Author: jaswini, Source: Token Dispatch, Compiled by: Shaw Golden Finance

The laser eyes say it all. In January 2025, U.S. Senator Cynthia Lummis updated her profile photo on the X platform with an emoji of flashing red laser eyes. This looks like a battle cry for Bitcoin believers.

The 70-year-old Wyoming senator announced her intention to make the biggest financial bet in American history. A few hours later, the news came: she was appointed chairwoman of the Senate Digital Asset Banking Subcommittee. After decades of managing Wyoming's mineral resources, Lummis now has the power to convince Congress to buy more than $100 billion worth of Bitcoin.

Her plan is to buy a million bitcoins over five years, creating a strategic bitcoin reserve that would make the U.S. the world’s largest institutional holder. Bigger than MicroStrategy, bigger than any government. But to understand how a woman who saw the bull market crash during the coronavirus pandemic and understood the ways of hard assets became Bitcoin’s most powerful political advocate, you need to go back to the beginning.

Her plan is to buy a million bitcoins over five years, creating a strategic bitcoin reserve that would make the U.S. the world’s largest institutional holder. Bigger than MicroStrategy, bigger than any government. But to understand how a woman who saw the bull market crash during the coronavirus pandemic and understood the ways of hard assets became Bitcoin’s most powerful political advocate, you need to go back to the beginning.

On a ranch in Laramie County, a young girl discovered that survival meant seeing opportunities where others only saw risks.

A ranch with a vision

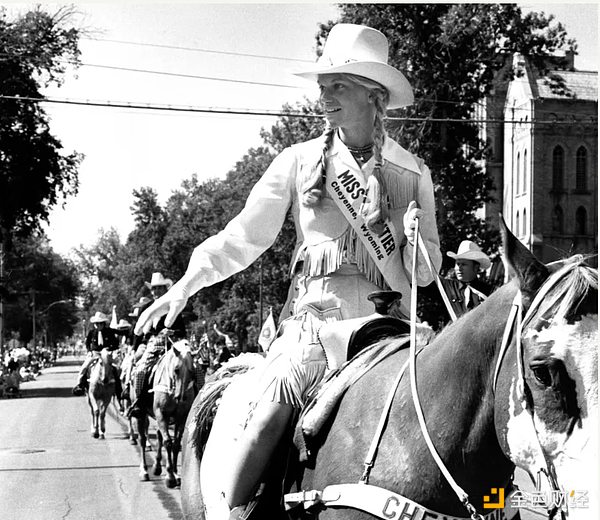

September 10, 1954, Cheyenne, Wyoming. Cynthia Marie Lummis was born into a world where cattle, land and mathematical precision were the core values. The Lummis Ranch has been passed down for four generations, enough for this family to know that wealth that cannot be transferred means that it can be lost.

From an uncompromising understanding of nature, the Lummis learned the earliest rules of the profession. Cows will die. Markets will collapse. Weather will destroy everything. Her parents, Doran and Enid, probably didn’t preach these lessons. Life on the ranch taught them firsthand: seeing commodity prices swing wildly because of factors beyond their control, watching disease wipe out herds overnight, knowing that global trade decisions in Washington could bankrupt a Wyoming rancher on Tuesday. It’s here that one learns to think in terms of hedges. To prepare for shocks. To diversify against forces that transcend individual business.

From an uncompromising understanding of nature, the Lummis learned the earliest rules of the profession. Cows will die. Markets will collapse. Weather will destroy everything. Her parents, Doran and Enid, probably didn’t preach these lessons. Life on the ranch taught them firsthand: seeing commodity prices swing wildly because of factors beyond their control, watching disease wipe out herds overnight, knowing that global trade decisions in Washington could bankrupt a Wyoming rancher on Tuesday. It’s here that one learns to think in terms of hedges. To prepare for shocks. To diversify against forces that transcend individual business.

Most importantly, you learn that conventional wisdom is often wrong. Survival means making bets that others won’t consider.

The Accidental Politician

University of Wyoming, 1978. At 24, while completing a degree in biology, Cynthia Lummis became the youngest woman ever to represent Wyoming in the House of Representatives. It was a pragmatic decision, knowing that the policies that affected her family’s ranch were being made by people who had never experienced the consequences of those policies firsthand.

Her education followed the same logic. She earned a degree in animal science in 1976, a degree in biology in 1978, and a law degree in 1985. She earned three degrees from the University of Wyoming. Her roots are deep in Wyoming, a state whose livelihood depends on an understanding of tangible value.

Her experience as Wyoming Treasurer from 1999 to 2007 was crucial to her later achievements. While managing the state's mineral revenue and investment funds, she kept pondering a question: How do you maintain purchasing power when the government controls the money supply?

Sixteen years later, her daughter and son-in-law have given her the answer in the form of a digital asset that most politicians still consider a scam or a curiosity.

The $330 Experiment

In 2013, Bitcoin was trading at $330.

When most Americans were just learning the term “cryptocurrency,” Cynthia Lummis bought her first Bitcoin for $330. Not because she understood the technology at the time, but because her years as a state treasurer had taught her how to find stores of value outside the traditional monetary system. “I was looking for a store of value,” she once said, “and I think Bitcoin is a very good store of value.”

The purchase was small and experimental. But it showed that she wasn’t buying Bitcoin for ideological or speculative reasons. She bought it for the following reasons: fixed supply, no central authority, protection against currency debasement. For someone who had watched inflation eat away at state coffers for years, Bitcoin offered a currency that governments couldn’t print, manipulate, or confiscate.

From an initial purchase of $330 worth of Bitcoin, she revealed that she had purchased up to $100,000 worth of Bitcoin in 2021.

More importantly, the transaction gave her credibility, proving that she recognized Bitcoin's potential earlier than Wall Street did. She invested her own money in the asset long before Bitcoin was politically secure.

Freedom Caucus Era

Washington, D.C., 2009. Cynthia Lummis entered the House of Representatives with a very deep understanding of how monetary policy affects real people. As a founding member of the House Freedom Caucus, she has always advocated for fiscal conservatism and sound money principles. During her tenure in the House, she established a persona that dared to challenge financial orthodoxy. She criticized the Federal Reserve's policies, arguing that they "punish savers and reward debt." She advocated a return to sound money principles and promoted policies that protect personal financial sovereignty.

Her work on Western issues, public land management, protection of energy interests, and navigating complex federal-state relations demonstrates her ability to think systematically about how national policies affect local communities. When she chose not to seek reelection in 2016, it seemed as if she was exiting the national political stage. In fact, she was preparing for her most ambitious project yet.

Senate Strategy

2020 Wyoming Senate Race. Lummis' return to federal politics comes with a few changes: She now publicly advocates for Bitcoin as part of her campaign platform. She's making advocacy for Bitcoin a core part of her appeal to voters.

Wyoming voters elected the first woman to represent the state in the U.S. Senate, and Lummis has come to Washington on a mission to challenge traditional monetary policy.

She demonstrated her ability to build bipartisan coalitions around cryptocurrency policy by working with Democrat Kirsten Gillibrand on the Responsible Financial Innovation Act. She co-founded the Financial Innovation Caucus with Democrat Kyrsten Sinema to establish an institutional framework for cryptocurrency advocacy within Congress.

One of Lummis’ most notable contributions was using her expertise in the Wyoming energy sector to respond to criticism of Bitcoin’s environmental issues. Rather than ignoring environmental issues, she advocated for policies that would encourage Bitcoin mining using idle natural gas, thereby harvesting energy that would otherwise be wasted. She argued that “40% of Bitcoin mining energy comes from renewable energy” and could accelerate the development of clean energy by providing financial incentives for renewable energy production.

By 2025, when Senate Banking Committee Chairman Tim Scott appointed her as the first chair of the Digital Assets Subcommittee, Lummis had positioned herself at the intersection of cryptocurrency advocacy and mainstream Republican politics.

She is no longer just a believer in Bitcoin, but its most powerful political defender.

The Bitcoin Act: America’s Hundred-Billion-Dollar Bet

Capitol Hill, March 2025. The Bitcoin Act, which promotes innovation, technology, and competitiveness through optimized investments across the country, represents the boldest monetary policy proposal in American history.

One million Bitcoins. Purchased over five years. About 5% of the total Bitcoin supply. Worth about $100 billion at current prices, but could be much more if the purchases themselves drive prices higher.

The proposed funding mechanism is ingenious. Diversify existing funds within the Federal Reserve System and the Treasury Department rather than requiring new appropriations; use proceeds from existing gold reserves; and use Bitcoin acquired through criminal and civil forfeiture.

Just as the Louisiana Purchase secured America’s westward expansion, a strategic Bitcoin reserve could secure America’s place in the emerging digital financial system.

But the proposal’s political challenges are enormous. It would require congressional approval for what would amount to the largest cryptocurrency purchase in history. It would need to convince fiscal conservatives that Bitcoin is a prudent store of value. And it would need to address Democratic concerns about volatility, environmental impact and the image of Trump’s crypto interests as money-making.

Lummis has set an ambitious timetable to pass comprehensive digital asset legislation by the end of 2025.

The Opposition’s Challenge

Lummis faces resistance from many sides: fiscal conservatives who worry about gamble state resources on a volatile asset; Democrats who associate Bitcoin with speculation and environmental damage; and traditional banks who worry about the disruptive impact of cryptocurrency adoption.

Some Democrats refuse to support any cryptocurrency legislation, while Trump profits from Meme Coin and World Liberty Financial.

Lummis tries to address concerns through transparency, bipartisanship and consumer protection clauses, but the political environment for Bitcoin remains brutal.

Lummis packages Bitcoin as a national security issue. She uses China's digital yuan as an example, warning that the United States lags behind in financial innovation; Singapore and Europe have clearer cryptocurrency regulations, attracting more companies to leave the United States.

Her strategic Bitcoin reserve plan defines early accumulation as economic warfare, in which digital assets provide geopolitical advantages like gold reserves once did.

At the 2025 Bitcoin Conference in Las Vegas, she revealed that several US military generals support the establishment of Bitcoin reserves, positioning cryptocurrencies as national financial security rather than speculation.

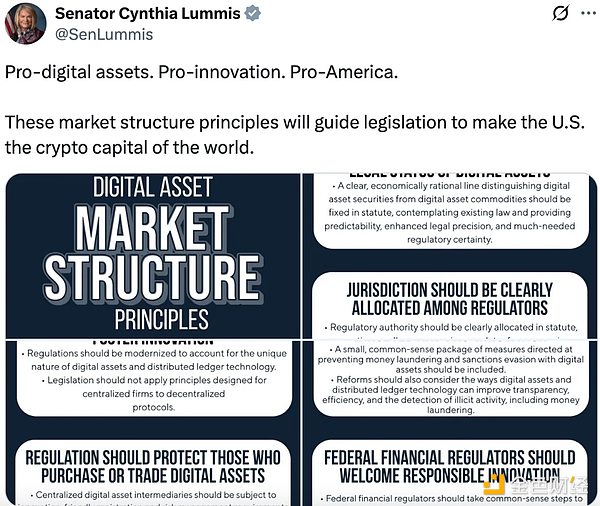

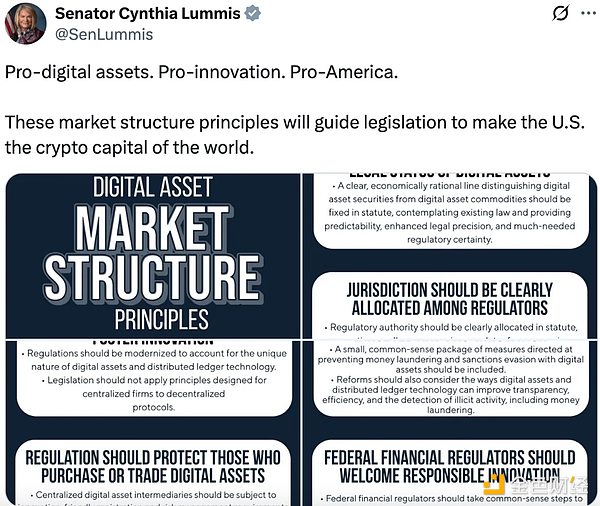

This national security angle appealed to Republicans who might otherwise have been skeptical of cryptocurrencies. Now, she’s further pushing for comprehensive market structure principles aimed at making the U.S. the “crypto capital of the world.”

Institutional Legacy

Whether her bill passes or not, Lummis has already changed the way U.S. institutions think about cryptocurrencies. The Senate Digital Assets Banking Subcommittee ensures that cryptocurrencies receive a lot of attention in Congress, and the Financial Innovation Caucus provides training for members who need to understand blockchain technology.

Her work with Democrat Kirsten Gillibrand proved that cryptocurrency policy can be bipartisan when focused on practical benefits rather than ideology.

Her transparency—disclosing Bitcoin holdings, using blind trusts, working across party lines—normalized cryptocurrency advocacy in mainstream Republican politics. She elevated cryptocurrency from a technical curiosity to a core economic policy concern, creating an institutional framework that will outlast her career.

While in federal office, Lummis championed Wyoming’s status as the most crypto-friendly state in the country. Wyoming established special purpose depository institutions (SPDIs) to allow cryptocurrency companies to keep custody of digital assets while receiving banking services. The state protects private keys as property, supports digital asset custody, and creates a regulatory sandbox for blockchain innovation.

Lummis’s achievement not only publicizes these innovations, but also establishes Wyoming as a model for other states. Her approach shows how state-level innovation can inform federal policy.

Lummis’s achievement not only publicizes these innovations, but also establishes Wyoming as a model for other states. Her approach shows how state-level innovation can inform federal policy.

The Wyoming model, with clear regulations, self-custody protections, and bank access for legal crypto businesses, provides a template for the comprehensive framework Lummis wants at the federal level.

The ultimate test is whether she can convince the U.S. government to make the largest cryptocurrency purchase in history. The strategic Bitcoin reserve is a bet on whether U.S. institutions can adapt quickly and maintain global financial leadership.

If successful, the United States positions itself as a dominant player in the digital asset space and could gain tremendous value as cryptocurrency adoption accelerates. The government's holdings of Bitcoin could appreciate significantly, providing resources for debt reduction and infrastructure development.

If unsuccessful, the United States could fall behind jurisdictions that have more aggressively embraced crypto innovation. Digital asset businesses could move elsewhere, taking jobs, tax revenues, and innovation with them.

This is the story of the rancher's daughter who learned to find value in cattle and is now asking America to make the biggest financial bet of the digital age.

Weatherly

Weatherly

Her plan is to buy a million bitcoins over five years, creating a strategic bitcoin reserve that would make the U.S. the world’s largest institutional holder. Bigger than MicroStrategy, bigger than any government. But to understand how a woman who saw the bull market crash during the coronavirus pandemic and understood the ways of hard assets became Bitcoin’s most powerful political advocate, you need to go back to the beginning.

Her plan is to buy a million bitcoins over five years, creating a strategic bitcoin reserve that would make the U.S. the world’s largest institutional holder. Bigger than MicroStrategy, bigger than any government. But to understand how a woman who saw the bull market crash during the coronavirus pandemic and understood the ways of hard assets became Bitcoin’s most powerful political advocate, you need to go back to the beginning. From an uncompromising understanding of nature, the Lummis learned the earliest rules of the profession. Cows will die. Markets will collapse. Weather will destroy everything. Her parents, Doran and Enid, probably didn’t preach these lessons. Life on the ranch taught them firsthand: seeing commodity prices swing wildly because of factors beyond their control, watching disease wipe out herds overnight, knowing that global trade decisions in Washington could bankrupt a Wyoming rancher on Tuesday. It’s here that one learns to think in terms of hedges. To prepare for shocks. To diversify against forces that transcend individual business.

From an uncompromising understanding of nature, the Lummis learned the earliest rules of the profession. Cows will die. Markets will collapse. Weather will destroy everything. Her parents, Doran and Enid, probably didn’t preach these lessons. Life on the ranch taught them firsthand: seeing commodity prices swing wildly because of factors beyond their control, watching disease wipe out herds overnight, knowing that global trade decisions in Washington could bankrupt a Wyoming rancher on Tuesday. It’s here that one learns to think in terms of hedges. To prepare for shocks. To diversify against forces that transcend individual business.

Lummis’s achievement not only publicizes these innovations, but also establishes Wyoming as a model for other states. Her approach shows how state-level innovation can inform federal policy.

Lummis’s achievement not only publicizes these innovations, but also establishes Wyoming as a model for other states. Her approach shows how state-level innovation can inform federal policy.