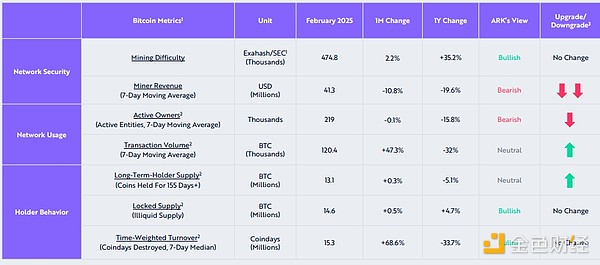

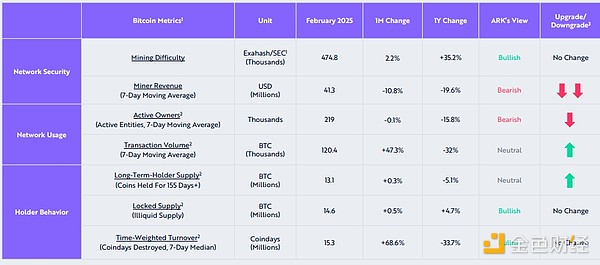

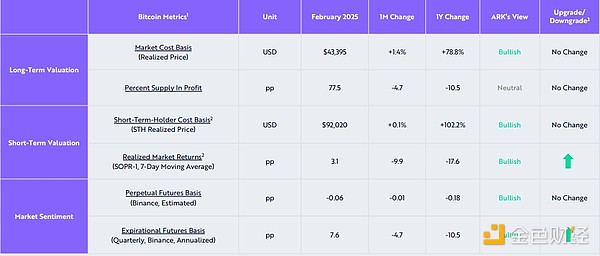

Source: ARK; Compiled by: Baishui, Golden Finance

Bitcoin is a relatively new asset class, and the Bitcoin market is fast-changing and full of uncertainty. Bitcoin is largely unregulated, and Bitcoin investments may be more susceptible to fraud and manipulation than regulated investments. Bitcoin is subject to unique and significant risks, including large price fluctuations, lack of liquidity, and theft. Bitcoin prices fluctuate wildly, including actions and remarks by influential people and the media, changes in Bitcoin supply and demand, and other factors. There is no guarantee that Bitcoin will maintain its value over the long term.

Market Overview

Bitcoin Reacts to Geopolitical Turmoil

Bitcoin Oversold

In February, Bitcoin prices fell 17.6%, closing the month at $86,391.

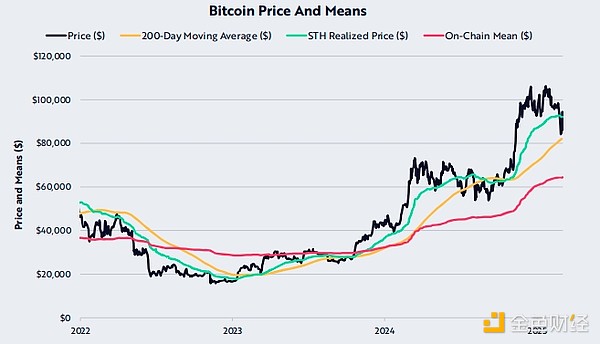

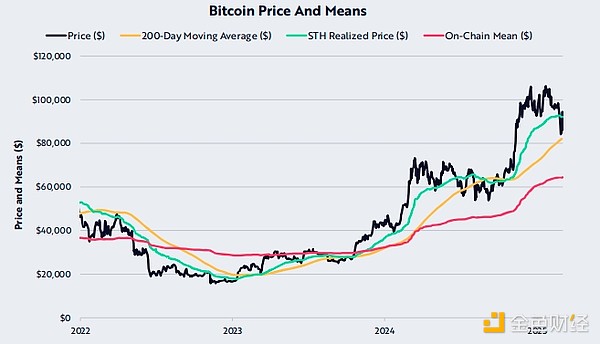

• As of March 3, Bitcoin prices were between its short-term holder (STH) cost basis and 200-day moving average—at $92,020 and $82,005, respectively.

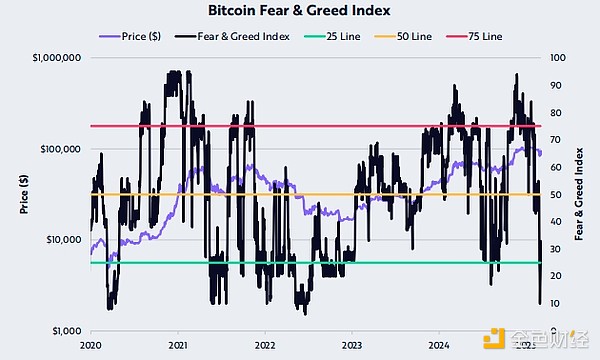

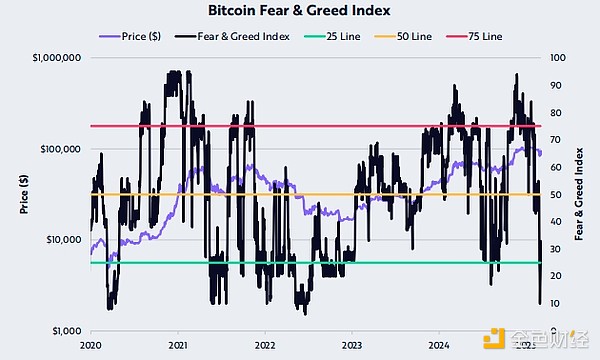

• The Fear & Greed Index has reached “Extreme Fear” levels not seen since mid-2022.

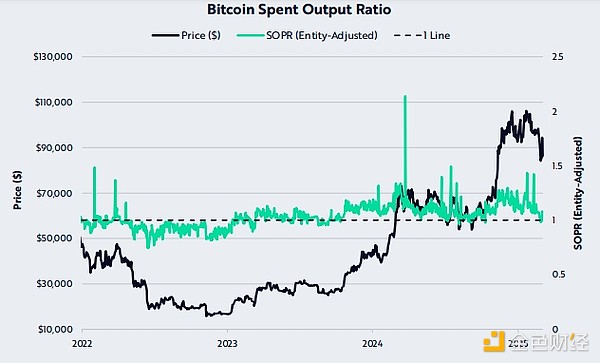

• Bitcoin’s Spend Output Ratio (SOPR) has fully reset.

Money Velocity, Uncertainty, Future Growth

Economic indicators, including slowing money velocity growth and declining consumer confidence, point to greater caution among businesses and households amid the political transition.

• Despite near-term uncertainty, ARK’s long-term outlook remains positive as we believe policy changes and technological breakthroughs in areas such as AI and robotics will reignite consumption and boost productivity.

ARK Key Takeaways

• In February, the Bitcoin price fell 17.6%, closing the month at $86,391.

• The Bitcoin price is between its Short Term Holder (STH) cost basis and its 200-day moving average.

• Bitcoin is oversold according to the Fear & Greed Index.

• The pace of contraction and consumer sentiment suggest future economic weakness.

On-chain activity is neutral to positive

The underlying bull market remains healthy

Bitcoin is oversold

Bitcoin price is at 200 Fluctuating between daily moving average and short-term holders’ cost basis

ARK’s View: Neutral

• In February, Bitcoin price fell 17.6% to close at $86,391.

• Bitcoin closed below its short-term holders’ (STH) cost basis at $92,020 and above its 200-day moving average and on-chain mean at $82,005 and $64,265, respectively.

• While the primary trend remains bullish, a recovery in the cost basis of short-term holders is necessary to restore momentum.

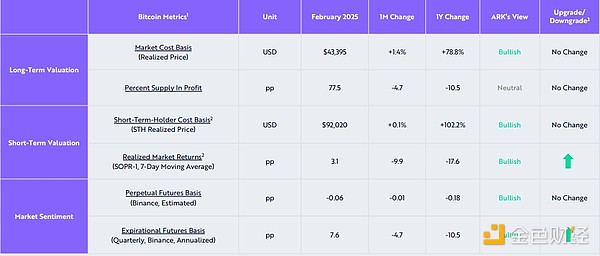

Bitcoin’s Fear & Greed Index Hits Two-Year Low

ARK’s View: Optimistic• The Fear & Greed Index reached an “Extreme Fear” level not seen since mid-2022.

• The index has not reached current fear levels since the start of the current bull run.

• We believe that the market is overly pessimistic in its reaction to current macroeconomic and geopolitical sentiment.

• The Fear & Greed Index measures Bitcoin’s relative volatility, momentum, trading volume, a composite of social media sentiment and Google Trends, and Bitcoin’s market share in the crypto industry from 1 to 100.

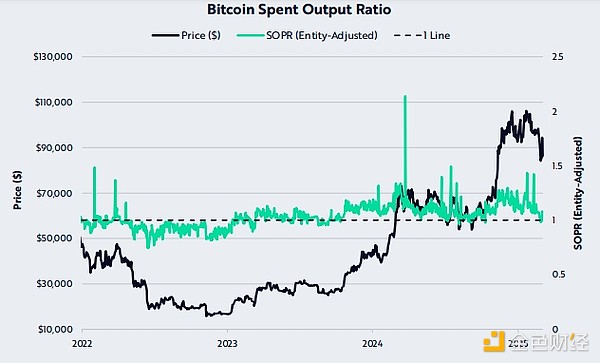

Bitcoin’s SOPR has reset

ARK’s View: Optimistic

Bitcoin’s Spend-Output Ratio (SOPR) has fully reset to 1.

• In a bull market, a SOPR of 1 indicates that the market is generally reaching breakeven levels, which often coincides with local bottoms.

• SOPR tracks realized profits or losses versus the transaction prices associated with those profits and losses.

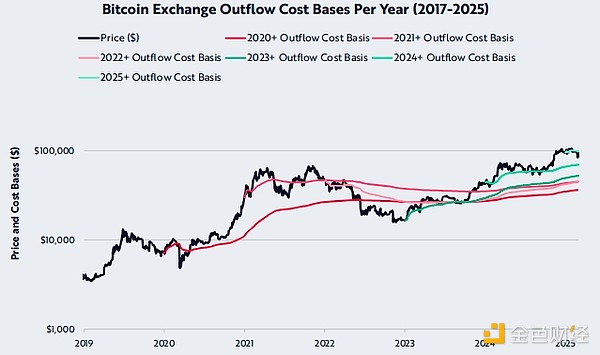

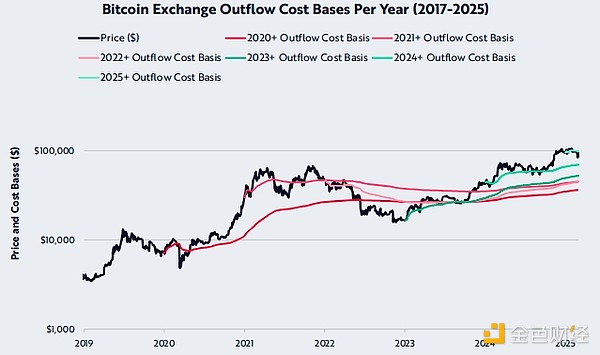

Bitcoin’s exchange outflow cost basis indicates overall profitability

ARK’s View: Optimistic

Except for 2025, all Bitcoin annual exchange outflow cost basis since 2020 have been below price, indicating strong support.

• Bitcoin’s cost basis has fluctuated between $36,280 and $69,494 from 2020 to 2024, indicating healthy unrealized profits and little incentive to panic and sell.

• The exchange outflow cost basis tracks the on-chain volume-weighted average price (VWAP) of outflows to exchanges, indicating that these funds may be long-term holdings.

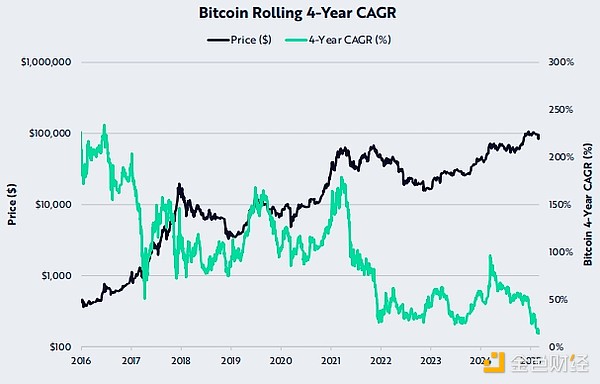

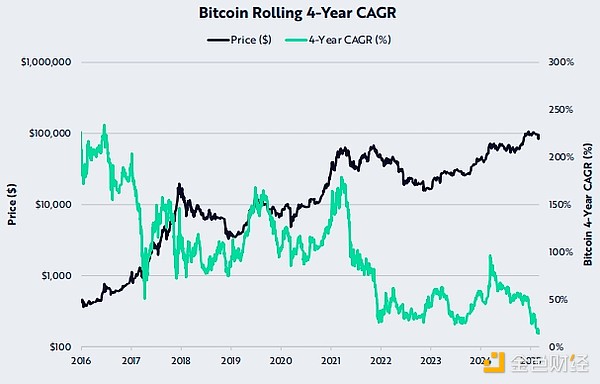

Bitcoin’s 4-year compound annual growth rate hits a record low

ARK’s view: bearish

• Bitcoin’s four-year compound annual growth rate (CAGR) hit a record low of 14%.

• While this has implications for long-term holding of Bitcoin, its relatively low CAGR could also be a sign that Bitcoin is oversold.

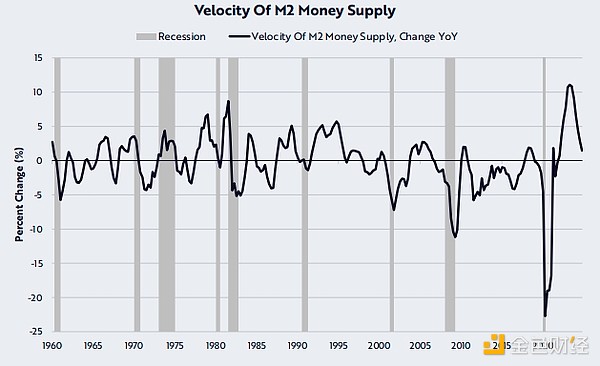

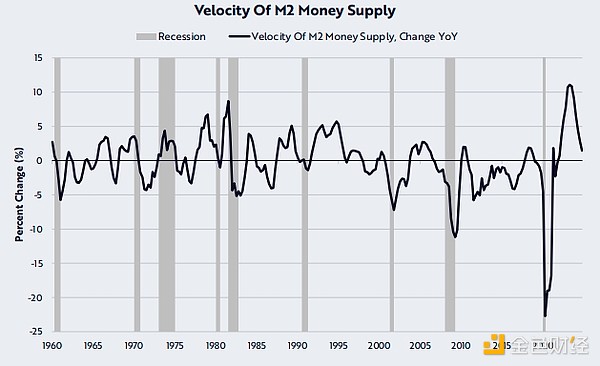

Money Velocity, Uncertainty, and Future Growth

M2 Money Supply Growth Slows as Uncertainty Heightens

ARK’s View: Bearish

• The speed at which money changes hands (also known as the “velocity of money”) is slowing.

• Consumers and businesses appear more cautious amid uncertainty surrounding the U.S. political transition.

• Nearly a third of the workforce (in federal, state, local, and quasi-government jobs in education and health care) may be concerned about government spending cuts.

• Despite short-term challenges, potential deregulation, tax cuts, and incentives for innovation in areas such as artificial intelligence and robotics could boost growth and productivity over time.

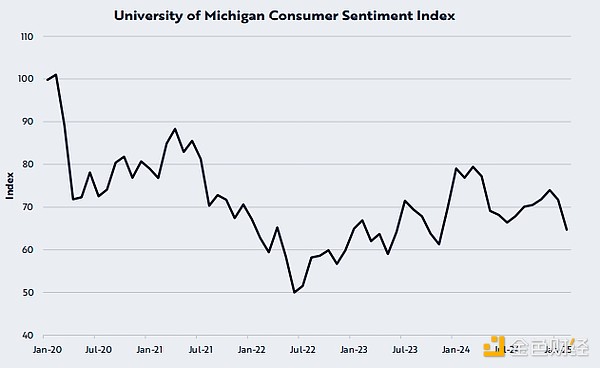

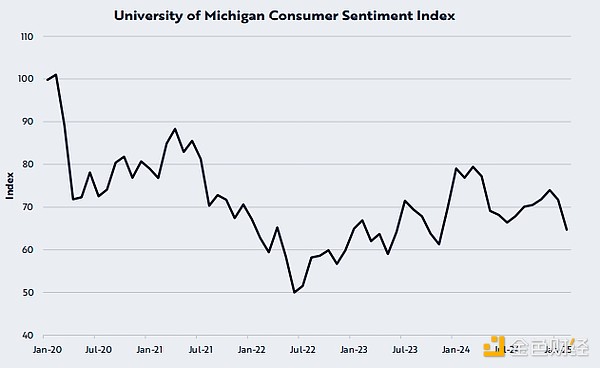

Consumer confidence falls below pre-election levels

ARK’s View: Bearish

Consumer confidence is below pre-election levels, according to the University of Michigan Consumer Sentiment Survey.

• Households appear to be turning cautious and holding off on purchases until the impact of new policies becomes clear.

• Evidence of this caution is a drop in actual consumer spending in January and forecast cuts from companies like Walmart and Target.

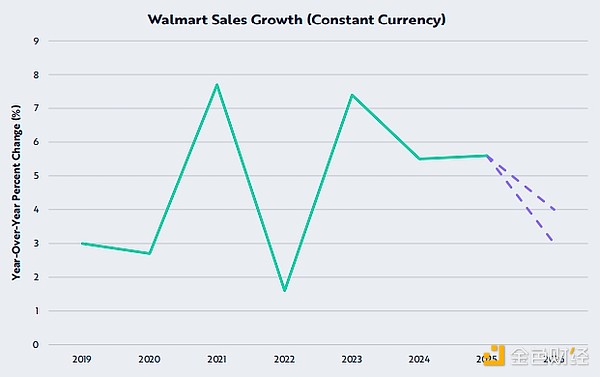

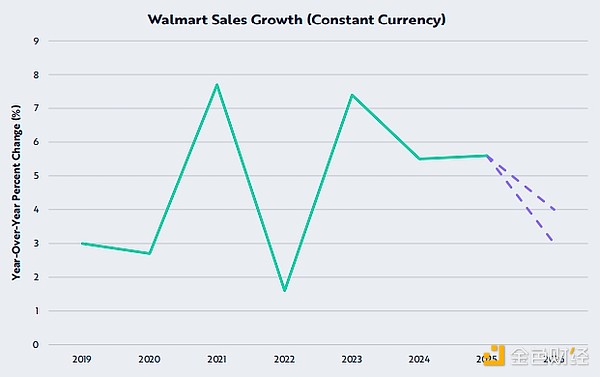

Walmart’s forecast cut suggests more cautious consumers

ARK’s view: bearish

Walmart is likely to benefit from preemptive buying in the fourth quarter as consumers rush to avoid tariff increases.

• The retailer recently cut its fiscal 2026 constant currency sales growth forecast to 3-4% (purple line on chart) from 5% last year, a 30% deceleration in growth.

• The shift in guidance highlights growing caution among consumers and signals a continued slowdown in retail spending.

Kikyo

Kikyo