As long as three things go right, the current bull market can last until its third birthday.

The current bull market is about to celebrate its second birthday, and this round of gains has exceeded the expectations of all but the most bullish Wall Street investors.

The S&P 500 has risen more than 60% since hitting a bear market closing low of 3,577.03 on Oct. 12, 2022, according to FactSet, a speed of increase that exceeded the expectations of many professionals, and Wall Street investment banks have had to raise their year-end targets for the index several times.

The road to the rise of U.S. stocks has become bumpy in the past three months. According to FactSet data, the VIX panic index rose to its highest level since March 2020 on Aug. 5, the day when global stocks fell sharply, and the VIX panic index quickly fell back as stocks rebounded. A similar plunge occurred in the first week of September, but that decline also attracted investors looking for bargain hunting opportunities.

Since then, the S&P 500 has recorded its best first three quarters since the late 1990s. If the upward momentum can be maintained until the end of December, it will be the second consecutive year that the S&P 500 has risen by 20% or more, the first time the index has achieved this milestone since 1998.

However, the potential risks facing the recent rise in US stocks have greatly increased. First, the current valuation of US stocks is high compared with historical levels, only slightly lower than the previous peak at the end of 2021.

Second, geopolitical risks have risen again. A new round of conflict between Israel and Iran has pushed up crude oil prices, and stock investors have begun to become nervous.

Third, as the third-quarter earnings season is about to kick off, investors may be more discerning about the earnings reports of Microsoft and other AI-related companies, hoping to see clues on how long it will take for these companies' huge investments in AI to pay off. Nvidia's second-quarter report released in August, although strong, was still not enough to boost the stock price.

Finally, the US presidential election on November 5 may cause volatility in the stock market, and many traders are hedging their portfolios.

With these uncertainties, many investors are looking for guidance on where the stock market will go next.

The team of analysts at Ned Davis Research has conducted in-depth research on this issue, studying how the previous US stock bull market performed after its second birthday.

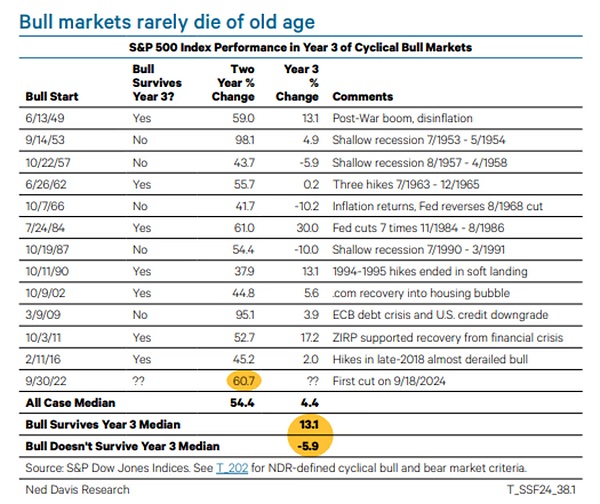

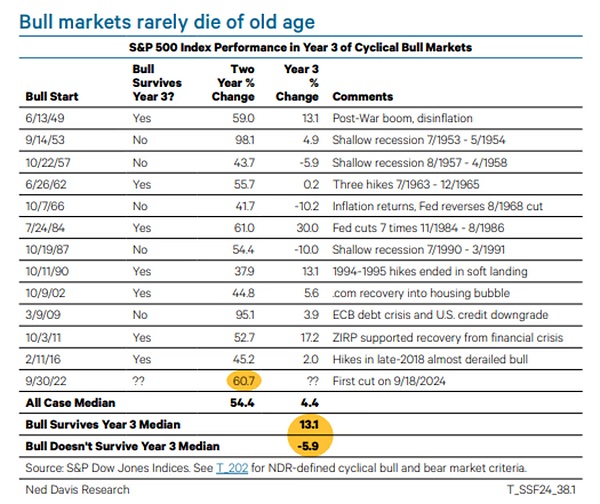

Analysts have found that there have been 12 bull markets that lasted at least two years since the end of World War II. If there is no major sell-off in U.S. stocks between now and the end of this week, the current bull market will be the 13th to last two years.

Seven of the 12 bull markets lasted until the end of the third year, which shows that the current bull market has a high probability of continuing.

The median two-year gain of the 12 bull markets is 54.4%, which means that compared with the past, the gains in U.S. stocks in the past two years are not particularly large.

But the gains will be smaller after two years. Bull markets that lasted into their third year had a median gain of 13.1% in that third year, according to Ned Davis Research, while those that didn’t made it to the third year had a median decline of 5.9%.

Bull markets don’t die of old age

Ned Davis Research’s analysis shows that there is not a single case where a U.S. bull market died of “old age.” Every bull market’s demise was due to some catalyst.

Recessions are the most common catalyst, killing three bull markets in their third year, and the fourth — the one that began in October 1966 — was killed by the Federal Reserve, which began tightening monetary policy to fight inflation.

The fifth example is the bull run that began in March 2009, which was killed when Standard & Poor’s downgraded the U.S. credit rating and the European sovereign debt crisis triggered a global panic.

The current bull run can last until its third birthday as long as three things go right, according to a team of analysts at Ned Davis Research.

First, the disinflationary trend that began in late 2022 must continue. Concerns that inflation could rise again have been creeping in since the Fed’s September slashing of interest rates, and concrete signs of another rise in inflation could cause investor panic.

Second, the Fed must succeed in delivering a soft landing for the U.S. economy. That means the Fed must keep U.S. growth rates positive while letting inflation fall back to its 2% target.

If a recession comes, U.S. stocks may fall as a result, but the team of analysts at Ned Davis Research sees little reason to worry about one at this time.

Third, profits at U.S. companies with large market capitalizations must continue to grow. Wall Street currently expects profit growth at the tech "Big Seven" to slow starting later this year.

The rest of the S&P 500 must take over from the "Big Seven" to contribute to the market's gains, and forecasts show that this is likely to happen. However, forecasts are also subject to change, and much will ultimately depend on how the U.S. economy performs between now and this time next year.

Weiliang

Weiliang