Author: Maggie @Foresight Ventures

From 2024 to 2025, Hyperliquid rose at an astonishing speed and became a major liquidity gathering place on the chain. Its total open interest exceeded US$10.1 billion, and the USDC locked position exceeded US$3.5 billion. Whales like James Wynn showed their skills here, leveraging hundreds of millions of dollars of positions with 40x leverage, driving market sentiment and harvesting liquidity. At the same time, the launch of HyperEVM further expanded the ecosystem and attracted many innovative projects to settle in.

Today, we will explore two key questions in depth:

How did Hyperliquid rise?

What are the ecological projects on HyperEVM worth paying attention to?

How did Hyperliquid rise?

Hyperliquid is a high-performance decentralized exchange (DEX) that focuses on spot and perpetual contract trading, and has launched HyperEVM, an EVM L2 on Hyperliquid. Most people know about Hyperliquid from the huge airdrop in November 2024. Before that, many people only thought it was an ordinary perp dex. Later, everyone slowly understood the special features of Hyperliquid.

Technology:

A decentralized trading platform without KYC, but with the experience of CEX: Hyperliquid does not require users to undergo KYC verification, allowing users to trade anonymously, attracting privacy-conscious traders and regulatory-sensitive institutions. Hyperliquid provides a CEX-like user experience (speed, UI/UX) but without identity verification, lowering the barrier to entry.

Products:

Low fees, high leverage: Market making fee is 0.01%, taker fee is 0.035% (as low as 0.019% for large customers). Supports 50x leverage, which is much higher than most DEXs (such as 20x on dYdX).

High-yield HLP vault: HLP offers an annualized rate of return of 14%-24%. By depositing USDC, you can participate in market making and liquidation income, which attracts DeFi users who pursue stable income. HLP's community-oriented design (no team commission) further enhances user trust.

Community-oriented and deflationary mechanism: All fees are allocated to the community (HLP and Assistance Fund), not the team or insiders, which enhances the decentralized attribute. Buybacks and destruction effectively reduce the circulating supply and support long-term value growth.

Marketing:

High-proportion airdrops and wealth effect: The 31% HYPE airdrop in November 2024 (310 million pieces, worth $1.2 billion) is one of the largest airdrops in crypto history. The airdrop is based on user transaction volume and referral points, which incentivizes early user participation and enhances loyalty. The price of HYPE soared from $3.9 to $27 (up to $34.96), creating a significant wealth effect and attracting more users to join.

Whale effect, attention economy: Hyperliquid's opening information is transparent, however, this transparency and manipulation coexist. On the one hand, the openness of on-chain data makes the whale's position invisible, and retail investors can use it to track the movement of smart money; on the other hand, whales use this transparency to reversely manipulate the market. Traders such as James Wynn use Hyperliquid's high leverage (40-50 times) and transparency to disclose large positions (such as $568 million BTC long orders) to attract follow-up funds and form a "position-emotion-price" positive feedback.

Economic model:

Income closed loop and deflation mechanism: Platform income is returned to token holders or ecological participants through repurchase, destruction, dividends, etc. Forming a positive cycle of "increased usage → increased revenue → increased token value".

Hyperliquid's main sources of income come from platform fees and HIP-auction fees.

Platform fees: including spot and perpetual contract fees (market making fee 0.01%, taker fee 0.035%, high trading volume users can be as low as 0.019%), funding rate and liquidation fees.

HIP-1 auction fee: New tokens listed through the HIP-1 standard must pay auction fees, all of which go to the Assistance Fund.

The fees are allocated to HLP and Assistance Fund.

The dual deflation mechanism (repurchase + destruction) enhances the value stability of HYPE.

The Assistance Fund regularly uses the accumulated USDC to repurchase HYPE in the secondary market, creating continuous buying pressure.

The HYPE portion of the HYPE-USDC trading pair in spot trading is directly destroyed to reduce the circulating supply.

Many projects want to emulate this model, but in fact it is not suitable for most projects because they do not have the prerequisites required for this model. 1. Insufficient income. Most projects have an annual income of less than 1 million US dollars, and even if the return ratio reaches 100%, it will have limited impact on the currency price. 2. The tokens of most projects lack use value support. 3. No cost structure advantage. As a derivatives platform, HyperLiquid has a lower marginal cost than DeFi projects that require a large amount of liquidity mining subsidies.

Ecology:

HyperEVM, as Hyperliquid's EVM, is compatible with L2, attracting DeFi projects to migrate and forming a diversified ecology of derivatives + lending + Meme.

In general, the rise of Hyperliquid is the result of multiple factors: technology (no KYC required, near CEX trading experience) + product (low fee, high leverage, high yield HLP vault) + marketing (large airdrop, whale effect) + economic model (revenue closed loop, buyback deflation) + ecology (HyperEVM). It is particularly worth learning its marketing strategy and economic model design. But we need to be vigilant about two major risks: 1. Regulatory pressure: In an increasingly stringent compliance environment, the KYC-free model may face major challenges. 2. Cycle test: The revenue structure is sensitive to market activity, and the sustainability of the business model in a bear market environment remains to be verified.

What ecological projects on HyperEVM are worth paying attention to?

As of May 31, 2025, data on DefiLIama showed that the HyperEVM ecosystem TVL reached US$1.8 billion, covering lending, DEX, Meme and other tracks.

(Data from DefiLIama:https://defillama.com/chain/hyperliquid-l1)

1. HyperLend

HyperLend is a lending project on HyperEVM, and its TVL has reached 3.7 Billions of dollars, is the top project on HyperLiquid, one of the three DeFi sets. Website: https://hyperlend.finance/

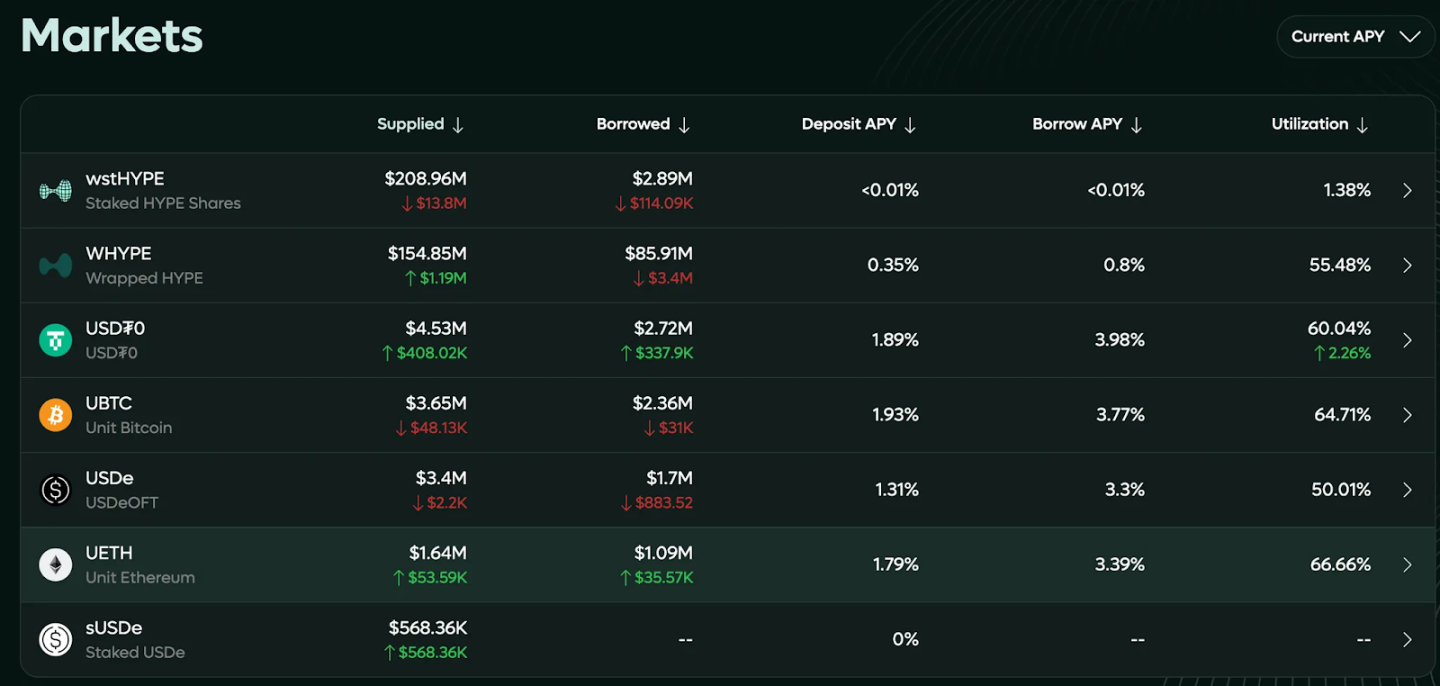

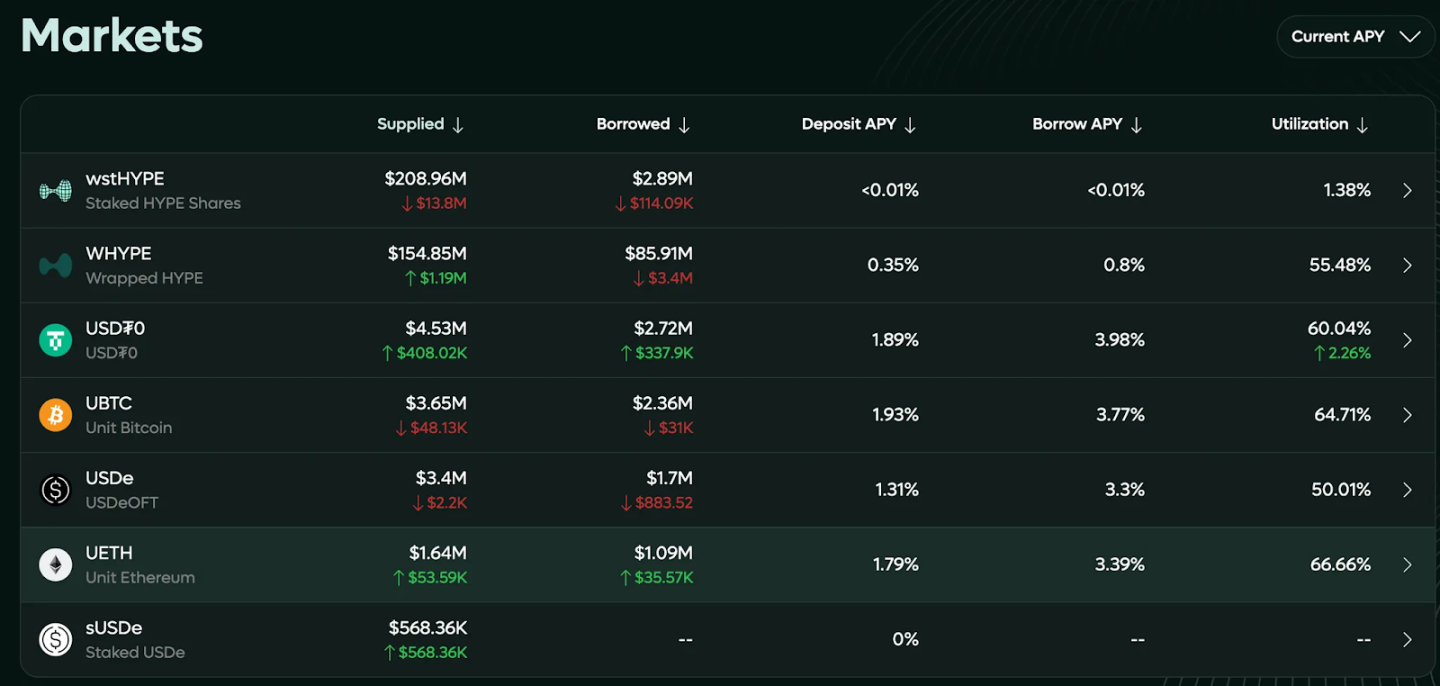

Currently, a large number of wstHYPE and WHYPE are being pledged on HyperLend to earn interest. However, since the HyperEVM ecosystem is still in its early stages, the overall demand for borrowing is low, resulting in a low lending APR for the time being. With the implementation of more applications, the expansion of user scale and the increase in leverage demand, the demand for borrowing is expected to increase, thereby pushing up the lending APR.

HyperLend's lending framework has a three-tier lending architecture that is flexible and focuses on risk isolation. It supports both peer-to-pool mode and peer-to-peer mode. Divided into:

Core pool: multi-asset shared liquidity, suitable for conventional lending scenarios;

Independent pool: contains only two assets, to achieve risk isolation and prevent cross-asset risk contagion;

Peer-to-peer pool: borrowers and lenders directly match, and can customize interest rates and terms, and interest rates are usually higher.

And support flash loans: uncollateralized, repayment within a single block, support high-frequency arbitrage and liquidation

After users deposit assets, they will receive income tokens (hTokens), which represent their deposit principal plus accumulated interest. Bookkeeping positions are tracked through debt tokens (DebtTokens), which accumulate interest over time to ensure that the process is transparent and traceable.

In addition, HyperLend works with HyperLiquid to allow users to borrow additional assets with hHLP as collateral and earn interest, thereby improving the efficiency of HLP capital utilization and bringing additional benefits to users.

HyperLend has established partnerships with multiple DeFi projects, including RedStone, Pyth Network, ThunderHead, Stargate, and Theo Network, enhancing its interoperability and influence in the Hyperliquid ecosystem.

HyperLend has launched a points reward program, where users use the protocol to earn points and may receive token airdrops in the future.

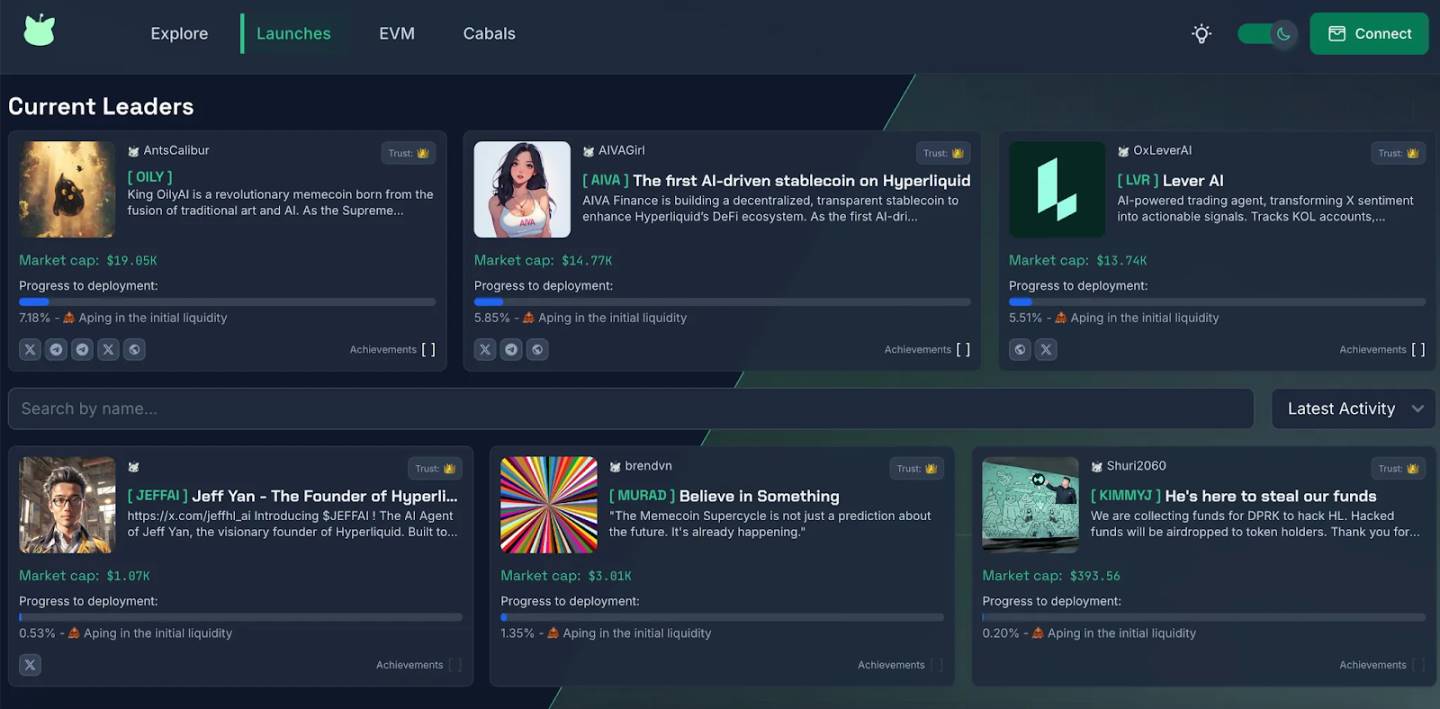

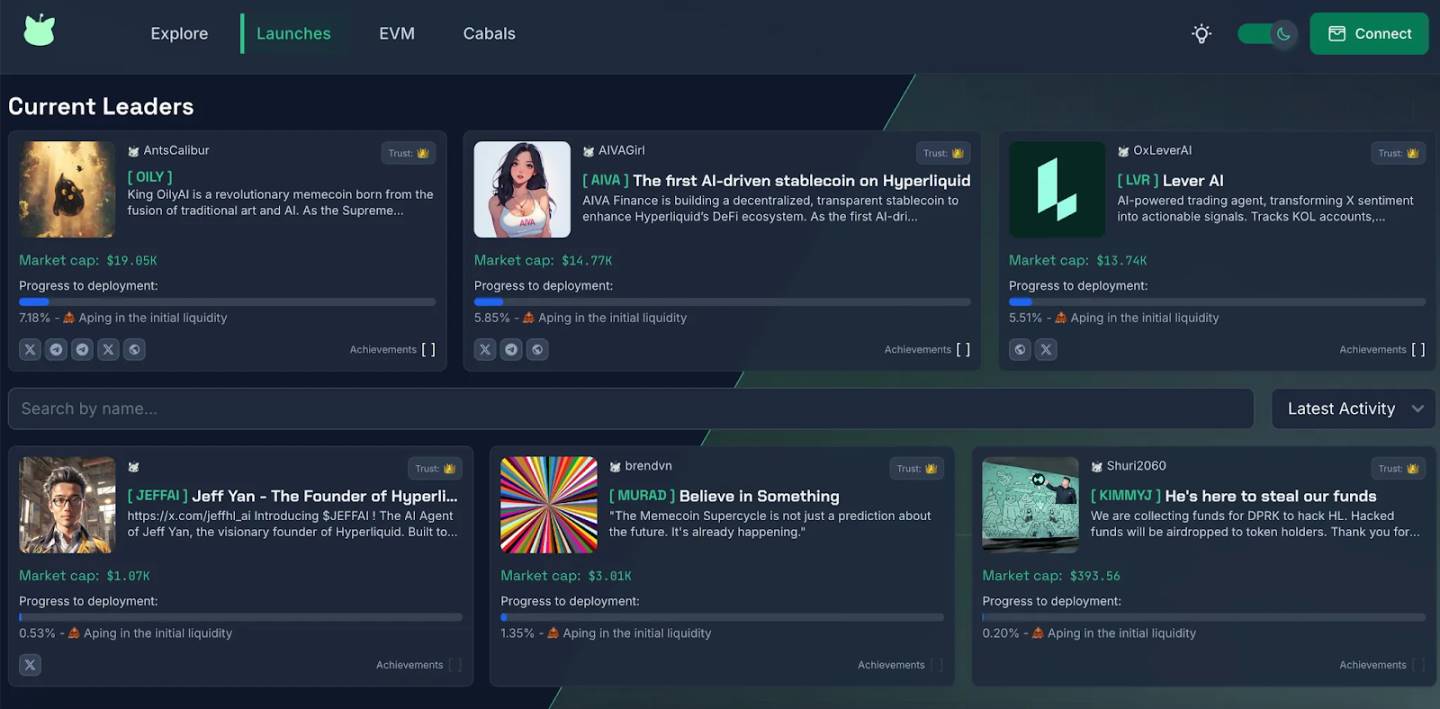

2. Hypurr Fun

Hypurr Fun is a meme launch platform on HyperEVM. It provides Telegram robots and web interfaces to facilitate users to trade quickly. It is currently a major traffic entrance on HyperEVM. Website: https://hypurr.fun/

The main features are:

One-click issuance and trading: Users can easily issue new tokens through robots and participate in transactions.

Advanced trading tools: Supports TWAP (time-weighted average price), automatic sniping, and portfolio management.

Profit repurchase mechanism: All transaction fees will be used to repurchase $HFUN tokens to enhance its market value.

Community interaction: Provide social features such as Whale Chats to promote communication between users.

$HFUN is the native token of Hypurr Fun, with a maximum supply of 1 million.

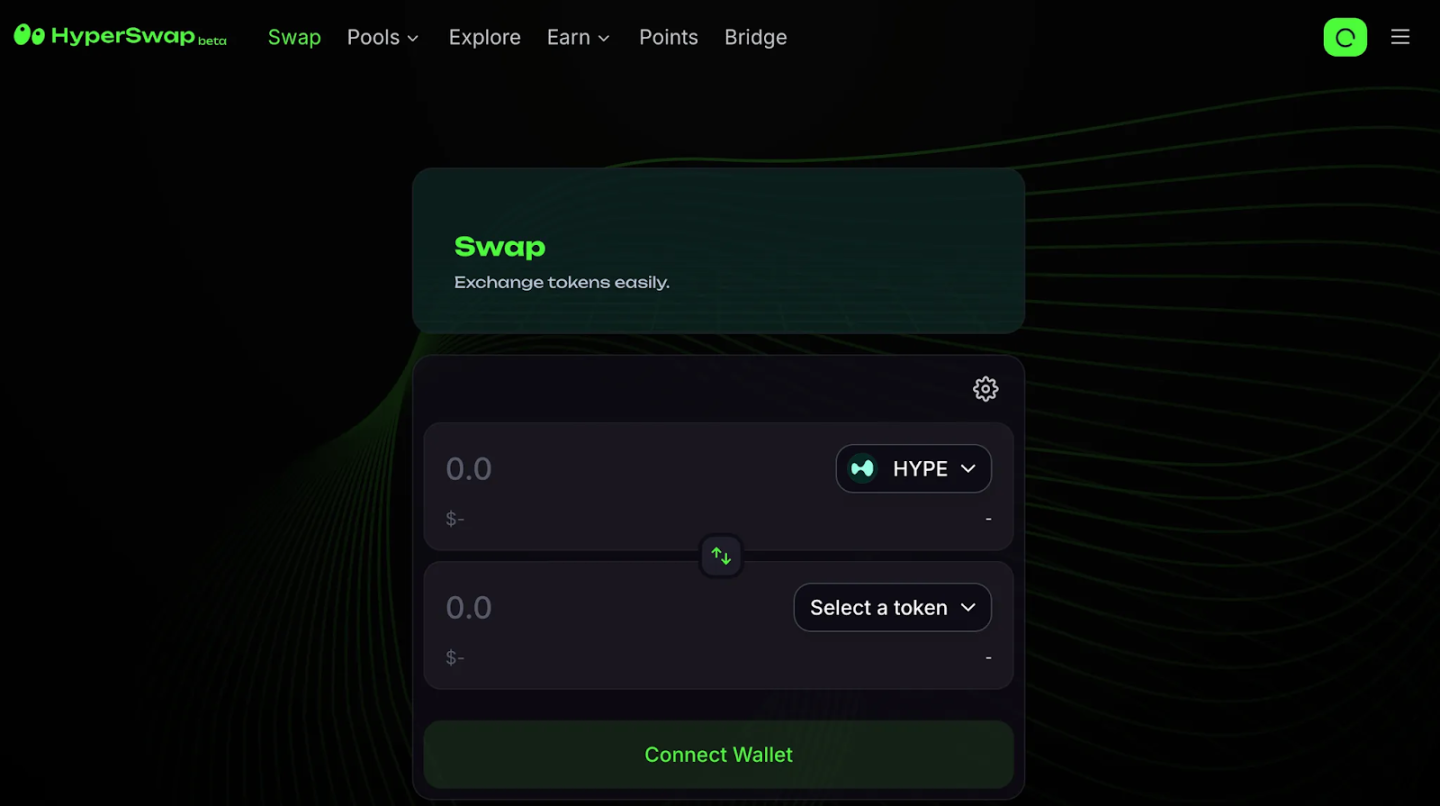

3. HyperSwap

HyperSwap is a low-slippage AMM on HyperEVM.

The main functions are:

Token trading: supports the exchange of multiple tokens, providing a fast and low-slippage trading experience.

Liquidity provision: users can create and manage liquidity pools to earn transaction fees and platform rewards.

Token issuance: allows users to issue their own tokens in a permissionless environment.

HyperSwap adopts a dual-token model, namely $xSWAP (liquidity mining token) and $SWAP (governance and revenue sharing token). Users obtain $xSWAP by providing liquidity, and can convert it to $SWAP to participate in platform governance and revenue distribution.

In addition, HyperSwap has launched a points program, and users accumulate points through activities such as trading, providing liquidity, and issuing tokens.

Summary

The rise of Hyperliquid is the result of multiple factors such as technology, products, marketing, and economic models. It is particularly worth learning about its marketing strategy and economic model design. However, it is necessary to pay attention to the two risks of regulatory pressure and cyclical tests. The HyperEVM ecosystem is in its early stages and is developing rapidly.

Anais

Anais