Author: Zz, ChainCatcher

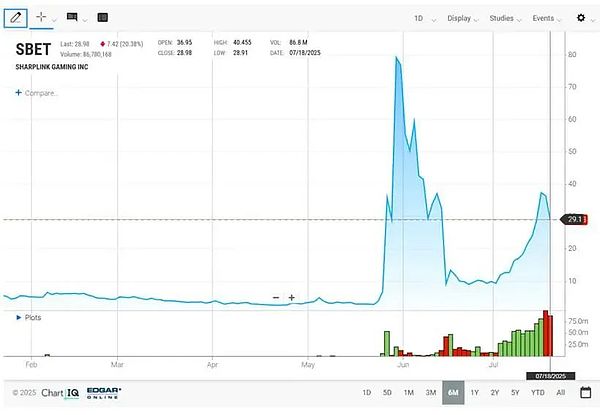

On July 15, 2025, a shocking news detonated the market: SharpLink, a gaming company on the verge of delisting, announced that it would buy all of the US$413 million it raised in a week into Ethereum. The capital market gave the most enthusiastic response to this - according to data from Investing and Nasdaq, its stock price soared 528% in six months, and soared by more than 150% in a single month.

However, SharpLink's counterattack story is just the tip of the iceberg. Almost at the same time, a broader capital alchemy was quietly taking place in different industries: a traditional consumer goods company (Upexi) easily incorporated SOL tokens into its reserves through ingenious bond design; a crypto mining giant (Bitdeer) successfully connected with traditional Wall Street capital; a Canadian cutting-edge technology company (BTQ) took advantage of loopholes in regulatory rules to raise tens of millions of funds from American investors.

From “junk stocks” on the verge of delisting to stable consumer brands, from crypto-native companies to cross-border technology upstarts. When people tried to find the mastermind behind all these transactions, the spotlight this time was not on Goldman Sachs or JPMorgan Chase, but on a medium-sized investment bank that had not been prominent in the public eye before: A.G.P. (Alliance Global Partners) As the operator or key participant in all these transactions, A.G.P. played this model to its full potential. On the SharpLink project alone, based on its commission rate, it earned perhaps more than $8 million in commissions in a week, and this is just the beginning of the massive plan it is leading with a total value of $6 billion.

While Wall Street giants were building compliance bridges for institutional clients, A.G.P.took a more radical approach: batch-transforming all kinds of listed companies into “ cryptocurrency proxy shares”and sitting at the table to become the one who designs the rules of the game.

Bulk trading of SharpLink and other US listed companies' encrypted vault construction

A.G.P.demonstrates trading techniques through four cases. Its model is not a standardized strategy, but a highly customized one: judging customer pain points and market hotspots, flexibly using tools such asATMprotocols, and designing charging plans that maximize their own interests for each transaction.

The most typical case isSharpLink. 2025year5month27Day, SharpLinkannounced the news: Completed4.25USD private placement financing,Consensysled the investment, founder of EthereumJoseph Lubin served as chairman. According to the 8-K, A.G.P. served as exclusive placement agent and earned 5-7% underwriting fees. However, the real main course was the subsequent ATM agreement. The subtleties of the ATM agreement require some explanation. Traditional stock issuance is like pouring a bucket of water into the market, which will inevitably lead to a sharp drop in stock prices. The ATM agreement is completely different. It is equivalent to installing a smart faucet for the company: when the stock price is high, the investment bank will open the faucet faster and sell millions of shares in a single day; when the stock price falls, the faucet will be immediately closed or the issuance will be slowed down to wait for a better opportunity; the company's management can decide to suspend or restart the entire plan at any time. Specifically, the core of the ATM agreement is the batch-based targeted issuance. Unlike the traditional issuance, which requires the price and quantity to be determined at one time, the ATM allows companies to raise funds in batches under the best market conditions. The issuance volume is controlled within 1-2% of the daily trading volume each time, which hardly attracts the attention of the market. This high-selling and low-stopping strategy not only protects the stock price, but also maximizes the financing efficiency.

From the charging structure, based on6month14USD 100 millionATM

In addition to SharpLink, another innovation case of A.G.P.is Upexi. 7Month17Day,A.G.P.Designed1.5USD convertible bonds for consumer products companyUpexi. Investors use SOL tokens as collateral to purchase bonds, enjoy an annual interest rate of 2.0%, and obtain the right to convert 4.25 U.S. dollars into stocks. In this way, for Upexi, this is equivalent to obtaining SOL reserves at a low cost, raising funds and catching the encryption express. Crypto funds holding SOL will lock in the rise of traditional stock markets. A.G.P., as the exclusive placement agent, earns underwriting fees from the transaction.

It is also worth noting that on June 18, A.G.P.as a co-manager participated in the issuance of US$330 million convertible bonds by the crypto mining company Bitdeer Technologies. By serving industry companies, A.G.P. not only earns direct underwriting income, but also establishes its position in the crypto mining financing market segment. The situation of BTQ Technologies, a post-quantum cryptography company, further demonstrates A.G.P.'s regulatory arbitrage capabilities. On July 11, A.G.P. raised C$40 million from U.S. investors for the company through the use of Canada's LIFE exemption mechanism (a channel that allows small financing to simplify approval). In return, A.G.P. received a 7% cash commission and warrants equivalent to 2.5% of the financing amount. The total rate of return brought by this cross-border regulatory arbitrage is close to 10%, far exceeding the 5-7% commission level of traditional IPO business.

A.G.P. has a golden finger

A.G.P.'sbusiness model is not a simple and crude copy and paste, but like an experienced hunter, it chooses the most accurate and effectiveweaponsfor different types ofpreyand the environment in which they are located. The choice of each case is closely coupled with its unique financial solution design. SharpLink is on the verge of extinction. Its business revenue has plummeted and its stock price is sluggish. It is a typical company that urgently needs drastic measures to prolong its life. For such a goal, management and shareholders are most receptive to radical plans and are willing to use high commissions in exchange for a glimmer of hope, which provides A.G.P. with the greatest operating and profit space.

SharpLink's transformation requires a sustained, self-reinforcing story. A one-off traditional share issuance cannot achieve this. The flexibility of the ATM (At-The-Market) protocol allows A.G.P. to turn financing behavior into a serial drama: “announce the purchase of coins to push up the stock price, and then immediately sell the stock at a high price in the secondary market; buy coins again after raising money, and push up the stock price again”. The cycle of stock price rising--” can only be perfectly realized by the ATM that can be issued at any time and in any quantity. It turns the company into a “perpetual motion ATM” under the control of A.G.P.

Upexiis a traditional consumer goods company, not a desperate enterprise. It was chosen to prove thatA.G.P.’s model can empower any robust company that desires“crypto narratives”, thereby greatly broadening its business boundaries.

Traditional companies are concerned about directly using cash reserves to purchase highly volatile crypto assets. SOLtoken-collateralized convertible bonds designed by A.G.P.designed: Simply put, A.G.P.found a group of wealthy crypto funds and asked them to use 150 million US dollars in cash to buy Upexi's bonds. The neat thing is that these funds must also put up their own SOL tokens as additional collateral.

For Upexi, it has 150more cash in its account, and it can also say to the outside world “We have SOLreserves” , the stock price story suddenly sounds good, and it didn't spend a penny. For crypto funds: their calculation is “steady interest earnings, and wait for a surge” . First, they take the 2%stable annual interest rate as a guarantee. The real goal is to wait for Upexishare price to take off, then use the agreed low price of 4.25to exchange bonds for stocks, and then sell them at a high price to make a lot of money.

AndA.G.P.? It is the one who “organized the game”. Regardless of whetherUpexi’s stock price goes up or down, as a middleman, it has first put a large amount of underwriting fees firmly into its own pocket.

Bitdeer Technologiesis itself a giant in the crypto mining industry and has no shortage of crypto stories. A.G.P. chose it to prove that it can not only transform “ outsiders ” , but also serve “ insiders ” , and serve as a “ bridge between the crypto world and traditional Wall Street capital. leaf="">”。

For crypto-native companies such as Bitdeer, the core pain point of their financing needs is to obtain the traditional financial market's “trust endorsement”. A.G.P. participated in the convertible bond issuance as a co-manager, which is equivalent to using its reputation as a licensed investment bank to enhance the credit of Bitdeer, making it easier for it to obtain recognition and funds from mainstream institutional investors. This move aims to establish A.G.P.'s authoritative position in the core track of crypto infrastructure financing. BTQ Technologies, a Canadian post-quantum cryptography company, is based in a “non-U.S.” jurisdiction. A.G.P. chose it to demonstrate its ability to navigate complex cross-border regulation, a high-threshold professional skill. Directly investing U.S. capital in a small Canadian tech company is a cumbersome process. A.G.P.precisely took advantage of Canada's LIFEexemption mechanism, a regulatory shortcut that bypasses the full prospectus requirement and quickly and cost-effectively introduces U.S. capital to BTQ. This is essentially a sophisticated “regulatory arbitrage”. A.G.P., with its mastery of the financial rules of different countries, has created excess returns and efficiency that traditional IPOs cannot match.

Behind the Midas Touch: Wall Street’s desire for money and radical change

In the macroeconomic environment of the post-epidemic era, traditional small and medium-sized companies generally face growth bottlenecks. When the traditional path to improve the main business becomes extremely difficult, they urgently need a new story that can instantly ignite market enthusiasm. Cryptocurrencies, especially Ethereum and Bitcoin, provide the sexiest and most easily understood by the capital market“growth narrative”.

Instead of investing several years in a difficult business transformation, it is better to directly announce the purchase of cryptocurrency——This radical"balance sheet revolution"can reshape a mediocre company into a technological pioneer overnight, which is the fundamental driving force behind the rise of the coin-stock linkage model.

The core contradiction in the current market is that there is a huge time gap between the actions of regulators (such as the USSECand the speed of market speculation.

SECand other institutions have indeed repeatedly expressed“serious concerns”about large-scale shareholder dilution, misleading marketing, and potential market manipulation. However, these warnings remained more at the level of risk warnings and framework discussions in the first half of 2025, and have not yet been transformed into specific, enforceable regulations that can comprehensively prohibit such operations.

There is a long process from issuing warnings to legislation to effective implementation. It was this regulatory vacuum period that was keenly captured by investment banks such as A.G.P., becoming a fleeting golden window in their eyes. Rather than saying “committing crimes against the wind”, it is better to say “snatching the last wave of dividends before the storm comes”.

The strategies of market participants perfectly illustrate that everyone is accelerating before the window of this wave closes:

As a pioneer,A.G.P.knows that this feast has a time limit. Therefore, it is expanding itsATMprotocol business at an unprecedented speed, expanding its customers from technology companies to a wider range of traditional industries such as retail, manufacturing, and biotechnology. The logic is very clear: complete as many transactions as possible and pocket the profits before the regulatory gate falls.

When B. Riley Securities,TD Cowenand other institutions formed special teams to enter the market, it just showed that the entire Wall Street had seen clearly that this was a special period of “anything is allowed unless prohibited by law”. The first-mover advantage is disappearing, and although the commission rate will decline due to competition, the certain dividend of this wave is attracting everyone.

Upgrade and Risk: "Noah's Ark" When the Storm Comes?

When the crypto market enters a bear market, or the regulatory punch finally falls, this carnival supported by leverage and narrative will come to an end. By then, the exhaustion of financing channels, the sharp impairment of assets, the collapse of stock prices and class action lawsuits will form a

Simply betting the future of A.G.P.on the success or failure of the current cryptocurrency-stock linkage may underestimate the core capabilities of this investment bank. A review of its trading cases reveals that, for A.G.P., the real “Golden Finger” is not a magic trick that turns stone into gold, but a set of replicable and highly flexible methodologies. It is not a specific asset or business, but the methodology itself. When the wave of “coin-stock linkage” recedes, it will almost inevitably apply this approach to the next trend, whether it is the tokenization of real-world assets (RWA), carbon credits, or any other asset with “narrative potential” and “regulatory ambiguity.” lang="EN-US">”new areas.

S3 Partnersdata show thatSharpLinkshort interest has soared 300% in the past month, indicating thatsmart money” has smelled the danger and is quietly withdrawing before the countdown ends and betting on the ultimate collapse of this carnival.

Written at the end

A.G.P.The story is a microcosm of Wall Street's search for survival space in the new era. This medium-sized investment bank has opened up a unique track surrounded by giants through market positioning and a profit model that guarantees income regardless of drought or flood.

However, the currency-stock linkage model walks on the edge of opportunity and risk, innovation and speculation. For investors, understanding who is the real winner is more important than participating in the game itself.

As the iron law of Wall Street shows: In the financial market, the one who really makes money is always the one who designs the rules of the game.

Weiliang

Weiliang

Weiliang

Weiliang Joy

Joy Kikyo

Kikyo Catherine

Catherine Weatherly

Weatherly Anais

Anais Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Weatherly

Weatherly