How will unclaimed LayerZero tokens be redistributed to active users?

LayerZero, token distribution, how will unclaimed LayerZero tokens be redistributed to active users? Golden Finance, robbing Peter to pay Paul.

JinseFinance

JinseFinance

The global NFT market is expected to reach $49 billion in 2025. US buyers account for 41% of global NFT purchases. The average selling price of NFTs remains stable at around $940, indicating a maturing buyer behavior.

Ethereum continues to dominate, supporting nearly 62% of NFT transactions in 2025.

OpenSea maintains its leading position, with over 2.4 million monthly active users in the second quarter of 2025.

Gaming NFTs are growing rapidly, accounting for 38% of total trading volume this year.

Over 80% of creators use mandatory royalty smart contracts.

Millennials and men dominate the market

33% of adults collect physical items, and 10% collect NFTs as a hobby or investment.

Men have a significantly higher tendency to collect than women, with 45% collecting physical items and 15% collecting NFTs; only 22% of women collect physical items, and the proportion of collecting NFTs is even lower at 4%.

Millennials (outstanding performance): 42% collect physical items and 23% collect NFTs, the highest among all age groups.

Generation Z: 20% collect physical items and only 4% collect NFTs.

Generation X: 37% collect physical items, 8% collect NFTs.

Baby Boomers (least interested): 29% collect physical items, only 2% dabble in NFTs.

Global NFT Market Size and Annual Growth Trends

In 2024, the global NFT market size was approximately US$36 billion, and is expected to grow to US$49 billion in 2025. In the first quarter of 2025 alone, global NFT sales exceeded $8.2 billion, signaling a market recovery from the volatility of the previous year. In the first half of 2025, over 85 million NFTs were minted globally. The average daily number of active NFT wallet addresses reached 410,000, a 9% year-on-year increase. Secondary market transactions accounted for 52% of total NFT sales in 2025, demonstrating continued participation and trading activity. Meanwhile, institutional investment contributed approximately 15% of the market's annual revenue. The number of active NFT trading platforms increased to 112, reflecting the diverse ecosystem. Furthermore, Asia saw the highest NFT trading volume, with South Korea, Japan, and China collectively accounting for over 40% of global activity. The NFT lending and fractional ownership markets are expanding, with a projected value of $2.3 billion in 2025.

NFT-related job recruitment has increased by 48% over the past year.

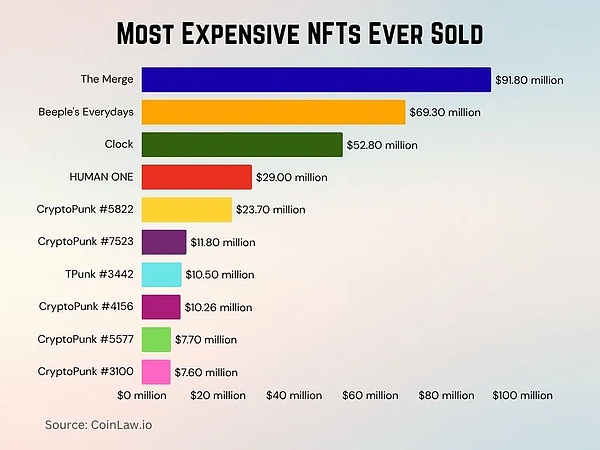

The most expensive NFT transaction record in history

"The Merge"

The transaction price was US$91.8 million, ranking first on the list.

Everydays: The First 5000 Days

sold for US$69.3 million, ranking second.

Clock

Clock, which raised funds for Julian Assange's legal defense, was sold for US$52.8 million.

HUMAN ONE

Beeple's HUMAN ONE, which combines physical and digital art, was sold for US$29 million.

CryptoPunk#5822

It sold for US$23.7 million, leading the Punk series.

CryptoPunk #7523

Transaction price: US$11.8 million.

TPunk #3442

Tron ecological rare token TPunk #3442 was sold for US$10.5 million.

CryptoPunk #4156

Transaction price: US$10.26 million.

CryptoPunk #5577

Transaction price: US$7.7 million.

CryptoPunk #3100

Transaction price: US$7.6 million.

Top NFT Categories Driving Market Expansion

Gaming NFTs will be the dominant category in 2025, accounting for 38% of global NFT trading volume.

Digital art remains active, accounting for 21% of the NFT market with a median selling price of $1,200.

Music NFTs have grown significantly, with tokens associated with streaming generating over $520 million in revenue this year. Real estate NFTs (tokenized virtual land and titles) exceeded $1.4 billion, a 32% year-over-year increase. Fashion NFTs, driven by digital wearables, are expected to reach a valuation of $890 million in 2025. Identity NFTs (decentralized identity and membership certificates) have exceeded 12 million issued. Event ticketing NFTs account for 5.3% of ticket sales at major US venues. Collectible NFTs (such as trading cards and avatars) continue to gain popularity in Japan and South Korea.

NFT (Non-Functional Tokens) trading volume, which connects physical goods to virtual reality, grew 60%, led by luxury brands.

NFT trading volume for carbon credits and green assets reached $300 million, bridging sustainable development and blockchain applications.

NFT Global Market Growth Forecast

The global NFT market size is expected to reach approximately $36 billion in 2024 and $49 billion in 2025. By 2034, the forecast range is wide (from $400 billion to over $700 billion), depending on adoption trends and model assumptions. The market is projected to reach $61.01 billion in 2025, demonstrating rapid early growth. The market's compound annual growth rate (CAGR) is projected to be 41.90%, indicating a strong upward trend. The United States leads the world in NFT investment by region, accounting for 41% of total transaction volume in 2025.

China

NFT activity has recovered, contributing 16% of total market investment.

South Korea

ranked third with 8%, driven by games and K-pop.

Germany & France

together accounted for 7%, focusing on digital art and collectibles. The United Arab Emirates (UAE), an emerging hub, will contribute 4% of global NFT investment in 2025. Singapore, home to over 140 NFT technology and blockchain startups, is attracting continued institutional funding. Latin America (Latin America), Brazil and Argentina together account for over 3.2%. With increasing cross-border collaboration and platforms, approximately 12% of NFT projects will have multi-regional origins in 2025.

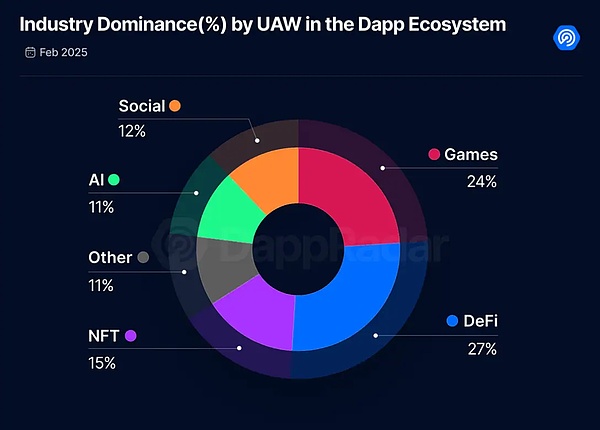

dApp Ecosystem Industry Share

(by Unique Active Wallet UAW)

DeFi leads with a 27% UAW share, indicating high user engagement.

Games followed closely behind, accounting for 24%, highlighting the continued dominance of blockchain games. The NFT sector accounted for 15%, maintaining its important position amid market fluctuations. Social dApps accounted for 12%, reflecting the growing interest in decentralized social platforms. AI-related dApps accounted for 11%, indicating the accelerated adoption of decentralized intelligent applications.

Other categories accounted for a total of 11%, covering emerging and niche use cases.

Blockchain networks supporting the NFT ecosystem

Ethereum

remained dominant, hosting over 62% of NFT contracts and leading in trading volume. Solana handles approximately 18% of NFT traffic and is known for its fast and low-cost transactions. Polygon, used by brands like Starbucks and Nike, contributes 11% of NFT minting activity. Immutable X dominates the gaming segment, processing NFT transactions for over 120 blockchain games.

Tezos

is favored by environmentally conscious artists due to its low-energy proof-of-stake mechanism.

BNB Chain

supports a variety of DeFi-NFT hybrid applications, with a market share of approximately 6% in 2025.

Flow

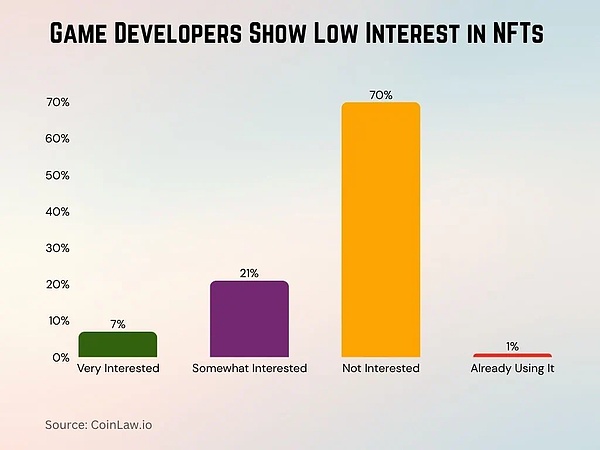

is the core platform for sports NFTs such as NBA Top Shot and NFL All Day. New Layer 1 chains like Aptos and Sui are attracting attention with their native NFT functionality; Ethereum Layer 2 chains like Arbitrum and Optimism contribute a combined nearly 9% of transaction volume due to their scaling advantages. Cross-chain interoperability tools have proliferated, with over 3 million NFTs bridged across chains in the past year. Game developers show low interest in NFTs. Only 7% of game developers are "very interested" in integrating NFTs.

21% expressed "some interest", indicating a potential but cautious attitude.

A whopping 70% of developers were "not interested", highlighting widespread skepticism in the industry.

Only 1% of developers have used NFTs, indicating that current adoption in the gaming sector is extremely low.

Institutional Participation and Venture Capital

Venture capital in NFT projects reached US$4.2 billion in 2025. In the first half of 2025 alone, more than 180 NFT startups received seed or Series A financing.

Andreessen Horowitz (a16z) is a top investor, investing over US$600 million in NFT infrastructure and platforms. Animoca Brands continues to lead gaming NFT investment, supporting over 70 projects globally. Institutions such as SoftBank, Sequoia Capital, and Paradigm are expanding into tokenized digital assets. Financial institutions such as Goldman Sachs and JPMorgan Chase are exploring the use of tokenized NFTs as digital asset collateral. NFT index funds and ETFs are becoming mainstream, with three major products approved for trading in the US market. Over 30% of institutional NFT transactions involve fragmented ownership or embedded yield mechanisms.

In addition, corporate funding strategies are beginning to incorporate NFTs, primarily for marketing or innovation exposure. NFT-focused accelerators and incubators are emerging, supporting over 200 teams worldwide.

NFT Trading Volume Share (by Category)

PFP NFTs dominate the market with a 37% share and remain the most popular category.

Gaming NFTs account for 25%, demonstrating strong participation in the play-and-earn ecosystem and the metaverse ecosystem.

Music/media NFTs accounted for 15%, highlighting the growth of digital assets driven by creators.

Other categories accounted for 12%, reflecting experimental or niche NFT uses.

RWA NFTs (Real-World Asset NFTs) accounted for 11%, indicating the accelerated adoption of physical asset tokenization. NFT cross-industry applications (gaming, art, sports, real estate) are expected to grow significantly in the gaming sector, generating $12.9 billion in NFT-related revenue in 2025. Art NFTs continue to thrive, with digital galleries and independent artists generating over $4.1 billion in sales. Sports NFTs (NFL, NBA, FIFA, and other leagues) are expected to generate a total of $2.7 billion in revenue in 2025. Real estate NFTs are being used to tokenize virtual worlds (such as Decentraland and The Sandbox) and real-world titles, generating over $1.4 billion in value. Fashion and luxury brands are leveraging NFTs for product authentication and digital twins, generating over $890 million in revenue this year. Ticketing platforms are using NFTs for events like Coachella and the Super Bowl, issuing over 1.8 million tokenized tickets by 2025. Educational institutions are beginning to issue NFT diplomas and certificates, with over 70 schools worldwide participating. Film studios and streaming media outlets are distributing content through NFT ownership models, selling over 400,000 NFTs for video content this year.

The tokenization of real-world assets (RWAs) is on the rise, with NFTs representing gold, art, and real estate.

Music NFTs allow fans to own copyrights or royalties, with music-related NFT sales exceeding $520 million this year.

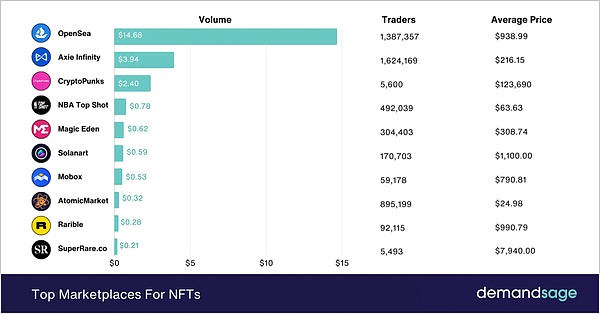

Top NFT Marketplaces: Trading Volume, Number of Traders, and Average Price

OpenSea leads the way, with $14.68 billion in trading volume, 1.39 million traders, and an average price of $938.99. Axie Infinity had a trading volume of $3.94 billion, with the highest number of traders (1.62 million) and a lower average price of $216.15. CryptoPunks had a smaller trader base (5,600) but a very high average price of $123,690. NBA Top Shot had a trading volume of $780 million, with 492,000 traders and an average price of $63.63.

Magic Eden had a trading volume of $620 million and an average price of $308.74.

Solanart had the highest average price ($1,100), 171,000 traders, and a trading volume of $590 million.

Mobox and AtomicMarket serve larger communities (59,000 and 895,000 traders, respectively), but have lower average prices ($790.81 and $24.98).

Rarible's trading volume is $280 million, with an average price of $990.79.

SuperRare.co's average price is as high as $7,940, with only 5,493 traders and a trading volume of $210 million.

The Impact of Royalties and Creator Revenue on Market Dynamics

By 2025, over 80% of NFT smart contracts will include automated royalty execution, ensuring ongoing revenue for creators.

The average royalty rate across platforms is 6.1%, reflecting competition and platform policies.

Ethereum-based platforms generated over $920 million in royalty revenue for creators this year. The introduction of optional royalty structures by Blur and OpenSea led to a 12% increase in buyer activity but an approximately 18% decrease in creator revenue.

Over 63% of NFT creators stated that in 2025, their revenue from secondary sales royalties would be higher than from initial minting. Among them, music NFTs that include royalties will generate an average of $3,400 per track for artists. The trend toward multi-tiered royalties is growing, allowing collaborators, influencers, and others to share in revenue.

Platforms such as Zora and Manifold support dynamic royalties, adjusting the proportion based on the sales tier.

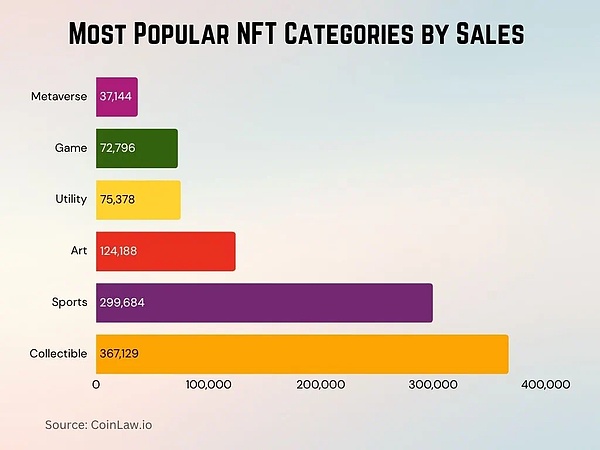

In the first half of 2025, disputes arising from circumventing royalties led to at least 15 platform-specific lawsuits. The NFT royalty debate is impacting DAO governance models, with 22% of DAOs voting on royalty-related agreements. Environmental Issues and Sustainability Trends After the Merge, the average energy consumption for minting NFTs on Ethereum has decreased by 99.95% compared to before 2022, making it more environmentally friendly. Platforms such as Tezos, Algorand, and Flow are favored by artists focused on sustainability. Between 2021 and 2025, the NFT sector's carbon footprint is estimated to decrease by over 75%. Over 30% of new NFT buyers factor environmental considerations into their purchasing decisions. By 2025, over 420 NFT series will include sustainability commitments or green project funding. Projects such as ClimateNFT, which tokenize and trade certified carbon offsets, have generated $80 million in trading volume this year. Companies like Adidas and Gucci have released "green NFTs" tied to tree planting or renewable energy credits. The NFT market has begun publishing energy efficiency scores, similar to product environmental impact ratings. Blockchain networks like Near Protocol and Celo have implemented carbon-neutral NFT solutions. Events like NFT.NYC and ETHGlobal have dedicated climate panels and showcases of green NFTs. NFT Category Sales Rankings: Collectibles dominated, with 367,129 transactions.

Sports NFTs followed closely behind with 299,684 sales, demonstrating growing fan-driven demand.

Art NFTs performed strongly, with 124,188 sales, reflecting continued interest in digital creation.

Utility NFTs had 75,378 sales, slightly exceeding the 72,796 sales of gaming NFTs.

Metaverse-related NFTs had the fewest sales, at only 37,144, indicating that this category is still in its early stages.

Regulatory environment and its impact on market growth

By 2025, 35 countries will implement comprehensive NFT regulation. The legal status of fragmented NFTs remains unclear in many regions, with regulatory sandboxes in the UK and Singapore.

The US SEC continues to review NFTs under securities laws, with at least nine high-profile cases underway; it requires NFT creators to disclose royalty income exceeding US$10,000 annually.

The European MiCA regulation will take effect in the first quarter of 2025, introducing unified disclosure rules for NFT projects.

Japan now requires all NFT-related financial services to comply with KYC and anti-money laundering regulations.

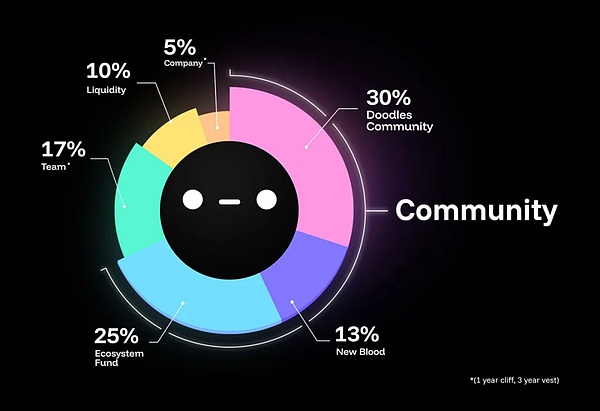

The tax authorities of Canada and Australia regard NFTs as capital assets, affecting transaction reporting. India's Digital Assets Act, 2025 imposes a 15% capital gains tax on NFT transactions, impacting market liquidity. Consumer protection laws now apply to NFT ticketing and membership benefits, mitigating the risk of "carpet pulls." Regulatory clarity boosts institutional adoption, with compliant NFT frameworks securing 40% more funding than unregulated projects. Doodles NFT Token Distribution Breakdown: 30% allocated to the Doodles community, focusing on decentralized ownership and participation.

25% will be invested in the ecosystem fund to support long-term growth and innovation.

17% will be reserved for the team (with a 1-year lock-up period and a 3-year vesting period) to ensure alignment of interests.

13% will be allocated to new blood to attract new contributors or talent.

10% will be reserved for liquidity to support trading and market stability. 5% will be allocated to the company, also with a vesting period.

NFT Integration with Web3 and Metaverse Platforms

Over 72% of Metaverse platforms support NFT assets (such as avatars, wearables, and land). Over 6.5 million users worldwide use wallet-based Metaverse NFT identities. Over 190 DAOs use tokenized voting rights for Metaverse governance. Furthermore, 45% of Gen Z users in the Metaverse own at least one NFT. Projects like The Sandbox and Decentraland are expected to have over one million NFT asset holders by 2025. Meta's integration with Apple Vision Pro allows the use of NFTs for authentication and access control in immersive spaces. In Web3 games like Illuvium and Star Atlas, NFTs serve as the standard for in-world currency and resource ownership. The total value of digital real estate sold as NFTs in the Metaverse will reach $1.3 billion in 2025. "Wear and Earn" and "Exercise and Earn" NFT models are popular in the health and fitness ecosystem.

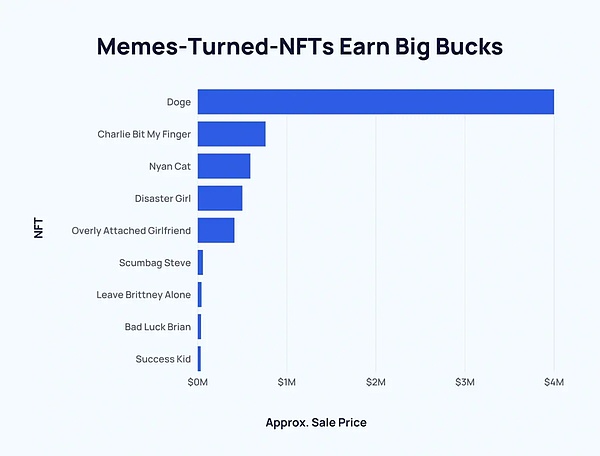

Best-selling meme NFTs and their earnings

Doge became the most valuable meme NFT with a staggering sale of nearly $4 million.

Charlie Bit My Finger earned nearly $750,000 thanks to its viral legacy.

Another internet icon, Nyan Cat, sold for approximately $600,000.

Disaster Girl turned viral fame into financial gains for approximately $500,000.

Overly Attached Girlfriend fetched approximately $450,000 through an NFT auction.

Meme NFTs such as Scumbag Steve, Leave Britney Alone, Bad Luck Brian, and Success Kid sold for less than $100,000, proving the value of digital nostalgia.

Challenges Impeding NFT Market Adoption

In the first five months of 2025, fraud and scams resulted in $170 million in NFT-related losses. Price volatility is the primary concern, with nearly 48% of buyers hesitant due to unpredictable valuations.

Wallet security and private key management remain obstacles for non-technical users; platform fragmentation makes it difficult for users to track and manage assets across chains; and varying royalty policies across markets impact creators' trust and income stability. Regulatory uncertainty, particularly in the United States and India, hinders institutional and retail participation. The lack of standardized NFT metadata leads to verification issues and a poor user experience for aggregators. Furthermore, high gas fees on Ethereum's Layer 1 during peak periods continue to hinder large-scale participation. NFT saturation and copycat projects have led to a decline in interest in parts of generative art. Many projects have limited real-world utility, resulting in high churn rates among first-time users. Recent Developments in the NFT Ecosystem: The ERC-6551 token standard is expected to become mainstream by 2025, allowing NFTs to represent other assets and identities. Europe regulates AI-generated NFTs under copyright law.

Major brands like Disney, Spotify, and Netflix are integrating NFTs for exclusive content access. A tokenized ticketing system supports over 20 global music and sports festivals. Dynamic NFTs with updateable metadata are being used in education and healthtech.

Zora Protocol launched Zora Network v3, offering near-zero fees and creator-first tools. Reddit avatar NFTs surpassed 18 million mints, marking a new benchmark for mainstream adoption. OpenSea Pro introduced automated routing and real-time arbitrage alerts for NFT traders. A cross-chain minting tool based on LayerZero and Axelar reduces user friction for multi-chain deployments.

South Korea launched its first NFT-linked life insurance product, combining DeFi and digital identity.

Conclusion

The NFT landscape in 2025 will no longer be defined by pixel art speculation, but rather a multi-dimensional revenue-generating digital economy that touches upon finance, culture, and identity. From institutional capital to Gen Z creators, the ecosystem is becoming more inclusive, compliant, and creative.

However, challenges such as royalty disputes, security concerns, and regulatory lags remain obstacles to seamless adoption.

As NFTs become more deeply integrated into Web3 infrastructure, the tokenization of real-world assets, and the creator economy, the coming years will see a refined market development rather than a disruptive revolution.

LayerZero, token distribution, how will unclaimed LayerZero tokens be redistributed to active users? Golden Finance, robbing Peter to pay Paul.

JinseFinance

JinseFinanceBTC is the top player in the Crypto asset industry, and analysts predict that its adoption will grow exponentially.

JinseFinance

JinseFinanceOpenSea has taken a proactive stance in addressing the security of its users' API keys following revelations from Nansen regarding a potential compromise of customer data stemming from a security incident.

Catherine

CatherineCompetition is heating up as the number of NFT marketplaces rises. More recent or widespread market developments may have an impact on the Solana NFT ecosystem.

Bitcoinist

BitcoinistWeb2 is still the favorite choice for gaming and recreational activities, according to the Twitter community.

Beincrypto

BeincryptoWhile metaverse platforms Decentraland and The Sandbox both have below 1,000 daily active users, they each have over $1 billion in valuation.

Coindesk

CoindeskData shows the daily Bitcoin entities have been recently retesting the bear market channel as the crypto's userbase observed little ...

Bitcoinist

BitcoinistThe new feature will automatically hide suspicious NFT transfers from view on their marketplace.

Cointelegraph

CointelegraphOpenSea’s sales in the past seven days exceeded $1.3 billion, yet the number of daily active users on the platform has dropped by more than 30%.

Cointelegraph

CointelegraphThe hacker's initial post, which was published in the announcements channel, claimed that OpenSea had “partnered with YouTube to bring their community into the NFT Space."

Cointelegraph

Cointelegraph