Author: Ciaran Lyons, Source: Cointelegraph, Compiled by: Shaw Golden Finance

BitMEX co-founder and Bitcoin billionaire Arthur Hayes is known for making bold and sometimes controversial Bitcoin price predictions, and he says he doesn't feel bothered even if he's wrong.

When Arthur Hayes was asked if he was worried that his Bitcoin prediction errors would trigger a negative reaction, he said: "No big deal."

Whether right or wrong, Hayes doesn't worry about his predictions

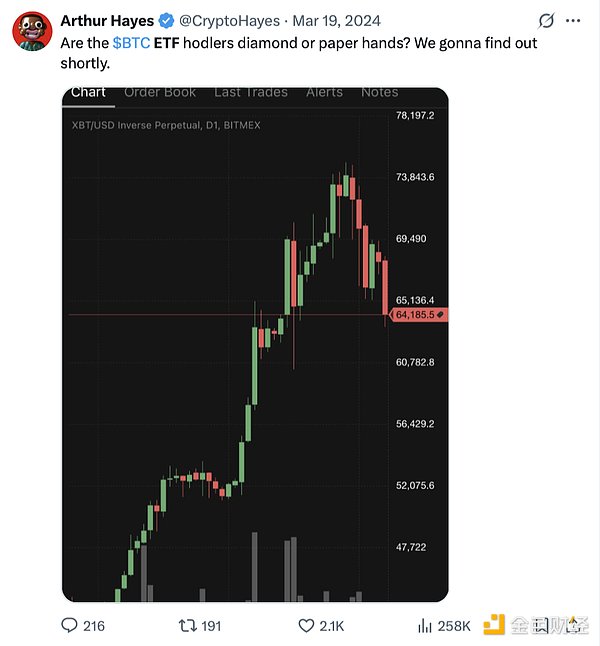

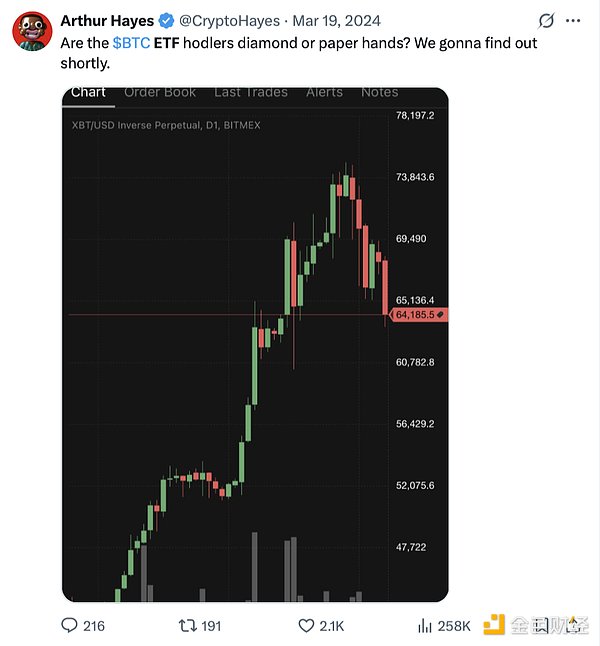

Arthur Hayes frankly admitted that most of his price predictions were inaccurate. "I made wrong predictions, and most of them were wrong," he said with a smile. "I don't know why people are so hesitant about this, in the end it doesn't really matter." Arthur Hayes added: "If you're roughly right, then it's fine." Hayes is outspoken about his predictions, whether they are right or wrong. Previously, Arthur Hayes made a short-term bearish prediction for Bitcoin, linking it to the depreciation of the Japanese yen. However, things didn't develop as he expected that weekend, and Bitcoin remained strong. To be fair, he later admitted his mistake on X, posting: "I was wrong." Arthur Hayes once said: "It's time to trade some shit meme coins." Similarly, in March last year, Hayes said that Bitcoin would rise to $110,000 before retesting $76,500. But just one month later, on April 9, Bitcoin fell to $76,500. Of course, Hayes' predictions are also correct. In December, he predicted a fall in the cryptocurrency market, saying there would be a “vicious sell-off” after U.S. President Donald Trump’s inauguration on Jan. 20, and he got it right.

Perhaps because over the years, the New York-raised Bitcoin veteran has developed a super-secret method for determining his year-end price target: “pick round numbers that humans like.”

Believes Bitcoin Will Hit $250,000 by 2025

His latest prediction is that Bitcoin will reach $250,000 by the end of this year, and he is confident that Bitcoin will not fall below $70,000 again along the way.

He said: "I don't really see the kind of major risk-off event that could spook the market, and I don't see a situation in the short term where people sell risk assets and cause Bitcoin to fall to those levels again." That said, Hayes does not agree with the extremely optimistic predictions of some Bitcoin supporters that Bitcoin could rise to $1 million by the end of this year. "I think it will happen before the end of 2028, but it won't happen this year."

However, Arthur Hayes is not in a hurry to make any short-term predictions in the short term. "I don't know, we'll wait and see, it really depends on the specific situation," he said. "If there's a situation where everyone thinks the same thing and I think differently, I usually try to make that prediction," he said.

Unlike most people who aspire to be trading geniuses, Hayes does have experience. He graduated from the University of Pennsylvania in 2008 with a bachelor's degree in economics. Just six years later, in 2014, at the age of 28, he co-founded cryptocurrency derivatives giant BitMEX with Ben Delo and Samuel Reed.

Recalling the days of house arrest

In 2020, Hayes resigned from BitMEX after the U.S. Department of Justice charged Arthur Hayes with Ben Delo, Samuel Reed and Gregory Dwyer for alleged violations of the Bank Secrecy Act.

Arthur Hayes and Ben Delo pleaded guilty in February 2022, admitting that they "willfully failed to establish, implement, and maintain an anti-money laundering program at the exchange." He ended up spending six months under house arrest, stuck in his home. It was a tough time, but Hayes also saw the positive side.

"It sucked to be in a place you couldn't leave for six months, but I made it to Miami; thank God it wasn't a prison," Hayes said with a laugh.

In March, U.S. President Donald Trump pardoned four former BitMEX executives.

Despite this string of legal troubles, Arthur Hayes remains one of the world’s most respected Bitcoin proponents. He’s considered an A-lister at cryptocurrency conferences, and his price predictions are taken seriously even when they’re sometimes spot-on.

Hayes can make bold predictions because, unlike many cryptocurrency executives who stick to safe calls, he’s a billionaire who lives life on his own terms. And that’s exactly what he planned to do all along.

“I’ve always been addicted to this game of trying to control my time,” he said. Hayes admitted that his current life is pretty comfortable. "I work out two or three hours a day, I read a lot, and then, you know, I write occasionally," he said.

Hayes said he enjoys living a life of luxury. "I know I'm happy because I can play tennis when I want, I can ski when I want, and things like that," he said, adding: "It's really not about how many bitcoins I have or how much cash I have in my bank account or wallet. The real question is if I can go pay for my friends or go skiing for six months if I want to."

Will the U.S. Government Actually Buy Bitcoin?

When Hayes was asked what his prediction was for the U.S. government actually buying Bitcoin for its strategic reserves. "I think the probability is only 1%", he said.

He added: "I still don't think they're going to sell the 200,000 bitcoins they seized, but I don't think the U.S. government is going to print money to buy bitcoin."

Hayes said that even if other countries adopt Bitcoin reserves, 200,000 BTC is already "worth a lot of money." Therefore, from the U.S. perspective, it may not trigger as much FOMO fear of missing out compared to other countries.

Hayes said that even if other countries adopt Bitcoin reserves, 200,000 BTC is already "worth a lot of money." Therefore, from the U.S. perspective, it may not trigger as much FOMO fear of missing out compared to other countries.

"Other countries, including China, may also have similar amounts of Bitcoin. I think it's more likely that countries will mine Bitcoin rather than print money and then use the printed money to buy Bitcoin," he said.

“If a country actually generates income, the situation is a little different,” he said.

Surprisingly, Hayes has never advocated for a U.S. Bitcoin reserve. On May 1, he said in an interview that he was “not terribly interested in the whole strategic reserve situation.” At the time, he said it was hard to imagine any “legally elected” politician publicly announcing that the government planned to print money to buy Bitcoin.

Bitcoin Finance Companies Will Become “Less Important”

Arthur Hayes also shared his predictions for Bitcoin Finance Companies, speculating that new companies will become increasingly less important. “I think as these trades become more saturated, they will become less and less relevant,” Hayes said.

“Each of these finance companies, at least if it’s in a market that already has finance companies, they’re not going to do as well, but it’s more difficult to generate non-dilutive accumulation of Bitcoin,” he explained.

Most finance companies conduct rights offerings, reduce their ownership percentage per share, and then use the proceeds to buy Bitcoin, which is a “very dilutive strategy,” Hayes said. “That’s hard to replicate over and over, especially in a market like the U.S. that’s almost saturated, maybe in other markets where there’s no Strategy, you can do it a few times,” he said.

Bitcoin ETFs Will Outperform Bitcoin Finance Companies

Arthur Hayes is more bullish on spot Bitcoin exchange-traded funds (ETFs). However, he did not predict how much money will flow into ETFs by the end of the year.

Hayes said: "I think it will continue to flow in because it is the easiest way for anyone with traditional assets to invest in cryptocurrencies. They don't have to worry about custody, it's a one-to-one replication."

He predicted that as fund managers trust spot bitcoin ETFs and more regulators and banks allow funds to invest in these ETFs, they will "clearly siphon capital" from Bitcoin Finance. "As retail investors, they will wonder if this is another fool paying a premium for the simplest thing like buying bitcoin," he said.

What is Bitcoin's biggest unknown?

When asked if he sees near-term risks to bitcoin prices, Arthur Hayes noted that global conflict could break out. But if an all-out world war breaks out, he's not sure whether prices will rise or fall. "Bitcoin could do very well or very badly," Hayes said. "Who knows what would happen in that scenario?"

He dismissed widespread concerns among many bitcoin users that quantum computing could undermine bitcoin's security. "I think too many people are paying attention to that, but I don't think it's going to be a problem for bitcoin in the end," he said.

Kikyo

Kikyo

Hayes said that even if other countries adopt Bitcoin reserves, 200,000 BTC is already "worth a lot of money." Therefore, from the U.S. perspective, it may not trigger as much FOMO fear of missing out compared to other countries.

Hayes said that even if other countries adopt Bitcoin reserves, 200,000 BTC is already "worth a lot of money." Therefore, from the U.S. perspective, it may not trigger as much FOMO fear of missing out compared to other countries.