Jessy, Golden Finance

On the evening of June 15, the top trading volume tokens ZKJ and KOGE on Binance Alpha plummeted by more than 90% in half an hour.

Because these two tokens have extremely high LP annualized returns and extremely low slippage wear experience. Therefore, they have become the preferred tokens for Binance Alpha points related income brushing points, but because it is a tool for brushing points, its price fails to truly reflect the market value, which lays a hidden danger for flash crashes. At the same time, the project party deliberately constructed a deformed path of insufficient unilateral liquidity of KOGE. Exit must be exchanged through ZKJ, which makes KOGE's liquidity highly dependent on ZKJ. When the market fluctuates, this structure is prone to cause a chain stampede reaction.

Finally, which was the fuse of the incident, three related addresses took advantage of the Alpha rule adjustment to trigger the withdrawal of funds and simultaneously withdrew $7.74 million in liquidity. This move directly led to the depletion of market liquidity. In the end, the exhaustion of liquidity and the liquidation of contracts formed a death spiral, causing the token to evaporate 90% of its market value in half an hour.

The occurrence of this incident can be said to be the inevitable result of the superposition of multiple factors. And the ones who were ultimately hurt were the retail investors who used these two tokens to brush points in order to obtain Binance Alpha points.

Tokens selected under the Binance Alpha brushing mechanism

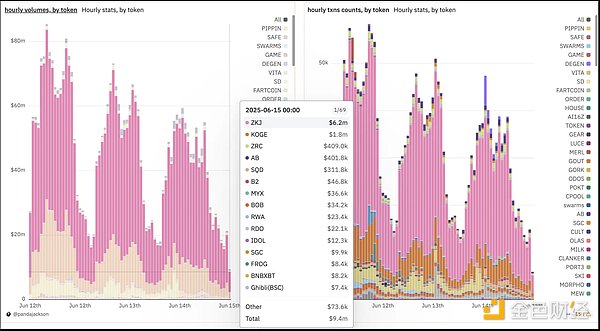

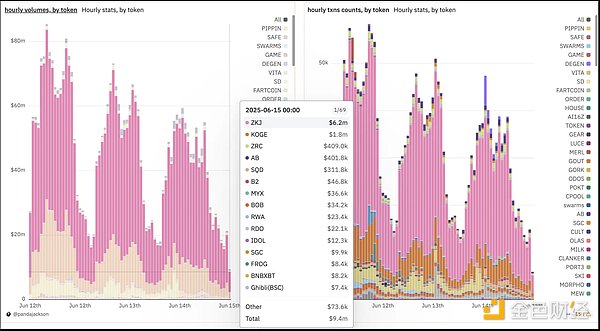

KOGE and ZKJ tokens are the tools for Binance Alpha to brush points. According to Dune data established by @pandajackson42, on June 14 alone, the total trading volume of Binance Alpha reached US$987 million, of which ZKJ and KOGE had trading volumes of US$703 million and US$159 million, respectively, occupying the top two places on the list.

First of all, according to Binance Alpha's scoring rules, it overly relies on the scoring rules of transaction volume and LP weight, which makes users choose tokens with good liquidity and low transaction costs to conduct a large number of transactions in order to obtain more points, even if these transactions may not have real market demand. ZKJ and KOGE just meet these conditions. Users can create a large amount of trading volume by conducting swiping transactions between them, thereby quickly accumulating points.

Specifically, the first is the feature that the slippage of these two tokens is almost zero - this is too important for high-frequency swiping. Ordinary tokens may wear out 5% of the principal after swiping ten times, while these two tokens can be nearly lossless. Secondly, the APY design of the dual-currency pool, the project party used algorithms to amplify early returns. Third, the depth of liquidity is concentrated on the ZKJ path, forming a false sense of security. Finally, the contract supports ZKJ but not KOGE, which allows arbitrageurs to hedge unilateral risks with derivatives.

It is precisely the characteristics of these two tokens that made the "ZKJ-KOGE pair brushing low wear" operation strategy popular in the crypto community at the time when participating in the Binance Alpha airdrop event. This strategy has been tested and verified by market traders and is considered to be an effective way to brush points. Once this strategy spreads in the community, it will attract more users to adopt it, further prompting ZKJ and KOGE to become popular choices for brushing points.

Human operation during the modification of platform rules

On June 14, Binance announced that starting from June 19, Binance Alpha airdrop will be distributed in two phases: Phase 1: Users with the required score (X) can receive it first, and everyone has a share; Phase 2: The threshold is reduced to Y (Y < X), first come first served, until the prize pool is distributed or the event ends. And it is this change that is regarded by some community members as an indirect catalyst for the early withdrawal of large households and the exit of LPs.

According to the observation of community user Emilia, the project party of KOGE has been adding unilateral liquidity to control the rise in the price of the currency, which also leads to the fact that the liquidity of KOGE/USDT is much smaller than what is seen. Once a large household smashes KOGE, the remaining LP cannot go to the KOGE/USDT pool, and must be exchanged for ZKJ, which further forms a stampede.

At the same time, some large investors established short positions in ZKJ on CEX to prepare for subsequent hedging. When market activity slowed down, APY declined, and the amount of funds for brushing decreased, large investors began to withdraw LP one after another, and exchanged KOGE in their hands for ZKJ, and then concentrated on selling ZKJ to complete the withdrawal of funds. As a result, the spot price fell rapidly, and the long positions of ZKJ contracts were liquidated on a large scale, further amplifying the downward range.

According to analyst @ai_9684xtpa, three related addresses completed precise coordinated operations between 20:28 and 20:50. It was their "withdrawal + sell-off" hunting action that became the final fuse for the outbreak of this incident:

Phase 1: Draining liquidity (20:28-20:33)

Address A (0x1A2...27599) took the lead in withdrawing ZKJ/KOGE liquidity pools, withdrawing tokens worth $4.29 million (including 3.76 million KOGE and 530,000 ZKJ);

Address B (0x078...8bdE7) simultaneously withdrew $3.45 million in liquidity (2.07 million KOGE + 1.38 million ZKJ).

Market impact: The liquidity pool was instantly exhausted, and the token lost price support.

Phase 2: False Swap Cover (20:28-20:58)

The two addresses swapped the withdrawn KOGE for ZKJ (a total of 6.05 million US dollars), creating the illusion of "huge transactions" on the chain and inducing investors to misjudge the market activity.

The third stage: step-by-step dumping (20:30-20:50)

Address A sells: 1.57 million ZKJ (worth $3.05 million) are sold in batches, causing the token to fall slightly;

Address B’s fatal blow: 1 million ZKJ (1.94 million US dollars) are sold in batches, triggering a minute-level plunge in KOGE;

Address C (0x6aD...e2EBb) liquidates: 770,000 ZKJ transferred by address B are sold quickly after receiving them, completely breaking through the ZKJ price defense line.

The entire sell-off adopts the "low volume and multiple transactions" strategy, which avoids large orders triggering market alarms until the concentrated selling of address B triggers a crash avalanche.

Summary:

The outbreak of this incident is the inevitable result of multiple factors. First, Binance Alpha's excessive reliance on the scoring rules of transaction volume and LP weight has spawned a volume-washing bubble, making ZKJ/KOGE a "scoring tool" without real demand; the project party deliberately constructed a deformed path of insufficient unilateral liquidity of KOGE, such as the withdrawal must be exchanged through ZKJ, and the large investors set up ZKJ short orders in advance; finally, the three associated addresses took advantage of the withdrawal of funds caused by the adjustment of Alpha rules to simultaneously withdraw 7.74 million US dollars of liquidity, and created false trading volume by switching positions from KOGE to ZKJ, and triggered a series of stampedes with step-by-step selling - liquidity exhaustion and contract explosion formed a death spiral, causing the token to evaporate 90% of its market value in half an hour.

For investors, it seems that behind all the "zero friction high returns" that rely on a single incentive, such as the scoring airdrop, there are deadly traps, which is a warning for investors.

Alex

Alex