Author: Steven Ehrlich Source: unchainedcrypto Translation: Shan Ouba, Jinse Finance

In recent months, I've noticed that the valuation premium of digital asset companies has gradually fallen below 1. In other words, compared to the already discounted spot prices, these companies' stocks may be a cheaper channel for investing in Bitcoin and Ethereum. Theoretically, you can now buy the corresponding asset worth $1 for only $0.5-$0.75.

Sounds like a good deal, doesn't it?

To find out more, I decided to delve into the logic behind these discounts and the conditions needed to drive their valuations back to parity.

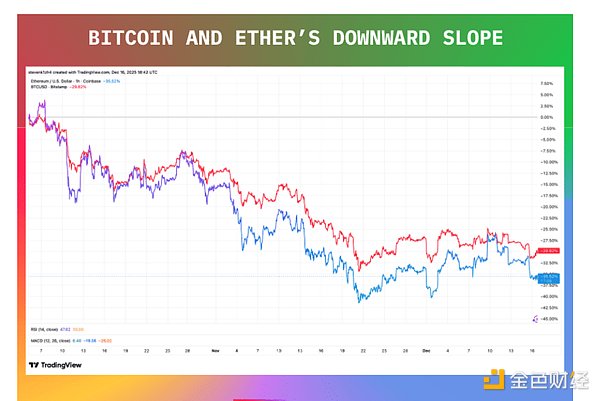

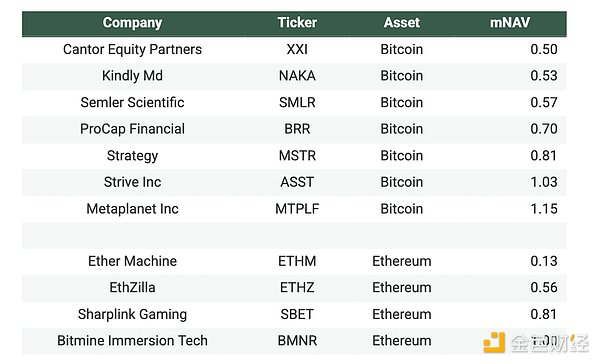

The first half of this article will review the recent performance of these companies and examine the history of discounted trading in crypto assets. The conclusion will analyze in detail what conditions need to change for these assets to turn around – is this an excellent buying opportunity or a capital trap? Crypto asset pool stocks are being sold off at bargain prices; is now the time to buy? Historical data shows they have upside potential, but due to the lack of easy arbitrage mechanisms, investment risk remains high. Key Takeaways: As the prices of Bitcoin and Ethereum have fallen sharply from recent highs, investors are turning their attention to value assets in the market. Currently, digital asset pool stocks, trading at a deep discount, have become a highly attractive investment option. This article will explore whether these valuation levels below a net asset value (mNAV) multiple of 1.0 present a golden opportunity for a comeback like the Grayscale Bitcoin Trust (GBTC), or a potential value trap. The valuation of digital asset pool (DAT) stocks has shifted from a significant premium to a deep discount; many companies now have market capitalizations far below the value of their underlying Bitcoin and Ethereum holdings. While history suggests that such discounts can generate substantial long-term returns, most DATs lack a clear valuation correction mechanism, meaning that pricing discrepancies may persist or even widen further. Stock buybacks and yield generation strategies (especially for Ethereum asset pools) may help support valuations, but they also bring risks related to leverage, liquidity, and execution. Buying discounted digital asset pool stocks is not risk-free arbitrage; it's more suitable as a long-term investment strategy backed by strong conviction, rather than a short-term speculative tool for bottom-fishing. Amid the continued decline in the crypto market, the "buy the dip" rhetoric is rampant. After all, Bitcoin's price has fallen by about 30% from its all-time high of over $126,000 in early October, while Ethereum has fallen by more than 35% during the same period.

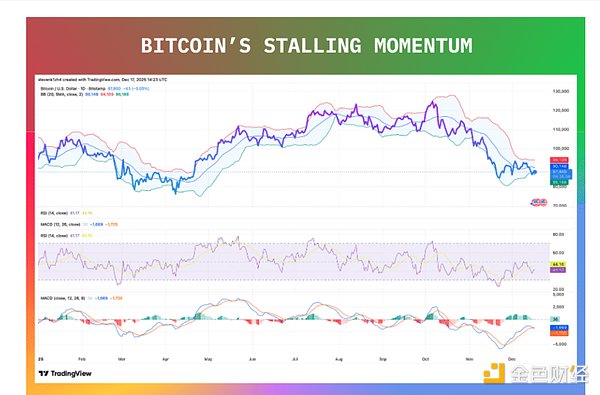

(Data source: TradingView)

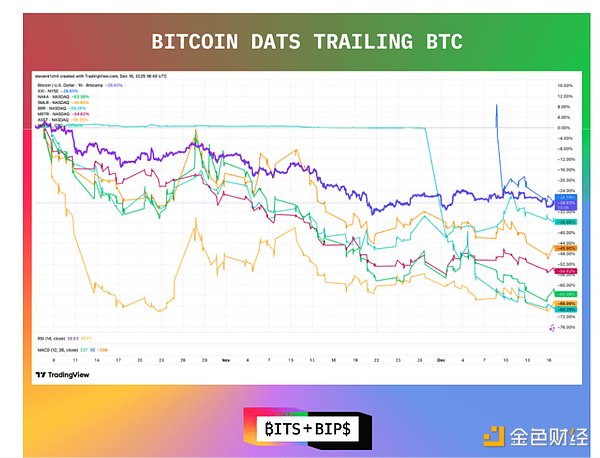

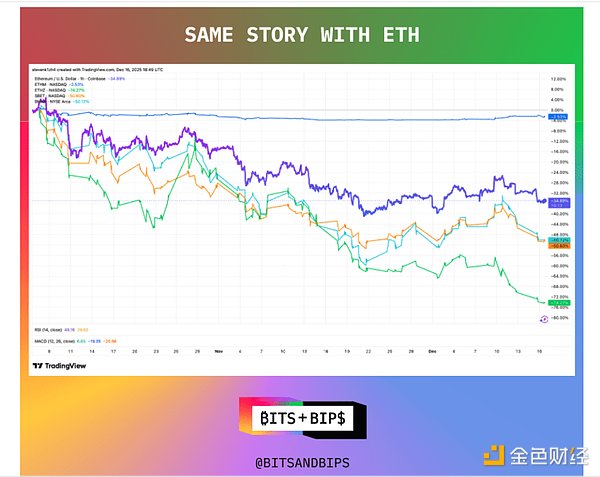

For long-term investors who are firmly bullish on the crypto market, this seems like a rare entry opportunity. But besides this, there is an even more discounted investment approach—buying and accumulating shares in digital asset companies that hold these crypto assets.

(Data source: TradingView)

This market structure raises a series of thought-provoking questions for investors:

(Data source: The Block)

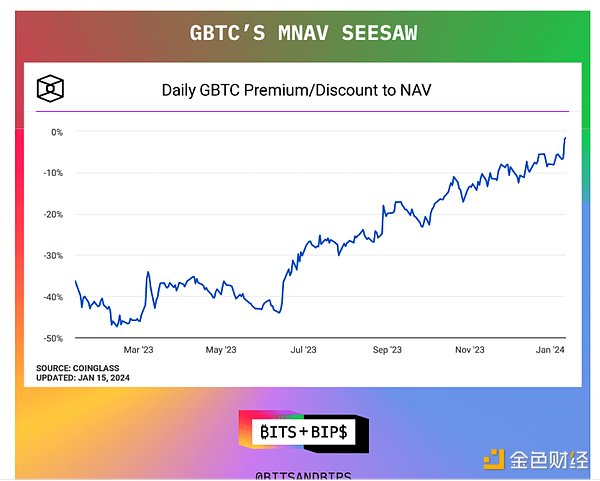

The high discount of this trust is due to multiple reasons. First, before its successful transformation into an ETF, it was essentially a closed-end mutual fund—meaning that while investors could subscribe to shares at net asset value, these shares could be freely traded on the secondary market at a premium or discount once issued. The core characteristic of a "closed-end" fund is that investors cannot redeem their shares for the underlying crypto assets.

For many years (since its initial offering in 2013), Grayscale Trust has maintained an extremely high premium, peaking at over 100%. A key reason for this was the lack of other compliant crypto investment channels for investors at the time, especially for those unwilling to hold their crypto assets themselves; Grayscale Trust was practically the only option. However, with the approval of Canada's first Bitcoin ETF (which allows for share redemption), Grayscale Trust's valuation premium began to shift to a discount. During the crypto winter of 2022, prominent institutions such as Three Arrows Capital, Genesis Trading, and BlockFi collapsed, causing Bitcoin prices to fall below $15,000, further widening the discount. Even with the recovery in Bitcoin prices in 2023, Grayscale Trust's discount status remained unchanged. This was largely because trust unit holders couldn't exchange their discounted units for equivalent spot crypto assets—essentially a liquidity discount. Ultimately, in October 2023, Grayscale won its case with the U.S. Securities and Exchange Commission (SEC), making the transformation of its trust into an ETF a certainty, allowing arbitrageurs to enter the market and close the discount gap. Those opportunistic investors who bought Grayscale Trust units at a significant discount not only benefited from the rise in Bitcoin spot prices but also made a fortune. Key Charts: Below is a list of companies in mainstream Bitcoin and Ethereum digital asset libraries, along with their corresponding net asset value multiples (mNAV)—an indicator that visually reflects the degree of premium or discount of a stock. The current discount data for some companies is remarkably similar to the situation of the Grayscale Bitcoin Trust during the 2022 crypto winter. Within the Bitcoin asset pool, the three companies with the largest discounts are Cantor Equity Partnership, KindlyMD, and Semler Scientific; while among all tracked assets, Ethereum Machines has the most severe discount, with a net asset value multiple of only 0.13. Investors can interpret these figures as follows: a net asset value multiple below 1 means that the company's overall valuation is lower than the actual value of the crypto assets it holds.

(Data source: Unchained)

What should be the reasonable range for net asset value multiples (mNAV)?

Will the history of Grayscale Bitcoin Trust repeat itself? The answer depends on multiple factors.

But first, we need to clarify the natural equilibrium point of valuation for this type of product. Unlike ETFs, its reasonable valuation multiple is not necessarily 1, but it will most likely fluctuate around 1.

Sosnick stated, "I can't pinpoint a specific reasonable premium or discount level, but it's certainly not several times the valuation. Some argue that a slight premium is reasonable if these companies can generate returns from their assets." Zach Pandel, Head of Research at Grayscale Investments, agreed, stating, "From an analytical perspective, in the long run, the net asset value multiple (mNAV) should remain around 1. In the private lending sector, these products typically trade at a discount to cover management fees. However, on the other hand, if digital asset pool companies can leverage more sophisticated financing channels to achieve asset appreciation in a unique way (one that other structured products cannot replicate), then theoretically, their long-term valuation multiple could very well be slightly higher than 1." Furthermore, the differences in the attributes of different underlying tokens cannot be ignored. For example, Ethereum supports staking and is an interest-bearing asset; Bitcoin, however, does not possess this inherent characteristic. B. Fedor Shabalin, a research analyst at Riley Securities, points out: "Ethereum asset pool companies can generate additional revenue through staking and restaking strategies. Sharplink Games' recent Q3 financial report shows that it generated over $10 million in revenue from staking alone. Bitcoin's token nature, however, does not inherently generate returns." How can DATs achieve a valuation return to 1 times their net asset value? However, pushing the net asset value multiple of such products back to around 1 is by no means easy. After all, investors cannot, like ETF authorized participants, exchange a corresponding proportion of crypto assets by subscribing to company shares. In an interview, Lumida Wealth founder Ram Aluvarya stated, “Digital asset pool companies need to establish clear valuation repair mechanisms. The Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (ETHE) had a chance to turn things around because their ETF transformation path was clearly visible. However, some digital asset pool companies today lack legitimate valuation repair channels and even explicitly prohibit the sale of their tokens to repurchase shares in their bylaws.” Aluvarya also pointed out a key difference between the current market and 2022: “When Grayscale’s two trust products launched their ETF transformation in 2023, their price lows had already passed. The discount alone is not enough to justify buying. Grayscale Trusts were also trading at a discount in 2022, but the discount gap has continued to widen.” This warning is particularly important, given the current depressed market sentiment. Some analysts warn that cryptocurrency prices may fall further, with some even predicting that Bitcoin could drop to $25,000. Historical experience shows that during periods of widespread investor panic, these digital asset portfolio stocks tend to consistently underperform their counterparts in the cryptocurrency market. As shown in the chart below, Bitcoin prices briefly rebounded last week, especially in the hours following the Federal Reserve's announcement of a 25 basis point interest rate cut. However, due to a lack of short-term positive catalysts and heightened concerns about a months-long downward trend in crypto assets, Bitcoin's upward momentum quickly dried up.

(Data source: TradingView)

Action Recommendations

Investors intending to invest in these value assets must clearly define their investment timeframe. While logically, barring major risks such as hacking, fraud, or flawed investment decisions, almost all digital asset portfolio companies will eventually see their valuations converge towards 1x net asset value, this process is destined to be fraught with difficulty. It may take years, and could even involve large-scale mergers and acquisitions, or hostile takeovers with forced liquidation.

Alex

Alex

Alex

Alex Weiliang

Weiliang Kikyo

Kikyo Catherine

Catherine Weiliang

Weiliang Miyuki

Miyuki Alex

Alex Catherine

Catherine Alex

Alex Kikyo

Kikyo