Deng Tong, Golden Finance

Since the rise of C2C trading, card freezing has been one of the biggest pain points for cryptocurrency users. As more and more ordinary users enter the cryptocurrency market, "freeze compensation" is no longer just a bonus, but a standard feature of crypto trading platforms.

I. Comparison of the "Compensation Mechanisms" of the Three Major Exchanges

1. Detailed Overview of OKX C2C's Freeze Compensation Mechanism

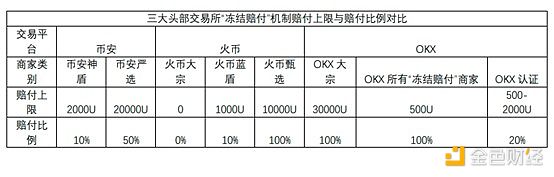

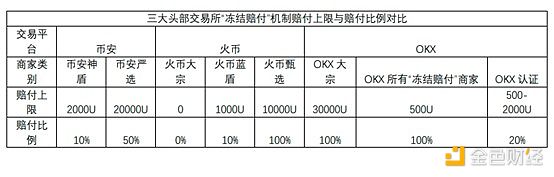

On August 27, OKX C2C officially launched its "freeze compensation" system. OKX's core advantages of "up to 100% compensation" and "zero transaction fees" not only maximize investor protection but also set a new standard for compensation in the crypto industry. OKX boldly promises its users: If a merchant payment freezes your receiving account, eligible users will receive compensation according to platform rules, up to 100% of the payment, with a maximum single payment limit of 30,000 USDT. OKX promises to charge no transaction fees for all C2C transactions. This means both users and merchants will be exempt from fees, regardless of the order amount. OKX also selected merchants designated with the "Frozen Compensation" label after a multi-dimensional evaluation. These merchants must meet additional requirements, demonstrating OKX's high screening standards for user accountability. Specific requirements include: a security deposit of at least 30,000 USDT; a certified merchant status of at least 180 days and serving at least 3,000 users; and no valid complaints regarding user account anomalies due to payment issues within the past 90 days. 2. Comparison of the "Freeze and Compensation" Mechanisms of the Three Major Exchanges Binance, Huobi, and OKX have successively launched their own "freeze and compensation" mechanisms, each with its own strengths and weaknesses. First, the compensation ratios vary significantly across platforms, ranging from no compensation at all to 10%, 20%, 50%, and even 100%.

This shows that OKX's "freeze compensation" mechanism is the most sincere, both in terms of compensation ratio and maximum compensation ceiling.

Secondly, the sources of compensation funds vary from exchange to exchange.

With platform funds as the fundamental backing, users' compensation rights are guaranteed to the greatest extent possible, eliminating the worry of seeking compensation. Leading exchanges truly prioritize user needs, mitigating compensation risks through a joint compensation model between the "platform" and "merchant." Users no longer need to worry about merchants running out of margin and refusing to receive compensation. Finally, regarding transaction fees, OKX and Huobi C2C transactions do not charge fees. Binance C2C transactions, on the other hand, require both merchants and users to pay fees, depending on the specific circumstances. This means that even for users who choose Binance for deposits and withdrawals, even if they may incur transaction fees, the freeze compensation ratio and upper limit are no better than those of other platforms. Overall, while leading exchanges in the industry have all implemented freeze compensation mechanisms, a comparison of the three major exchanges shows that OKX C2C's freeze compensation mechanism is the industry leader.

3.How Users Can Identify Various "Freeze Compensation" Mechanisms

While major exchanges have launched their own "freeze compensation" mechanisms, a closer look reveals that each has its own merits. Choosing and utilizing the "freeze compensation" mechanism that best benefits investors is crucial. Regarding compensation ratios, higher compensation ratios mitigate potential losses from a freeze. This is particularly true for "100% full compensation." "Full compensation" directly covers user losses resulting from a frozen card, eliminating the risk and incurring losses. It's important to note that while some platforms offer 100% compensation, their maximum compensation cap is relatively low. Users accustomed to large transactions should choose platforms with higher maximum compensation caps. Those accustomed to small transactions should confirm whether small orders qualify for "100% full compensation." From the perspective of compensation ratio, OKX offers 100% compensation for merchants with less than 500 units, and 100% compensation for larger merchants. This rule, with a maximum limit of 30,000 units, is industry-leading and can best meet the compensation needs of both small and large traders. Regarding the source of compensation funds, users can choose platforms that provide platform compensation funds for an added layer of protection. Regarding transaction fees, users may prefer "zero-fee" platforms.

II. Leading Exchanges and Users Build a C2C Security Line

1. Leading Exchanges' "Security Actions"

To ensure the security of C2C transactions on their platforms, leading exchanges go beyond simply freezing compensation payments and implement rigorous controls across multiple dimensions, including "strict merchant management," "optimizing customer service teams," and "rigorous risk control systems."

1) Strict Merchant Management

The three platforms prioritize merchant management and have made extensive efforts to ensure user transaction security. For example, OKX, Binance, and Huobi have all introduced "Merchant Management Regulations," establishing rules governing merchant behavior and effectively protecting user rights. OKX also categorizes its C2C certified merchants into two tiers: Certified and Diamond. Diamond merchants are subject to a probationary period, and those who fail to meet the probationary criteria will be removed from the platform. 2) Optimizing Customer Service Teams: Major exchanges are actively upgrading their customer service systems. OKX, Binance, and Huobi HTX are implementing hierarchical management, teamwork, and the integration of intelligent and manual services to efficiently respond to customers. For example, OKX requires an initial response time of 10 minutes for all user issues. However, most OKX customer service representatives can identify issues and provide solutions within 2-3 minutes. During peak ticket periods, they can handle 300-400 user issues in a single day, truly achieving 24/7 order dispute resolution. 3) Rigorous Risk Control Systems: Leading exchanges continue to strengthen their risk control capabilities. Binance monitors transactions using a powerful risk control engine. OKX launched "Ouyi Protect" in May of this year, leveraging a comprehensive product security framework including AI monitoring, POR, self-custody, 24/7 expert support, regulatory compliance, a cyber defense team, and feedback mechanisms to safeguard platform operations. Huobi also upgraded its technology that same month. In short, all major mainstream platforms have implemented a comprehensive C2C risk control system through a variety of technologies. 2. How can users achieve a smooth C2C trading experience? For a smooth C2C trading experience, users need to choose both high-quality platforms and merchants; both are essential. 1) Choose a leading trading platform with a more comprehensive "freeze compensation" mechanism. As mentioned above, users can consider key factors such as the platform's compensation ratio, compensation funding source, and transaction fees to select an exchange that suits their trading needs. Platforms like OKX, whose compensation ratios and maximum compensation limits far exceed industry standards, along with platform-backed funding and zero transaction fees, are preferred by users. 2) Merchants that meet both "Logo" and "Data" standards. For example, on the OKX platform, OKX has established different merchant tiers. "Diamond Merchants" are top-tier merchants with excellent reputations and large trading volumes; "Certified Merchants" are excellent merchants with integrity, reliability, and rich trading experience. These logos are clearly displayed on the C2C trading interface, allowing users to select them as needed. In addition, the OKX merchant page clearly displays information such as the merchant's margin amount, number of trades completed in the past 30 days, the transaction rate, the number of counterparties, and even detailed data crucial to the user's trading experience, such as average payment time and average token release time. Merchants that meet both "Logo" and "Data" standards help users mitigate trading risks and ensure a smooth trading experience.

Conclusion: When Users No Longer Worry About "Freezing Your Card"

As more and more ordinary users try their hand at cryptocurrency trading, exchanges must prioritize eliminating trading risks and providing reliable financial security.

Newcomers often struggle to understand complex blockchain technology white papers, nor do they understand exchanges' risk management systems or merchant management rules. "Freeze and Pay" mechanisms, which truly safeguard user funds, have become a new trend in crypto exchanges. This is particularly true of the "freeze and pay" mechanisms of the three leading exchanges, which are helping to alleviate the biggest pain point for crypto users: "Freezing Your Card."

As the crypto industry continues to develop and improve, and thanks to the dedicated efforts of exchanges, the era of "freezing your card" may become a thing of the past.

JinseFinance

JinseFinance