Author: Anthony Pompliano, well-known crypto KOL; Translation: Golden Finance xiaozou

After nearly a decade in the Bitcoin and crypto industry, you think you have seen everything that can happen, but occasionally there are new situations that make your jaw drop. This is exactly how I felt yesterday when I saw a recent video of Cardano founder Charles Hoskinson talking.

Hoskinson made a relevant speech about selling altcoins in the Cardano treasury and buying Bitcoin.

This video is eye-opening for three reasons. First, Hoskinson essentially admits that his altcoin cannot compete with Bitcoin in the long run. The only way to create long-term economic value is to sell altcoin assets and buy Bitcoin. This seems to indicate that altcoin founders have realized that Bitcoin will never disappear.

Second, Hoskinson seems to understand that Bitcoin Treasury companies are launching a speculative attack on Bitcoin. These companies are buying Bitcoin by selling stocks, so the altcoin foundations are also able to sell altcoins in exchange for Bitcoin. This theory of "speculative attack," popularized by Pierre Rochard in 2014, has become one of the most important ideas driving Bitcoin adoption in recent years.

The third point is perhaps the most intriguing - the outperformance of Bitcoin treasury companies has become too dazzling to ignore. Take Metaplanet, for example. Simon Gerovich, Dylan LeClair and their team have created one of the world's best-performing stocks. The company grew its balance sheet holdings from zero to 10,000 Bitcoin in just over a year. This speed of development is amazing.

Imagine that you now hold hundreds of millions of dollars worth of altcoins, but you watch them continue to depreciate in front of Bitcoin. You will naturally start to think: selling altcoins and switching to Bitcoin may realize asset appreciation. This is no different from selling depreciating US dollars or public company stocks. We are witnessing this speculative attack infiltrating every corner of the financial world.

Everyone is eager to get Bitcoin and is willing to sell any asset in exchange for more Bitcoin. This has always been the core argument of Bitcoin believers - that hard money will eventually suck up capital like a black hole - and it is exciting to see this theory come true around the world.

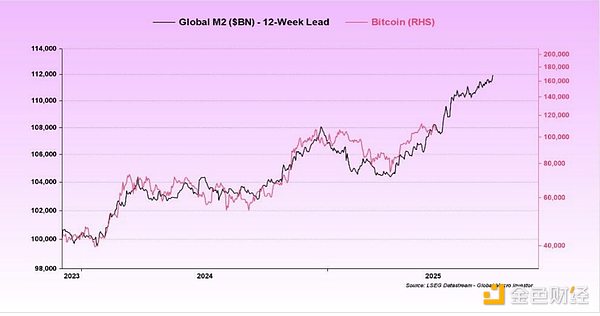

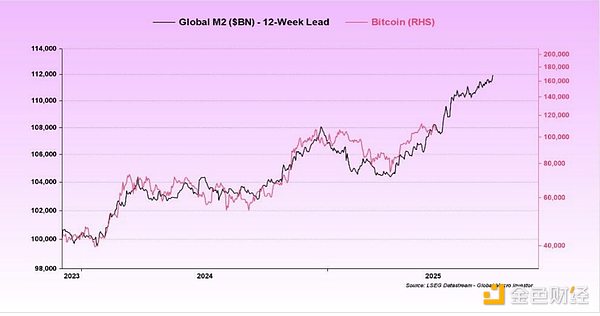

If you think Bitcoin is nearing the top of this cycle, remember: Bitcoin still has a long way to go to catch up with the global M2 money supply. Raoul Pal recently pointed out that "89% of Bitcoin's price action is related to global liquidity."

This means that Bitcoin could hit $150,000 in the coming months, but after all, no one has a crystal ball to predict the future, so we will have to wait and see. Bitcoin is infiltrating Wall Street in new ways, and people are doing everything they can to hoard this digital asset. And launching a speculative attack - especially if you own altcoins - is a wise choice.

This means that Bitcoin could hit $150,000 in the coming months, but after all, no one has a crystal ball to predict the future, so we will have to wait and see. Bitcoin is infiltrating Wall Street in new ways, and people are doing everything they can to hoard this digital asset. And launching a speculative attack - especially if you own altcoins - is a wise choice.

Kikyo

Kikyo

This means that Bitcoin could hit $150,000 in the coming months, but after all, no one has a crystal ball to predict the future, so we will have to wait and see. Bitcoin is infiltrating Wall Street in new ways, and people are doing everything they can to hoard this digital asset. And launching a speculative attack - especially if you own altcoins - is a wise choice.

This means that Bitcoin could hit $150,000 in the coming months, but after all, no one has a crystal ball to predict the future, so we will have to wait and see. Bitcoin is infiltrating Wall Street in new ways, and people are doing everything they can to hoard this digital asset. And launching a speculative attack - especially if you own altcoins - is a wise choice.