Author: Sam Bourgi, Source: Cointelegraph, Translated by: Shaw & Jinse Finance

Since the Bitcoin halving in 2024, the Bitcoin mining industry has faced a more severe operating environment. Halving is a core mechanism in Bitcoin's monetary design, reducing the block reward approximately every four years to ensure Bitcoin's long-term scarcity. While halving enhances Bitcoin's economic resilience, it also puts miners under direct pressure from a sharp drop in revenue overnight.

According to TheMinerMag, by 2025, this has led to "the most challenging profit margin environment in Bitcoin mining history," with sharp revenue declines and soaring debt being the main obstacles.

Even publicly listed Bitcoin mining companies with large cash reserves and ample funds are finding it difficult to remain profitable solely through mining.

To sustain operations, many mining companies have accelerated their transformation into other data-intensive business areas to stabilize revenue and reduce over-reliance on the price of computing power alone. Two of the most important areas among these opportunities are artificial intelligence and high-performance computing (HPC), both of which have grown rapidly since the end of 2022 due to surging demand for computing power. Bitcoin mining companies have a unique advantage in tapping into these markets because their mining farms are already equipped with large-scale power access and cooling infrastructure that can be used for purposes other than SHA-256 hashing.

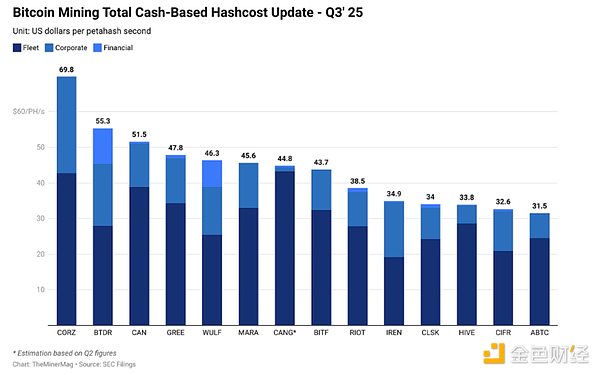

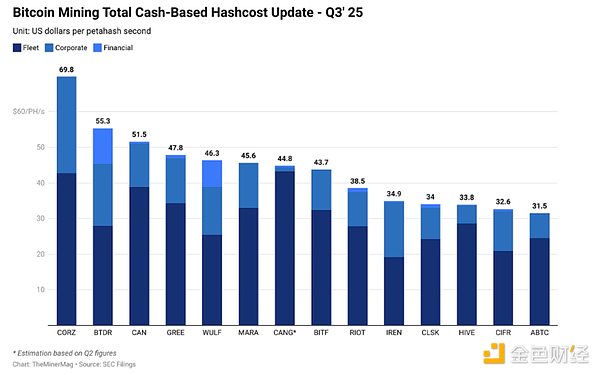

Average cost of Bitcoin mining for 14 publicly traded mining companies in Q3 2025. Data source: TheMinerMag

By 2026, Bitcoin will still be in its fourth mining cycle, which began after the halving in April 2024 and is expected to last until around 2028.

With the block reward fixed at 3.125 BTC, increasing competition has further driven the industry's shift towards efficiency and revenue diversification. Here are three key themes expected to drive the Bitcoin mining industry in 2026: Mining profitability depends on energy strategy and the transaction fee market. Hash rate measures the computing power that secures the Bitcoin network, while hash price reflects the revenue generated by that computing power. This distinction remains central to mining economics, but as block rewards continue to shrink, profitability is increasingly influenced by factors beyond scale. Access to low-cost energy and entry into the Bitcoin transaction fee market have become crucial for miners to maintain profitability throughout the cycle. The price of Bitcoin continues to play a significant role. However, 2025 did not see the surge many in the industry had anticipated, nor the surge typically seen a year after a halving. Instead, Bitcoin's price action was more stable, climbing in steps before finally breaking through a peak of $126,000 in October. Whether this marks the peak of this cycle remains an open question. However, price volatility has had a significant impact on miners' revenue. Data from TheMinerMag shows that the price of hashrate has fallen from an average of about $55 per PH/s in the third quarter to what the media outlet calls a "structural low"—close to $35. To make matters worse, the average cost of Bitcoin mining continued to rise throughout 2025, reaching about $70,000 in the second quarter, further squeezing the profit margins of miners already facing declining hashrate prices. The sharp price correction in Bitcoin, falling from its high to below $80,000 in November, is closely linked to the plight of miners. If Bitcoin enters a broader downtrend, the pressure on miners could persist into 2026, although similar situations have occurred during previous halving cycles, there is no guarantee that this will not happen again. Over the past three years, Bitcoin mining profitability, measured in US dollars per unit of computing power, has declined, reflecting the post-halving revenue compression and increased mining difficulty. Source: BitInfoCharts

Artificial Intelligence, High-Performance Computing, and Industry Consolidation Reshape the Mining Landscape

Listed Bitcoin mining companies are no longer simply positioning themselves as Bitcoin companies. They are increasingly describing their businesses as digital infrastructure providers, reflecting a broader strategy of leveraging power, real estate, and data center capabilities for profitability beyond block rewards.

One of the first companies to take this step was HIVE Digital Technologies, which began shifting part of its business to high-performance computing in 2022 and reported revenue related to high-performance computing the following year. This strategy was particularly noteworthy at a time when the industry was still primarily focused on increasing computing power.

Since then, more and more listed mining companies have followed suit, either converting parts of their infrastructure for GPU-based workloads related to artificial intelligence and high-performance computing, or have indicated plans to do so. These companies include Core Scientific, MARA Holdings, Hut 8, Riot Platforms, TeraWulf, and IREN.

These initiatives vary widely in scale and implementation, but overall, they indicate a broader shift occurring throughout the mining industry. With profit margins under pressure and competition intensifying, many mining companies are now viewing artificial intelligence and computing services as a means to stabilize cash flow, rather than solely relying on block rewards. By 2024, artificial intelligence and high-performance computing had already generated substantial revenue for some mining companies. Source: Digital Mining Solutions

This shift is expected to continue until 2026. This continues the consolidation trend pointed out by digital asset investment and advisory firm Galaxy in 2024, which noted at the time that a wave of mergers and acquisitions among mining companies was growing.

Bitcoin Mining Stocks: Volatility and Dilution Risk

Publicly listed Bitcoin mining companies play a pivotal role in the market, not only ensuring network security but also becoming one of the largest corporate holders of Bitcoin. In the past few years, many listed mining companies have moved beyond simple operating models and begun to view Bitcoin as a strategic balance sheet asset.

More and more miners are following the example of Strategy's Michael Saylor, adopting a more cautious Bitcoin treasury reserve strategy, retaining a portion of the mined Bitcoin.

By the end of the year, mining companies had become among the largest publicly held Bitcoin holders, with companies like MARA Holdings, Riot Platforms, Hut 8, and CleanSpark all ranking among the top ten in terms of total corporate Bitcoin holdings. [Image of the largest publicly listed Bitcoin treasury company. Source: BitcoinTreasuries.NET] However, this exposure also exacerbated volatility risk. As Bitcoin prices fluctuate, mining companies holding large Bitcoin reserves experience greater balance sheet volatility, similar to other digital asset treasury companies that face pressure during market downturns. Mining stocks also face ongoing equity dilution risks. The industry remains capital-intensive, requiring continuous investment in ASIC hardware, data center expansion, and debt repayment during economic downturns. When operating cash flow tightens, mining companies often turn to equity financing to maintain liquidity, including at-the-market (ATM) offerings and secondary stock issuances. Recent financing activity highlights this trend. Several mining companies, including TeraWulf and IREN, have utilized the debt and convertible bond markets to improve their balance sheets and fund various growth initiatives. From an industry-wide perspective, Bitcoin mining companies raised billions of dollars through debt and convertible bond issuances in the third quarter alone, continuing the accelerating fundraising pattern that has been in place since 2024. Looking ahead to 2026, dilution risk is likely to remain a key concern for investors, especially given continued pressure on mining profits and a Bitcoin bear market. Mining operators with higher break-even costs or aggressive expansion plans are likely to continue relying on equity capital, while operators with lower break-even costs and stronger balance sheets are better positioned to limit shareholder equity dilution as the cycle matures.

Weatherly

Weatherly