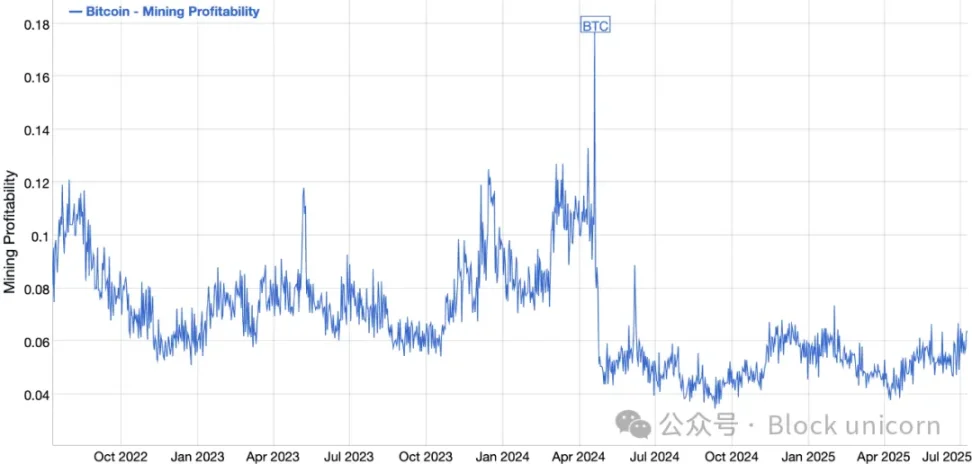

In April 2024, Bitcoin’s fourth halving quietly reset the rules of the game for miners. The reward per block dropped from 6.25 BTC to 3.125 BTC. At first, the market didn’t care. The price barely budged. But for miners, whose margins were already slim, the math became harder overnight.

This meant they had to put in the same effort but only got half the reward.

Maintaining the old model meant paying for energy and upgrading equipment. Some tried, but most made less money. The profitability of mining fell from an average of about $0.08 per day (1 terahertz/second) to $0.055 per day (1 terahertz/second).

Everyone knew the halving was coming. Most people prepared to transform their business and stopped selling the bitcoins they mined. Lower revenues with the same costs meant smaller profit margins. They instead hoarded bitcoins, betting on its long-term value.

They haven’t stopped. Michael Saylor’s Strategy (then called MicroStrategy) has set a template with its bet on Bitcoin.

Marathon, already the largest miner by vault size, has added more than 30,000 BTC to its balance sheet in just over a year since the halving. The company mined at least 8,900 BTC and bought more than 21,000 BTC from the open market.

Riot kept every satoshi it mined (about 5,000 BTC) for 12 months after the halving and bought more than 5,000 BTC during that time. Even Hut 8, which has produced relatively little, has added more than a thousand BTC since the halving and sold almost none of its hoarded bitcoins.

Hive, which has recovered from Ethereum’s move to proof-of-stake (PoS), has seen its Bitcoin reserves grow by more than 25% since the halving, and has subsequently sold some of its reserves to support expansion. Core Scientific, which had its wallets emptied after bankruptcy, has accumulated more than 900 Bitcoins since the halving, 700 of which came in a single quarter. This is extraordinary for a miner that once sold every coin to survive.

These are not actions in the normal business of Bitcoin miners, but desperate moves to try to evolve.

This shows one thing: hoarding Bitcoin is no longer a stopgap measure. This shows confidence in Bitcoin’s rise, but it also reveals something else.

Building a Bitcoin treasury helps long-term price appreciation. But asset appreciation does not equal income and cannot cover daily operating expenses.

Post-halving, profit margins are tighter. It’s more expensive than ever to mine bitcoin, and many are realizing that the old model — mine, sell, repeat — isn’t working anymore. Some miners are finding they already have the foundation for a transformation: facilities built for energy-hungry machines. They’re starting to repurpose that infrastructure for AI computing.

Core Scientific is leading the charge with a high profile move. In June 2024, it signed a 12-year, $3.5 billion deal for GPU infrastructure hosting with AI cloud provider CoreWeave. It’s one of the largest AI hosting deals ever. The contract gives Core a long-term revenue stream that’s virtually unrelated to bitcoin prices, and it’s sparking a quiet scramble in the mining space.

Riot has made a similar move. In January 2025, Riot paused plans to expand its 600-megawatt bitcoin mine in Corsicana and began reselling the mine to hyperscale data centers and AI companies. The company has pivoted from expanding computing power to finding AI tenants. The Corsicana mine was designed to scale, with 1 GW of power and a huge footprint. Riot figured that instead of installing more ASICs, it could lease them out to AI operators.

Hut 8 chose a different direction. It spun off its entire mining division into a separate entity called American Bitcoin, retaining an 80% stake. This allowed the parent company to focus on data center infrastructure and AI services. In September 2024, Hut 8 launched Highrise, a GPU-as-a-service division that started with a thousand Nvidia H100s and a five-year contract with a cloud customer. Earlier this year, it announced a 300-megawatt high-performance computing campus in Louisiana.

Hive, with its long history of GPU mining before the Ethereum merger, is relying on its legacy. It repurposed more than 4,000 old GPUs for cloud computing, then deployed H100 and H200 clusters in Quebec. By early 2025, Hive had an annual AI revenue run rate of $20 million and planned to reach $100 million the following year. It sold some bitcoin in 2024 but kept most of what it mined that year.

Even Bitcoin's staunchest supporter, Marathon, has adjusted course. In September 2024, it appointed two AI industry veterans to its board of directors. The company developed immersion cooling equipment designed for AI inference workloads. In early 2025, it began exploring providing data center hosting services for AI customers. As of May 2025, the company held more than 49,000 bitcoins. Since April 2024, the company has sold almost none of its mining proceeds.

Iris Energy is all in on AI. It’s selling every bitcoin it mines to expand its data centers. By mid-2025, it has deployed more than 4,000 GPUs and is building facilities in Texas and British Columbia to house 20,000 GPUs. Its infrastructure is growing fast, though it’s still cash-out.

Some miners see Bitcoin as a strategic reserve. Others see it as liquid inventory to support growth. But in either case, they’re all trying to stretch the same assets—cheap land, spare energy, access to the grid, and specialized cooling systems—into something more useful than just mining.

Mining alone is no longer a guarantee of survival.

Electricity prices are unchanged. Hashrate keeps climbing. The miners that survive do so by increasing optionality. Some are service providers, some are cloud computing providers, and many are still experimenting to find their way.

For now, most miners still mine Bitcoin. But that’s no longer the whole business. It’s just one of many revenue streams that could include AI hosting, GPU leasing, energy brokerage, and even sovereign-grade computing infrastructure in the future.

It’s too early and too little data to tell whether miners’ pivot to AI will be successful. While the high-performance computing (HPC) business hasn’t scaled for everyone yet, it helps that AI computing has significantly higher profit margins per megawatt than mining.

For some, it’s already starting to show some signs.

Iris Energy’s AI services revenue has grown from negligible to $2.2 million in June 2025. This relatively new business unit has a profit-to-revenue ratio of 98%, compared with 75% for mining.

It’s not a foolproof strategy, however. Building AI facilities is expensive. It requires not only electricity, but also networking, redundancy, cooling, and customers to keep filling the racks. Not every miner will succeed. Some will overbuild, some will miss the market turn, and some will still be completely dependent on Bitcoin in a few years.

This industry is no longer a single industry.

They started by stacking blocks. Then they started hoarding Bitcoin. Now, they’re stacking GPUs. However, Bitcoin mining has not stopped.

Most miners who have turned to AI are still mining Bitcoin.

Last month, Bitcoin’s hash rate hit a record high, far higher than the level at the halving. This shows that mining difficulty and costs have increased because miners need to devote more computing resources to solve blocks and receive rewards.

Under these circumstances, it becomes economically unviable for businesses to sell mined bitcoins at lower margins. Unless bitcoin prices rise or transaction fees soar, only the most efficient operations will be profitable.

Increasing efficiency could mean lowering electricity and computing costs. It could even mean holding onto bitcoin and selling only when prices rise well above their post-halving average. This explains why most miners are turning to artificial intelligence to get a higher return on their investment.

Alex

Alex

Alex

Alex Brian

Brian Alex

Alex Alex

Alex Alex

Alex Alex

Alex Hui Xin

Hui Xin Joy

Joy Brian

Brian Hui Xin

Hui Xin