Source: Liu Jiaolian

The calm break of BTC's sideways trading at 84.5k in the past two days has suddenly turned the market from bearish to bullish. In the eyes of many people, this strong rise above $90,000 is a break from the trend of the three-month downward channel.

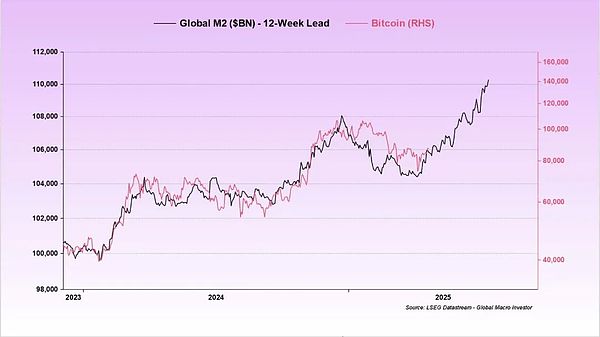

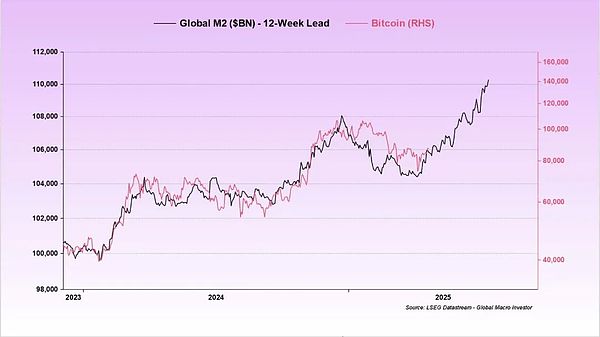

The macro school once again brought out the global M2 liquidity chart that they talk about every day, pointing to the chart and saying, look, the trend of BTC and M2 macro liquidity cannot be said to be very close, it is exactly the same.

However, if you look closely, you will still see a small deviation in some parts. It doesn't matter, you can move the data back and forth to adjust it to a more seamless look.

Anyway, it's always comforting to follow the map. Either we have passed the local bottom and started to rise; or we are likely to witness another backtest in early May, and then ride away?

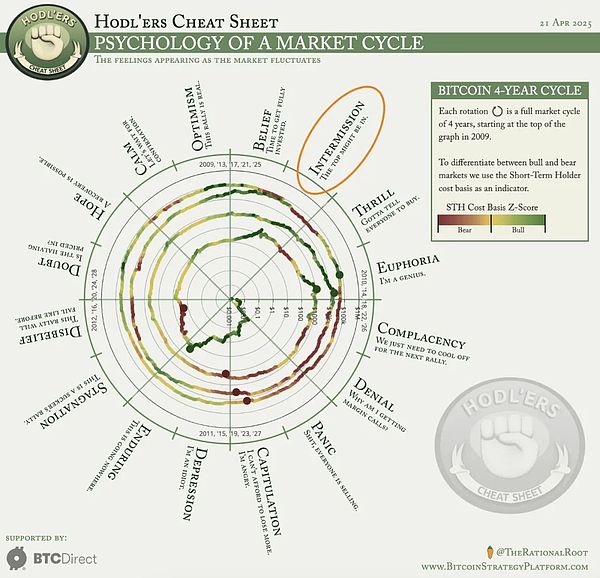

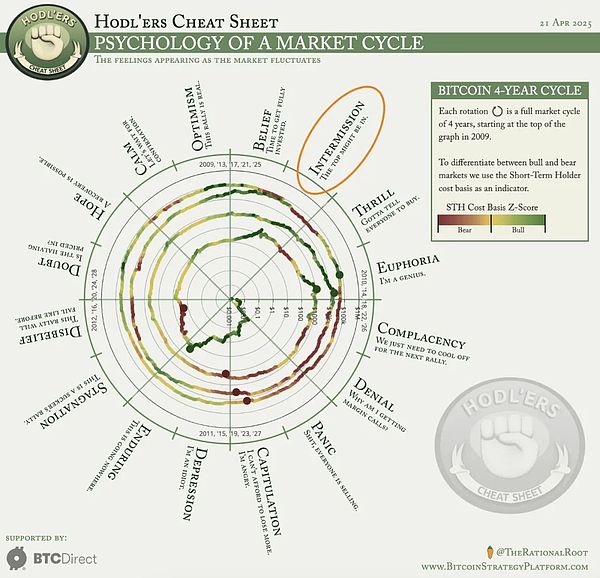

The cyclical school, based on the 4-year halving cycle, pointed out that it is time to start the bull market.

If the bull's top is the top of Mount Tai, then now it has just reached Zhongtianmen?

The technical graphics school brought out the ancestral secret recipe Wyckoff accumulation mode, and pointed out that the half-year accumulation period at the end of 2022, the second accumulation period after breaking through the previous high in March 2024, and the two quarters of consolidation are the second accumulation period. The current pullback in April 2025 is a retracement of the support level.

However, what the teaching chain does not understand is that the support was retested many times during the rise in 2023. Why does it only need one retracement and then rush up during the bullish rise in 2025?

For the future, it is just imagination.

If you can mentally calculate the Kelly formula f = p - q / b, it is easy to understand a truth: the winning rate (p) determines the position. No matter how high the odds (b) are, they are just a supporting role that creates a bigger stage for the winning rate.

For all kinds of operations that gamble on the probability of getting rich, the extremely low winning rate determines that the best strategy is actually not to participate and stay away.

Just like every time I see someone posting a post about earning tens of millions of U with a few U principal, I always smile helplessly. If you win by getting 10,000 times, what is the winning rate? I'm afraid there is no chance of even one.

Ten thousand times one chance is just a return to one. There is definitely no chance of one, because someone is sure to make a steady profit by taking a cut. So it is a road of no return to zero.

Back to BTC.

If you really keep a serious account, you might as well test how much you earn when BTC = 200,000 dollars; how much you lose when BTC = 50,000 dollars. That is just the probability of doubling and halving from $100,000.

And what is the winning rate of this round of $200,000? There are a thousand Hamlets in the hearts of a thousand people.

If you think that the winning rate is only 80%, and the odds are only twice, then the bet amount calculated by Kelly is only 8 - 2/2 = 70% of the warehouse.

Alex

Alex