You may have heard that the Monetary Authority of Singapore (MAS) recently officially released the final regulatory response to the "Digital Token Service Provider" (DTSP) system under the Payment Services Act, and clearly announced that it will be fully implemented on June 30, 2025, without any buffer period.

This time, it is no longer a policy trial in the consultation stage, nor is it a "call" of symbolic regulatory gestures.

The signal released by MAS is very clear: without a license, no Token-related business may be engaged. Regardless of whether the customer is in Singapore or whether the business is on-chain.

On the surface, this is a new license requirement for token services, but in fact it is a structural reconstruction of the operating logic of Web3 projects.

Last week, there were many interpretations of the document, and Portal Labs will not repeat the comprehensive interpretation. Let me just talk about some of our views on the implementation of this regulation.

A structural clearance under "administrative regulations"

Some people regard DTSP as an extended version of VASP, but it is not.

The launch of DTSP marks that MAS is trying to systematically reconstruct the vague but broad concept of "token services" and to define the boundaries of what can and cannot be done in the form of legal provisions.

From the perspective of MAS, the so-called "token services" are no longer limited to the issuance of tokens themselves, but cover all kinds of behaviors that the project party may touch, including issuance, publicity, trading, transfer, custody, OTC matching, and even providing technical or operational assistance.

In other words, as long as you are a part of this token mechanism, whether active or passive, you may be regarded as a service provider.

The more critical change is that MAS has abandoned the place of registration or on-chain deployment as the basis for compliance judgment, and returned the core judgment standard to "where the people are, where the business behavior is."

This means: Even if your contract is written on the chain, the system is deployed in the cloud, and your customers are all over the world, as long as you are based in Singapore and are promoting token-related businesses, you are very likely to be regarded as "operating in Singapore".

The classic remote architecture model of "people in Singapore, things on the chain" has officially bid farewell to the regulatory vacuum period.

And MAS's attitude towards this is not ambiguous. In this round of responses, MAS made it clear that it will adopt an "extremely cautious" attitude towards DTSP licensing, which will only apply to a very small number of applicants.

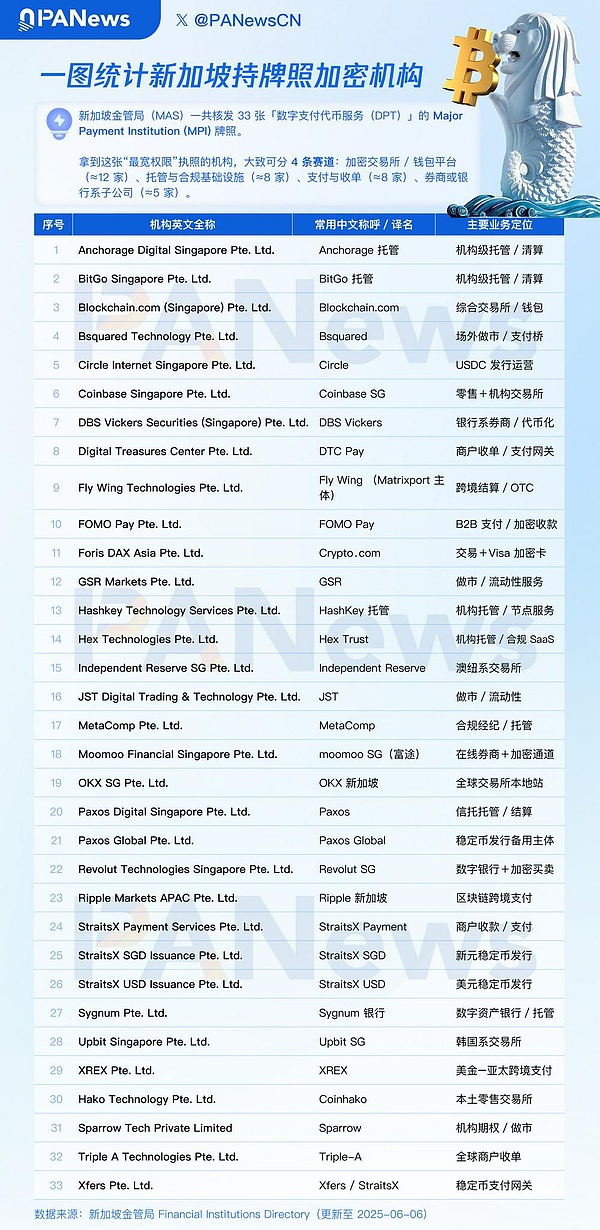

According to PANews statistics, there are only 33 crypto projects that currently hold MPI licenses, and the license was open for application as early as 5 years ago. It is conceivable how difficult and how likely it is to get the DTSP license next.

Therefore, Portal Labs believes that this is not a license bidding, nor is it a goal that can be achieved by the efforts of the technical team. It is more like an active screening of the project governance structure. Web3 project architectures that lack role isolation, have unclear funding paths, and unclear division of responsibilities will lose their eligibility to remain in this round of clearance.

However, this is not the hostility of Singaporean regulation towards Web3, but a more directional signal, that is, under the mainstream regulatory trend, the logic of regulatory arbitrage is gradually coming to an end.

"Where to go" is no longer the answer

Then, where else can we go?

The first reaction of many Chinese Web3 project parties is: move to Hong Kong.

This expectation is not groundless. In the past two years, Hong Kong has frequently released welcome signals: promoting the VASP system, officials publicly stated, and holding Web3 Carnivals... It was once regarded as the main candidate for "taking over Singapore's withdrawal projects."

Just after the announcement of the new DTSP regulations in Singapore, Hong Kong Legislative Council member Wu Jiezhuang also immediately expressed his welcome and issued a bilingual statement in Chinese and English on the social platform, saying: "If you are unable to continue to operate in Singapore and intend to move to Hong Kong, please contact me to learn about the relevant situation. We are willing to provide assistance and welcome you to develop in Hong Kong!"

This statement undoubtedly sends a positive signal that Hong Kong is "taking advantage of the situation to absorb". However, from the perspective of regulatory reality, the problem is far from that simple.

Hong Kong's regulation is not loose, it is another form of expression of the structured regulatory system:

At the CEX level, Hong Kong explicitly requires trading platforms to operate with a license and accept SFC supervision in accordance with the Securities and Futures Ordinance. The platform must not only provide compliance solutions at key nodes such as user access, currency selection, and custody mechanisms, but also establish independent audit, anti-money laundering and risk control systems. Compared with the gray area path of "adjusting while doing" in the past, Hong Kong's regulatory approach emphasizes "pre-emptive structural design" and is suitable for institutional platforms that are willing to operate in compliance for a long time.

At the token issuance level, Hong Kong has not yet issued a special law for the public issuance of tokens, but referring to the regulatory trends in the United States, the European Union, and Singapore in recent years, although there is still room for the issuance of some tokens at this stage, if legislation is promoted in the future, the possibility of further tightening of the regulatory framework cannot be ruled out.

In terms of the implementation of Web3 projects, although Hong Kong has frequently released support signals, the current regulatory system that has truly landed is still focused on a few areas such as virtual asset trading platforms. For other Web3 projects (such as DeFi, DAO, RWA issuers, etc.), exclusive regulatory channels have not yet been established. In reality, supervision is more inclined to accept project types with clear structures, sufficient information disclosure, and the ability to be penetrated and identified under the existing licensing system. To some extent, this is more like "partial opening under the guidance of financial compliance" rather than a general acceptance of all forms of innovation.

In other words, Hong Kong does welcome the implementation of the Web3 industry, but the premise is that you can match the regulatory rhythm. If your operating structure in Singapore has already stepped on the line, it is likely that you will not be able to land in Hong Kong in the near future.

As for other alternative locations, such as Dubai, Portugal, Seychelles, and even some regional cities with "seemingly better atmospheres" such as Shenzhen, they either lack mature financial regulatory frameworks or have unclear and unsustainable compliance paths. They can be accommodated in the short term, but it is difficult to build a medium- and long-term legal basis.

The new DTSP regulations are not an isolated case, but represent a broader regulatory trend: sovereign jurisdictions no longer accept the "puzzle-like" Web3 architecture of "registration place", but begin to define the attribution of responsibility by "where people are and where things happen".

Therefore, the more urgent problem that Web3 projects need to solve is no longer "where to move", but whether you can still "exist in compliance" after moving there.

From this perspective, Singapore is not the end point, and Hong Kong is not the solution. The next stop for Web3 is not another "arbitrage depression", but a comprehensive physical examination of architectural capabilities, governance logic and compliance mentality.

The real question is how to stay?

The biggest signal released by the new DTSP regulations has never been a suppression of a certain type of project or region, but a systematic update of regulatory logic.

In the past, many Web3 projects relied on "jigsaw-style architecture" to shuttle through the gray area of compliance: the place of registration was located in country A, the technical team was in country B, the market was in country C, customers were spread all over the world, KYC was outsourced to country E, and funds were in country F. This seemingly distributed, but in fact "impenetrable" operation method was once regarded as the "standard configuration" of Web3 projects.

But today, the perspective of supervision has undergone a fundamental change - no longer looking at where your company is registered or where the code is deployed, but directly anchoring:

Who controls the issuance decision of the Token?

Are the custody paths and capital flows of user assets clear?

Where is the actual controller of the project located and what responsibilities does he perform?

Is there a mechanism for penetrating governance, structural isolation, and clear division of rights and responsibilities?

What is being tested is no longer the wording skills of a legal opinion, but the "structural capacity" of the Web3 project as a whole, that is, whether it can build a role system and responsibility framework that can be truly penetrated, accountable, and sustainably operated.

In such a regulatory context, "moving the place of registration" is no longer a solution in essence. It is more like a risk transfer game, shifting potential problems from one jurisdiction to another area where regulation has not yet responded, and cannot fundamentally improve risk exposure.

From this perspective, DTSP is not just an ultimatum for Web3 projects, but also a turning point in investors' compliance perspective. It makes a key question unavoidable: "Am I investing in a project, or a legal risk entity that has not yet been clearly identified?" For investors, this regulatory evolution means an upgrade in the judgment dimension. In traditional investment logic, a white paper, a roadmap, and an AMA are enough to build confidence expectations. In the reality of stricter regulation, the "structural transparency" of Web3 projects will become a must-check item: Does the token itself have a legal issuance path and basis? Is the control structure clear, and are there any internal responsibilities overlapping or hidden dangers of holding on behalf of others? Do founders face excessive legal risks, and do their roles need to be separated and isolated?

Will the project have compliant financing, coin issuance and even exit mechanisms in the future?

These questions are no longer just for lawyers to answer, but investors must also learn to raise and examine them.

In other words, regulation is forcing the Web3 market as a whole to enter a new stage of "identity governance". Web3 project parties no longer rely solely on "narratives", but must submit answers to structural design; investors no longer only look at valuations, but must ask "Are you ready to be penetrated by regulation?"

DTSP is just the beginning, and a greater compliance resurgence is happening simultaneously around the world.

* Tip: Investment is risky, please participate in Web3 under the premise of legality and compliance.

Weiliang

Weiliang

Weiliang

Weiliang Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Weiliang

Weiliang Catherine

Catherine