Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

Coinbase has been quite active recently.

On the one hand, it applied to the US SEC to launch stock tokenization transactions; on the other hand, it teamed up with Shopify to allow consumers in 34 countries to shop with USDC on the Base chain; at the same time, it also supports all Base ecological assets through DEX.

Coins, stocks, payments, contracts...all-round layout, and completed the closed loop on its own public chain Base. Coinbase's ambition is becoming fully apparent.

"On-chain brokerage": Coinbase's dream of a super portal

According to Reuters, Coinbase is seeking approval from the US SEC to provide users with stock tokenization trading services. Once approved, users will be able to trade tokenized assets representing US stocks through blockchain technology. Coinbase will directly compete with traditional retail brokerages such as Robinhood and Charles Schwab, and is also expected to open up its new on-chain securities business.

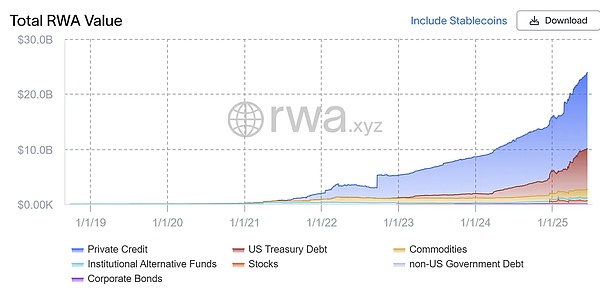

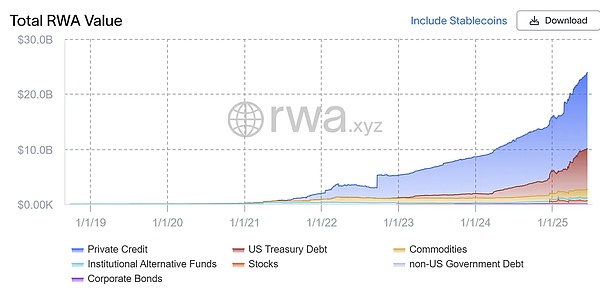

Behind this move is a rapidly rising market: so far this year, the overall market value of the RWA field has grown from US$15.7 billion in January to the current US$23.9 billion, an increase of more than 50% in just a few months.

Photo: rwa.xyz

Coinbase is not the only player who has spotted this trend. Last month, its main competitor Kraken announced that it would launch a U.S. stock token product "xStocks" outside the United States, with the first batch covering more than 50 stocks and ETFs such as Apple, Tesla, and Nvidia. The product is deployed on the Solana blockchain and supports 24/7 trading.

However, if Coinbase wants to implement this model in the United States, it still needs to overcome the high regulatory threshold: it must obtain a "no objection letter" or exemption license from the U.S. SEC. According to current regulations, all institutions that provide securities trading services must hold a brokerage license. Fortunately, Coinbase acquired Keystone Capital, which holds the license, as early as 2018. Although the subsidiary has not yet been actually put into use, Coinbase is theoretically qualified to provide similar services.

In addition, Paul Grewal, chief legal officer of Coinbase, also made it clear that the stock tokenization business is the company's current "high priority" strategic direction. If this model is successfully implemented, Coinbase is expected to break the traditional brokerage pattern and set off a head-on impact on Wall Street on the chain.

Coinbase's strategic fulcrum: Base

Coinbase is fully promoting the Base chain, trying to build it into the underlying infrastructure and strategic hub of the closed loop of on-chain finance.

Recently, Jesse, the head of Base, said that Coinbase has launched all Base ecological assets through the DEX mechanism, and users can trade seamlessly with CEX account funds. This means that once the projects on Base are issued, they can reach all Coinbase platform users at the first time. This has brought huge gains to Base in terms of liquidity and market attention.

In real payment scenarios, Coinbase is also pushing Base to accelerate its breakthrough. On June 13, the e-commerce platform Shopify announced a partnership with Coinbase and Stripe to allow merchants to accept USDC as a payment method. Consumers can now use USDC on the Base chain to check out in 34 countries.

Traditional financial giants have also included Base in their on-chain experiments. Today, JPMorgan Chase announced that it will pilot the issuance of JPMD tokens on Base to represent US dollar deposits. JPMD is scalable and may support interest-bearing and deposit insurance in the future, and is seen as a compliant alternative to stablecoins. This shows that large institutions are actively exploring the compliant issuance, circulation and settlement paths of on-chain assets, and Base may become an important foothold for banks, securities firms, payment platforms, etc. to "go on the chain."

From a strategic perspective, Base is a key bridge for Coinbase to the on-chain primary market, on-chain securities firms, on-chain payments, and even "on-chain banks." Base carries the ecological activity, while Coinbase recycles the entrance and assets with CEX.

From stock tokenization, to on-chain payments and stablecoins, to the issuance experiment of large institutional assets, Coinbase attempts to use the three major tools of coins, stocks, and chains to build a "on-chain financial empire" that can operate in compliance. However, the ever-changing regulatory policies, the fierce competition among competitors, and the deep integration of technology and compliance are all unavoidable tests for the expansion of this "empire".

Kikyo

Kikyo