In recent days, the crypto market has received good news one after another.

In the mainstream market, the crypto industry has once again achieved a milestone, marking the start of a new era for the industry. At the same time, companies and institutions from all over the world are also eager to try.

The macroeconomic situation has improved, and the industry is not to be outdone. In recent days, there have been frequent reports of good news about the industry. First, the U.S. state government's strategic reserves achieved its first victory. New Hampshire passed the Strategic Bitcoin Reserve Act, which authorizes the state treasurer to purchase Bitcoin or digital assets with a market value of more than 500 billion U.S. dollars, and sets the upper limit of holdings at 5% of the total reserve funds. Bitcoin is expected to see new growth. Second, the new SEC chairman took office and made it clear that the core priority during his term is to establish a reasonable regulatory framework for the crypto asset market. He continued to release positive signals. BlackRock was also rumored to be discussing an ETH pledge proposal with the SEC, and market confidence rebounded.

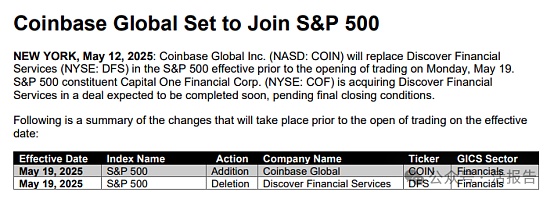

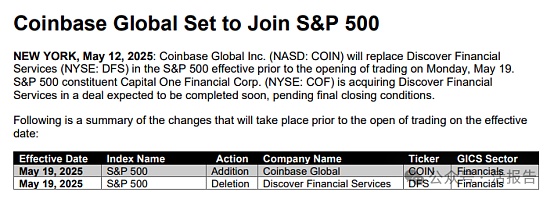

For the crypto market, Coinbase is not a household name, but it is also well-known. As the largest and most compliant crypto exchange in the United States, Coinbase is also unique in the global crypto exchange field. Coinbase was founded in 2012 and has a history of 13 years. In the past 13 years, it has experienced ups and downs between bull and bear markets, becoming the best window for traditional finance to observe the crypto industry. On the other hand, this move has further promoted the IPO boom of crypto companies. Since last year, many companies such as Circle, eToro, Bgin Blockchain, Chia Network, Gemini, and Ionic Digital have been promoting IPOs. Kraken has reorganized its organization to meet regulatory requirements. Coinbase has set a good example and has become a typical example.

JD is still in the organizational structure, but Ant Digits is progressing faster and has already implemented actual cases. Last year, Ant Digits cooperated with green energy service provider GCL Energy to successfully complete the first domestic RWA case based on photovoltaic physical assets involving 200 million yuan, and subsequently cooperated with Conflux Tree Graph Chain, Patrol Eagle Group, Sui and other projects to promote the implementation of RWA projects.

Overall, whether it is the IPO of US crypto companies or the promotion of RWA by local Hong Kong companies, as the crypto industry is gradually gaining popularity, companies and institutions have shown an active attitude towards layout, but due to regional differences, the ways of participation are slightly different.

Against this background, the attention paid to the trends in the mainland market is continuing to increase, and the opening of funds on the market is the focus of attention. There are even rumors that the mainland is expected to open a paper BTC spot ETF in the future, which is similar to a book transaction without spot delivery, similar to the paper gold model. This move can not only participate in cryptocurrency transactions to a certain extent under the compliance control of funds, but also avoid actual holding, and the transactions are transparent and traceable. Of course, rumors are just rumors. Considering the risks of cryptocurrency to the financial market, especially under the current regulations, the feasibility can only be described as a fantasy, but it can also be seen from this that the market has expressed quite high expectations for the opening of mainland funds.

It can be foreseen that as the mainstreaming of crypto assets increases, more and more companies will be involved in it, and funds, attention, and resources will further flow into the market. This round of institutional FOMO wave has only just begun.

Kikyo

Kikyo