According to media reports, Joe Consorti, director of BTC custody service provider Theya, believes that BTC prices are expected to reach a new historical high between the third and fourth quarters of 2025, and said: "When the printing press starts running, gold will be the first to notice, and then BTC will follow more violently."

Value Storage Showdown: BTC Vs. Gold

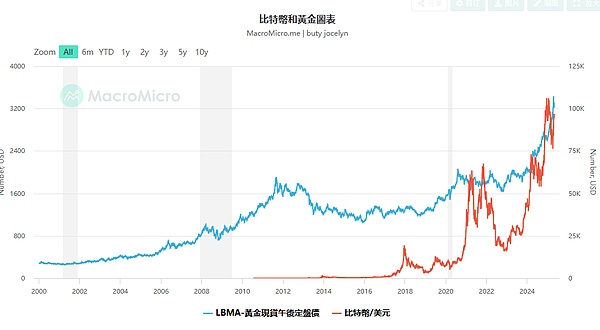

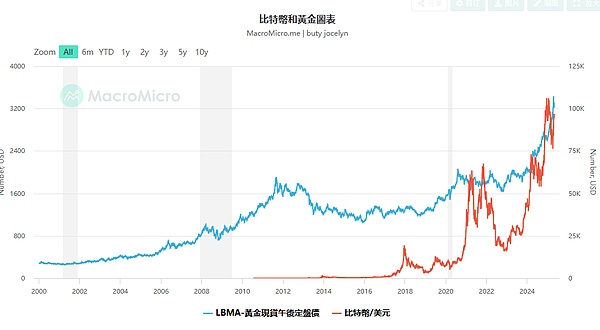

From 2000 to early 2008, the spot gold price (ie London gold) was flat, with a trough price of US$255.

Data source: LBMA's gold spot afternoon fixing price

In September 2011, as the Federal Reserve's loose monetary policy significantly increased the money supply, the spot gold price rose rapidly to $1,851.

Since 2013, the price of BTC has gradually climbed and exceeded $100. In October 2013, the price of BTC exceeded $1,000.

From 2011 to 2020, the Federal Reserve continued to implement loose monetary policy, and the price of gold was in the range of $1,000 to $1,500.

In 2020, the COVID-19 outbreak and the "gold buying fever" surged, accelerating the growth of gold prices, reaching $1,944.75 in August 2020. In 2024, with the increasing uncertainty in the global political and economic situation, the price of gold rose sharply and rapidly, reaching another high of $2,736.45 in October 2024.

In 2018, BTC saw its first price surge, with the price rising to $16,408;

In 2021, it continued to soar to

On April 22, 2025, the spot gold price soared to $3,499.83 per ounce on that day, a recent high.

Since the historical prices of gold and BTC have shown convergence in the upward trend, when the gold price hits another new high, the subsequent price trend of BTC has attracted much attention.

△ BTC and gold price trend chart

Source: sc.macromicro.me

Price correlation of safe-haven assets

Gold has long been regarded as an important safe-haven asset, and is usually preferred when the portfolio needs to enhance liquidity hedging capabilities or as a reserve tool. Due to its scarcity, stability, indivisibility, and its value not being attached to national sovereign credit, gold has also become an important defensive asset for countries in the face of inflation risks.

The total supply of the digital asset BTC is constant at 21 million, and it adopts a "halving" mechanism every four years (the most recent one occurred in April 2024), which makes it have scarcity and anti-inflation characteristics similar to gold, and is called "digital gold". Since the outbreak of the new crown epidemic in 2020, the US dollar has weakened and global sovereign credit risks have risen, and BTC has begun to attract more and more attention from safe-haven funds.

After the Bitcoin spot ETF was listed in 2024 and the US government included BTC in the "strategic reserve option" in 2025, it not only promoted the expectation of more sovereign funds to enter the digital asset market, but also increased the further attention of global investors to safe-haven assets. At the same time, investors are also trying to find more correlations between the price trends of gold and BTC and the triggering of market sentiment.

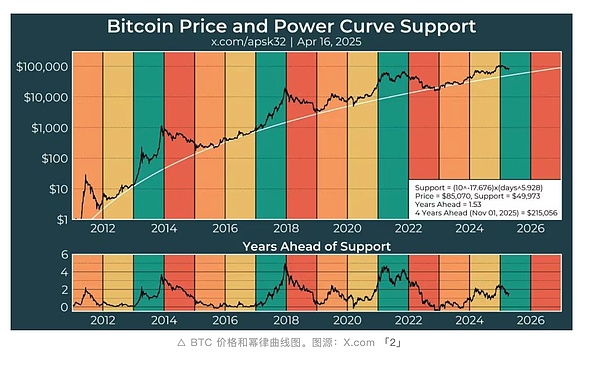

According to the law of past price trends, the price of BTC tends to peak within 12 to 18 months after halving. The peak of this cycle is expected to occur in May 2025, with a price target of $156,000.

From April 28 to May 4, 2025, the spot price of BTC fluctuated between $92,785.32 and $97,895.76, with an amplitude of 5.51%.

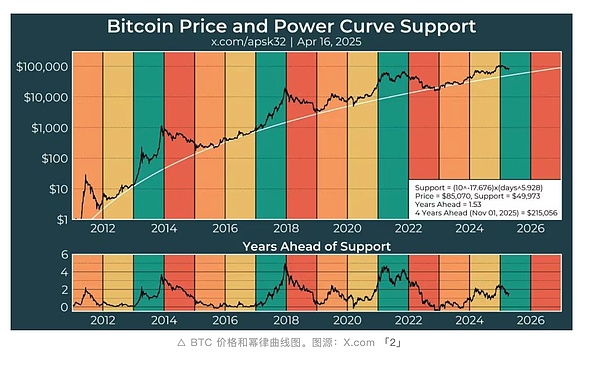

Based on the mechanism of BTC's halving every four years and the power curve fitting of BTC's market value in gold ounces, analyst apsk32 predicts that the price of BTC is expected to reach $450,000 in November or December 2025. 「1」 Investor Robert Kiyosaki also published a forecast on the X platform for the BTC price, but it was relatively conservative, predicting that the BTC price will reach $200,000 by the end of 2025.

JP Morgan Chase predicts that gold prices will continue to rise, and are expected to reach $3,675 per ounce by the end of 2025 and break through $4,000 by mid-2026.

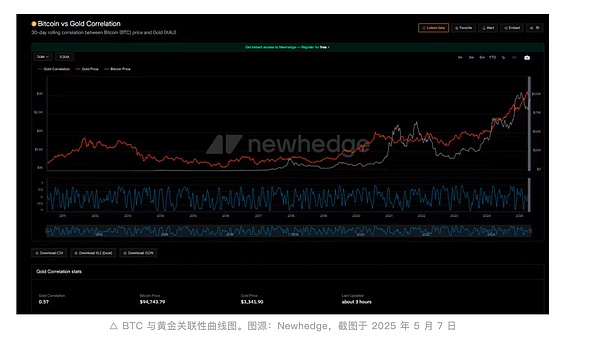

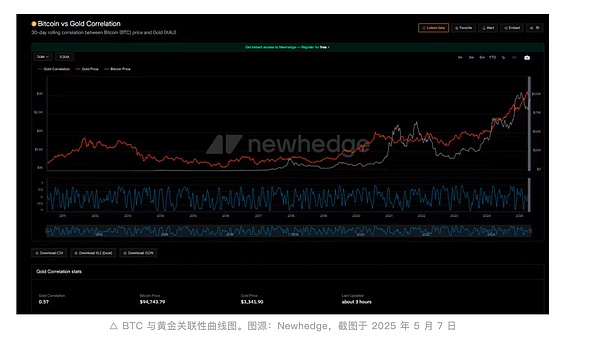

Data from data platform Newhedge shows that as of May 7, 2025, the correlation index between gold and BTC is about 0.57「4」. Some analysts believe that considering the macroeconomic situation, this correlation may increase as the two compete for capital inflows in the safe-haven asset market.

Projection of the same market sentiment

Joseph Cavatoni, senior strategist for North American markets at the World Gold Council, believes that when risk assets rise, BTC and gold (prices) are positively correlated. But when the market falls, gold (price) is negatively correlated, while BTC (price) is positively correlated.

Galaxy Digital CEO Mike Novogratz said in an interview with CNBC media: BTC and gold are both key indicators of financial management.

Against the backdrop of increasing global macroeconomic uncertainty, the role of BTC and gold in the safe-haven asset market is actually to collaborate with each other, carrying the emotional changes of investors' concerns about the outlook for the US dollar and US Treasury bonds in price fluctuations, and resolving the volatility brought by hot money in times of economic uncertainty.

However, due to the virtuality of digital assets and the large differences in regulatory systems in different countries around the world, gold, as a physical safe-haven asset, has higher certainty and stability. This is also what Kang Qiao, senior strategist for the North American market at the World Gold Council, believes: Under the comprehensive consideration of the three factors of investment diversification benefits, liquidity and rate of return, increasing the proportion of gold in the investment portfolio is expected to provide better risk-adjusted returns - as a more balanced physical asset, gold provides protection when the market is down and brings returns when it is up.

Jasper

Jasper