Author: M7 Research Source: X, @m7_research

Recently, with Trump issuing $TRUMP on the Solana chain, a wave of celebrity token issuance has been set off. Tokens such as $MELANIA, $RYAN, $ENRON, and $LIBRA have appeared one after another, and the Meteora platform has quickly become the preferred issuance platform for such high-profile projects. These token projects show a striking similarity: extremely high FDV, exaggerated trading volume, and violent price fluctuations. On the surface, these tokens are sought after by the market due to the celebrity effect, but in-depth analysis shows that behind this is actually a set of carefully designed wealth harvesting mechanisms.

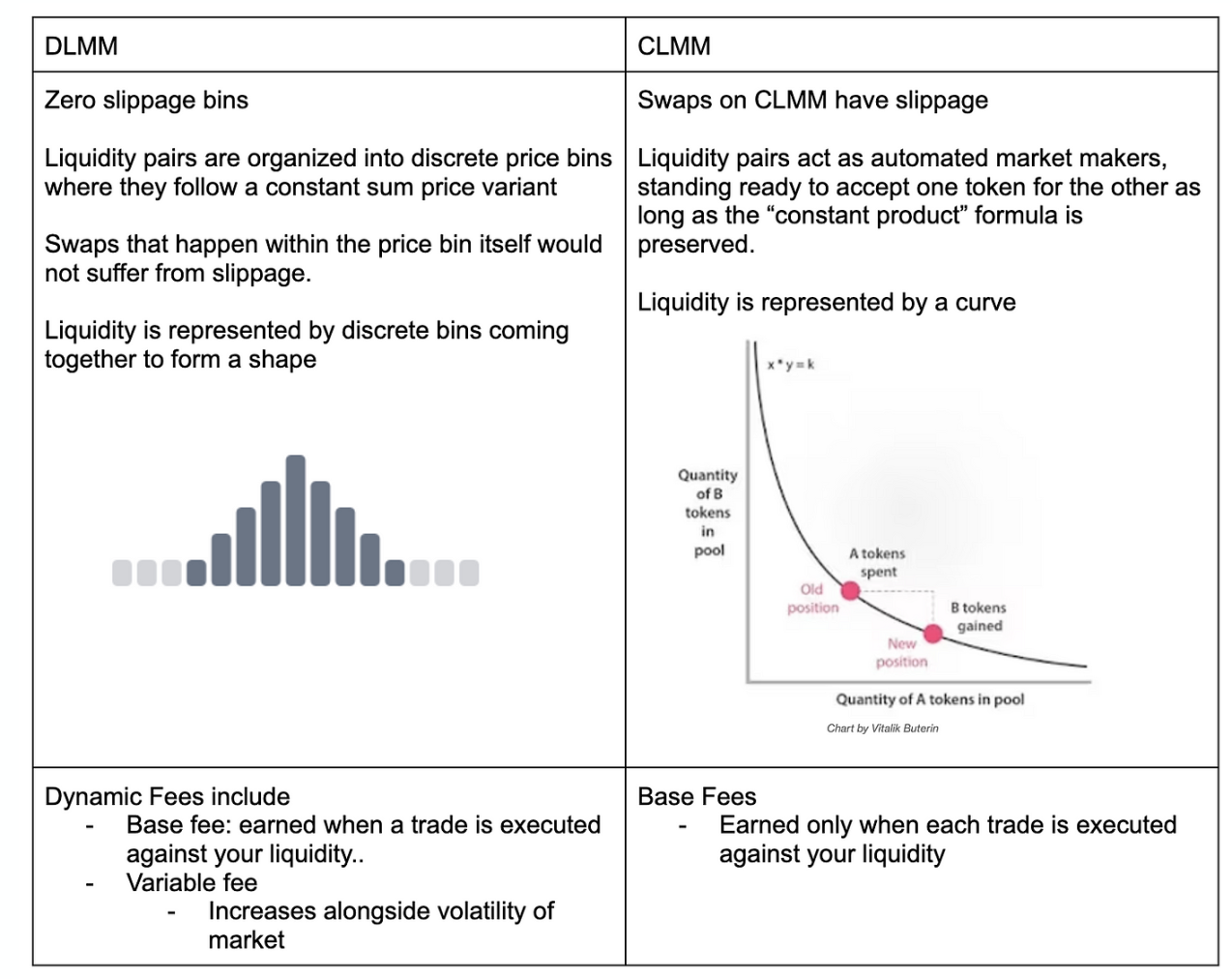

Meteora Platform: Innovative Mechanism Becomes a Manipulation Tool

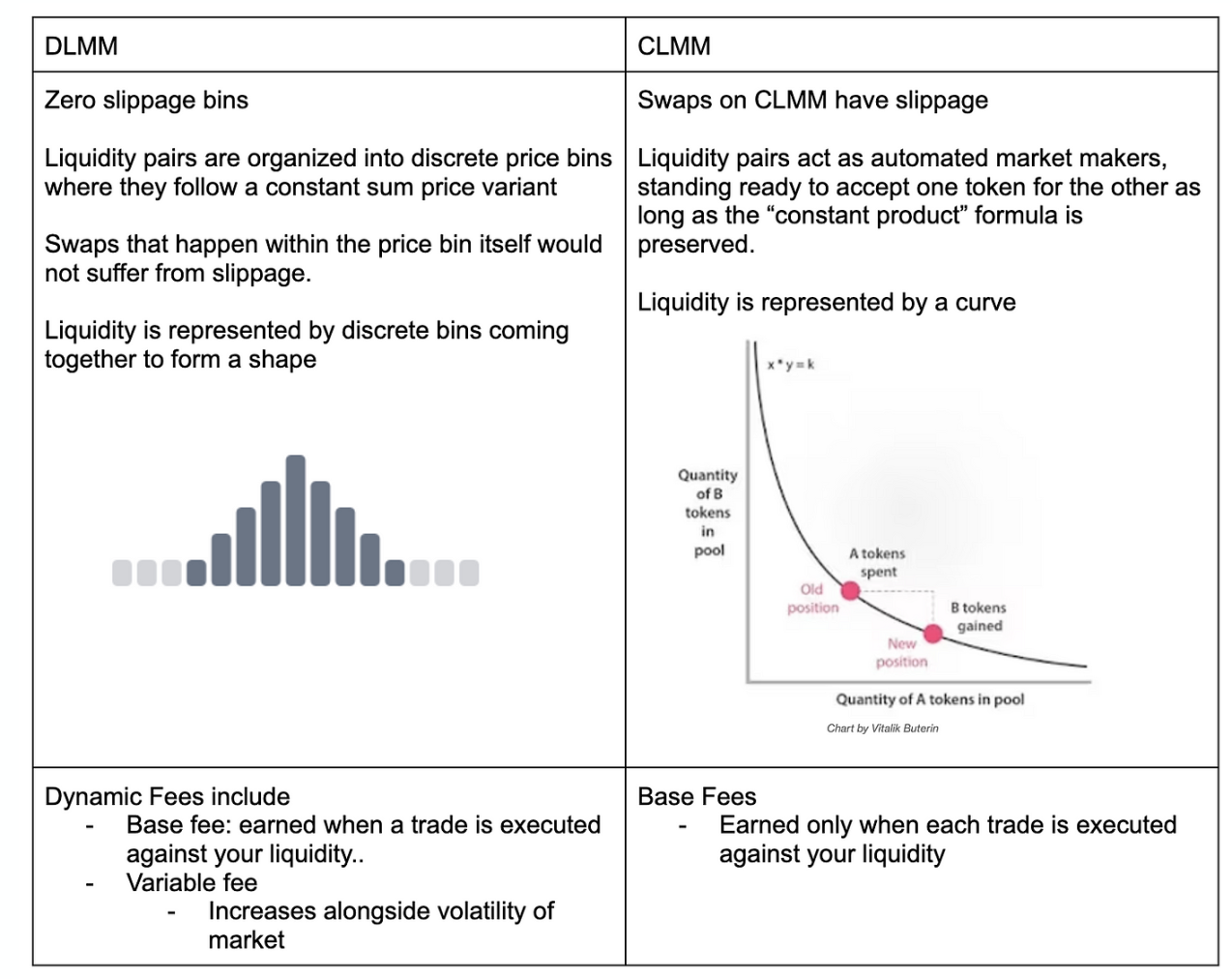

The Meteora platform has gained favor with its DLMM model, which has lower transaction slippage and a flexible liquidity management mechanism. However, these innovative features, which were originally designed to improve capital efficiency, have been improperly exploited and become profit-making tools for project owners and insider traders.

Operation mode of systematic manipulation

In a typical celebrity token issuance, the project party usually takes the following steps:

It has been observed that project parties often create DLMM pools for tokens and USDC trading pairs in advance and only inject unilateral liquidity. This means that at the opening, a large number of limit sell orders have been preset waiting for liquidity to flow in, and the zero slippage feature of the DLMM trading bin further amplifies the project's profit margin.

Insider Trading Analysis: Precise Timing and System Operation

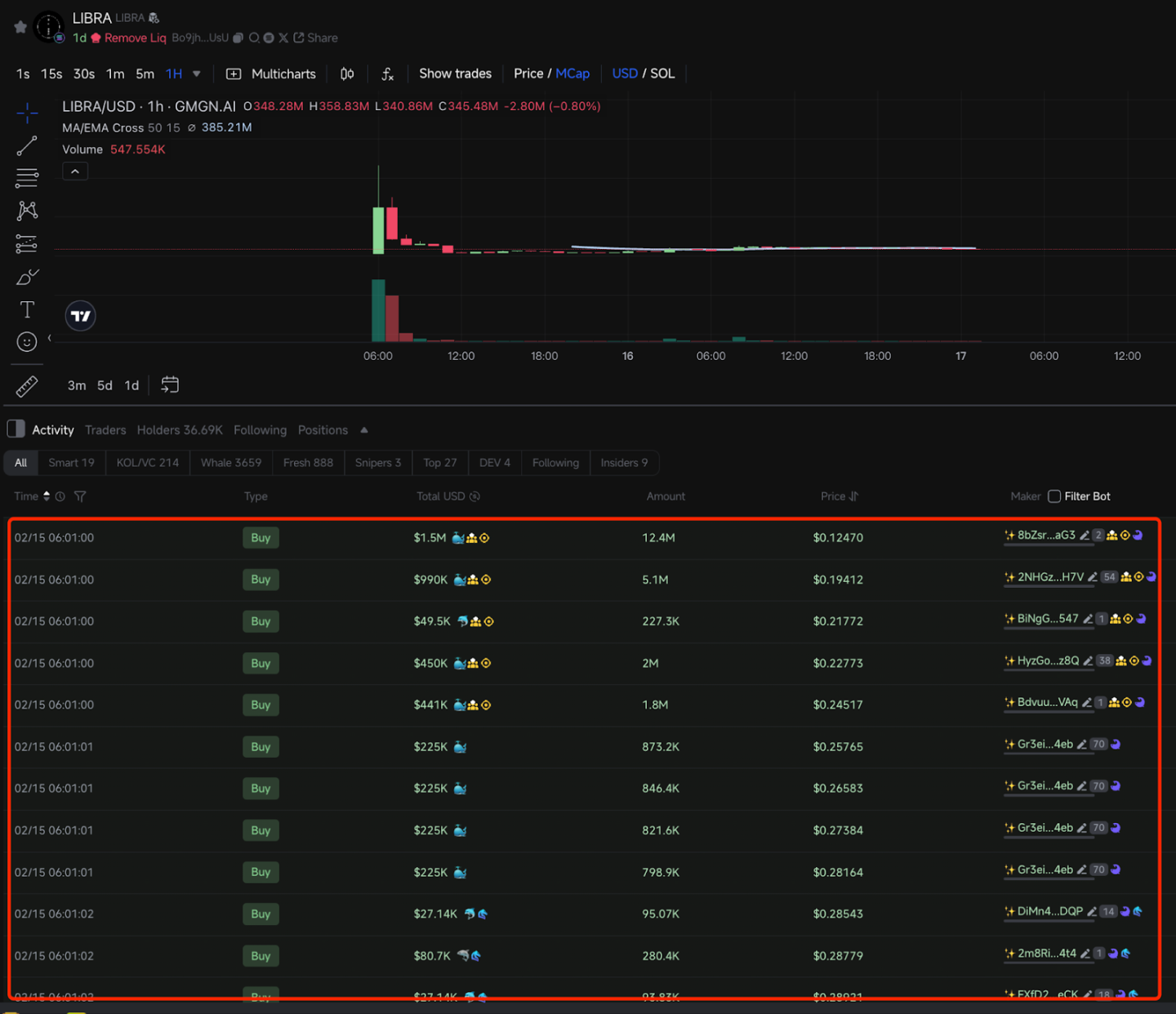

In the cases of $MELANIA, $ENRON, $LIBRA, etc., insider traders all knew the contract address (CA), trading pool information and opening time in advance. Specifically:

$LIBRA created the token on the 14th, and the transaction was not created until 20 minutes before the opening of the market on the 15th https://solscan.io/tx/3vtogCe5Q52iUYbY6CLRTV3RUf2ggSDoAkPtCYpJrvpvdoqx71mJbS5zgwvze7CDHTBzNohbg4eJiFPw5kUnu5Dh

$ENRON created the token on January 25th, and the Meteora pool was not established until one hour before the transaction on February 4th https://solscan.io/tx/ydzeZfhtfM4vwU2dH7ALB3acavcNBh5oTSuPgCCBPonoQvm4AbCo5P2Rw4WqyWUvRJj4D3mUN68JzTK1uwqF8Ej

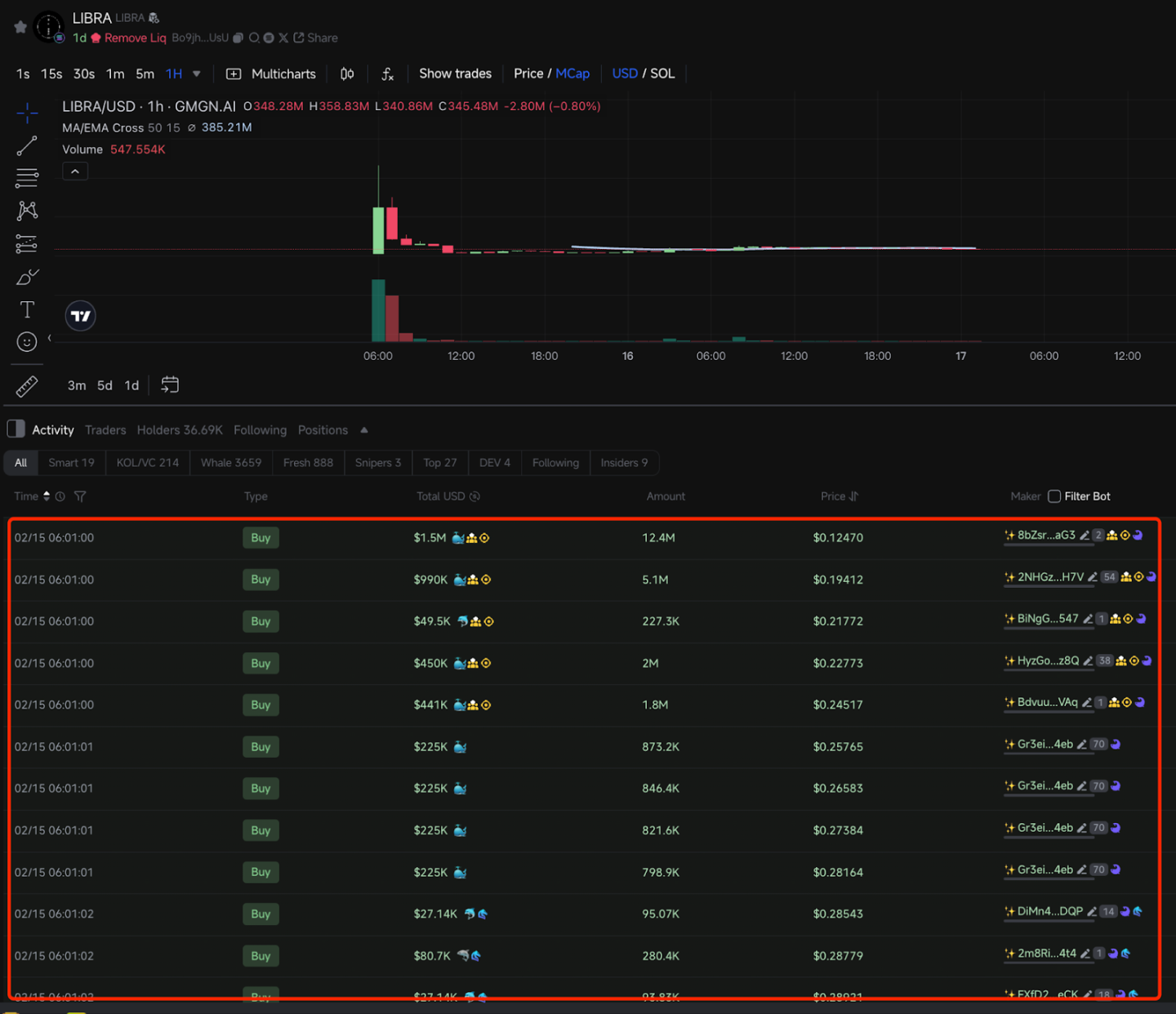

According to GMGN data, nearly $4.5 million of funds poured into $LIBRA in just 2 seconds after it opened.

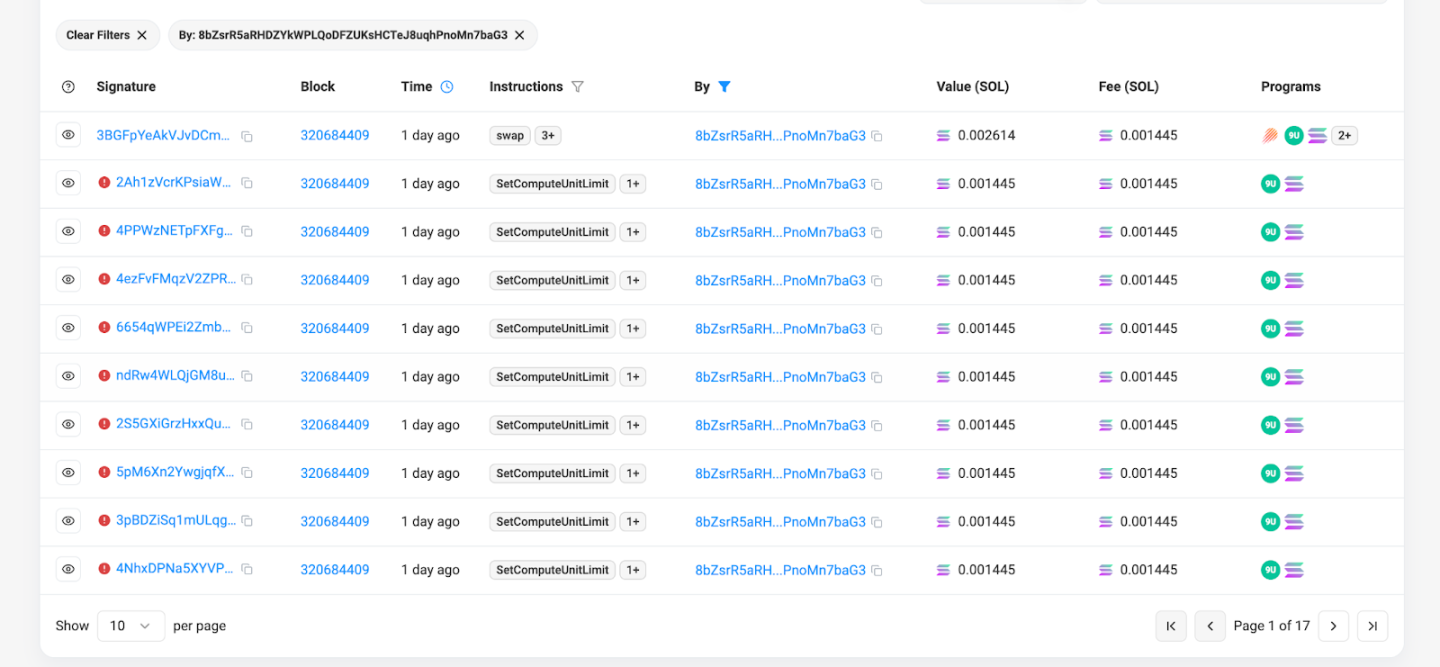

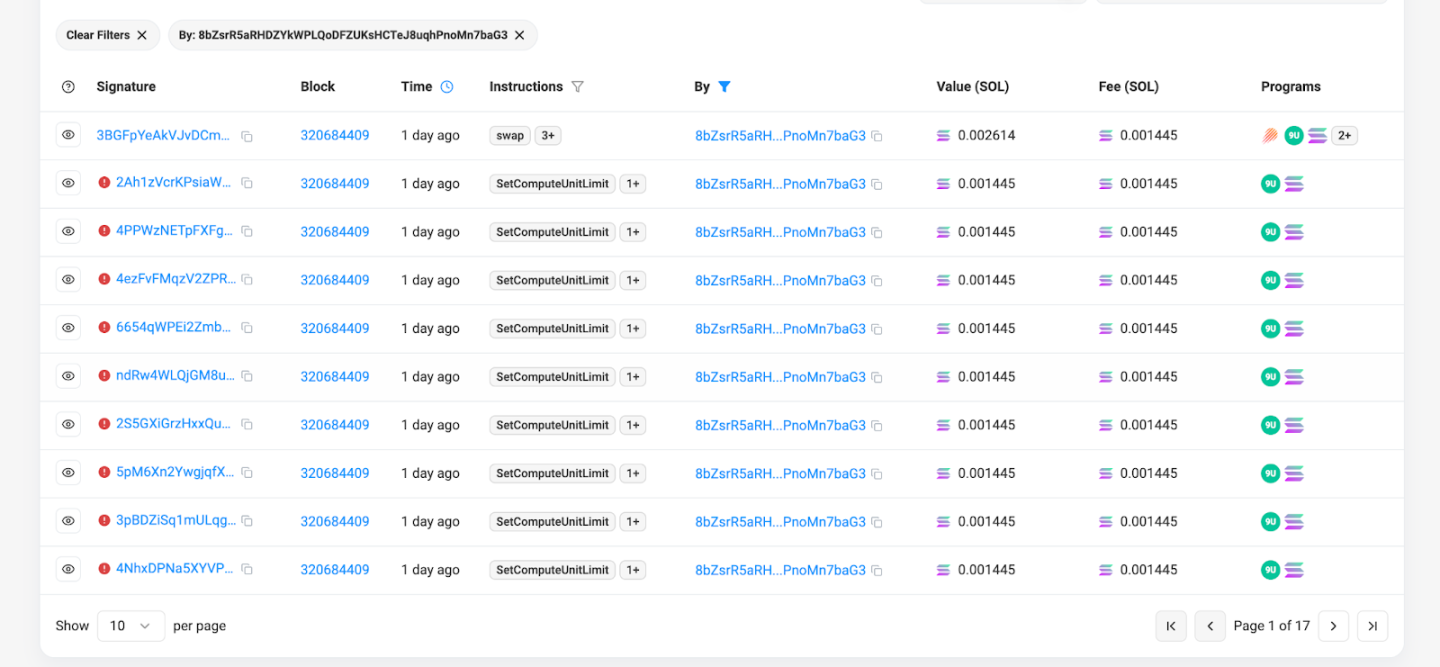

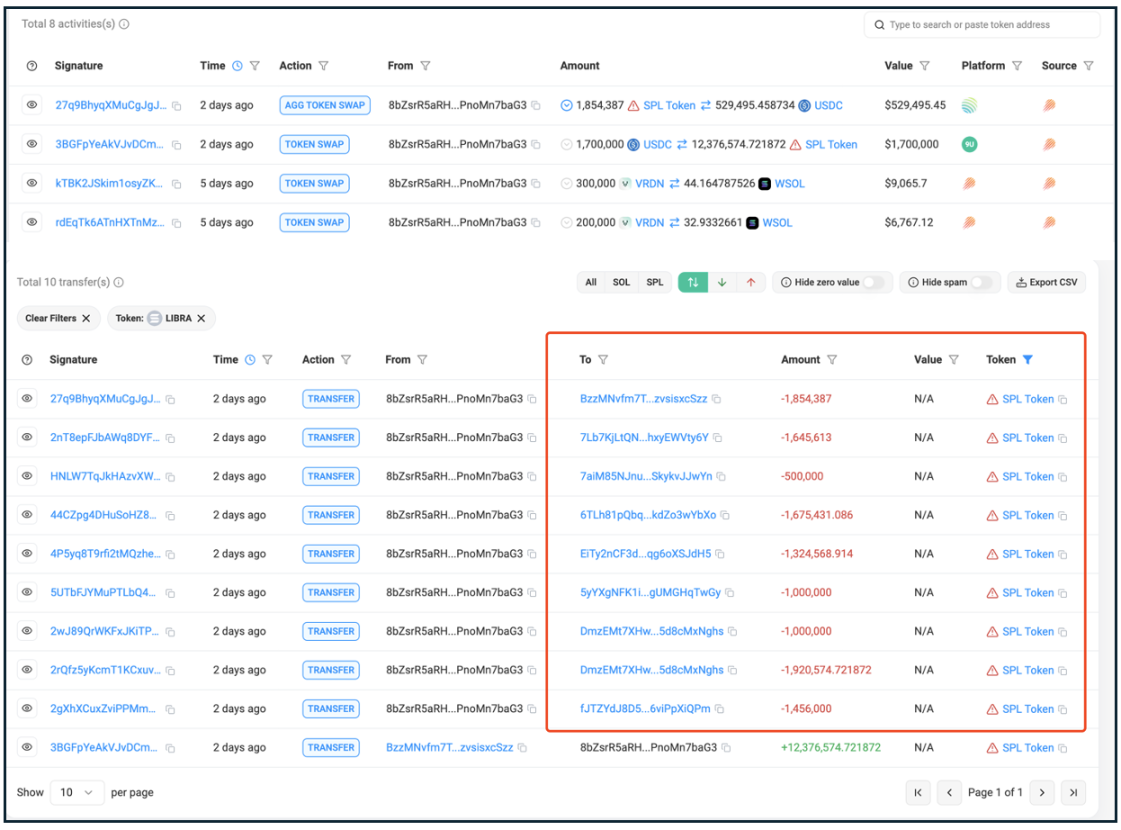

A trader (address: 8bZsrR5aRHDZYkWPLQoDFZUKsHCTeJ8uqhPnoMn7baG3) took the lead with a single $1.4 million sniper transaction. The account initiated 170 transactions in the opening block and was not successful until the moment the transaction was opened. Considering that there are pools on Meteora that only add unilateral liquidity every day, such a large amount of precise investment is obviously derived from insider information.

Detailed explanation of profit model

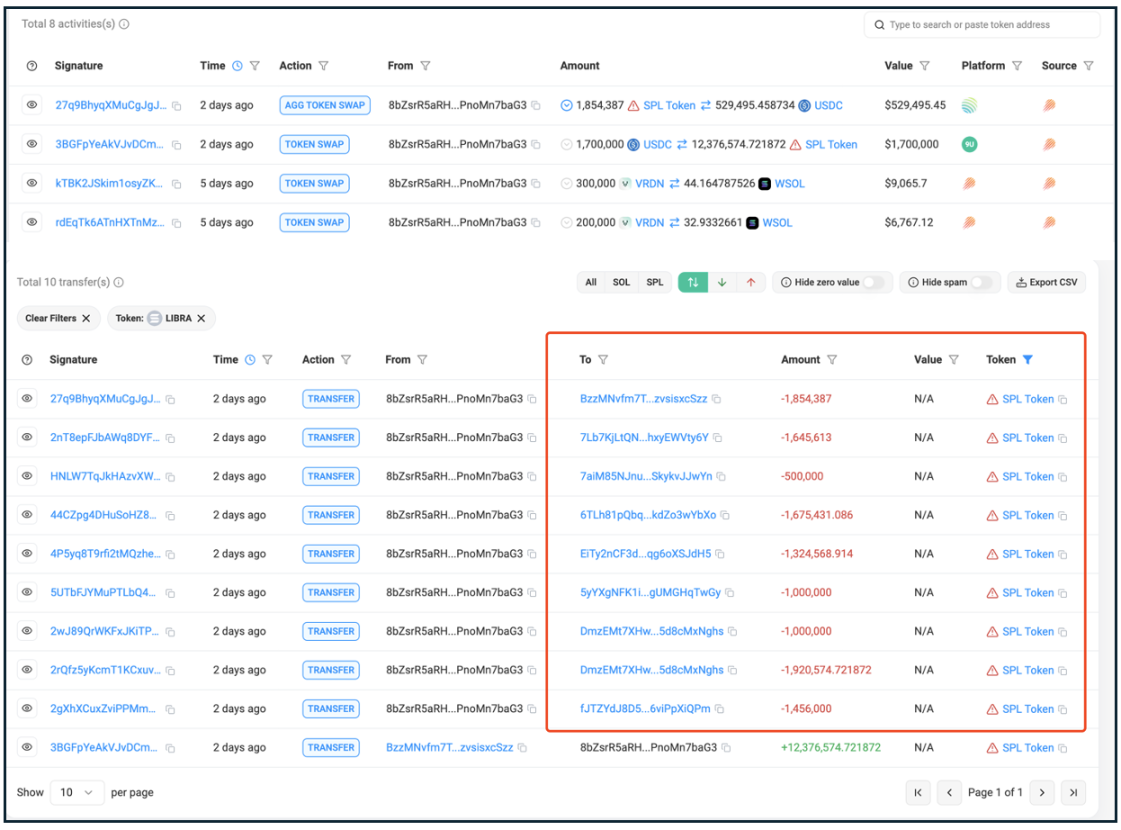

This sniper trader adopted a systematic profit strategy:

Quickly exchanged 1.8 million tokens into US$530,000

The remaining tokens were distributed to 8 sub-accounts

Take the largest sub-account (DmzEMt7XHwA1tZM5d1XBGvTFWoUpTLutpR5d8cMxNghs) as an example: 750,000 tokens were sold every 20 seconds, 14 times in a row.

The remaining tokens were added to the $LIBRA-$SOL trading pair as one-sided liquidity, and 5,500 SOL were harvested after only 7 minutes.

Convert all LIBRA and SOL obtained to USDC within 5 hours after the opening, making a profit of 5 million US dollars.

In the end, the sniper account made a total profit of 17 million US dollars through this bulk dumping method.

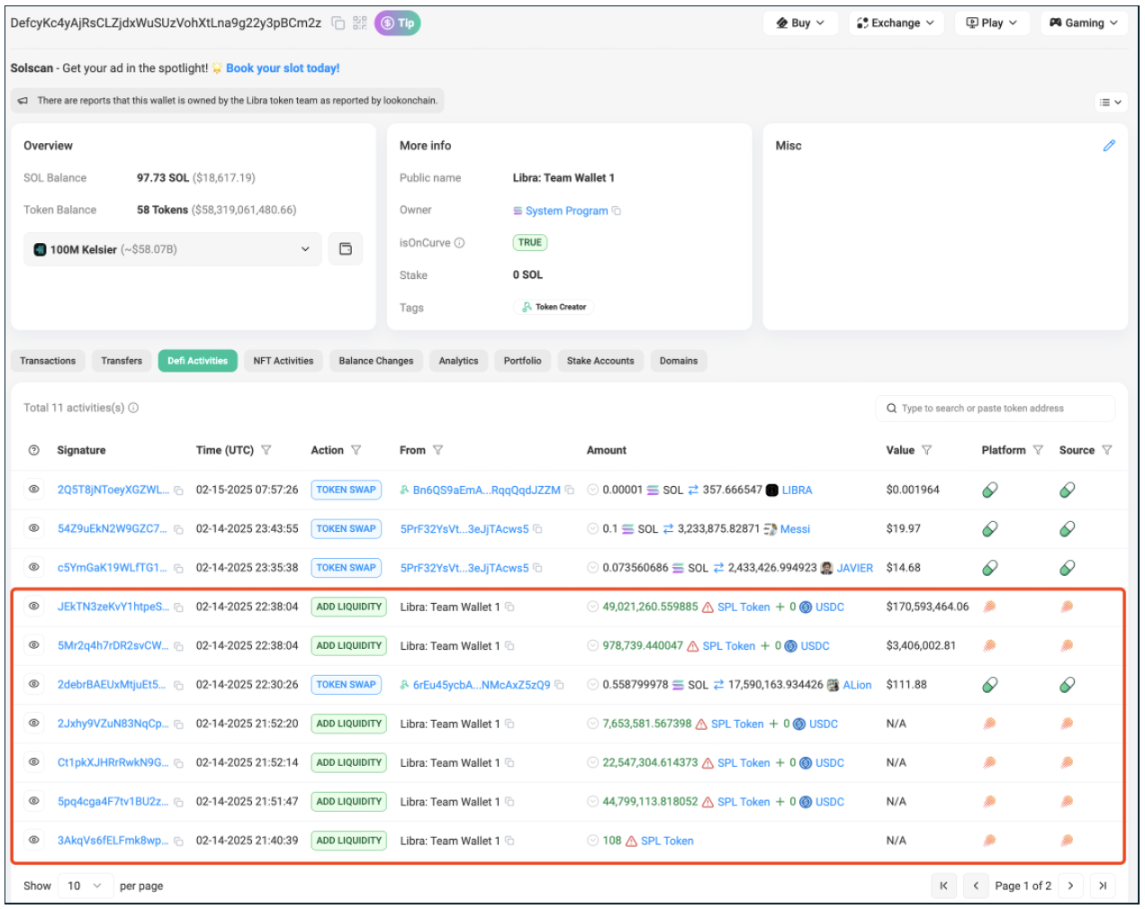

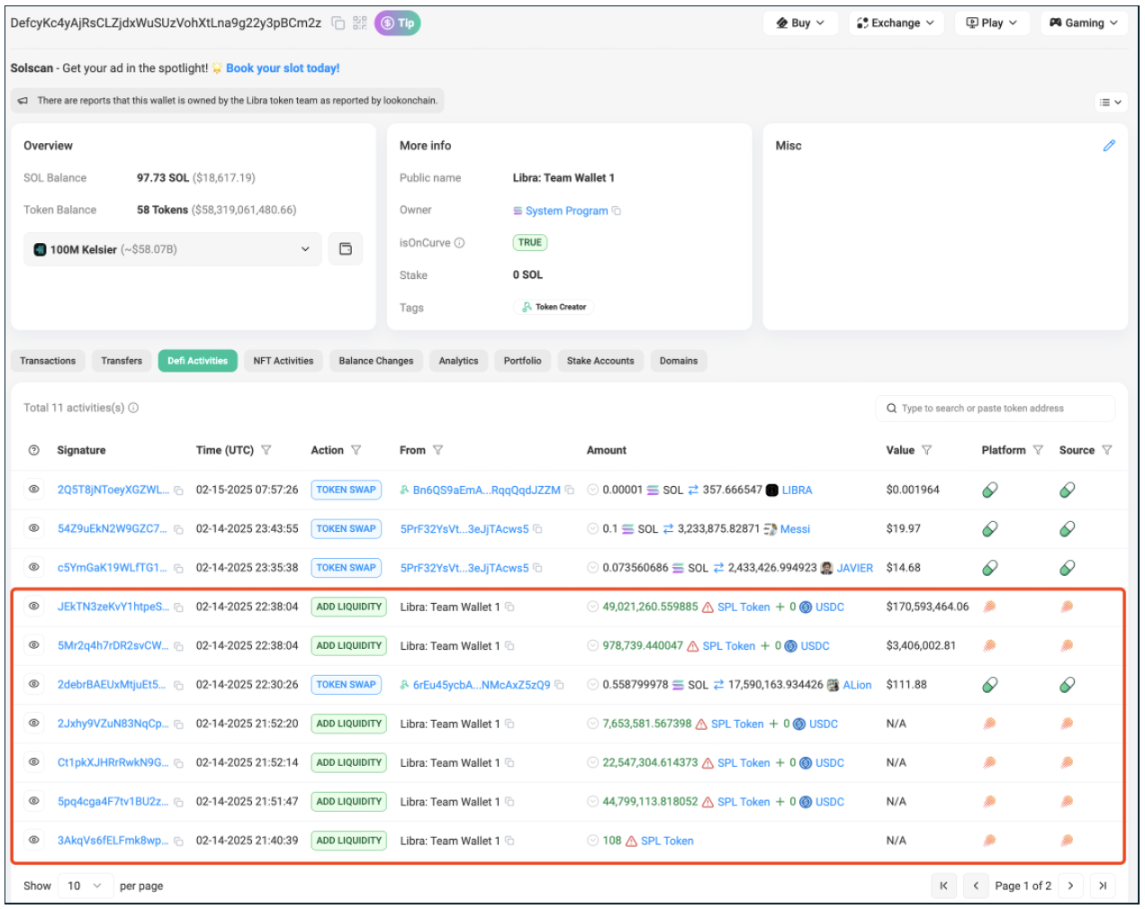

At the same time, the project party made even more profit. The developer address (DefcyKc4yAjRsCLZjdxWuSUzVohXtLna9g22y3pBCm2z) also used the unilateral liquidity mechanism to add tokens to the Meteora pool, and the fee income alone reached 10 million US dollars.

Market Impact and Warning

Although the $LIBRA case has attracted much attention due to its high attention, $ENRON, $MELANIA and $RYAN all show similar operating modes. Investors have unknowingly fallen into the "celebrity + Meteora + big truck" fund harvesting trap. The high liquidity mechanism of the Meteora platform has been abused by project parties and insider traders, which has seriously overdrawn the liquidity and investor confidence of the cryptocurrency market.

Weatherly

Weatherly