Original: Liu Jiaolian

BTC temporarily stabilized at 59k overnight. Now the market is like a frightened bird, shaking at the slightest disturbance. Yesterday, we initially looked forward to the consequences that the United States will face after the defeat of this round of financial war. There are three main ones: interest rate cuts, recession, and financial collapse. However, interest rate cuts do not necessarily lead to collapse. At least, interest rate cuts are not the cause of collapse. I am afraid that both are the result of recession.

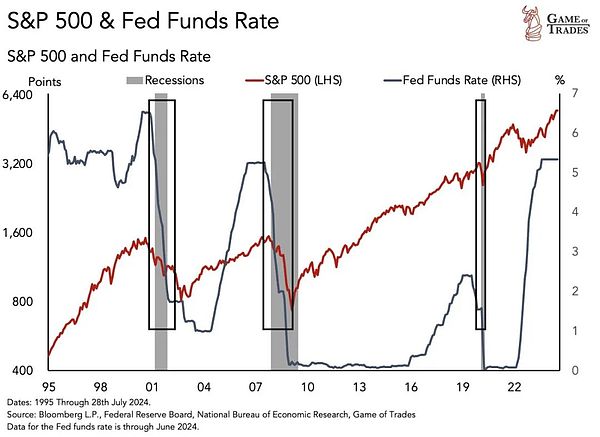

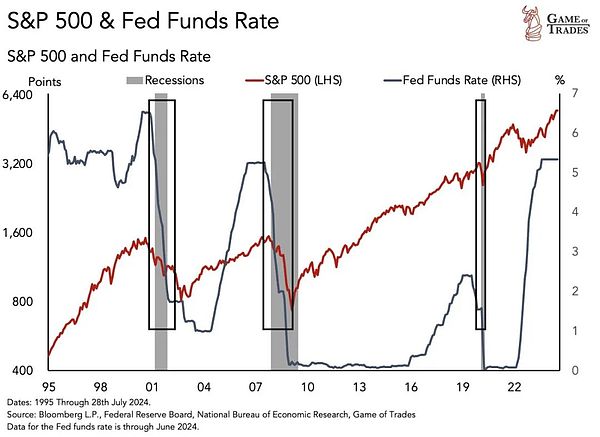

So why, from the historical data chart, it feels like the Fed started to cut interest rates first, followed by recession, and then the US stock market began to collapse? The reason is that the Fed can always "peek" at the real data of economic deterioration earlier than the market, and the public data shown to the market is modified and released with a delay, so that the Fed can always "preempt" the market.

However, to be honest, the officials of the Federal Reserve and the Bureau of Statistics are too arrogant and treat the people as idiots. It is obvious from the data that the more "wolf is coming", the worse the manipulation effect will be. The market has long seen through it. As long as the Federal Reserve cuts interest rates, or even expects to raise the white flag of surrender, I will run away and sell at high prices, so as not to stay where I am and wait to be buried.

So if this kind of market manipulation is done too much, it will become a kind of "self-realization" - because everyone expects a collapse, so they run away, and the result is actually a collapse.

The script of the Fed's failure was actually written as early as last year. It's just that the Bureau of Labor Statistics whitewashed the data and has not officially raised the white flag of surrender until today.

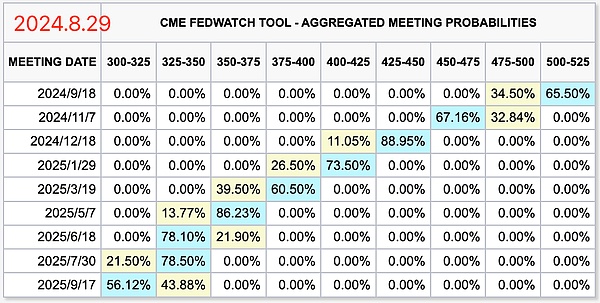

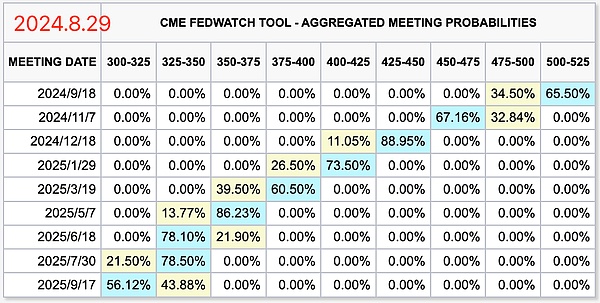

From the CME rate cut probability table, starting from next month, the Fed's turn to rate cuts is probably 100% certain. Apart from the Chinese self-media and a few pro-American scholars who claimed that the Fed would never cut interest rates (implying that they would never surrender and would never admit defeat in this round of financial war), I am afraid that even Americans themselves do not believe this nonsense.

Last September, when the two major forces in this round of financial war were fighting to the climax, the teaching chain clearly pointed out that since one side was unwilling to give up the interest rate hike and the other side was unwilling to give up the exchange rate, the result of the two gods' battle would inevitably push up the prices of BTC and gold. On the day of writing, BTC closed at 27,000 US dollars and gold closed at 1931 US dollars. You have all seen what kind of rise has begun in the past year.

Now we have to start thinking and considering where the Fed and the US dollar will go after the defeat of this round of financial war.

We must first consider a traditional, classic closed loop of the dollar tide, the method of harvesting and the direction of the dollar flow. Simply put, it is a cycle of interest rate hikes plus a cycle of interest rate cuts, completing two waves of harvesting.

The first is the interest rate hike cycle, which draws dollar liquidity back to the United States from all over the world, explodes the leverage and exchange rates of other countries, cuts asset prices by the Davis double kill, and simultaneously issues bonds to dilute everyone's wealth (the first wave of harvesting). The harvested dollars are delivered to interest groups through deficit spending, pushing up U.S. stocks, and further concentrating liquidity in the hands of U.S. interest groups and their financial white gloves, namely Wall Street institutions.

After the layout is completed, manipulate economic data, reverse monetary policy, and start a cycle of interest rate cuts. During the interest rate cut cycle, the US interest groups that obtained a large amount of US dollar liquidity in the previous step rushed out of the United States and rushed to the world through their white gloves. Faced with high-quality assets at a discount everywhere, they made large-scale acquisitions, and even "took advantage of your illness to buy your life" (the second wave of harvest) like the cheap merger of Ermao - anyone who has started a business and was forced to sign an unequal treaty ("selling body contract") when the company urgently needed financing should have a deep understanding of the cold and ruthless nature of financial capital that only wants to add icing on the cake and never help in times of need.

The first wave of harvest is to rob your money. The second wave of harvest is to buy your life with your money.

However, since the Chinese people stood up, the United States' tried and tested financial harvesting technique has become a little difficult to play.

In fact, it messed up that time in 2008. In the interest rate hike cycle, it raised interest rates head-on, but it didn't blow up others, but it pulled up its own real estate leverage, and exploded into the subprime mortgage crisis. However, relying on its unparalleled financial transmission ability, the crisis was quickly transmitted to the whole world, causing a global financial crisis. This tactic of killing one thousand enemies and hurting eight hundred of its own people also scared the whole world. Everyone rushed to rescue the market, bought US bonds crazily, and gave blood transfusions to the Americans. Finally, they worked together to help them get through it.

In the end, it was the people of the world who took on everything.

However, we should also thank that global financial crisis for directly igniting the inspiration of Satoshi Nakamoto and giving birth to the epoch-making great invention of BTC.

By 2016, the Americans had recovered and felt that eating big white steamed buns with pickles was a bit too uncomfortable. They missed the luxurious days of eating bird's nest and shark's fin every day, so they started another round of interest rate hikes. This time, it simultaneously attacked the global industrial chain, engaging in a trade war (restricting China's exports to the United States, suppressing the demand side) and imposing embargoes and sanctions (restricting the export of high-end technology from the United States to China, suppressing the supply side), hoping to "block both ends" and achieve success in one fell swoop.

Man proposes, God disposes. In 2020, a global pandemic came, which directly interrupted the Fed's interest rate hike process, forcing it to quickly return interest rates to zero and start unlimited money release. However, the old Americans once again demonstrated their powerful and terrifying ability to withstand blows: in 2008, they blew up and destroyed the jobs and money of thousands of people, but they didn't feel any pain at all; in 2020, they blew up and destroyed millions of lives, but they didn't frown. This kind of thing that might trigger a domestic revolution in another country, the old Americans actually swallowed it alive like they had mastered the magical skill of bone-melting cotton palm, without a burp, and still talked and laughed. This invincible strength really frightened the opponent.

It is easy to change a country, but it is difficult to change one's nature. In 2022, the Americans felt a little better about themselves, and immediately began to raise interest rates at an ultra-high speed. On the one hand, it is to cope with high inflation, and on the other hand, it is probably to make up for the results of the three-year interest rate hike from 2016 to 2019 that was lost in 2020 as soon as possible.

But because the speed is too fast, I can't keep up with the pace. The Federal Reserve has only been playing for more than half a year, and it has blown up its own small and medium-sized banks such as Silicon Valley Bank and Signature Bank. Friends who read the teaching chain articles in 2023 should know all these. But if you think about it more deeply, why are these small and medium-sized banks so stupid and stupid that they don't know that they may have a maturity mismatch problem? Did they not receive some key information? Who created an information wall for them, causing an information gap between them and big banks and big capital?

Don't be afraid of thinking too much or too deeply about financial things. You have to believe that Zhuang must think much more and much more deeply than you do.

When the Fed can no longer increase interest rates in the second half of 2023, the Fed's failure will be inevitable. However, it feels that it can still hold on. Hold on a little longer, maybe the opponent will surrender first?

It has to be said that this is completely a strategic fluke and a manifestation of opportunism.

This first wave of interest rate hikes was a bit hasty. With high inflation hanging over our heads, we really have no choice.

The main reason is that we didn't spoil the Americans this time. They issued bonds and sold bonds in an attempt to make the first wave of harvests. We also reduced our holdings of US bonds. You suck up US dollar liquidity, and I suck it too. We got a lot of US dollar liquidity and did two things: the first thing was to lend it to countries with US dollar leverage, so that they could close their positions and not be blown up. In exchange, they had to do currency swaps with us and kick the US dollar out of bilateral trade; the second thing was to hoard gold while defending the exchange rate, which led the whole world to hoard gold, and also promoted the rise of other US dollar hedging alternatives such as BTC, intercepting the returning US dollar liquidity.

This makes the Americans very uncomfortable. The first wave of harvest was not harvested, and the basis for the second wave of harvest no longer exists. If the harvest is not harvested, the Federal Reserve will not dare to cut interest rates. Because the current high interest rate keeps the US dollar tight, it can also make the US dollar appear relatively strong. If the interest rate is cut and there is no sufficient high-quality asset support, then the massive US dollars that are sharply magnified by the money multiplier will face a huge risk of rapid depreciation!

If the US dollar depreciates rapidly, it will cause a huge blow to the credit of the US dollar. This is something the United States cannot accept in any way.

It is precisely because of this consideration that the US Bureau of Labor Statistics would rather whitewash the data in the first half of the year and cooperate with the Federal Reserve to maintain high interest rates. It dares not cut interest rates, and at the same time fantasizes that the conditions and opportunities for the second wave of harvest will fall from the sky.

But China's two moves are too stable. Time is not on the side of the Federal Reserve at all. Its persistence is nothing but meaningless hardening and consumption. The longer it hardens and consumes, the slimmer the hope of victory and the greater the risk of collapse. Isn't it that the Sam index has reached the critical value of recession?

Besides, both moves are open plots. The dollar was abandoned after the chaos, and it left without any mercy, which chilled the hearts of small countries. No one asked the dollar to leave, it wanted to leave by itself. We just sent warmth to the door in time after it left. You abandoned your girlfriend with your own hands, and you don't allow others to take care of her? Is it too overbearing? So, open plots have no solution.

Now the cycle is about to reverse, the US dollar can't stand the loneliness, after sleeping at home, it wants to go out and sleep all over the world. This is bullying. If you want to make the bully talk some reason, it may not work without Dongfeng, aircraft carriers, and 055 destroyers, so you have to build more.

People are all made of flesh and blood. After experiencing the good of a warm man, who would want to use their own flesh to bear the desires of the village bully? So, as long as the new love can beat the village bully and has enough force to keep him out, then as the teaching chain said, "This time the dollar has run away ruthlessly, and it doesn't need to come back."

After seeing this situation clearly, we can roughly deduce how the post-war situation will develop after the Federal Reserve surrenders.

On one hand, the US dollar liquidity trapped in the United States is eager to get out, and on the other hand, there are few beauties in the world who are kicked down in the interest rate hike cycle and waiting for the US dollar to take over. They are still standing well and nestling in the arms of others. If you want to rely on your own strong ships and powerful guns, the one next to the beauty doesn't seem to be a vegetarian either. After weighing it, you really don't dare to use force.

What can I do?

This side has to go out, and the old road over there can't go back, so you have to find a new outlet to release the flood and reduce pressure.

So this huge amount of US dollar liquidity has to flow into the crypto market that is open to it.

BlackRock is a veteran in the end. It has been intensively preparing for the new post-war situation this year, and has launched BTC and ETH crypto ETF products, paving the way, building bridges, and opening up the channel from the US domestic market to the crypto market, so that the overwhelming and surging US dollar liquidity can rush to the crypto world more quickly and conveniently.

By then, Satoshi Nakamoto will comfort Powell's empty heart with his loving and tolerant heart.

JinseFinance

JinseFinance