Bitcoin as early as 2020.

In five years, it has transformed from an ordinary technology company into a "Bitcoin investment pioneer". In 2020, MicroStrategy's stock price was only more than $10; by 2025, the stock had soared to $370, with a market value of over $100 billion.

Buying coins not only swelled MicroStrategy's balance sheet, but also made it the darling of the capital market.

In 2025, the craze intensified.

From technology companies to retail giants to small gaming companies, U.S. listed companies are using cryptocurrencies to ignite a new engine for valuation.

What is the secret to the wealth code of increasing market value by buying coins?

MicroStrategy, a textbook on the integration of coins and stocks

It all started with MicroStrategy.

In 2020, this enterprise software company took the lead in starting the craze of buying coins in US stocks. CEO Michael Saylor once said that Bitcoin is "a more reliable asset for preserving value than the US dollar";

Recharging faith is wonderful, but what really makes this company stand out is its gameplay in the capital market.

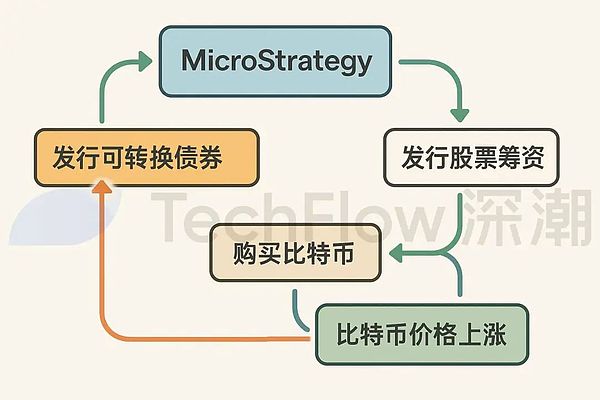

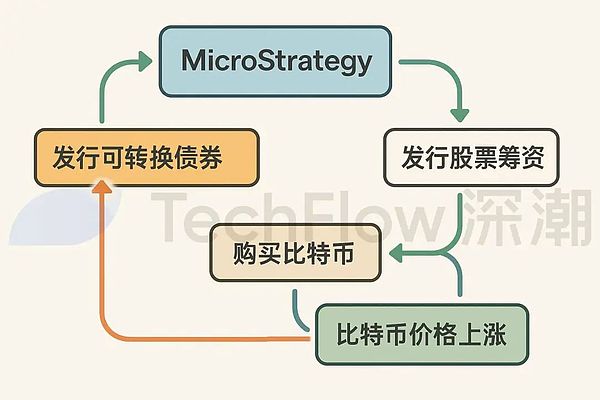

MicroStrategy's approach can be summarized by a combination of "convertible bonds + Bitcoin":

First, the company raises funds by issuing low-interest convertible bonds.

Since 2020, MicroStrategy has issued such bonds many times, with interest rates as low as 0%, far below the market average. For example, in November 2024, it issued $2.6 billion in convertible bonds with almost zero financing costs.

These bonds allow investors to convert into company shares at a fixed price in the future, which is equivalent to giving investors a call option,whileallowing the companyto obtain cash at a very low cost.

Secondly, MicroStrategy invested all the funds raised in Bitcoin. Through multiple rounds of financing, it continued to increase its holdings in Bitcoin, making Bitcoin a core component of the company's balance sheet.

Finally, MicroStrategy used the premium effect brought about by the rise in Bitcoin prices to start a set of "flywheel effects."

When the price of Bitcoin rises from $10,000 in 2020 to $100,000 in 2025, the value of the company's assets increases significantly, attracting more investors to buy stocks. The rise in stock prices enables MicroStrategy to issue bonds or stocks again at a higher valuation, raise more funds, and continue to purchase Bitcoin, thus forming a self-reinforcing capital cycle.

The core of this model lies in the combination of

low-cost financing and high-return assets. Borrow money at almost zero cost through convertible bonds, buy Bitcoin, which is highly volatile but long-term bullish, and then use the market's enthusiasm for cryptocurrencies to amplify valuations. This approach not only changed MicroStrategy's asset structure, but also provided a textbook example for other US stock companies.

SharpLink, the intention of backdoor listing is not wine

SharpLink Gaming (SBET) optimized the above approach and used Ethereum (ETH) instead of Bitcoin.

But behind this, there is also a clever combination of the power of the currency circle and the capital market.

Its gameplay can also be summarized as "backdoor listing", the core is to use the "shell" of listed companies and encryption narratives to quickly amplify the valuation bubble.

SharpLink was originally a small company struggling on the edge of delisting from Nasdaq. Its stock price was once less than $1, and its shareholders' equity was less than $2.5 million, with huge compliance pressure.

But it has a killer weapon - Nasdaq's listing status.

This "shell" attracted the attention of the giants in the currency circle: ConsenSys led by Ethereum co-founder Joe Lubin.

In May 2025, ConsenSys, together with several crypto venture capital firms (such as ParaFi Capital and Pantera Capital), led the acquisition of SharpLink through a $425 million PIPE (private equity financing).

They issued 69.1 million new shares ($6.15 per share) and quickly took over 90% of SharpLink's control, eliminating the cumbersome process of IPO or SPAC. Joe Lubin was appointed chairman of the board, and ConsenSys made it clear that it would work with SharpLink to explore the "Ethereum Treasury Strategy."

Some people say this is the ETH version of MicroStrategy, but in fact the gameplay is more sophisticated.

The real purpose of this transaction is not to improve the gambling business of SharpLink,but to become a bridgehead for the currency circle to enter the capital market.

ConsenSys plans to use the $425 million to purchase about 163,000 ETH, package it as the "Ethereum version of MicroStrategy", and claim that ETH is a "digital reserve asset".

The capital market tells a "story premium", and this narrative not only attracts speculative funds, but also provides a "public ETH proxy" for institutional investors who cannot directly hold ETH.

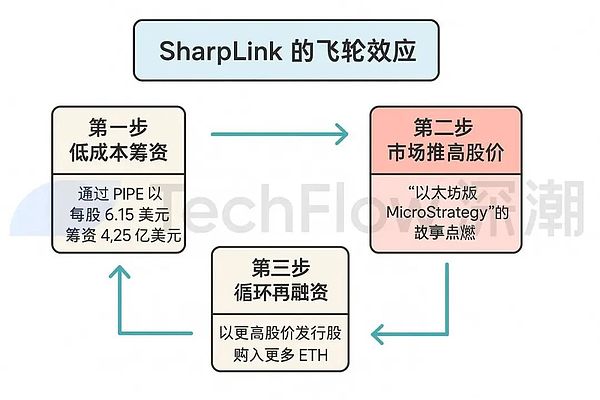

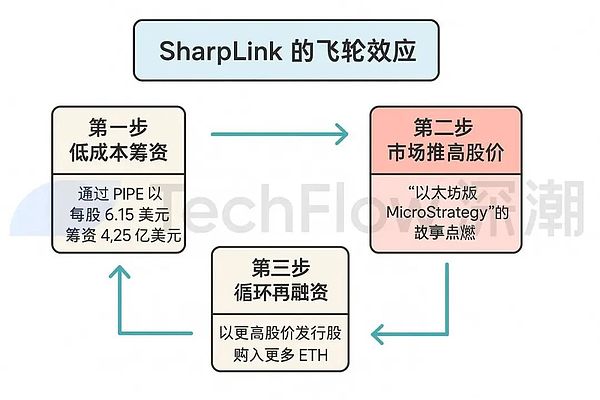

Buying coins is just the first step. The real "magic" of SharpLink lies in the flywheel effect. Its operation can be broken down into a three-step cycle:

The first step is low-cost fundraising.

SharpLink raised $425 million at $6.15 per share through PIPE. Compared with IPO or SPAC, this method does not require cumbersome roadshows and regulatory processes and is less expensive.

The second step is that market enthusiasm pushes up stock prices.

Investors were ignited by the story of "Ethereum version of MicroStrategy", and the stock price soared rapidly. The market's enthusiasm for SharpLink's stock far exceeds its asset value. Investors are willing to pay a price far higher than the net value of their ETH holdings. This "psychological premium" has rapidly expanded SharpLink's market value.

SharpLink also plans to pledge these ETH tokens and lock them in the Ethereum network, and can also earn an annualized return of 3%-5%.

The third step is circular refinancing. By issuing stocks again at a higher stock price, SharpLink can theoretically raise more funds and buy more ETH, and the cycle will repeat, and the valuation will snowball.

Behind this "capital magic", there is the shadow of a bubble.

SharpLink's core business - gambling marketing - is almost ignored, and the $425 million ETH investment plan is completely disconnected from its fundamentals. Its stock price has skyrocketed, driven more by speculative funds and crypto narratives.

The truth is,Coin circle capital can also use the "shell + buy coin" model to use the shells of some small and medium-sized listed companies to quickly inflate the valuation bubble.

The real purpose is not the wine. It is naturally good if the business of the listed company itself is related, but it is not important if there is no connection.

Imitation is not a panacea

The coin buying strategy seems to be the "wealth code" of US-listed companies, but it is not a panacea.

The road of imitation is crowded with latecomers.

On May 28, GameStop, the gaming retail giant that once became famous for its retail investors' battle against Wall Street, announced that it would purchase 4,710 bitcoins for $512.6 million in an attempt to replicate MicroStrategy's success. But the market reacted coldly: After the announcement, GameStop's stock price fell 10.9%, and investors did not buy it.

On May 15, Addentax Group Corp (stock code ATXG, Chinese name Yingxi Group), a Chinese textile and clothing company, announced plans to purchase 8,000 Bitcoins and Trump's $TRUMP coin by issuing common stock. At the current Bitcoin price of $108,000, the purchase cost will be as high as more than $800 million.

But as a comparison, the company's total stock market value is only about $4.5 million, which means that its theoretical purchase cost is more than 100 times the company's market value.

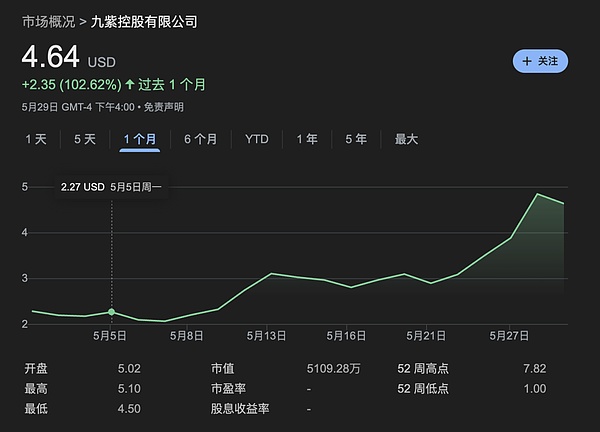

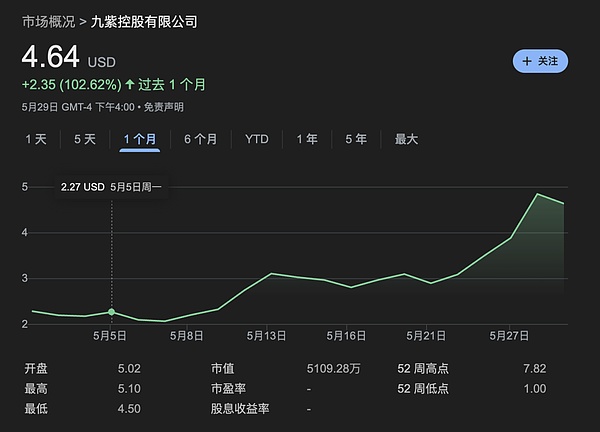

Almost at the same time, another Chinese US-listed company Jiuzi Holdings (stock code JZXN, Chinese name Jiuzi Holdings) also joined the coin buying craze.

The company announced plans to purchase 1,000 bitcoins in the next year, at a cost of more than $100 million.

Public information shows that Jiuzi Holdings is a Chinese company focusing on new energy vehicle retail, founded in 2019. The company's retail stores are mainly distributed in third-tier and fourth-tier cities in China.

And the total market value of the company's stock on Nasdaq is only about $50 million.

The stock price is indeed rising, but the matching degree between the company's market value and the cost of buying coins is the key.

For more latecomers, if the price of Bitcoin falls, if they really buy it, their balance sheets will face tremendous pressure.

The strategy of buying coins is not a universal code for wealth. Lack of fundamental support and excessive leverage in buying coins may just be an adventure leading to a bubble burst.

Another way out of the circle

Despite the risks, the craze for buying coins may still become the new normal.

In 2025, global inflationary pressures and expectations of dollar depreciation continue, and more and more companies are beginning to regard Bitcoin and Ethereum as "anti-inflation assets." Japan's Metaplanet has increased its market value through Bitcoin treasury strategy, and more US listed companies are following MicroStrategy's path faster and faster.

Under the general trend, cryptocurrencies are increasingly showing up in global politics and economics.

Is this a kind of "out of the circle" that people in the currency circle often talk about?

Comprehensively observing the current trend, there are two main paths for cryptocurrencies to go out of the circle and into the mainstream:

The rise of stablecoins and crypto reserves in corporate balance sheets. On the surface, stablecoins provide a stable medium for payment, savings and remittances in the crypto market, reduce volatility, and promote the widespread use of cryptocurrencies. But its essence is an extension of the hegemony of the US dollar.

Take USDC as an example. Its issuer Circle has a close relationship with the US government and holds a large amount of US debt as reserve assets. This not only strengthens the global reserve currency status of the US dollar, but also further penetrates the influence of the US financial system into the global crypto market through the circulation of stablecoins.

Another way out of the circle is for listed companies to buy coins as mentioned above.

Coin buying companies attract speculative funds and push up stock prices through encryption narratives, but except for a few leading companies, it remains a mystery how much the fundamentals of the main business of subsequent imitators can improve in addition to increasing market valuations.

Whether it is stablecoins or encrypted assets entering the balance sheets of listed companies, encrypted assets look more like a tool to continue or strengthen the previous financial structure.

Whether it is cutting leeks or financial innovation, this is more like looking at the two sides of a coin, depending on which end of the table you sit.

Catherine

Catherine