1 Introduction

Since the Kyrgyz National Investment Agency signed a memorandum of understanding with Binance co-founder Zhao Changpeng (CZ) in early April to cooperate on crypto assets and blockchain technology, the Kyrgyz government has interacted frequently with CZ. On May 5, CZ posted a local license plate with "888BNB" on social media and praised it. At the same time as this dynamic, the President of Kyrgyzstan tweeted a meeting with CZ and invited CZ to join the National Crypto Committee. CZ suggested that Kyrgyzstan include BNB and BTC in the national cryptocurrency reserves. So, why does CZ like Kyrgyzstan so much? What are the characteristics of the country's tax and regulatory system involving crypto assets? This article will reveal the answer for you.

1.1 National Profile

The Kyrgyz Republic (Kyrgyzstan) is located in the northeast of Central Asia, at the junction of Central Asia, Western Europe and East Asia. Its capital is Bishkek. The national language of Kyrgyzstan is Kyrgyz, and the official language is Russian. The currency is the Kyrgyzstani Som (Som). Kyrgyzstan has made significant progress in the field of crypto assets in recent years. It has actively formulated crypto asset regulations and supported the development of digital technology and blockchain ecosystems. It is a leader in digital asset regulation and market size development in Central Asia and a core area of the crypto industry.

1.2 Qualitative Analysis of Crypto-Assets

According to the definition of Kyrgyzstan's Law on Virtual Assets, virtual assets are a set of data in electronic digital form that has value, is a digital expression of value and a means of proving property or non-property rights, and is created, stored and circulated using distributed ledger technology or similar technologies, rather than monetary units (currency), means of payment and securities. Crypto-assets are a type of virtual assets.

2 Tax Policy

2.1 Overview of the Tax System

The legal system of Kyrgyzstan was developed within the framework of the laws of the former Soviet republics, and in many respects it is similar to the legal systems of the Russian Federation and other former Soviet republics. In general, its legal system can be divided into four levels: constitutional laws, codes, laws and regulations. After Kyrgyzstan's independence, its legal system has been further revised and improved, and a series of laws covering various fields have been promulgated, including the new Constitution, Civil Code, Foreign Trade Law, Tax Law, Investment Law, etc.

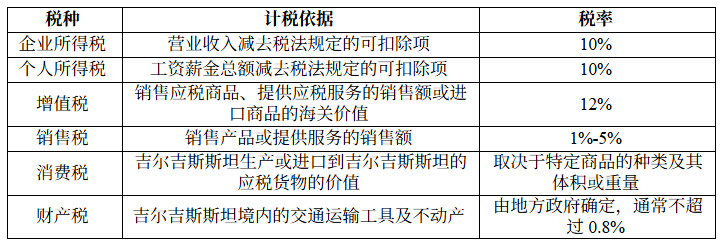

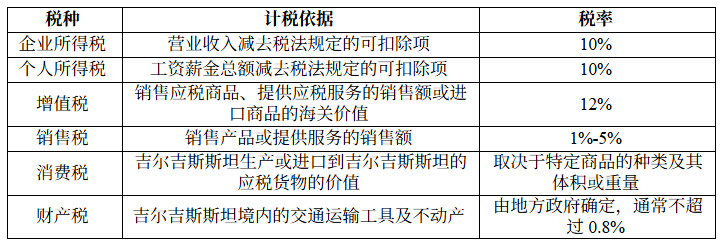

Specifically in terms of taxation, the tax authorities of Kyrgyzstan manage taxpayers in accordance with the tax collection and management procedures in the Kyrgyzstan Tax Code (hereinafter referred to as the "Tax Code"), and taxpayers should also comply with the requirements of the Tax Code and fulfill their tax obligations in accordance with the law. Kyrgyzstan's taxation mainly consists of income tax, turnover tax and other small taxes, including central taxes such as corporate income tax, personal income tax, value-added tax, sales tax, consumption tax, underground resource use tax, and local taxes such as property tax and land tax. In addition, the Tax Code also introduces a variety of tax systems, including a simplified tax system based on a single tax type, a digital currency mining tax, an e-commerce tax, an entertainment tax, a special tax on business licenses, a special trade zone business tax, a special tax system for free economic zones, and a special tax system for high-tech parks.

Corporate income tax: 1) Resident enterprises. Legal entities and individual business operators established and registered in accordance with the laws of Kyrgyzstan are resident entities in Kyrgyzstan (including resident enterprises and non-enterprise units, institutions and organizations, etc.). Partnerships are transparent entities under Kyrgyz law. The profits obtained from partnerships are regarded as the profits of the participants of the enterprise, and the partnership itself does not need to pay corporate income tax. The scope of taxation is the corporate income tax paid on its annual total income obtained worldwide. Special economic zones usually offer preferential policies to reduce corporate tax burdens and implement a free currency management system. However, a special incentive fee of 0.1% to 2% of income will be charged depending on the location of the enterprise. Kyrgyzstan exempts resident enterprises in innovative technology parks that meet the conditions from corporate income tax. 2) Non-resident enterprises. Enterprises established under foreign laws and non-resident individuals who need to register as self-employed persons in Kyrgyzstan are tax non-resident enterprises in Kyrgyzstan. Specifically, they include non-resident enterprises with permanent establishments in Kyrgyzstan and non-resident enterprises that have income from Kyrgyzstan but do not have permanent establishments in Kyrgyzstan. The scope of taxation is their income from Kyrgyzstan.

Personal income tax: 1) Resident taxpayers. Any individual who resides in Kyrgyzstan for 183 days or more in any consecutive 12 months is a resident taxpayer in Kyrgyzstan. Individuals who perform official duties for Kyrgyzstan abroad are also considered resident taxpayers in Kyrgyzstan. People with Kyrgyz nationality and foreign citizens who have obtained Kyrgyz permanent residency or a returnee certificate among Kyrgyz resident taxpayers shall pay personal income tax in Kyrgyzstan on their global income. Individuals who meet the criteria for resident taxpayers but do not have Kyrgyz nationality and do not have permanent residency or a returnee certificate shall only pay personal income tax on their income from Kyrgyzstan. Self-employed individuals do not need to pay personal income tax, but shall pay corporate income tax. 2) Non-resident taxpayers. Individuals who have resided in Kyrgyzstan for less than 183 days in any consecutive 12 months are non-resident taxpayers in Kyrgyzstan. Non-resident taxpayers shall pay personal income tax on their income from Kyrgyzstan.

Value-added tax: Taxpayers include enterprises and individuals that sell taxable goods and provide taxable services in Kyrgyzstan; enterprises that import taxable goods; and foreign enterprises that provide labor, services, and electronic services (including e-commerce services to Kyrgyz resident individuals) in Kyrgyzstan. According to the tax law, in addition to enjoying VAT preferential policies, the sale of VAT-taxable goods and the provision of taxable services and labor in Kyrgyzstan are subject to VAT. At the same time, VAT is also required for the import of taxable goods, and the tax base is the customs duty-paid price of the imported goods. No VAT is required for the sale of crypto assets.

Simplified tax based on a single tax: From January 2024, the income ceiling of 30 million soms has been abolished. Except for a few industry entities that still cannot apply for the simplified tax system based on a single tax, any individual business operator and enterprise (except foreign enterprises that do not have a permanent establishment in Kyrgyzstan) taxpayers can apply for it. The tax base of the single tax is usually sales revenue, and there are special provisions for the tax base for taxpayers engaged in special business types.

Special tax system tax benefits: 1) Special tax system for free economic zones. Taxpayers registered in free economic zones are subject to the special tax system for free economic zones. Except for some special circumstances, taxpayers subject to the special tax system of free economic zones are exempted from all tax obligations and only need to fulfill the obligation to pay social security contributions. The special tax system of free economic zones does not increase new tax obligations, so the tax system itself does not involve tax declaration and payment. 2) Special tax system of high-tech parks. Taxpayers registered in high-tech parks are subject to the special tax system of high-tech parks. Taxpayers in high-tech parks are exempted from corporate income tax, sales tax and value-added tax obligations, but the tax obligations of other taxes still need to be fulfilled in accordance with general regulations. The special tax system of high-tech parks also does not increase new tax obligations, so the tax system itself does not involve tax declaration and payment.

Overall, in order to better promote economic development, Kyrgyzstan has continuously simplified the tax system, optimized the tax structure, and introduced digital tools in tax management to establish a more efficient and fair tax system and improve tax transparency and compliance.

2.2 Crypto tax policy and latest developments

According to the government decree issued on August 1, 2020, Kyrgyzstan has implemented a special tax system for entities engaged in mining in the field of crypto assets, imposing a crypto mining tax. The Tax Code stipulates that companies and individuals that use software and hardware to perform computing operations for mining activities should pay crypto mining tax instead of income tax. Taxpayers should submit applications to the tax authorities as taxpayers of mining tax at the place of tax registration. The tax base of crypto mining tax should be the accrued amount of electricity consumed in the mining process, including value-added tax and business tax, and the tax rate is set at 15%.

The amount of excess profit from the sale of crypto assets over their purchase cost, as well as the value of crypto assets obtained free of charge, are all components of the taxpayer's annual total income, and income tax is required to be paid in accordance with regulations. Among them, the country defines the sale of crypto assets as: exchanging crypto assets for domestic or foreign currency. The exchange of one crypto-asset for another is not considered a sale. The applicable income tax rate is 10%.

There is no VAT on the sale of crypto-assets in Kyrgyzstan. However, when selling goods, works, and services that are exempt from VAT, trade activities and production sectors pay a 2% sales tax, and the rest are subject to a 3% sales tax. According to the provisions of Islamic finance, when selling shares, organizational interests, currencies, crypto-assets, fixed assets, and goods, the tax base is the proceeds from the sale minus the acquisition cost.

It is worth noting that on October 15, 2024, the Financial Market Supervision and Administration of the Ministry of Economy and Trade of Kyrgyzstan announced the start of discussions on the legislative supervision and solicitation of suggestions from relevant parties on the "Resolution of the Cabinet of Ministers of Kyrgyzstan on Amending the Resolution of the Government of the Kyrgyz Republic No. 159 of April 15, 2019 on Approval of the State Tax Rate". The purpose is to ensure the state's non-tax revenue by increasing the state tax rate for enterprises operating in the non-bank financial sector, such as crypto asset exchange operators, insurance institutions, professional participants in the securities market, pawnshops, and organizations engaged in crypto asset mining. In particular, financial stability is improved by imposing higher taxes on high-risk industry participants such as crypto assets, insurance companies, and securities.

3 Crypto asset regulatory dynamics

3.1 Crypto asset regulatory policy

In 2022, Kyrgyzstan passed the "Virtual Assets Law", which laid the regulatory foundation for the creation, issuance, storage and circulation of crypto assets. It has promoted the vigorous development of Kyrgyzstan's crypto asset industry, and it stands out among Central Asian countries with its positive attitude towards crypto assets and blockchain. The "Virtual Assets Law" clarifies the licensing system for crypto asset service providers (VASPs), which is uniformly supervised by the National Financial Market Regulatory Service. This allows service providers to easily enter the market and regulators to better supervise. As of January 31, 2025, the Financial Supervision Authority has issued 144 licenses for crypto asset service providers. Of the total number of licenses issued, 8 licenses were issued to crypto asset trading operators, and the remaining 138 licenses were issued to crypto asset exchange operators.

On January 10, 2025, in order to improve the efficiency of crypto asset service providers, the Resolution of the Council of Ministers of the Kyrgyz Republic No. 823 of December 31, 2024 on Amending Certain Resolutions of the Cabinet of the Kyrgyz Republic in the Field of Virtual Asset Circulation was adopted. The main changes include: 1. Improving the requirements for crypto asset trading operators. Including requirements for customer identification and verification, publication of exchange rules, verification of the reputation of beneficial owners, etc.; prohibiting transactions through unlicensed operators and using crypto asset wallets with higher confidentiality; and requiring 2,000,000 calculation indicators for the minimum authorized capital of operators trading crypto assets. 2. Activity requirements for crypto asset exchange operators. Requirements for verifying the reputation of beneficial owners, conducting annual audits and notifying changes to authorized institutions have been introduced; the use of prepaid cards of foreign financial institutions and the transfer of crypto assets to addresses of online casinos and decentralized systems are prohibited; the minimum authorized capital of crypto asset exchange operators is set at 1,000,000 calculation indicators. 3. Changes in the regulatory provisions for the issuance of crypto assets. The possibility of issuers issuing crypto assets through private placements has been ruled out; the possibility of nominating issuers of foreign currency crypto assets has been determined.

Since the 2022 Virtual Assets Law established a clear legal framework for crypto activities, Kyrgyzstan has also successively demonstrated its active preparation and openness to the crypto industry by promoting the inclusion of crypto banking technology in its banking system, digital payments and financial regulations. In October 2024, the Ministry of Economy of Kyrgyzstan initiated and submitted to Parliament a bill on the establishment of a crypto bank in Kyrgyzstan. The bill proposes to amend the current crypto-asset legislation, requiring crypto banks to be legal entities registered in Kyrgyzstan, providing one or more banking services related to crypto-assets under a license issued under the Kyrgyz Law on Banks and Banking Activities. After obtaining a license, crypto banks are entitled to carry out any type of digital asset-related activities provided for in this law without obtaining additional licenses. Crypto banks do not need a separate license to conduct banking business. The creation of crypto banks will ensure that user rights are protected, thereby reducing the risk of fraud and unauthorized access to funds. Crypto banks will also serve as an implementation platform for new financial technologies such as smart contracts and DeFi, helping to modernize the financial system.

It is worth noting that in February 2025, the Financial Market Supervision Agency of the Ministry of Economy and Commerce of Kyrgyzstan announced the start of discussions on the legal regulation of the activities of crypto-asset service providers and the collection of suggestions from relevant parties. The general policy for regulating the crypto-asset market is to ensure transparency, security and protection of market participants. The proposed regulations will involve modifying and revising the norms of regulatory behavior to adapt the legal framework to the development dynamics of the crypto-asset market and create a clearer and more stable legal environment for participants in the crypto-asset market. And promote crypto asset service providers to establish internal controls. This indicates that Kyrgyzstan will introduce stricter regulatory policies to further improve the transparency of crypto asset transactions. The introduction of the proposed regulations will also help to combat terrorist financing and money laundering and improve its operational efficiency.

3.2 Latest developments in the local crypto industry

The Ministry of Finance of Kyrgyzstan has created the first national crypto asset exchange, Coin National Exchange, and is the first country in Central Asia to establish a national crypto asset exchange. The exchange officially entered the register of the Ministry of Justice on December 30, 2024, and its main business is financial market management. The Kyrgyz Stock Exchange, BTS Exchange, EVDE Universal Exchange and many crypto asset exchanges currently belong to this category. According to the Ministry of Finance document, 100 million KGS was allocated from the republican budget as the initial authorized capital of Coin National Exchange.

In order to continue to consolidate its position as a regional crypto center, Kyrgyzstan actively supports the development of stablecoins. In April 2025, the Kyrgyz company Old Vector issued a stablecoin A7A5 pegged to the Russian ruble, maintaining a 1:1 peg to the Russian ruble. A7A5 was issued in accordance with Kyrgyzstan's newly adopted crypto regulations and is supported by the government. According to the official white paper, the project's reserve report is updated weekly, and an independent company conducts an external audit every quarter to ensure full accountability and trust. A7A5 generates income from interest income and automatically distributes 50% of its income to all token holders every day when bank deposit funds are received. Holders do not need to perform any actions to receive these distributions.

In terms of stablecoins and CBDCs, Kyrgyzstan previously launched the Gold Dollar (USDKG), a stablecoin pegged to gold and the US dollar. Unlike other stablecoins, USDKG is a 1:1 dollar-anchored, gold-backed stablecoin, and the role of the country's Ministry of Finance is limited to providing gold reserves. The rest of the development, auditing, and maintenance are done by private companies and individuals. This move may better promote the standardization and transparency of the crypto ecosystem, modernize infrastructure, promote cross-border trade, and attract international investment. In addition, in mid-April this year, the President of Kyrgyzstan also signed a bill to give legal status to the "digital som", and if Kyrgyzstan finally decides to issue CBDC, then the digital som will become the country's legal currency.

4 Summary and Outlook

Kyrgyzstan actively promotes the development of the crypto industry, focuses on optimizing the tax policy of crypto assets, and has a clear tax system and competitive tax rates, which not only enhances Kyrgyzstan's attractiveness in the global crypto asset market, but also creates stable and favorable operating conditions for investors and market participants. At the same time, both the previous regulatory reforms and the frequent interactions with CZ show Kyrgyzstan's friendly attitude towards crypto assets. We believe that in the context of the rapid growth of the global crypto asset industry, Kyrgyzstan's relevant tax and regulatory systems will help it create a competitive advantage in the field of crypto assets. In particular, with the development of the country's crypto banks, national exchanges and stablecoins, Kyrgyzstan's crypto assets will be further integrated with the traditional financial system, promoting the development of innovative infrastructure in the country and even in Central Asia, as well as the vigorous development of the overall industry.

Joy

Joy