Source: Bloomberg; Compiled by: AIMan@黄金财经

On the surface, Donald Trump's personal net worth doesn't seem to have changed much since returning to the White House: $6.5 billion on Election Day and $6.4 billion now.

But a deeper look at the data reveals an unprecedented and clear shift in the way he and his family have consolidated their empire, and they are able to use their fame, influence and power to profit at a faster pace.

Whether applying their brand to real estate projects or associating it with perfume and mattresses, the Trump family has long used licensing agreements to make quick money, while real estate development requires years of planning and execution. But with cryptocurrencies, the Trump family can accelerate the monetization of its brand.

Add to that the loosening of restrictions on overseas transactions during the second Trump administration, and it's a huge sum of money.The Pengbo Billionaires Index shows that cryptocurrency investments have added at least $620 million to Donald Trump's wealth in a few months.The index values the Trump family's gains from projects such as World Liberty Financial and Trump Memecoin (TRUMP) for the first time.

Trump’s Wealth Breakdown

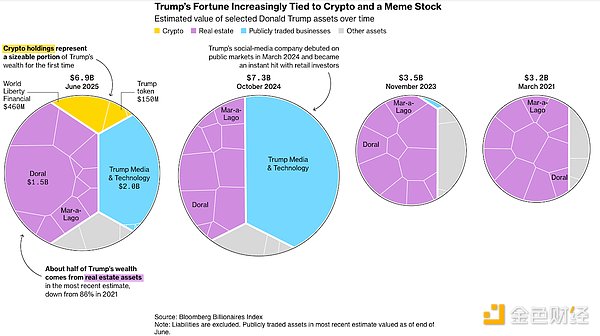

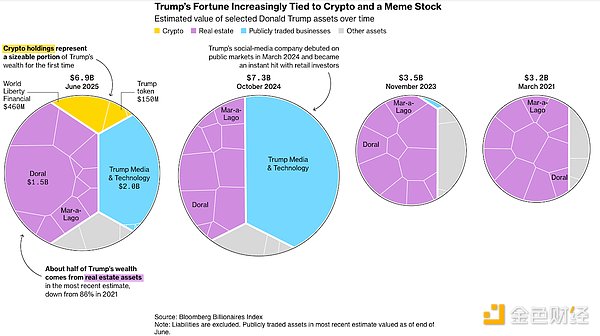

Trump’s Wealth Is Increasingly Tied to Cryptocurrencies and Meme Stocks

Long-term valuations of some of Donald Trump’s assets

Source: Bloomberg Billionaires Index Note: Liabilities are excluded. Publicly traded assets in the latest valuations are as of the end of June.

The money earned by a growing number of virtual tokens and little-known companies that have gained value through their association with the president and his "Make America Great Again" campaign far exceeds the more than $34 million the Trump Organization earned last year from real estate license transactions.

"I'm incredibly proud of our amazing company. We've never been stronger," said Eric Trump, executive vice president of the Trump Organization.

While the president's assets are managed by a trust managed by Donald Trump Jr., he still personally benefits from the Trump Organization's success, and the Bloomberg Wealth Index attributes his family's various interests to the patriarch. Many of the Trump children’s private investments aren’t included because the details of their financial interests aren’t clear, including the Washington private club Executive Branch, Japanese hotel company-turned-bitcoin hoarder Metaplanet, broadcast and podcast company Salem Media Group Inc., prediction market startup Kalshi and online drug retailer BlinkRX. While Trump and his children have dabbled in cryptocurrency — Eric and Donald Jr. have spoken, sometimes alone and sometimes together, at events in Abu Dhabi, Washington, Dubai and Las Vegas since December alone — one of the biggest boosts to his personal wealth is a project that’s been brewing for years, close to home.

Eric Trump (left) and Donald Trump Jr. at the Bitcoin 2025 Conference. Photo: Ronda Churchill/Bloomberg

Doral Resort, $1.5 billion

In January, Trump National Doral Resort received approval to build about 1,500 luxury apartments on the property, a long-standing goal of the Trump family that required extensive outreach to the community. This brings the value of the more than 600-acre Miami suburb with four golf courses and a resort with more than 600 rooms to $1.5 billion from the previous $350 million, according to Bloomberg calculations.

Trump Media & Technology Group Corp., $2 billion

Meanwhile, wild swings in Trump Media & Technology Group Corp., Trump’s publicly traded social media company, highlight how quickly assets divorced from fundamentals can lose their luster. Truth Social’s parent company reported a net loss of $401 million last year, but added more than $4 billion to Trump’s fortune in October. Today, even as the company attempts to move into finance and bitcoin, Trump’s holdings are worth as much as $2 billion.

The boom in Trump-related crypto projects, however, has given the family new ways to profit.

World Liberty Financial and USD1, $460 million

The most notable of these is World Liberty Financial, a platform that sells its own branded tokens and issues a stablecoin called USD1 — a virtual currency designed to reflect the value of the U.S. dollar. The Trump family has profited from the project through token sales, a stake in the project’s parent company, and holdings of its World Liberty-branded tokens.

As of March, World Liberty had sold $550 million worth of tokens. About $390 million of that went to the Trump family, according to Bloomberg calculations. The Trump family also owns 22.5 billion tokens, worth more than $2 billion based on the price at which the tokens changed hands in June. Because the tokens are not transferable, they are excluded from Trump's net worth calculations, although the company has said in recent weeks that this may change soon.

The Trump family reduced its stake in World Liberty from 60% to 40% last month, according to details on the company's website. It is not clear who the buyer was or what the Trump family received from the divestment.

World Liberty also launched a stablecoin, USD1. Abu Dhabi-based technology investment company MGX said it would use the token to invest $2 billion in cryptocurrency exchange Binance, which greatly increased the circulation of USD1. Binance founder Zhao Changpeng has been seeking a presidential pardon after pleading guilty to violating U.S. anti-money laundering laws, according to the Wall Street Journal. He currently serves as an advisor to World Liberty, along with cryptocurrency industry leader Justin Sun and Pakistan Cryptocurrency Council Chairman Bilal bin Saqib.

Donald Trump attends the Bitcoin 2024 conference in Nashville. Photo by Brett Carlsen/Bloomberg

Applying the market value of stablecoin issuer Circle Internet Group Inc. to the ratio of its USDC issuance to World Liberty would imply a value of about $1.4 billion, according to Bloomberg calculations. Bloomberg excluded the stablecoin from Trump's net worth because its valuation was considered too speculative given its limited application. But its $2.2 billion in circulation means its reserves could generate about $100 million for World Liberty this year.

Memcoin TRUMP, $150 million

A separate token, TRUMP, bearing the president’s name, was launched over inauguration weekend. The Trump family benefits when the price of memecoins rises: Fight Fight Fight and Trump Organization affiliate CIC Digital hold 80% of the TRUMP supply, with some of that stake to be sold within three years. Memecoins have no underlying value and trade based on market sentiment.

Trump memecoins, sought after for their connection to the current president’s family, soared in demand after a contest in May that invited 220 of the largest holders to a private dinner at Trump’s golf club in Virginia, where he gave a speech. Sun was one of the guests, posting a selfie in a black tie on his way to the event at Trump’s golf club in Virginia. Guests dined on filet mignon and seared halibut, while protesters outside held signs calling it a “scam fest.”

Memecoins are difficult to value, often because creators control the vast majority of the supply, and if they sell, the market crashes. Crypto risk modeling firm Gauntlet found that digital wallets associated with TRUMP’s creation hold nearly 17 million tokens.

Those wallets, in turn, moved about 17 million TRUMP tokens to cryptocurrency exchanges.

Activists from the group Our Revolution hold a demonstration outside the Trump National Golf Course in Sterling, Virginia, on May 22, following a dinner featuring 220 of the largest holders of TRUMP tokens. Photographer: Kevin Wolf/AP Photo

The Trump Organization owns 40% of the stake, the same as its disclosed stake in World Liberty Financial. After applying a steep liquidity discount and adding nearly $300 million in trading and sales proceeds, Trump’s memecoin investment is worth about $150 million, according to Bloomberg calculations. That doesn’t include the 800 million TRUMPs worth more than $7 billion that will unlock over the next three years starting later this month.

While World Free Finance and TRUMP Token were originally separate projects, they have clashed in at least one area: Eric Trump revealed that World Free Finance plans to accumulate a “large position” in TRUMP memecoins as a reserve of the company’s virtual assets.

The Trump family also has a trump card in the cryptocurrency space.

American Bitcoin, unaccounted for

An entity spun off from a small Trump investment bank is planning to become a public company, adding another cryptocurrency fortune to the Trump family. When its predecessor was founded in February, a press release said it would focus on artificial intelligence infrastructure and data centers. By March, the company had a new strategy, pivoting into cryptocurrency and changing its name.

Hut 8 Corp., a bitcoin miner, agreed to acquire a majority stake in American Bitcoin and transfer nearly all of its cryptocurrency mining equipment. Hut 8 Corp. plans to merge with Nasdaq-listed penny stock Gryphon Digital Mining Inc. and take the entire company public. American Bitcoin is 20% owned by the Trump family and its partners.

Gryphon’s stock price currently values the new company at more than $3 billion, according to Bloomberg calculations. That figure looks high by almost any traditional measure, given that the new company’s primary asset will be the bitcoin mining equipment provided by Hut 8, which has a book value of about $120 million.

But like many of the assets and businesses that make up Trump’s new wealth, fundamental value is often not the point.

Weatherly

Weatherly