There's been a major event lately. While it hasn't been mentioned much on the Chinese internet, it's been widely discussed in North American crypto circles. It's the AWS outage!

What Happened

The incident began at 3:00 AM Eastern Time (3:00 PM Beijing Time) on October 20th, when Amazon Web Services (AWS) detected a system anomaly in the US-East-1 region in Northern Virginia. This is one of AWS's most heavily trafficked and dependent nodes globally. Around 6:30 a.m., AWS announced that the issue had been "substantially mitigated" and that most services had resumed normal operations. However, the good times didn't last long. Later that morning (around 11:00 a.m. EST), new connectivity issues reappeared, this time affecting the Elastic Compute Cloud (EC2) service—AWS's core virtual computing resource, which powers most websites and blockchain nodes worldwide. The AWS engineering team began deploying a second round of fixes around 1:00 p.m. and announced at 4:00 p.m. that services were "gradually recovering."

As of now, the AWS status dashboard shows that all major regions have resumed stable operations, but some users are still reporting delays and intermittent access issues.

Impact on the crypto industry

Centralized exchanges

Coinbase, the largest crypto exchange in the United States, stated that its services were unavailable due to the outage, and users were unable to trade, deposit or withdraw funds.

If Coinbase were a centralized exchange, it would be understandable that it was affected by the AWS outage.

The Ethereum ecosystem was impacted

However, a bunch of so-called decentralized Infuras were deeply affected, especially the Ethereum ecosystem:

Although the core blockchain of the Ethereum mainnet remained operational and continued to produce blocks.

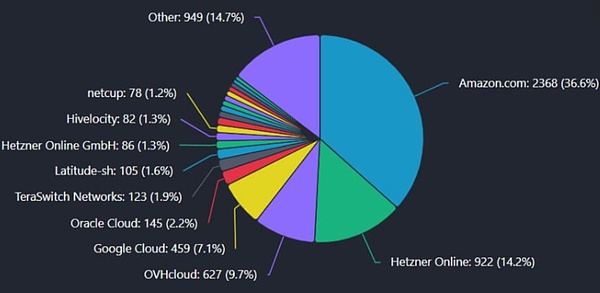

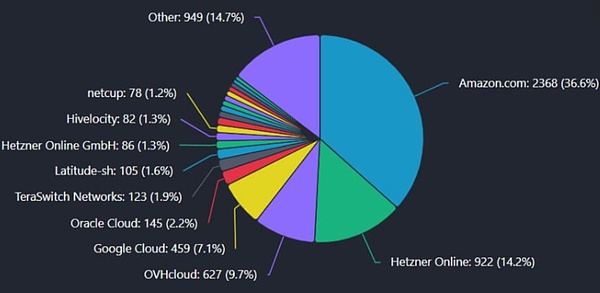

However, 37% of the nodes were offline on AWS, resulting in a decrease in network capacity and delayed transaction confirmation.

Because Ethereum has no miner support, its nodes are highly dependent on cloud service providers. Together with Google Cloud and Azure, the total hosted nodes reach 68%.

In addition to the Ethereum mainnet, a large number of Layer2s in the Ethereum ecosystem are also deeply affected:

Base: Performance has dropped by about 25%, and users have reported connection problems and transaction failures. Optimism, Arbitrum, Polygon, Linea, Scroll: Node synchronization delays and sequencer issues caused about 80% of transactions to stall. Wallets and application layers were also severely affected: MetaMask: About 70% of connections failed, and users reported zero balance displays and synchronization issues. Ledger and Trust Wallet: Intermittent synchronization failures and transaction signing delays.

Market Reaction

The incident triggered market panic. Ethereum, which had just regained the $4,000 mark, fell 2.5%, and Layer 2 tokens were also affected. When the market discovered that the "centralized" blockchain was actually running on AWS, Amazon's stock actually rose 1.61%. Although networks such as Solana and Bitcoin were completely unaffected, they were also dragged down by this incident, causing their prices to fall.

I remember what a highly respected old OG said to me: Those who believe in the "decentralization" of the project are all leeks who have never entered the industry.

Brian

Brian