The long-awaited rate cut came as expected, but the market was not as excited as usual.

In the early morning of December 19th, Beijing time, the Federal Reserve announced its last interest rate decision of the year, deciding to lower the target range of the federal funds rate by 25 basis points to 4.25%-4.50%, successfully achieving the third consecutive rate cut. So far, the cumulative reduction of the Federal Reserve in this round of rate cuts has reached 100 basis points.

Even if there is a selling of facts, the release of liquidity is a great thing for the risk market, but this time, it is different. The U.S. stock market fell first and gave pricing with actions. Choice data showed that as of the close of Eastern Time on the 18th, the Nasdaq fell 3.56% and the S&P 500 fell 2.95%. The Dow Jones Industrial Average fell 1,000 points, a drop of 2.58%, and fell for the 10th consecutive day, the longest consecutive decline since October 1974.

The crypto market followed closely, with Bitcoin falling below $100,000 and testing $99,000. ETH fell by more than 7.2% at its highest point, and the altcoin sector fell by more than 10%. Why did this rate cut lead to such a result?

01

Hawkish expectations triggered market panic, Powell slapped Trump

Rate cuts are a good thing, but the risk market hype revolves around two words - expectations. While cutting interest rates, Fed Chairman Powell made a long-lost hawkish statement, saying that the decision to cut interest rates in December was more challenging, but it was the "right decision", emphasizing that the Fed should be "more cautious" when considering adjusting the policy interest rate in the future. Whether the Fed will cut interest rates in 2025 will be based on future data, not current forecasts. The Fed will consider further rate cuts after inflation improves.

Compared with previous votes with relatively consistent decisions, this rate cut also ushered in differences. Cleveland Fed Chairman Hammack voted against the interest rate resolution, believing that this rate cut should be skipped, reflecting that the resistance to rate cuts is continuing to increase.

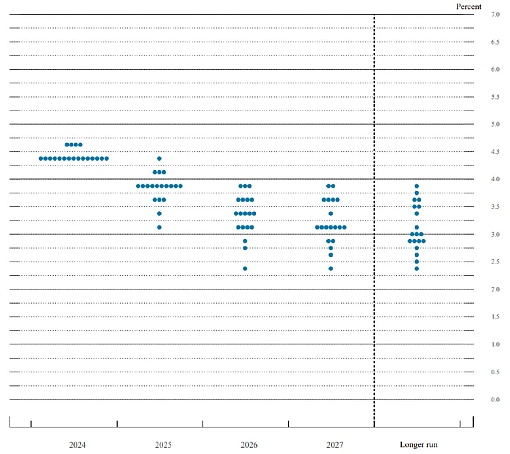

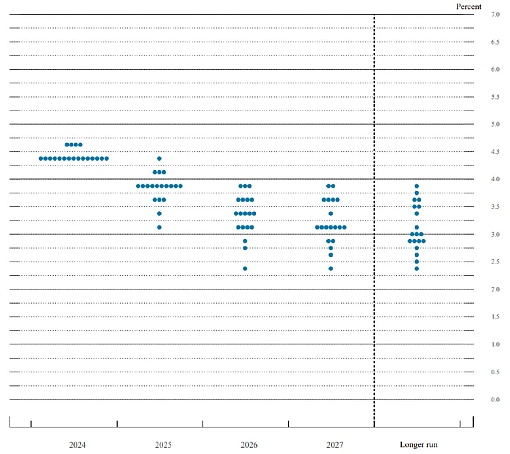

In the economic outlook forecast released by the Federal Reserve on the same day, the economic growth rate was raised and the unemployment rate was lowered, which also showed the hawkish stance of the Federal Reserve. Judging from the dot plot, based on this outlook, 10 of the 19 FOMC members believe that by the end of 2025, the target range for the federal funds rate will fall to between 3.75% and 4%. Considering the so-called "more cautious", based on 25 basis points, the Fed seems to be able to cut interest rates at most twice next year, which is a big retracement compared to the four expectations in September.

Against this background, the sharp drop in U.S. stocks, which have already digested the news of the December rate cut, is understandable. After all, whether there will be a soft landing in the future market remains to be considered. In fact, from a macro perspective, the severity is still within controllable range. Despite the initial hawkish remarks, there is still a consensus on the rate cut in 2025, but the neutral interest rate has risen. From the Fed's perspective, this hawkish speech is most likely an early warning to deal with the uncertainty of Trump's subsequent administration, thereby leaving some room to prevent the inflation caused by Trump's policy proposals.

Although the expectation of interest rate cuts has a significant impact on risk markets, the disaster of cryptocurrencies is even worse. Powell's words caused Bitcoin to fall by more than 5% and further collapsed the crypto market. According to Coinglass data, as of 5 pm, more than 260,000 people worldwide were liquidated in the past 24 hours, with a total liquidation of US$780 million, a long liquidation of US$661 million, and a short liquidation of US$118 million.

At the press conference, when Powell was asked whether the Federal Reserve would establish a national reserve of Bitcoin, he replied, "We are not allowed to own Bitcoin. The Federal Reserve Act stipulates what the Federal Reserve can own, and the Federal Reserve does not seek to change. This is a question that Congress should consider, but the Federal Reserve does not want to amend the law."

Powell's attitude undoubtedly reflects his opposition to cryptocurrencies. The Federal Reserve is not considering including Bitcoin in its balance sheet and does not want to talk about the issue. During this term, Powell has made it clear that he will not resign, and Trump does not have the power to replace him.

Coincidentally, not long ago, Trump also made his usual "great theory", saying that he would do something great in the field of cryptocurrency. When answering the question of whether the United States would establish a strategic reserve of Bitcoin similar to oil reserves, he said bluntly: "Yes, I think it will." Earlier, an anonymous transition team source also revealed that Trump hopes to make Bitcoin exceed $150,000 during his term of office, because cryptocurrency is "another stock market" for him. Considering Trump's clear ruling theory of "the stock market is everything", the news has a high degree of credibility.

And on December 17, market news came again, saying that Trump plans to establish a strategic Bitcoin reserve (SBR) through an executive order, and plans to use the Treasury's Exchange Stabilization Fund (ESF) to buy Bitcoin, and the asset now exceeds $200 billion. On the same day, the Bitcoin Policy Institute drafted the full text of the executive order and stated that the order will take effect after Trump signs it after taking office.

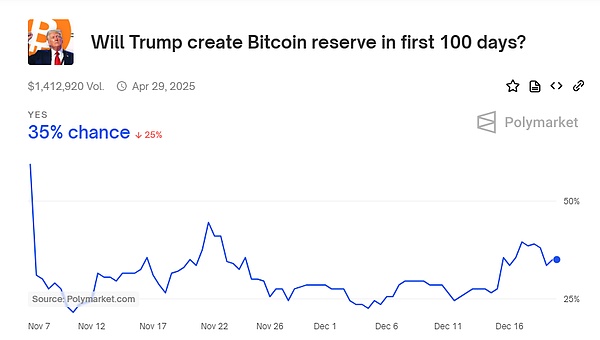

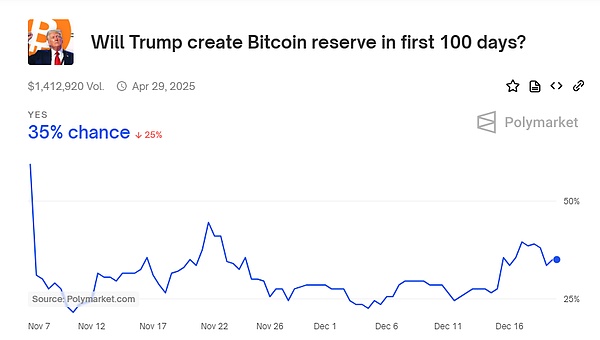

Stimulated by a series of news, the Bitcoin national reserve plan seems to be just around the corner, and the market has high hopes for it. The vote on Bitcoin reserves on Polymarket has continued to grow from 25% to 40%. Yesterday, Bitcoin rose all the way and once hit a new mark of $110,000. But Powell's speech at this time is undoubtedly a direct slap in the face of Trump. If the Federal Reserve does not cooperate, the so-called national reserve will obviously encounter strong obstacles.

02

The Federal Reserve has no intention, and the national reserve of Bitcoin is full of difficulties

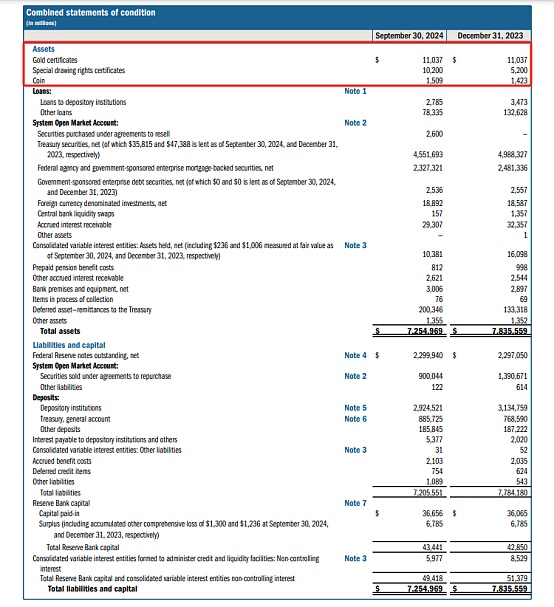

Take the "Bitcoin Act" proposed by Senator Cynthia Loomis as an example. This bill requires the government to purchase up to 200,000 bitcoins per year within 5 years, with a total of 1 million. Calculated at $100,000 per bitcoin, excluding the premium in the purchase, the government needs to raise at least $100 billion. From the detailed operation, the source of funds can be composed of three parts. One is to use the Federal Reserve's treasury remittances, up to $6 billion per year. The probability of this option is relatively small because the Federal Reserve's account is still in a loss state, with a loss of more than $200 billion. In fact, since September 2023, the Federal Reserve has not remitted any funds to the Treasury. The second is to transfer the money from the Federal Reserve's capital surplus account to the Treasury's general fund. This method has been used in the FAST (Repairing America's Surface Transportation) Act, but if it is used to buy Bitcoin, it is very likely to cause the public to question the independence of the Federal Reserve.

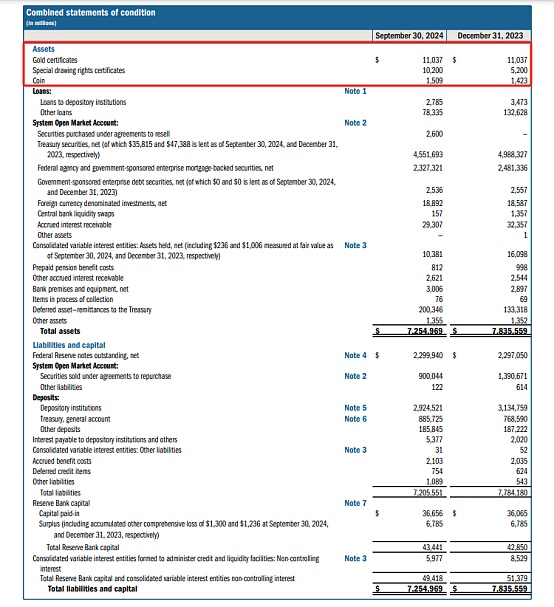

Compared with the first two, the third option is more feasible, that is, to adjust the fair value of gold according to market prices, so that the Federal Reserve can marketize the benefits of the official value of the Treasury's gold reserves. According to the financial report released by the Federal Reserve, the Federal Reserve's official reserve assets are gold, special drawing rights and coins. Among them, gold refers to the Treasury's gold dollar-denominated certificates. Calculated at an official price of slightly more than $42.22 per troy ounce, the nominal price is $11 billion. If calculated at a market price of $2,700, the reserve will reach $703.4 billion. In fact, looking at the three methods, no matter how to buy Bitcoin, the U.S. Treasury needs the full support of the Federal Reserve.

On the other hand, the US national reserve assets need to be highly liquid, which helps maintain the international reserve currency status of the US dollar and serves as the last means of payment. From this perspective, the highly volatile Bitcoin does not seem to meet the standard. If the US government purchases Bitcoin in large quantities, although it will further push up its price, it will highly concentrate Bitcoin on the government side. When selling in large amounts, the impact of slippage and volatility will be more than a little bit, and the government will even eventually bear this huge impairment loss, not to mention that the rise of non-sovereign currencies will more or less weaken the global recognition of the US dollar.

With the superposition of various reasons, the Fed's dislike for encryption can be said to be deep-rooted, and Powell has repeatedly expressed his opposition to cryptocurrencies before. It is worth noting that in this statement, Powell also left room, "This is something that Congress should consider", that is, Congress can amend the bill to include Bitcoin in the reserves, but considering the complex interests and the wide range of impact, the possibility of functional modification is minimal.

This is why the purchase of the foreign exchange stabilization fund is relatively more credible. Unlike the Federal Reserve's path, the fund is affiliated with the US Treasury. After obtaining the president's consent, the Treasury can bypass Congressional appropriations and directly use the ESF to trade gold, foreign exchange and other credit and securities instruments, and the use is relatively flexible.

Overall, although Trump has won both houses of Congress during this term, power has been highly concentrated, and he has also actively published relevant plans, but from a probability perspective, the possibility of Bitcoin becoming a strategic reserve asset in the United States is still very low. However, for Trump, who does not take the usual path, everything is possible. After all, from a realistic perspective, the US government already holds more than 210,000 bitcoins, ranking first among governments worldwide. If partial replacement of reserves is achieved, the appreciation of bitcoin can still play a very positive role in the debt-ridden United States.

03

Institutional FOMO rises, and the crypto market cannot escape path differentiation

In the long run, despite the brief Black Thursday, the prospects for the crypto market are still bright under foreseeable regulatory benefits. Institutions have also expressed high optimism about the upcoming 2025.

Bitwise gave clear price data in its 2025 forecast, indicating that the number of countries holding Bitcoin will double, Bitcoin ETFs will also usher in more inflows, Bitcoin will reach $200,000, and if strategic reserves are achieved, there will be no upper limit, and it will reach a price of one million US dollars in 2029. Ethereum will undergo a narrative shift in 2025, driven by Layer 2, stablecoins and tokenized projects, reaching $7,000, and Solana will directly target $750. In addition, it also stated that 2025 will be the first year of IPOs for crypto companies, and Coinbase will become the largest trading broker.

VanEck's expected phases are clearer, and it stated that the cryptocurrency bull market will continue to develop in 2025 and reach its first high in the first quarter. At the peak of this cycle, the price of Bitcoin is expected to be about $180,000, while the price of Ethereum will exceed $6,000. Other well-known projects, such as Solana and Sui, may exceed $500 and $10, respectively. After the first quarter, BTC prices are expected to fall back by 30%, while altcoins will fall even more, by 60%. The market will consolidate in the summer and then rebound in the fall, with major tokens regaining growth and recovering to their previous highs by the end of the year.

Compared to Bitwise, VanEck is more optimistic and believes that Bitcoin reserves will become a reality. The federal government or at least one state (such as Pennsylvania, Florida or Texas) will establish Bitcoin reserves. It is also expected that the number of countries using government resources for mining will increase from the current 7 to double digits. On the other hand, VanEck also made predictions for the sub-sectors, believing that stablecoins, DeFi, NFT, Bitcoin Layer-2, RWA, and AI agents will all usher in rapid development. By 2025, DEX trading volume will exceed $4 trillion, accounting for 20% of CEX spot trading volume; NFT trading volume will reach $30 billion; Bitcoin Layer-2 lock-up volume (TVL) will reach 100,000 BTC; the total value of securities tokenization will exceed $50 billion; and the on-chain activities of AI agents will exceed 1 million.

Presto's predictions are also consistent, indicating that the price of Bitcoin will reach $210,000, the ETH/BTC ratio will rebound to 0.05, Solana will exceed $1,000, and it is believed that a sovereign country or S&P 500 company will include Bitcoin in its treasury reserves.

From last year's forecast, VanEck's forecast success rate is about 56.6%, and Bitwise's is about 50%, so from the perspective of institutions, the credibility is quite good. In general, about 200,000 is the peak forecast of Bitcoin in the next year, and Ethereum is about 6,000-7,000 US dollars. Institutional bullish sentiment is very strong.

However, from the current obvious path differentiation, the seemingly beautiful bull market still has risks everywhere, especially altcoins, which are most susceptible to liquidity. In fact, even today, many altcoin holders will find that the coin price has not even returned to the previous bear market level.

The lack of market liquidity can also be seen from Binance's new coins. The listing effect of "Universe Exchange" is continuously weakening, and the high-rise fall has become the main theme. According to statistics from Gyro Finance, as of December 19, the average decline of the 10 new tokens on Binance since November exceeded 57.94%. Taking PENGU, which was just launched on December 17, as an example, it soared to 0.07 after its launch and quickly retreated to 0.033, a decline of 51.81%.

It is precisely because of the market difficulties and many doubts that Binance Wallet recently launched the Binance Alpha function, hoping to activate the transaction volume and stimulate the wallet ecology by opening up low-market-value potential tokens, and maintain its leading advantage in the fierce market competition. However, from the current point of view, the short-term platform activity is prominent, and the long-term effect is still to be discussed.

In this regard, in this round of bull market, holding mainstream tokens may be the best choice. Currently, the crypto market has rebounded, with Bitcoin now trading at $101,652 and ETH trading at $3,674.

Olive

Olive