At the intersection of crypto and traditional finance (TradFi), a new type of publicly traded company has emerged: digital asset treasury companies (DATCOs). These firms explicitly prioritize the accumulation of digital assets (typically Bitcoin) as a core business strategy. While Michael Saylor's Strategy (formerly MicroStrategy) laid the groundwork with its pioneering Bitcoin accumulation in 2020, this year's surge of new entrants and novel capital strategies has made DATCOs a central narrative in both the stock and crypto markets. This article comprehensively examines the DATCO ecosystem, delving into the market mechanisms behind their valuations, visualizing their geographic distribution, and analyzing the capital structures that support these companies' continued accumulation of large crypto asset positions. We also assess the risks inherent in this model, particularly potential crises in the event of capital exhaustion or a collapse in equity premiums.

1Summary

The total value of digital assets held by Digital Asset Treasuries Companies (DATCOs) has surpassed $100 billion, with publicly listed companies Strategy (MSTR), Metaplanet (3350.T), and SharpLink Gaming (SBET) leading the way.

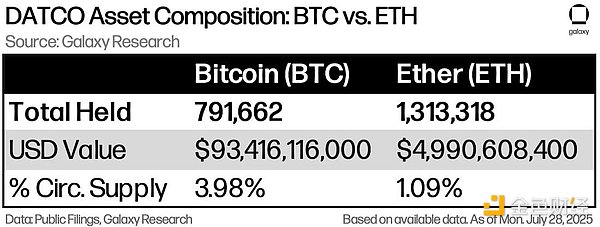

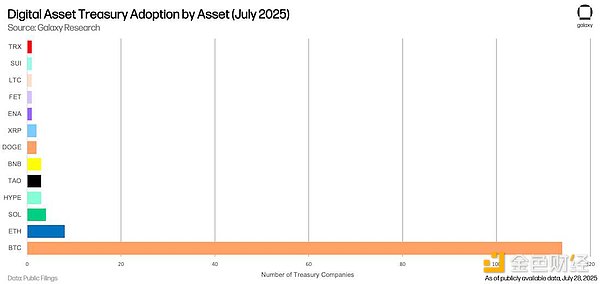

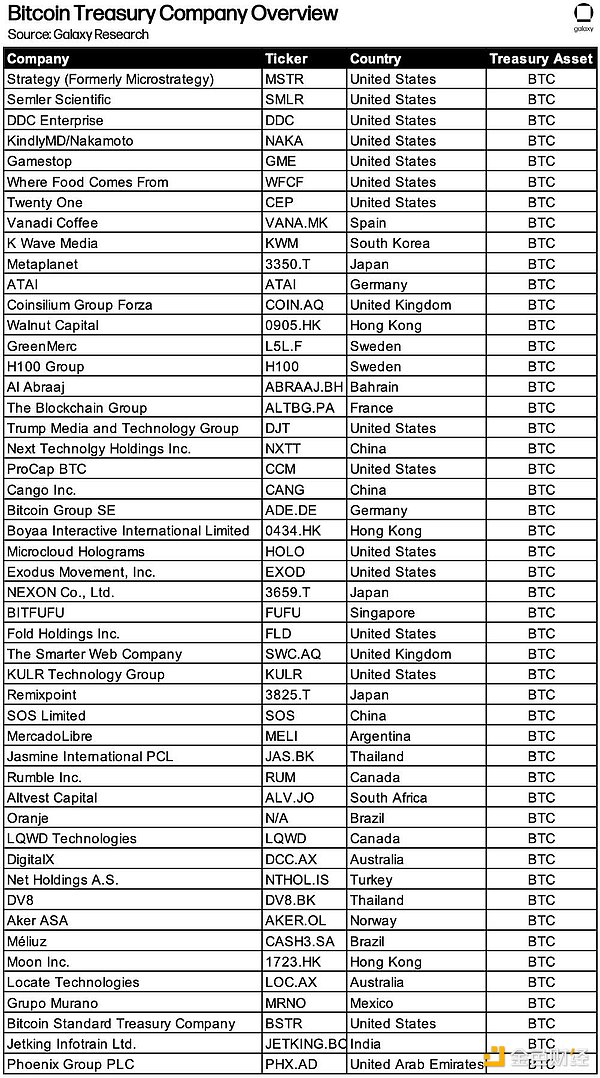

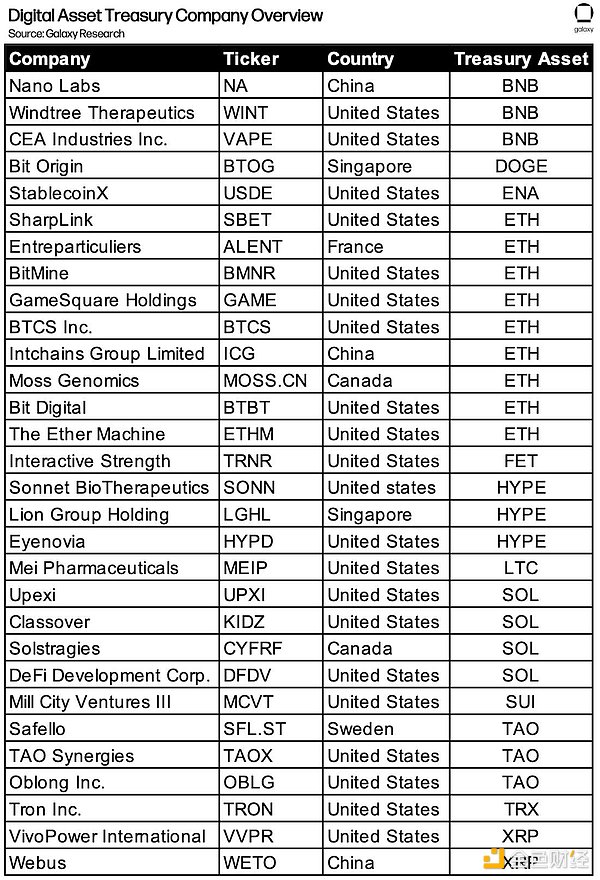

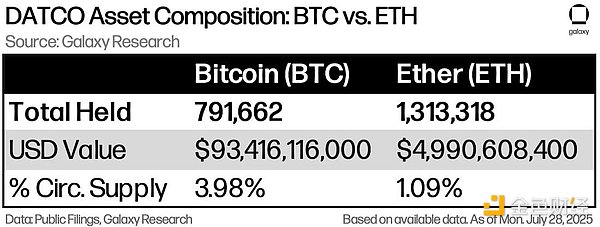

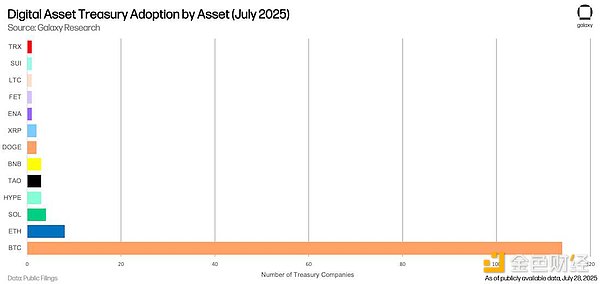

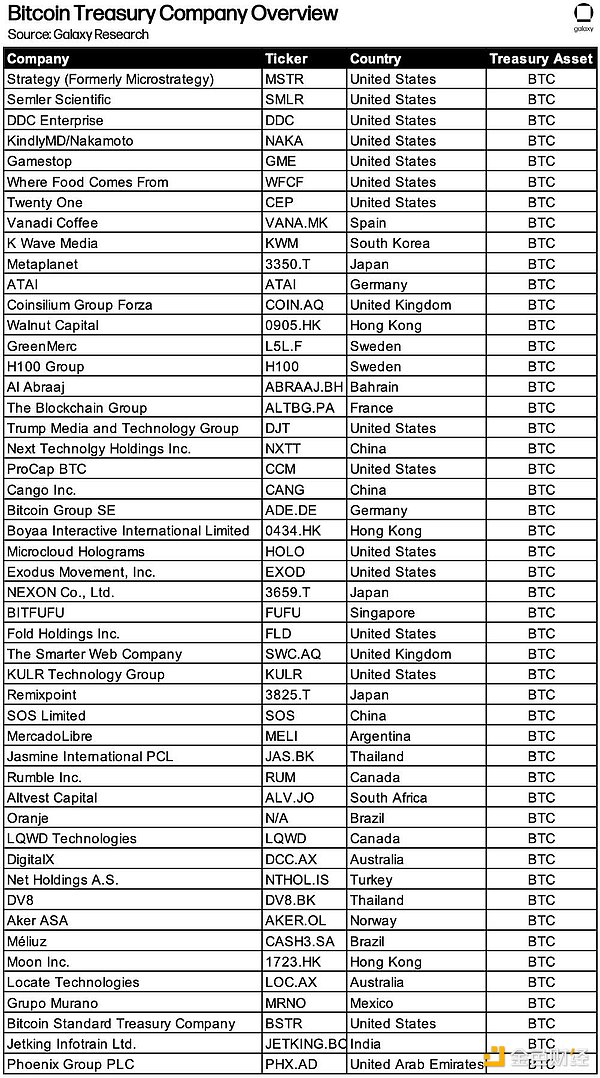

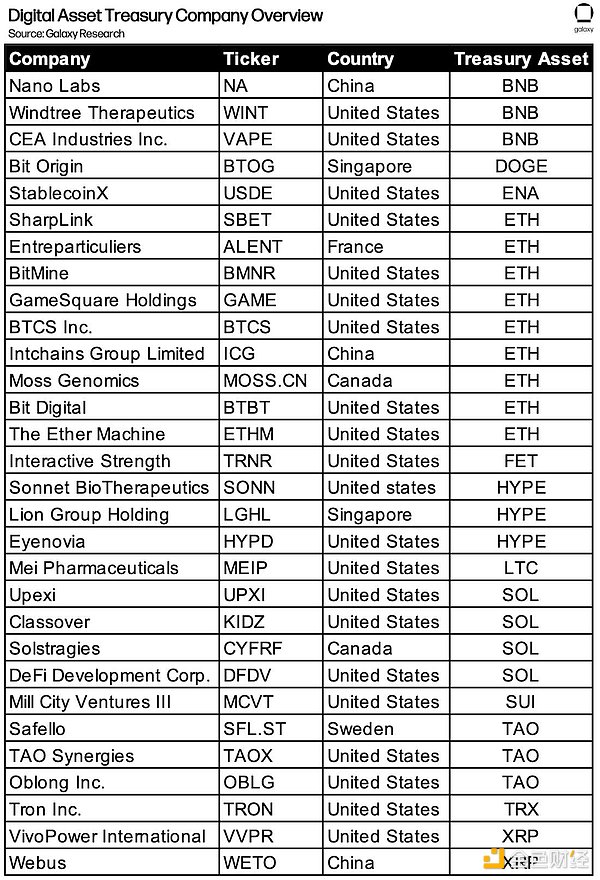

Bitcoin Treasuries dominate the category, holding over $93 billion worth of BTC, while Ethereum-focused DATCOs have accumulated over $4 billion in ETH. Together, these vault firms hold 791,662 BTC and 1,313,318 ETH, representing approximately 3.98% of BTC's circulating supply and 1.09% of ETH's circulating supply. Strategy alone has over $28 billion in unrealized profits, valuing its BTC holdings at $71.8 billion at current market prices. Smaller participants also demonstrate a lower BTC cost basis and significant upside potential. New entrants are diversifying their portfolios beyond BTC and ETH. Treasuries have begun holding at least ten other digital assets, including SOL, XRP, BNB, and HYPE. Ethereum treasuries are employing strategies such as staking and DeFi yield farming to generate potential non-dilutive returns on treasury capital—an advantage unattainable with pure BTC strategies. While the United States remains the primary hub, the surge of new entrants highlights growing international demand for DATCOs, driven primarily by regional capital market dynamics. DATCOs differ from ETFs in their strategic fundraising and capital deployment capabilities and are likely to benefit from narrative-driven investor inflows. The DATCO model is vulnerable to premium collapse, regulatory changes, and capital market volatility. Companies that rely heavily on PIPE financing or are highly leveraged could experience sharp drawdowns in adverse market conditions. While DATCOs are currently creating a positive feedback loop for cryptocurrency prices, the potential liquidation of positions could backfire if the category becomes overextended. However, this risk is currently theoretical, and excluding Strategy, DATCOs are relatively small—holding only approximately $32 billion in assets, representing a mere 0.83% of the $3.8 trillion total cryptocurrency market capitalization. 2. Definition Before delving deeper, let's first clearly define the core concepts of the Digital Asset Treasury Company (DATCO) model. Digital Asset Treasury Company (DATCO): A publicly traded company that incorporates Bitcoin or other digital assets as a primary strategic function on its balance sheet. Unlike traditional companies (like Tesla) that only have incidental exposure to crypto assets, DATCOs actively accumulate digital assets with the explicit goal of continuously expanding their holdings. Investors view these companies as leveraged, high-beta alternatives to their existing holdings. Equity Premium to Net Asset Value: This metric quantifies the premium a company's stock price trades at relative to its net asset value (NAV) per share. This is defined as: Premium (%) = ((Stock Price / NAV Per Share) - 1) * 100. This formula reflects the public equity market's valuation premium for a company's digital assets. Note: This concept differs from the broader concept of enterprise valuation premium (including debt or fully diluted shares), which is more commonly used to describe these companies. mNAV: This stands for "net asset value multiple," expressing the same concept as premium, but expressed as a multiple rather than a percentage. For example, a stock trading at 2.75 times mNAV has a premium of 175%. ATM (At-the-Market Equity Offering): This allows a company to issue additional shares over time at the prevailing market price. When a company's stock price trades at a premium to its NAV, each dollar raised through an ATM will purchase more crypto assets than it will dilute. ATMs are often the capital formation tool of choice for DATCOs because of their scalability and the ability to avoid significant discounts or large-scale offerings. PIPE (Post-IPO Private Equity): A negotiated capital raise in which large investors subscribe to newly issued shares at an agreed-upon price. This is common in stocks with illiquidity or a low float. While PIPEs can provide rapid financing, they often come with significant equity dilution and short-term price risk, which will be discussed in detail later. Bitcoin Yield: This is a key performance indicator that tracks how efficiently Bitcoin Vault companies accumulate BTC on a diluted per-share basis over time. This metric reflects a company's capital efficiency—its ability to convert raised funds into BTC without significant equity dilution. Higher BTC yields are generally associated with higher equity premiums. 3. Methodology: This paper analyzes the structure, market impact, and capital strategies of digital asset treasury companies (DATCOs) as of July 2025, drawing on a combination of primary and secondary data sources. The research prioritizes public data and employs a unified analytical framework across all included companies. The analysis is based on cross-validation of the following information sources: listed company financial filings; official press releases; on-chain data analysis platforms; and voluntary disclosures by companies.

Inclusion Criteria

For a company to be classified as a Digital Asset Treasury Company (DATCO) and included in this analysis, it must meet the following criteria:

Be publicly listed on a major exchange (e.g., Nasdaq, Tokyo Stock Exchange);

Hold a significant amount of digital assets on its balance sheet;

Implement a clear and prudent fund management strategy, where asset accumulation is core to its business model;

This criterion excludes Bitcoin mining companies (e.g., Riot, Marathon) whose digital asset holdings are primarily a byproduct of their mining operations rather than an active capital allocation decision;

It also excludes companies like Tesla and Blockchain, whose digital asset purchases are not a core component of their business models.

Holdings and Valuation Assumptions

BTC and ETH holdings are based on the latest disclosed balances (as of July 28, 2025).

Market prices used in the calculation (as of July 28, 2025):

• BTC price: $118,000

• ETH price: $3,800

All foreign currency holdings (such as JPY for Metaplanet, EUR for ALTBG) are converted to USD at the spot exchange rate at the time of reporting:

• EUR/USD: 1.17

• JPY/USD: 144.2

4History

The Digital Asset Treasury Company (DATCO) model was developed by Michael In 2020, Saylor pioneered the conversion of MicroStrategy, the company he led, into the first publicly traded company to convert a significant portion of its cash reserves into Bitcoin (at the time, Bitcoin price: $11,650). This move redefined how companies viewed Bitcoin—not just as a speculative asset, but as a strategic reserve asset to protect against fiat currency devaluation. MicroStrategy's transformation significantly increased the company's market capitalization and established a new narrative for using Bitcoin as a corporate reserve fund, inspiring numerous imitators. The operational template Saylor created—increasing Bitcoin holdings through debt issuance, launching a market-priced equity offering, and publicly expressing a bullish stance on Bitcoin—established a replicable business model. While MicroStrategy remained an isolated example for many years, it laid the foundation for others to follow.

2023-2025Development Period

Between 2023 and 2025, multiple catalysts will drive DATCOs from an isolated phenomenon to a systematic trend:

In 2023, the U.S. Financial Accounting Standards Board (FASB) will revise accounting standards to allow listed companies to use fair value measurement for digital assets, enabling crypto holdings to be valued at market prices;

In 2024, the U.S. Securities and Exchange Commission will approve a spot Bitcoin ETF, marking the official entry of Bitcoin into the mainstream financial infrastructure system;

Global tensions and increased volatility of fiat currencies will prompt more companies to use Bitcoin as a means of storing value;

6. Market Composition and Asset Concentration

As of July 28, digital asset treasury companies (DATCOs) collectively held over 791,000 BTC and 1.3 million ETH, valued at approximately $93 billion and $5 billion, respectively, at current market prices.

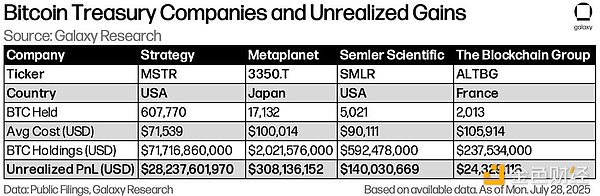

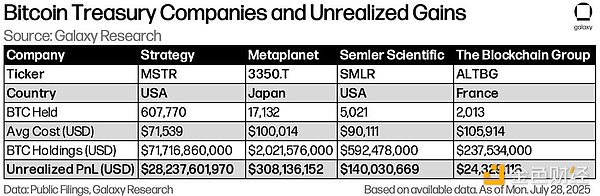

This asset structure reflects both the dominance of BTC in existing strategies and the rise of the ETH treasury narrative, particularly among new entrants focused on staking returns or ecosystem development. Strategy (MSTR) remains a core participant, holding 600,000 BTC, representing over 70% of all publicly listed companies' total BTC holdings. It has become the world's third-largest Bitcoin holder, trailing only the pseudonymous founder Satoshi Nakamoto and BlackRock's ETF products. A second tier of companies, including Metaplanet and Semler Scientific, comprise the next largest group of holders based on market capitalization and unrealized gains.

While Strategy dominated, firms such as Metaplanet and Semler Scientific also showed significant unrealized gains. Data based on publicly disclosed holdings and using a BTC price of $118,000. Note: Slight discrepancies between calculated and reported unrealized gains may be due to exchange rate fluctuations at the time of each company's cryptocurrency purchase. Beyond Bitcoin, a growing number of companies are implementing "alternative currency-first" treasury strategies. Companies including SharpLink Gaming (SBET), Bit Digital (BTBT), and Tron Inc. (formerly SRM Entertainment, ticker: TRON) are actively increasing their holdings of non-BTC digital assets and engaging in yield-generating strategies. This model introduces a productive income dimension to traditional strategies—a feature currently unavailable in pure Bitcoin strategies (although, low-risk, BTC-native yield solutions may emerge in the future).

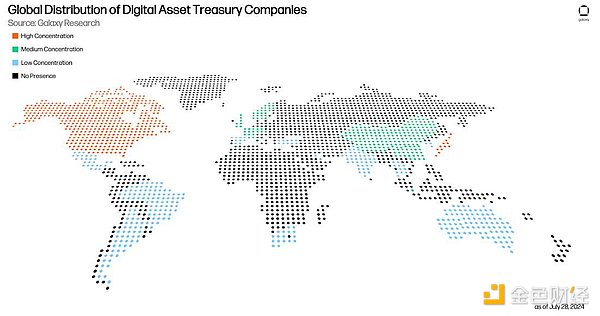

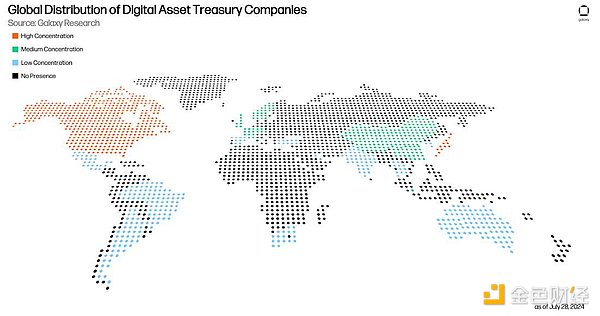

Although Bitcoin is still the absolute dominant asset of all current DATCOs, companies have begun to increase their holdings of other tokens such as ETH, SOL, XRP, BNB, and HYPE based on narrative logic. 7. Geographic Distribution of Digital Asset Treasury Companies (DATCOs) Digital asset treasury companies (DATCOs) have become a global phenomenon. The following chart, compiled by Galaxy Research based on publicly disclosed cryptoasset holdings, shows the global distribution of public DATCOs as of July 2025. To assess the level of DATCO activity, we categorize countries into three tiers (high, medium, and low) based on the number of public DATCOs and the size of their digital asset holdings. The high concentration tier includes countries with more than 10 listed DATCOs or companies holding unusually large crypto reserves (e.g., Japan, which was included in this tier due to Metaplanet's significant Bitcoin vault holdings). Countries with a medium concentration level, including three to nine DATCOs, represent increasing institutional participation and a trend toward adoption. Countries with a low concentration level, with only one or two identifiable DATCOs, are in the early stages of participation and market testing.

8Valuation Differences and the Equity Premium Phenomenon

There is significant divergence in the valuations of Digital Asset Treasuries Companies (DATCOs). While these companies share a strategy of accumulating digital assets, the premiums public market investors assess for their equity relative to net asset value (NAV) vary widely. The table below highlights this disparity by comparing a cross-section of eight BTC/ETH/TRX vault companies with significant publicly disclosed digital asset holdings and comparable market capitalizations (data as of July 28th). Some companies' premiums are relatively modest, such as MSTR's 58% (reflecting its scale and maturity), while Metaplanet, driven by its aggressive capital formation model, commands a premium of 179%. The premium differentiation for ETH-related DATCOs is even more pronounced. For example, Bit Digital trades at a 108% premium to the dollar value of its ETH holdings, suggesting the market is pricing ETH's unique return potential into future capital efficiency. Not all premiums are attributable to treasury strategies. Some companies have real-world businesses that generate underlying revenue, such as SharpLink Gaming, which operates a sports betting data platform. The chart also includes Tron Inc. (ticker TRON), renamed from SRM Entertainment, which has 365 million TRX staked. While its treasury size is smaller than some of its BTC peers, its 64% premium primarily stems from brand synergy and narrative exposure within the TRON ecosystem. For emerging alternative currency treasury strategies, symbolic value and signaling play a real role in valuation. 9. Capital Strategy and Market Mechanisms The core engine of the DATCO model lies in raising capital at a premium and converting this capital into a higher per-share holding of crypto assets. Companies that execute this cycle most effectively typically achieve the largest premiums (Metaplanet is a prime example). This section will analyze two of the most commonly used tools: At-the-Market (ATM) offerings and PIPE financing. Established DATCOs generally use an "At-the-Market (ATM)" offering as their primary strategy for continuously accumulating digital assets. This mechanism allows companies to gradually issue additional shares at market prices, avoiding the significant discounts and market volatility associated with large-scale offerings. ATMs provide companies with precise control: they can raise funds when demand is high and pause when the market cools, ensuring that the issuance rhythm is in sync with investor sentiment. When DATCOs' stock prices trade at a premium to their NAV, each dollar raised through ATMs will purchase more crypto assets than the resulting per-share dilution. This creates a "per-share crypto asset appreciation cycle": the company issues additional shares, which then purchases tokens, which in turn increases the per-share NAV, further widening the premium (known in the industry as "accretive dilution"). Metaplanet has mastered this strategy, continuously expanding its Bitcoin position by dynamically adjusting its ATM program. However, ATMs also carry risks. Excessive use can suppress stock prices. However, when used effectively, they can become an engine for efficient capital growth for DATCOs. Private Equity Investments (PIPEs) are a common tool for smaller or newly established DATCOs to quickly raise capital. Unlike ATM offerings, PIPEs are negotiated with large institutional buyers and are typically priced at a fixed market discount. While these financings are highly efficient in terms of speed and scale, they carry significant risk of equity dilution and future oversupply pressure. In June 2025, Nakamoto Corporation (not Satoshi Nakamoto) announced the completion of a $51.5 million PIPE financing to support its Bitcoin reserve strategy. The transaction closed within 72 hours and was priced at $5.00 per share. "We will continue to execute our strategy to raise as much capital as possible to acquire as much Bitcoin as possible," said Nakamoto CEO David Bailey. Both BitMine and SharpLink Gaming have strategically raised ETH through PIPEs. While these financings expand token reserves, they also increase the number of outstanding shares. While PIPEs are highly efficient in terms of speed and scale, the rapid influx of capital can suppress valuations based on NAV. Because PIPE shares typically have a lock-up period, investors anticipate that these shares will enter the market, creating future selling pressure. These instruments are best used in markets where there is a significant premium and investors fully understand the company's ability to convert capital into digital assets. PIPEs are neither inherently superior nor inferior; they are highly effective tools that can maximize both returns and risks. 10. What factors could trigger a market reversal? The core of the DATCO growth model relies on maintaining a consistent premium for equity relative to net asset value. If this premium disappears, or even turns into a discount, the model will begin to unravel. Several companies' stock prices have begun to show signs of a discount to their NAV. In such circumstances, companies may use digital asset reserves or operating cash flow to initiate share repurchases to capitalize on this discount. (Bitmine has received board approval to repurchase up to $1 billion in stock if management deems it appropriate.) If only a few companies take such actions, the impact on the entire ecosystem will be limited. However, these DATCOs are highly interconnected—both interconnected and synchronizing with the underlying cryptoasset markets. If redemptions or repurchases spread across the industry, it could trigger a larger market reversal. The current landscape of treasury company trading strategies is becoming increasingly crowded. In the past week alone, at least ten companies have announced the adoption of DATCO strategies. The operational template is clear, and capital is pouring in—which presents a risk. When hundreds or even thousands of companies implement a homogeneous, one-way strategy (issuing additional shares → purchasing cryptoassets → repeating the cycle), the entire system becomes structurally fragile. A deterioration in any one variable—investor sentiment, crypto prices, or capital market liquidity—could trigger a chain reaction. A reversal in DATCO trading could significantly pressure digital asset prices themselves. Just as inflows from treasury companies provided a "sustained buying" for Bitcoin, redemption-driven outflows are likely to have the opposite effect. At the very least, the net accumulation of assets could be interrupted. A similar self-reinforcing cycle occurred during the investment trust boom of the 1920s. Trust companies traded shares at a premium to net asset value (NAV) and raised funds through secondary offerings to purchase more assets. When market sentiment reversed, the same mechanism amplified downside risk. The collapse of premiums cut off access to financing, while leverage amplified losses from asset devaluation. These chain reactions accelerated the 1929 stock market crash and the subsequent Great Depression. While DATCOs offer greater transparency and better oversight than the trusts of the era, the mechanism of capital formation based on mNAV is strikingly similar. A market reversal could lead to industry consolidation. Large players like Strategy (MSTR), which are well-capitalized and still trade at a premium, could begin acquiring smaller DATCOs at a discount to NAV. These transactions essentially allow acquirers to leverage their equity premium to acquire BTC at a discount. However, this strategy presupposes that the acquirer maintains this premium advantage.

As these companies scale, their influence on the digital asset market also grows. A market reversal would weaken the biggest positive factor for cryptocurrencies in this cycle: the normalization of digital assets on corporate balance sheets. A reversal of DATCO transactions could reduce public market appetite for exposure to various digital assets and slow the inflow of funds into crypto ETFs, which, all else being equal, would drag down the price of the underlying cryptocurrency.

It should be noted that, excluding Strategy, DATCOs remain a relatively small player in the digital asset ecosystem, holding only approximately $32 billion in cryptocurrencies, representing approximately 0.83% of the global market capitalization. While the daily influx of new DATCO announcements may exaggerate their current significance, the aforementioned market risks remain largely theoretical. However, as this category continues to expand, these risks warrant close monitoring. 11. Conclusion and Outlook: Digital Asset Treasuries (DATCOs) have evolved from a novel capital allocation experiment into a significant source of structural buying pressure in the crypto market. Their continued rise is not only reshaping how market participants gain exposure to digital assets but is also profoundly altering perceptions of the relationship between the crypto market and traditional finance (TradFi). Looking ahead, DATCOs will play a more significant role in the crypto space. However, this development is not without risks. The reciprocal relationship between DATCO stock trading and Bitcoin prices warrants close attention. Funds flowing into BTC treasuries enable them to conduct more value-added financing, which in turn leads to more BTC purchases. This cycle creates a powerful stimulative effect during bull markets. However, if the macro environment shifts toward risk aversion, this stimulus could quickly turn into a dampener. However, there is a legitimate concern: BTC prices are increasingly influenced by risk appetite in public equity markets. This is perhaps inevitable—if Bitcoin is truly "the purest form of capital," companies will naturally scramble to acquire it. While DATCOs broaden institutional participation, they can also create structural dependencies, undermining Bitcoin's goal of becoming a non-correlated asset. The Digital Asset Treasury Company (DATCO) model works best when three conditions are met simultaneously: 1) digital asset prices are on a sustained upward trend; 2) equity premiums remain high; and 3) capital markets remain liquid and receptive. The DATCO landscape is likely to continue expanding in breadth and complexity. Galaxy Research anticipates the following trends: • Continued protocol diversification, with more companies exploring tokens (particularly proof-of-stake chains) to generate non-dilutive returns; • The rise of hybrid fund management models, combining cash-flow-generating operating businesses with capital-efficient digital asset accumulation; • Further geographic diversification, with new companies in emerging markets adopting similar strategies leveraging local regulatory and capital market conditions. DATCOs reflect the financialization of cryptocurrency (and the crypto-fiatization of finance). While imperfect, they offer a powerful bridge between these two increasingly intertwined worlds. While DATCOs cannot in any way replace the core principles of self-custody and decentralization that underpin cryptocurrency, they provide a compliant and liquid channel for large-scale capital to gain exposure to digital assets. 12. Appendix: Company Directory The following table lists related companies that employ the Digital Asset Treasury Company (DATCO) model. These include the case companies analyzed in detail in this report, as well as other companies that exhibit similar fund management characteristics but are not included in the core dataset due to strategic differences. This list is not exhaustive. The group of companies integrating digital assets into their balance sheets is dynamically expanding, and the DATCO model continues to evolve in both form and function. Companies may enter and exit this classification at different times as capital strategies adjust. This list is intended to provide guidance on the breadth and diversity of public market fund management strategies and to serve as a reference for subsequent research.

Catherine

Catherine