By Katie Greifeld, Bloomberg; Compiled by Wuzhu, Golden Finance

Waving the White Flag

The race for the lowest fees in the $9 trillion U.S. exchange-traded fund industry is over.

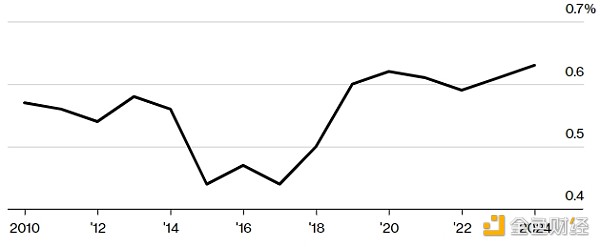

The average expense ratio for ETFs launched this year has risen to 0.63%, according to Athanasios Psarofagis of Bloomberg Intelligence. While that’s still relatively cheap, it’s the highest average in data going back to 2010, with an average of 0.44% in 2017.

It’s a surprising change of trend after a years-long race to the bottom in fund fees, led by firms like Vanguard Group and BlackRock. Issuers have raced to minimize the cost of ETFs that track stocks, bonds and, more recently, bitcoin. About 60% of industry assets now hold ETFs that charge 0.1% or less, according to Bloomberg Intelligence.

New ETFs are getting more expensive

Fund issuance expense ratios are higher than in previous years

Source: Bloomberg Intelligence Note: 2024 data is year-to-date

While rock-bottom fees are a good thing for investors, it’s a tough environment for issuers. An analysis by Citigroup last October found that of more than 3,300 U.S.-listed ETFs, about a third to half may not cover annual operating costs. If your fund is priced below 0.1%, you’ll need to trade big to make enough profit. Vanguard, with an average fee of 0.09%, might only earn $1.3 billion a year on $2.5 trillion in ETF assets, according to a recent report by Psarofagis. Given that backdrop, it makes sense that new funds are getting more expensive. Recently launched ETFs tend to be derivatives-based and actively managed products, which can charge higher fees. Most issuers will tell you that client demand is the driving decision behind such offerings — and indeed, traffic suggests that’s the case — but the fact that they’re a more lucrative proposition for the companies behind the funds helps, too.

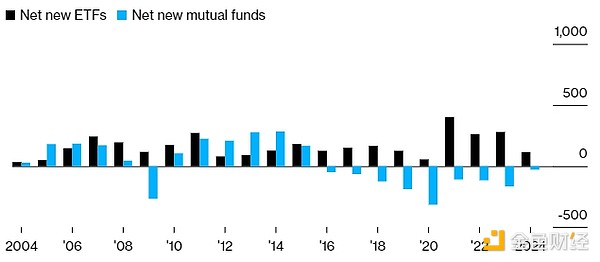

A slew of funds liquidated

Mutual funds are disappearing faster than new strategies can be launched. Data through Monday show that while 95 new mutual funds have launched this year, 123 have shut down. If the trend continues, it will be the ninth straight year of net closures, with more than 1,100 funds liquidated during that time.

The category is shrinking for all the familiar reasons: Investors, professional traders and advisors are increasingly embracing lower-cost, tax-efficient ETFs (known for shifting taxable capital gains) at the expense of mutual funds.

Mutual Fund Industry Shrinks

Mutual funds have settled at net value, while ETFs have grown

Source: Morningstar Note: 2024 data as of May 6

“No advisor wants to discuss large capital gains distributions with clients at the end of the year,” said Jane Edmondson, head of thematic strategies at TMX VettaFi.

While mutual funds still accounted for the vast majority of U.S. fund assets as of the end of March, ETFs accounted for the majority of U.S. fund assets, according to Bloomberg Intelligence data. ETFs have been a key component of the ETF market, with the share of mutual funds reaching an all-time high of 31.5%, up from an estimated 16% in 2015. This rapid growth has prompted issuers to explore various avenues to wrap their mutual fund strategies in ETF wrappers.

One avenue is to convert mutual funds into ETFs, with about 70 funds having made such a conversion in the past few years. In addition, some issuers and at least one stock exchange have petitioned the SEC to allow listing of ETF asset classes of their existing mutual funds.

But an important caveat in this discussion is that mutual funds have a strong incumbent advantage in the U.S. retirement system because 401(k)s were built to fit into that structure. There is no pressing reason for that to change — capital gains taxes do not apply to tax-advantaged vehicles like 401(k)s, and intraday liquidity is not necessarily a desired feature for retirement accounts.

Other News

Grayscale Investments reported flat first-quarter revenue after the issuer decided to keep fees unchanged for its flagship Bitcoin ETF.

As Wall Street prepares for a new era of faster securities settlement times, Citigroup’s global custody business is taking steps to avoid trade failures ahead of a late-May deadline.

DCRE ETF

During a deep dive on Bloomberg TV’s ETF IQ this week, Morris Chen, portfolio manager at DoubleLine Capital LP, dropped in to talk about the DoubleLine Commercial Real Estate ETF (ticker: DCRE). Chen said the actively managed ETF invests in relatively short-term commercial mortgage-backed securities, with DCRE offering a yield to maturity of about 6.5%.

DCRE was launched in March 2023 after the collapse of Silicon Valley Bank, which was pretty much the center of the commercial real estate storm. While there’s still a lot of controversy surrounding office properties in the new normal of hybrid office, Chen was quick to point out that the commercial real estate sector is much broader than that:

Real estate is really centered around the housing market… I can tell you that hotels are doing well. I can tell you that some of the apartment markets are doing well, too. So to me, this isn't a "wait and see" comment, it's about where it is and what's going on, and that's how we look at it.

DCRE has about $133 million in assets and has gained 7.6% in total return since inception, compared to a benchmark return of 3.3%.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Edmund

Edmund Davin

Davin decrypt

decrypt cryptopotato

cryptopotato Coindesk

Coindesk Coinlive

Coinlive  Tristan

Tristan Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist