Yesterday, the Beijing Municipal Public Security Bureau’s Rule of Law Brigade published an article on its official account: “First! A “new channel” for handling virtual currencies involved in cases”. This article has caused a lot of ripples. Many friends in the circle know that in the field of web3, Lawyer Liu has done some research on the judicial disposal of virtual currencies. People have been asking me in private messages what this so-called “first” and “new channel” is all about. Some friends even said, “Doesn’t China prohibit virtual currency transactions? Isn’t this disposal just selling the virtual currencies seized by judicial organs for money? Doesn’t it mean that now that China has liberalized judicial disposal business, will it completely liberalize private virtual currency transactions in the future?”

In fact, these understandings are somewhat biased, and even the Beijing Municipal Public Security Bureau’s own article, some of the expressions are not very accurate.

(Image source: Faqingyuan, please delete if infringement)

1. What is the "first" and "new channel" of judicial disposal in Beijing?

According to the article of the Beijing Municipal Public Security Bureau's Rule of Law Corps, the Beijing Municipal Public Security Bureau and the Beijing Equity Exchange (hereinafter referred to as "Beijing Exchange") signed the "Framework Agreement on Cooperation in the Disposal of Virtual Currency Involved in the Case" for the disposal of the virtual currency involved in the case.

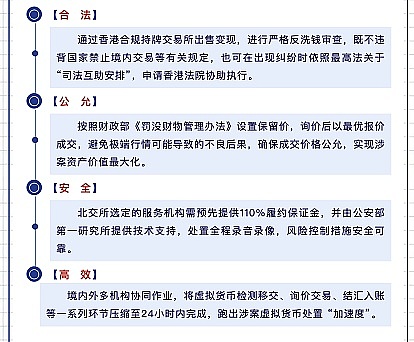

The article introduces the specific mode of disposal as follows:

(i) Beijing's public security organs entrust the physical virtual currency involved in the case to the Beijing Stock Exchange for disposal;

(ii) After accepting the entrustment of the public security, the Beijing Stock Exchange selects a third party to conduct inspection, reception, transfer and other operations on the virtual currency involved in the case, and sells it publicly through a Hong Kong compliant licensed exchange (disposal and conversion into legal currency);

(iii) After the approval of the State Administration of Foreign Exchange, the converted funds are converted into foreign currency and transferred to the special account of the public security organs.

According to the article, this model has helped the Shunyi Branch of the Beijing Municipal Public Security Bureau to handle a case involving virtual currency.

However, as a web3 lawyer who is deeply involved in domestic judicial disposal business, from the practical experience of Lawyer Liu, the disposal model of cooperation between the Beijing Municipal Public Security Bureau and the Beijing Stock Exchange is not the first in China, nor does it use any new channels. This joint disposal model of domestic entrustment + overseas disposal has been done by disposal companies as early as 2023.

II. Disposal model of virtual currency in China

The reason for this is that Lawyer Liu is too familiar with the judicial disposal model in mainland China. Generally speaking, my country's judicial disposal has gone through three periods:

(I) Disposal 1.0 Period

During the period from 2018 to 2021 (roughly), domestic judicial organs mostly directly realized the disposal of virtual currencies involved in judicial seizure through the over-the-counter OTC (U merchants) of exchanges, private individuals, etc. There is the possibility of money laundering by taking advantage of the disposal and monetization for judicial authorities, which poses a huge compliance risk; (ii) Disposal 2.0 period From September 2021 to 2023, based on the "9.24 Notice" ("Notice on Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation"), which prohibits the exchange of virtual currency and legal tender in mainland China, in principle, no more virtual currency disposal and monetization activities will be carried out in China. Some third-party disposal companies will dispose of and monetize virtual currency overseas, and then bring the monetized funds into the country through foreign exchange settlement, and then pay them to judicial authorities. There is a problem here that many disposal companies’ settlement items are false settlements of foreign exchange under the guise of foreign exchange quotas under trade/services/capital items, which is essentially a violation of the relevant regulations of the State Administration of Foreign Exchange and the People’s Bank of China, so it is still non-compliant;

(III) Disposal 3.0 Period

From the end of 2023 to the present, a small number of domestic third-party disposal companies have taken the lead in completing a disposal model similar to the cooperation between the Beijing Stock Exchange and the Beijing Municipal Public Security Bureau, that is, a joint disposal model between China and foreign countries.

In short, domestic judicial authorities entrust mainland third-party disposal companies, and then the third-party disposal companies entrust overseas entities to dispose of and convert into legal currency (generally US dollars, Hong Kong dollars, offshore RMB) on overseas compliance platforms; the converted legal currency is transferred to the foreign currency account of the domestic third-party disposal company, and then the disposal company settles the foreign exchange and transfers it to the special account of the judicial authority or the fiscal non-tax account after entering the country, and finally completes the disposal closed loop.

Therefore, the disposal model of the Beijing Stock Exchange and the Beijing Municipal Public Security Bureau may be the first time in Beijing to adopt this kind of joint disposal of domestic and foreign cases, but from a national perspective, many places have already operated in this way in practice.

Third, is there a problem with the disposal model of the Beijing Stock Exchange?

In fact, after carefully reading the article of the Beijing Municipal Public Security Bureau, Lawyer Liu still found a little:

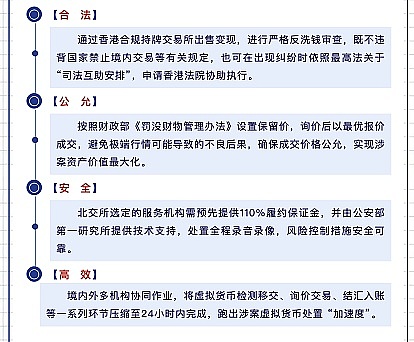

First, the Beijing Stock Exchange actually accepted the commission of the Beijing Municipal Public Security Bureau and then selected a "professional service agency" to carry out substantive disposal operations. Therefore, in essence, the Beijing Stock Exchange is not even a third-party disposal company, but only an intermediary and introduction party. It needs to entrust the case source it has obtained to a third-party disposal company;

Second, "the service agency selected by the Beijing Stock Exchange needs to provide a 110% performance bond in advance", which is still relatively high in practical operations. Normally, if you want to dispose of virtual currency worth RMB 100 million, for example, the third-party disposal company needs to provide a margin of RMB 110 million before it can proceed with the disposal. In fact, in practice, you don’t need to pay so much. Normally, after disposing and cashing out virtual currency worth RMB 100 million overseas, there will definitely be some losses (such as slippage losses, exchange fees, technical service fees of the disposal company, etc.), and the final amount returned to the country will definitely be less than RMB 100 million. Therefore, in principle, it is acceptable for the disposal company to submit a deposit of no less than the amount remitted to the judicial authority for disposal;

(Source: Faqingyuan, please delete if infringement)

Third, regarding the service fee. The article mentioned that "the reserve price will be set in accordance with the Ministry of Finance's "Measures for the Management of Confiscated Property", and the transaction will be completed with the best bid after inquiry..." Lawyer Liu checked the measures and found a provision about the reserve price: "According to the needs, the confiscated items can be auctioned by "one item, one auction" and other methods. If the public auction is adopted, the reserve price of the auction object should generally be determined. The reserve price is generally determined by referring to the appraisal price made by the price appraisal agency or the qualified asset appraisal agency, or by referring to the market price or by inquiry on the Internet. If the public auction fails, the reserve price of the next auction shall not be lower than 80% of the reserve price of the previous auction. If the auction fails for three or more times, the law enforcement agency may adopt a no-reserve auction or switch to other disposal methods through the Internet platform after consultation with the financial department at the same level. " That is to say, the reserve price here is only used when the judicial disposal is carried out by way of public auction. However, if the judicial disposal of virtual currency is carried out in a compliant exchange in Hong Kong, it is not considered a public auction of the property involved (in essence, it is sold at the market price of the virtual currency).

In fact, the "Shandong Province Confiscated Items Disposal Procedures (Trial)" jointly issued by the Shandong Provincial Department of Finance and 17 other departments on August 25, 2023, but more directly mentioned the issue of the disposal and realization price of virtual currency:

"Prepaid cards and virtual currencies confiscated by law by law law enforcement agencies can be negotiated with the merchants that issued the prepaid cards and virtual currencies, and the merchants will bid for recovery. The recovery price is agreed upon by both parties and, in principle, shall not be less than 80% of the face value or balance of the virtual currency or prepaid card. The two parties sign a recovery agreement. "

In the defense of criminal cases involving virtual currency that Lawyer Liu has experienced, we have encountered some local judicial organs and disposal agreements signed, where the highest disposal fee rate was as high as 35%! (That is, only 65 million yuan was paid back after the final disposal of virtual currency worth 100 million yuan, and the remaining 35 million yuan was collected by the disposal company as a handling fee); currently, compliant disposal companies generally cannot charge a service fee higher than 20%, which is also consistent with the regulations of Shandong Province.

Fourth, Written in the End

Some people may think that the Beijing Municipal Public Security Bureau has issued an article saying that judicial disposal can be legally carried out, so does it indicate that China will liberalize judicial disposal or even virtual currency transactions in the future?

Lawyer Liu’s view is this: There is no such thing as liberalizing or not liberalizing the judicial disposal of virtual currency involved in the case, because the country has never banned it. Judicial organs across the country have been exploring the judicial disposal of virtual currencies since 2017 and 2018, and the domestic disposal has never stopped until the joint disposal model formed at home and abroad.

As for the claim that the country has liberalized virtual currency transactions, it is too early. I predict that in the next two to three years, the mainland of my country will still focus on strong supervision and will not allow citizens to generally participate in virtual currency transactions.

Catherine

Catherine