Author: Michael Nadeau, founder of The DeFi Report; Translation: Jinse Finance xiaozou

1. Momentum indicators and key data on the chain

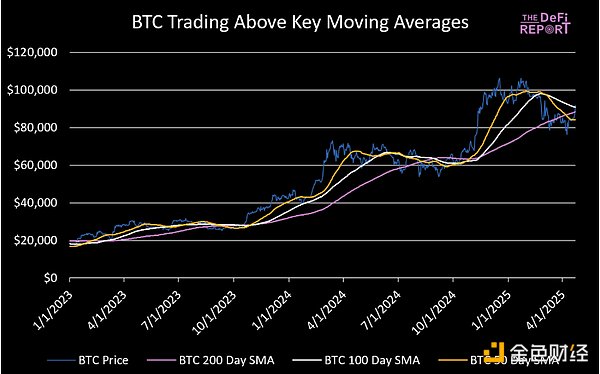

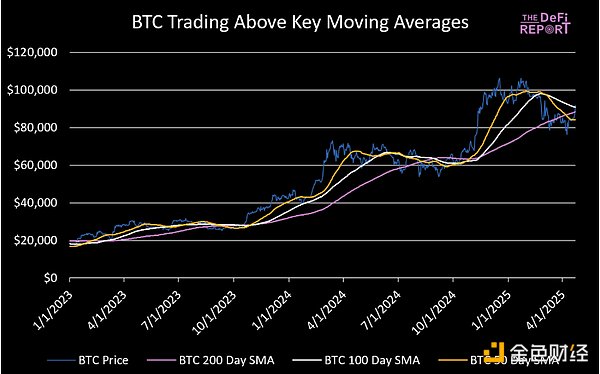

(1) Moving average

Main conclusions:

• After forming a “death cross” on April 7, Bitcoin has rebounded and broken through all key moving averages - a trend that is in line with our previous expectations.

• Bitcoin's subsequent performance will reveal the direction of the market: whether it will continue the long-term market that everyone expects, or maintain a long-term downward trend.

• We expect a pullback from the current level. If a pullback occurs, the key observation is whether Bitcoin can form a higher low above $76,000.

• If it falls below $76,000, pay attention to the support above $70,000. If this position is maintained, the bull market can continue. If it is lost, it confirms that the cycle has shifted to the left and the downward trend continues.

• If Bitcoin hits $95,000 and stabilizes, it is expected to hit a new historical high.

To this end, let's look at the KPI data to see if we can find clues to predict BTC's next move.

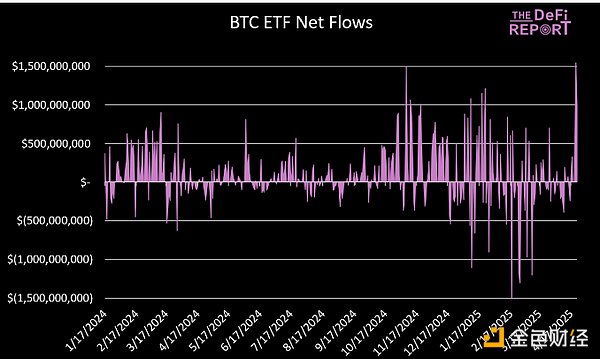

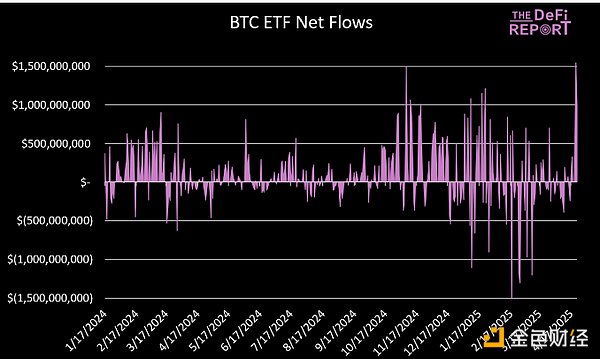

(2) ETF fund flows

Main conclusions:

• ETFs had a net outflow of US$3.8 billion from February to March, and another US$600 million in the first three weeks of April.

• However, on Tuesday this week, there was a major trend reversal with a single-day net inflow of US$1.54 billion (a record high).

• It remains to be seen whether this trend can continue. We believe that without the participation of the US market and ETFs, it will be difficult for Bitcoin to return to its historical highs.

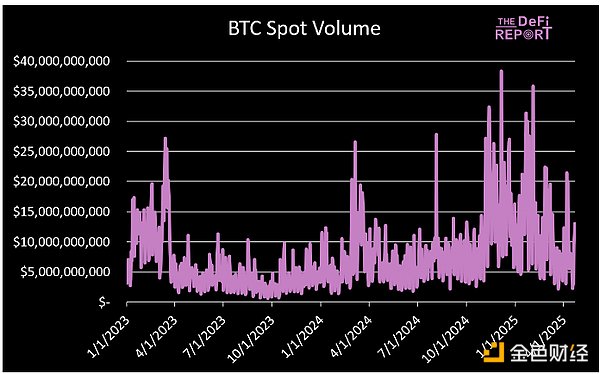

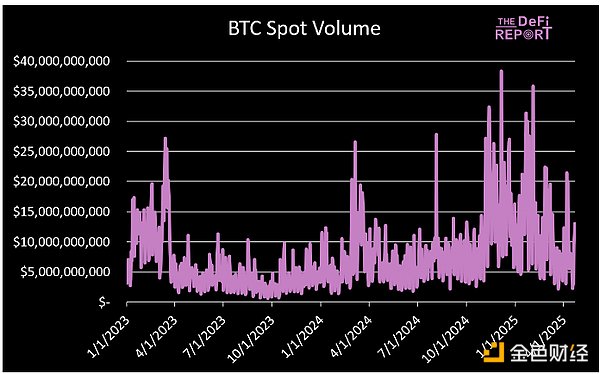

(3) Spot trading volume

The average daily trading volume in April was US$8.7 billion, close to the level when the bull market started in early 2023. The rebound day trading volume on Tuesday was US$13 billion, which is still less than half of the typical trading volume on a high-volatility day.

In addition, the average number of active addresses in April fell by 22% compared with November/December last year.

Note: Investors should be aware of the reflexive nature of Bitcoin and the crypto market - prices often move first, followed by on-chain activities.

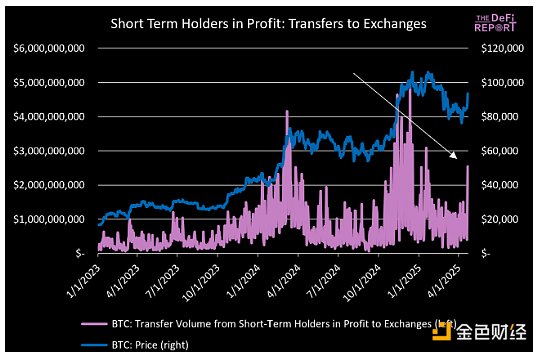

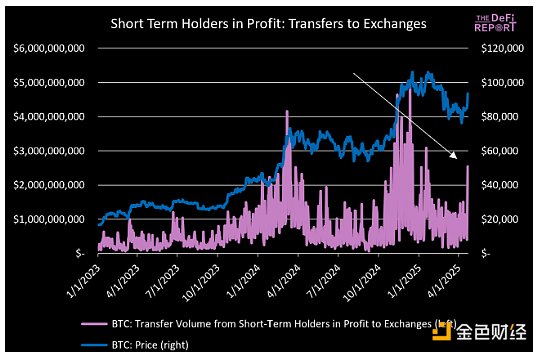

(4) Short-term holders

The current price of Bitcoin ($92,500) is hitting the short-term holder cost line, which forms an important support area with the key moving average.

Long-term holders build a support base, but the late-cycle rise is mainly driven by short-term holders.

Therefore, we are closely watching the on-chain behavior of long-term holders as their holdings return to profitability.

Key Takeaways:

• Short-term holders’ positions are down 11.4% since the beginning of February.

• Exchange inflows surged to $4.4 billion from Tuesday to Wednesday this week.

• This shows a tendency for short-term holders to “paper hands”.

• This is exactly what we saw in March 2022, when the price of Bitcoin briefly recovered to the cost basis level of short-term holders (after falling from a high of $69,000). In that case, it was a signal that the bear market would continue until the end of the year.

(5) Long-term holders

Long-term holders are returning as buyers, currently controlling 69% of supply (up from the 66% low on 2/1/25).

Historical references:

• 2017 bull market peak: long-term holdings accounted for 51.6%

• 2018 bear market bottom: 67.3%.

• 2021 bull market double top: first peak 58.9%, second peak 69%.

• 2022 bear market bottom: 69.5%.

• December 2024 peak: 67.3%.

Judgment: The current high concentration lays a solid foundation for the market, but ETFs may distort the authenticity of the data.

(6) Long-term and short-term holder supply ratio

Short-term holders are transferring chips to long-term holders. The ratio hit the bottom when the price peaked in December last year.

Similar patterns appeared at the cycle tops of 2017/12, 2021/4, 2024/3 and 2024/12.

A "double top" structure appeared in the previous cycle: the first peak in March 2021 was driven by short-term holders, and the second peak in November was dominated by long-term holders.

Potential scenario: If history repeats itself, it may be difficult to continue the rally in this round, but it may reappear in the range of $110,000 to $130,000.

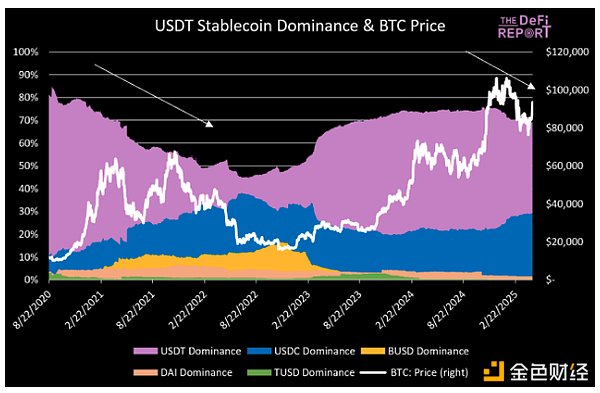

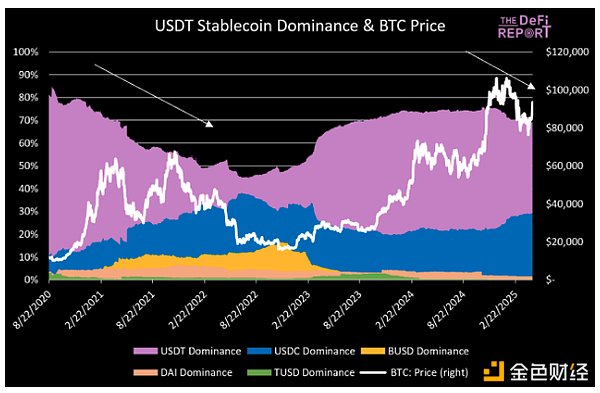

(7) Stablecoins and USDT Dominance

Bitcoin prices are usually highly positively correlated with the growth of USDT circulation (and market share).

It is worth noting that the supply of USDT has remained stagnant at around US$140 billion since mid-December last year. At the same time, the supply of USDC has continued to rise (up 47% since mid-December). This phenomenon is exactly the same as in the previous cycle, when USDC supply continued to grow throughout the bear market and did not fall back until the end of the third quarter of 2022.

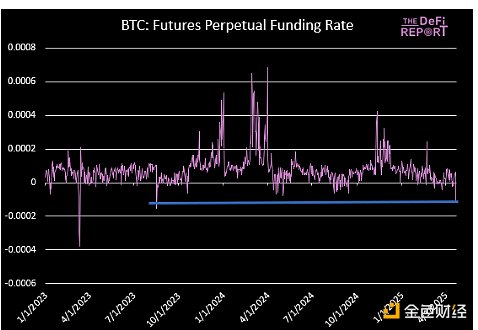

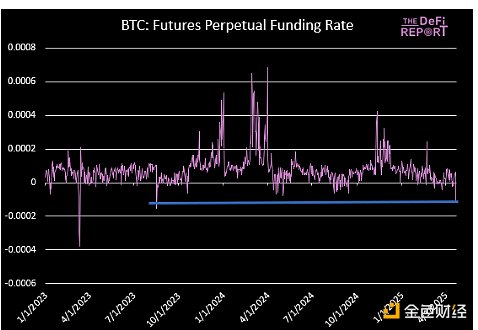

(8) Funding Rate

The funding rate turned sharply negative on Tuesday as short sellers bet that Bitcoin would encounter resistance at the $94,000 mark and fall back. The current short position cost has hit the highest level since August 2023.

This clearly reveals the positions of traders and speculators. If they misjudge, the market may break out of a short squeeze, pushing Bitcoin above the $100,000 mark.

The short liquidation amount on Tuesday/Wednesday was only $23 million and $13 million respectively - this modest figure shows that the game between longs and shorts has not yet entered the decisive stage.

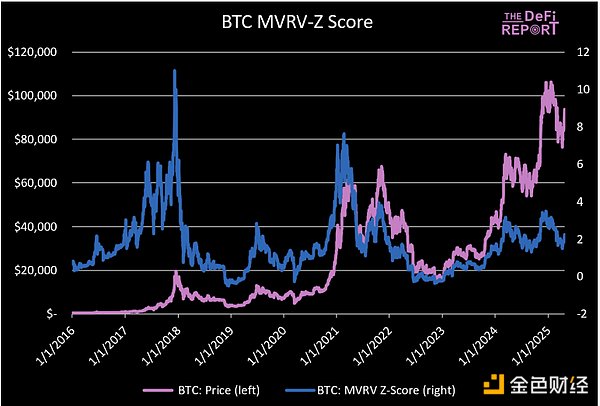

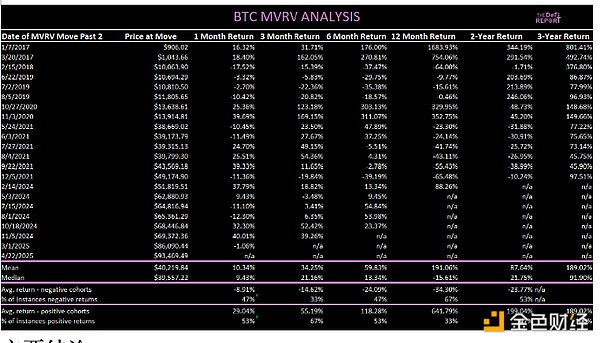

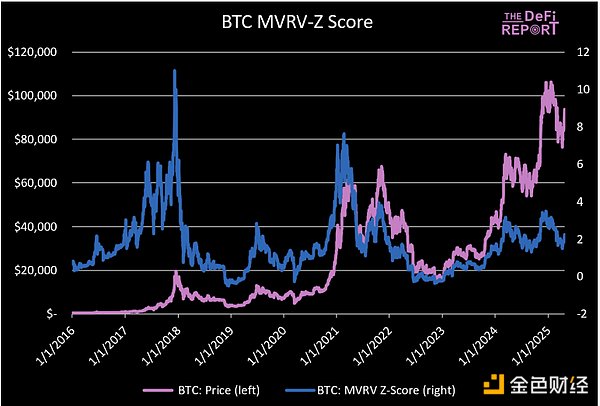

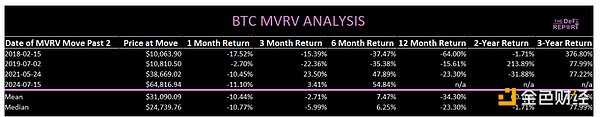

(9) MVRV-Z score analysis

Bitcoin’s current MVRV-Z score is 2.2. This analysis uses the Z score to standardize data across cycles and market states. A Z score of 2.2 means that Bitcoin’s current trading price is 2.2 standard deviations above its historical mean. Since January 1, 2017, Bitcoin has been below this level 70% of the time and above this level 30% of the time.

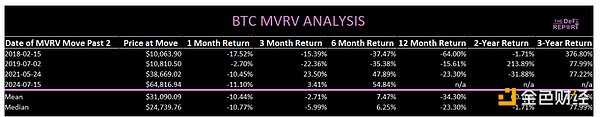

We focused on the periods when the MVRV-Z score broke through the 2 quantile during the uptrend, and specifically selected the third or more such breakthroughs in 18 months (as we are currently seeing). Here are the returns during these special periods:

In all cases, the 12-month return rate was negative.

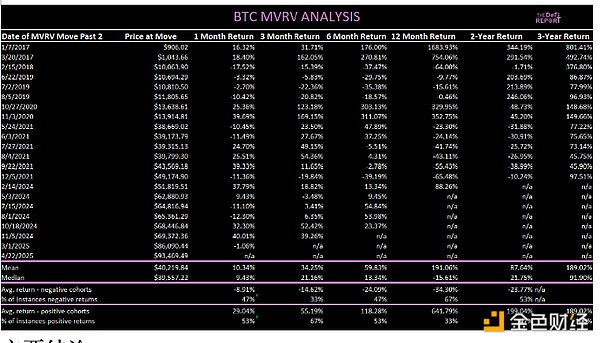

To maintain the integrity of the research, we also counted all the cases in which MVRV broke through 2 points in the rising market since January 1, 2017:

Main conclusions:

• Average return rate in 1 month: 10.34% (probability of positive return 53%).

• Average return rate in 3 months: 34.25% (probability of positive return 55%).

• 6-month average return rate: 59.83% (53% probability of positive return).

• 12-month average return rate: 191% (84% if the outlier on January 7, 2017 is excluded), but the probability of positive return is only 33%.

In general, buying when the MVRV-Z score exceeds 2 points may result in considerable returns, but historical data shows that such opportunities usually appear at the beginning of the cycle (such as early 2017 and late 2020).

(10) Summary of Momentum and On-Chain Indicators

• On-chain activity has shown a continuous downward trend in the past three months. This phenomenon is not only seen in the Bitcoin network, but also in the Ethereum and Solana chains.

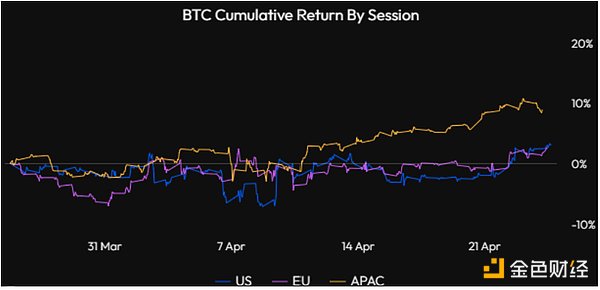

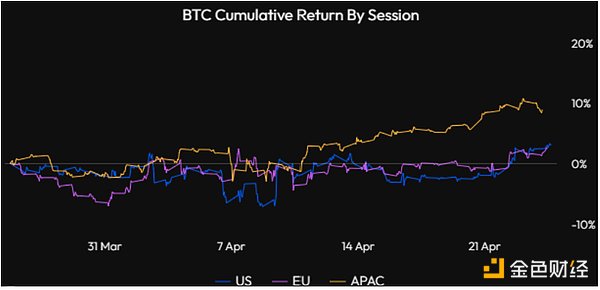

• As can be seen from the data, this week's market was mainly driven by the Asia-Pacific/China region (although there was a large inflow of funds in the ETF market on Tuesday, it is not reflected in the chart below). Although this is a positive sign, we insist that without the strong participation of the US market, Bitcoin will find it difficult to restart the bull market.

• Stablecoin growth has shown signs of fatigue - USDT supply has remained stagnant at $140 billion for the past four months. Historical data shows that slowing USDT stablecoin supply growth tends to coincide with Bitcoin's volatility/consolidation cycles (such as April-October 2024 and September-December 2021, the latter of which eventually evolved into a bear market).

• The ratio of long-term and short-term holders is the core indicator we focus on. As mentioned above, long-term holders usually lay the foundation for parabolic movements, while the large-scale entry of short-term holders is the key force that drives prices to new highs. Although market conditions can change quickly, we do not think there are signs of this at present. Longer periods of volatility and consolidation will create healthier conditions for new funds to enter the market.

• MVRV-Z score analysis shows mixed returns in the short term, but the outlook for 2-3 years is more optimistic. We prefer to position Bitcoin when it approaches the 1-point level (rather than the current level).

• It should be noted that this analysis is based on historical data backtracking. Investors should recognize the reflexive nature of the crypto market - price changes often precede narratives and on-chain activities, and the market may turn quickly.

Finally, this on-chain data analysis does not include Bitcoin held by ETFs and centralized exchanges (about 18.7% of the total supply).

2. Short-term market structure

Is Bitcoin decoupled from Nasdaq?

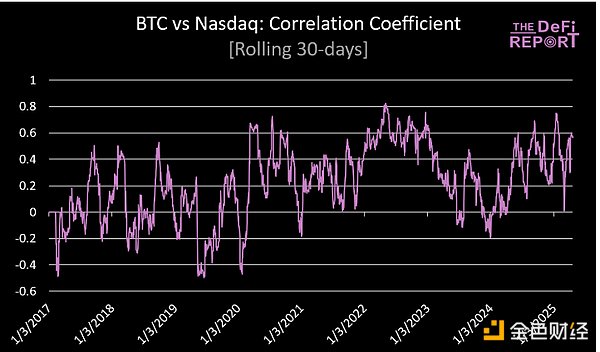

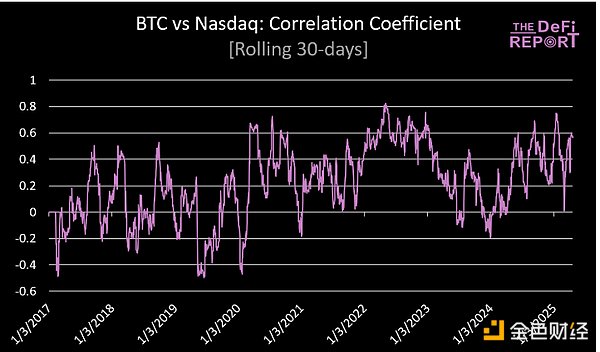

As global capital withdraws from the US market, discussions about "Bitcoin and Nasdaq decoupling" are rampant. We are cautious about this, but this is not because we do not think Bitcoin will "decouple". In fact, Bitcoin and the Nasdaq index have historically had a low correlation (the average correlation coefficient since January 1, 2017 is 0.22, and the median is 0.23).

Despite this, Bitcoin’s correlation with the Nasdaq has risen to 0.47 this year, and tends to rise to 0.4 when the Nasdaq is under pressure (on days when the Nasdaq falls ≥2% in a single day since 2017).

We don’t think this correlation will change in the short term. This begs the question: does the Nasdaq have further room to fall? We think it does.

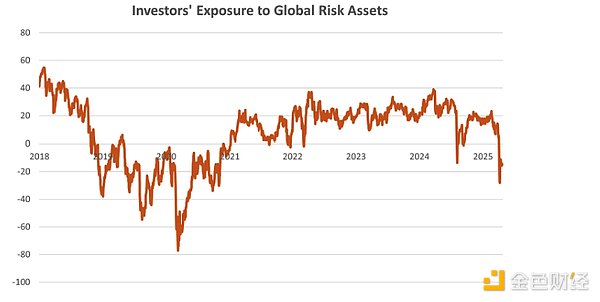

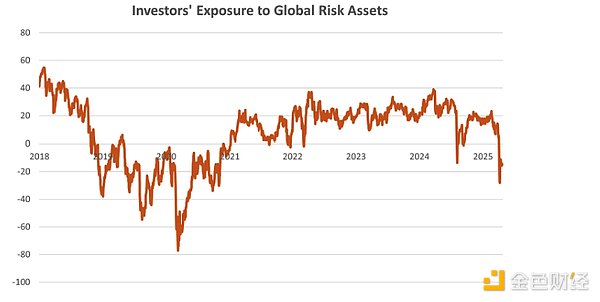

Why? Despite the continued flight from risk assets (see below), the market is currently trading at a forward P/E ratio of 19x.

Below is a comparison of the bottom P/E ratios of four major market adjustments in history:

• 2022 bear market: 15 times (equivalent to the current S&P 500 index of 4248 points)

• COVID-19: 13 times (equivalent to 3682 points)

• Major financial crisis: 17.1 times (equivalent to 4815 points)

• Internet bubble: 20 times (equivalent to 5665 points)

Important background:

• Analysts cut earnings estimates by 2.2% during the COVID-19 pandemic (very fast), 4.2% during the 2022 bear market, 64% during the GFC, and 38% during the dot-com bust.

[Big cuts in earnings estimates during the dot-com bubble and GFC led to passively higher P/E ratios at market bottoms]

• So far this year, earnings estimates have only been cut slightly by 0.3%.

At the same time:

• Corporate layoffs have exceeded the level of major financial crises (mainly government layoffs), but have not yet been reflected in labor market data.

• Survey data such as the Philadelphia Fed Manufacturing Index, New Housing Starts, Philadelphia Fed New Orders, Container Ship Bookings, and Los Angeles Port Trade Volume are all weak.

• The Atlanta Fed expects negative growth in the first quarter.

• The Fed remains on hold (only 5% chance of a rate cut in May).

• The tariff negotiations are quite complex, will take longer than the market expects, and may escalate further.

In summary, we believe that the Trump administration is trying its best to "staircase" lower the stock market (to lower the dollar exchange rate and interest rates). Nevertheless, the economy may be already scarred. Therefore, we think the market may see the next round of decline when hard data starts to be released.

On the other hand, the market may still face uncertainty if:

• The tariff agreement progresses faster than expected.

• The bond market remains stable without serious liquidity problems.

• The Trump administration successfully shifts the market's attention to tax cuts and deregulation (which they are currently working on).

3. Long-term pattern analysis

The long-term pattern of Bitcoin and even the entire cryptocurrency market is extremely optimistic.

Why?

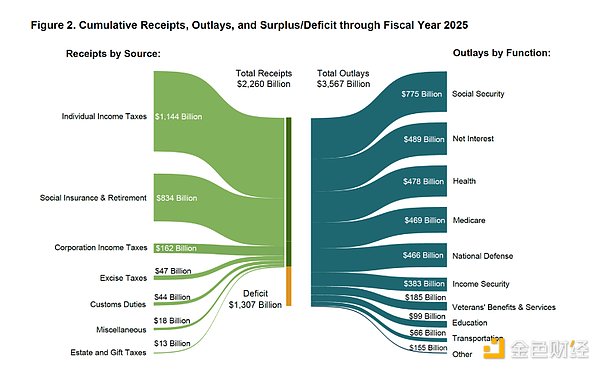

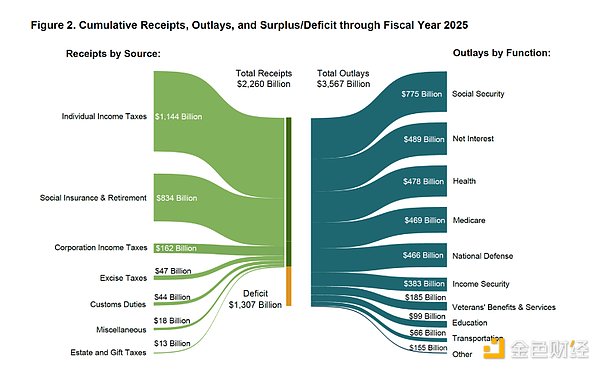

US fiscal deficit

The US budget deficit is expanding rather than shrinking!

We admit that we have changed our position on this issue many times. But with Musk announcing he will leave the White House in May, it is now clear that DOGE is mostly a political show, targeting small fish and shrimp.

In short, this deficit train is unstoppable. The Treasury will most likely continue to play an important role in providing liquidity. This is not only the case in the United States (as we have seen in the past few years), but Europe is also increasing fiscal spending on defense and infrastructure.

We expect the Fed to expand its balance sheet again in the third/fourth quarter. As this process unfolds, we expect to see monetary repression/yield curve control, and rising global inflation. This will be an environment where investors prefer non-sovereign hard assets (such as gold and Bitcoin) rather than stocks.

4. Risk Management and Final Conclusion

Our regular readers know that we like to wait for the "sweet spot" and hold cash until the opportunity arises.

Buying Bitcoin and other assets like SOL at the 2022 lows was such a "sweet spot". Adding positions (including allocations to meme coins) before the US election in September last year was also such an opportunity.

We also think it was wise to add cash in December/January this year.

Is it now the "sweet spot" to be long crypto?

For us, the answer is no. We see the risks coming. But we like to simplify. We think the core logic can be summed up as follows:

If you believe that the global trade and monetary system is undergoing a structural reset (as we do), then you can ignore Trump's rhetoric and focus on the real signals conveyed by people like Bessant.

Our view is that this process will take a long time, and now we haven't even started the second half of the first inning. The Federal Reserve is on hold, and we are currently happy to wait and see. Therefore, we choose to hold Bitcoin for the long term while maintaining sufficient cash reserves.

Possibly miss out on short-term gains? We accept it calmly. Investments must be in line with personal risk preferences. Cash is also a position. Given the many opportunities in the cryptocurrency market, we choose to remain patient.

Kikyo

Kikyo