Author: Fairy, ChainCatcher

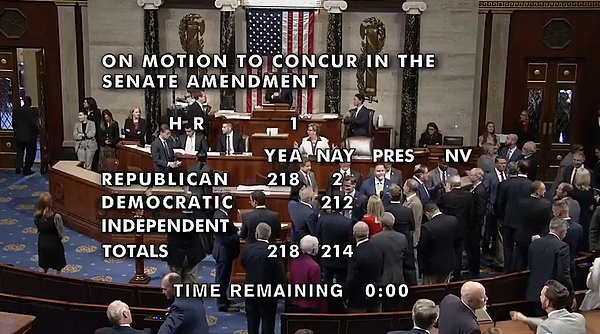

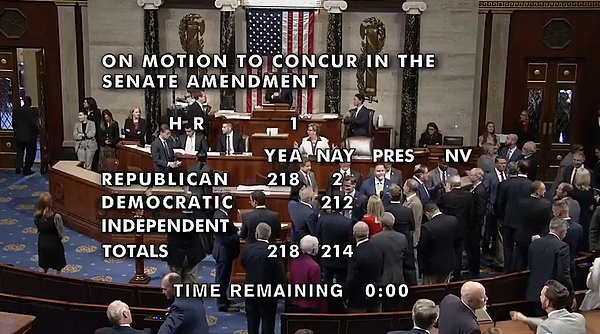

After a marathon vote full of pressure, tug-of-war, and threats, the U.S. House of Representatives finally passed the One Big Beautiful Bill Act by a narrow margin of 218 votes to 214.

This 869-page bill has sparked fierce disputes between the two parties and led to a "public breakup" between Trump and Musk. Musk even threatened that if it is passed, he would announce the establishment of a "new American political party" the next day.

According to the White House, Trump will sign the bill at 5 a.m. Beijing time on the 5th, and this "fiscal experiment" is about to begin.

The thrilling legislative journey of the "Beautiful Big Bill"

From its initial proposal to its final success, the legislative journey of the "Beautiful Big Bill" has gone through many twists and turns. In mid-May, Republican lawmakers launched the legislative process with the "budget reconciliation procedure", intending to bypass the traditional threshold of 60 votes in the Senate and advance it with a simple majority.

(Note: Budget reconciliation is a special legislative mechanism that allows budget-related bills to be passed in the Senate with only 51 votes. Currently, the Republicans hold 53 seats in the Senate and the Democrats hold 45 seats.)

On May 22, the House of Representatives passed the bill by a narrow margin of 215 to 214. Before the vote, because the difference in votes between the two parties was very small, Republican Speaker Johnson made several amendments at the last minute to meet the requirements of some Republican congressmen, but even so, all Democrats opposed the vote and there were differences within the Republican Party.

On June 4, Musk publicly opposed the bill, calling it "disgusting," and began to lobby Republican lawmakers privately to try to prevent the president from signing the bill. This further fermented the legislative game and pushed the bill to a higher level of public opinion. (Related reading: Overturning US stocks, Bitcoin plummeting, Musk and Trump "swearing" out a financial tsunami?)

After entering the Senate, the offensive and defensive battles became more intense. On June 29, the clerk read the 940-page bill text all night, which took about 16 hours, becoming a rare scene in Washington politics. On July 1, after Vice President Vance cast the key vote to break the 50-50 deadlock, the bill finally passed the Senate final draft with 51 votes.

On July 3, the House of Representatives voted again on the Senate version and completed the final passage with the same gap of 218 votes to 214 votes. During this period, Democratic leader Jeffries, in order to delay the procedure, gave a single speech of 8 hours and 46 minutes, setting a record for the longest time in the House of Representatives.

Throughout the process, Trump was highly involved, calling members of Congress many times, publicly exerting pressure on social platforms, and criticizing opponents by name for "making a big mistake."

Who wins and who loses? The interests behind the bill

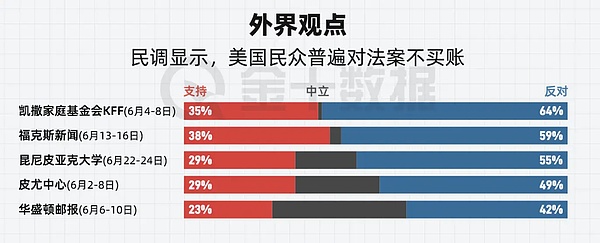

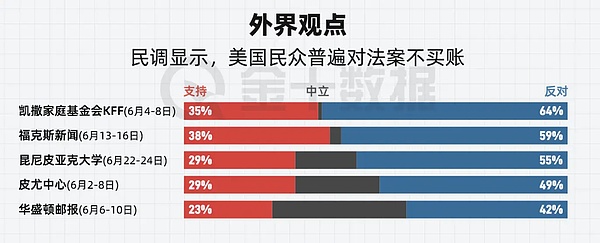

The final version of the "Beautiful Bill" is 869 pages long and complex, with the core provisions focusing on large-scale tax cuts and substantial cuts in social welfare spending. Multiple polls show that the American public generally "does not buy into" the bill.

Image source: Jinshi Data

After the heavy hammer of the bill fell, the obvious "winners" and "losers" were drawn.

Winners: the rich, companies and traditional energy

The first clear beneficiaries are high-income groups and large companies. The bill not only makes the personal and corporate tax cuts implemented by Trump in 2017 permanent, but also further expands the tax cuts for capital gains, inheritance taxes, corporate R&D expenditures and shareholder dividends.

Data disclosed by U.S. Senator Bernie Sanders showed that the bill provides $975 billion in tax breaks for the richest 1% of Americans, while providing $211 billion in estate tax exemptions for the richest 0.2% of Americans, and large companies have received a tax cut of $918 billion.

In addition, the traditional fossil energy industry has received "green light" subsidies, while clean energy incentives such as electric vehicles and solar energy have been cut - this is also one of the important triggers for Musk's "runaway".

Loser camp: low-income people, the younger generation

In sharp contrast to the above winners, low-income families and marginalized groups in society are facing a direct impact. The bill cuts more than $1 trillion in government spending, with Medicaid and food subsidy programs being the hardest hit. The new insurance threshold, work requirements and changes in the funding mechanism are expected to cause more than 12 million people to lose their health insurance qualifications within 10 years.

According to the CBO's calculations, the US debt will surge by $3.4 trillion in the next decade due to the bill. This means that the government will have to borrow more to fill the fiscal gap, and the additional interest expenditure is expected to be as high as $600 billion to $700 billion. This heavy interest burden will eventually be passed on to future generations, squeezing the investment and benefits of the younger generation in key areas such as education and housing.

Crypto opportunities in the eyes of industry leaders

Although the "Beautiful Big Bill" does not directly involve the issue of cryptocurrency, industry insiders generally believe that its passage is still good news for the crypto market.

KOL Crypto Big Beautiful pointed out that the United States will significantly increase its fiscal deficit every year, and the size of the U.S. national debt will continue to rise in the future, which is undoubtedly a major positive for Bitcoin. At the same time, this controversial bill was still passed smoothly, which also demonstrated the strong control of the Trump administration in Congress, which is beneficial to the passage of the next encryption policy.

DWF Labs co-founder Andrei Grachev's forecast is even more optimistic. He said that with the passage of the "Beautiful Big Act", coupled with the traditional market active season in the fourth quarter and the possible interest rate cut environment, Bitcoin and related encryption stocks are very likely to set a new record high. Although the altcoin market will also benefit partially, the performance of mid-cap currencies is expected to be relatively inferior to Bitcoin.

Crypto KOL Phyrex believes that although the bill is not directly beneficial to the crypto industry, it reflects the fiscal expansion of deglobalization in the United States and the drastic reconstruction of global capital flows, which will indirectly help promote liquidity for cryptocurrencies, especially the remittance tax will directly drive the rise in the market value of stablecoins.

BitMEX founder Arthur Hayes has a different view. He believes that if Trump's "Big and Beautiful Act" is passed, the replenishment of the US Treasury General Account (TGA) may lead to a tightening of US dollar liquidity, and Bitcoin will fall back to $90,000 to $95,000; if the replenishment is smooth and stable, Bitcoin will fluctuate in the range of $100,000, and it will be difficult to break through the historical high of $112,000 in the short term. In addition, it is expected that before the speech of Federal Reserve Chairman Powell at the end of August, the market may go sideways or fall slightly, and Bitcoin may rise after liquidity is restored in early September.

As the "Beautiful Big Bill" landed, crypto legislation also entered an accelerated period. The Republican leadership of the U.S. House of Representatives has announced that the week of July 14 will be "Cryptocurrency Week" and will review three important digital currency-related bills. (The GENIUS Stablecoin Act, the CLARITY Act, and a proposal to restrict the Federal Reserve from issuing central bank digital currencies)

The wind has risen, waiting for the response.

Joy

Joy