Magic Eden 潜在空投指南

JinseFinance

JinseFinance

Author: Jonnyhimalaya

This article explores some of the most promising Layer1 Bitcoin decentralized exchanges (Dexs) and automated market makers (AMMs). Most of these markets are still under development, and some are only in the testnet stage. In general, these markets can be divided into two categories: order book trading platforms and automated market makers. This article conducts research interviews with most of the teams involved.

DeFi on Bitcoin is coming. We have already seen the initial appearance of DeFi on Bitcoin, such as Ordinals, Runes, and the emergence of meta-protocols such as BRC20 and TAP. The community wants to trade “shitcoins” on Bitcoin, but that’s about to change!

Currently, trading tokens on Bitcoin is a poor and friction-filled experience. On markets like Unisat and Magic Eden, sellers of tokens (BRC20 or Runes) have to list a specific amount of tokens at a specific price and wait for buyers to buy the same amount of tokens at the same price, which adds friction to trading.

Many teams are trying to solve this problem by bringing AMM and Dex-style trading to Bitcoin, providing the trading experience we are used to on the EVM. Since Bitcoin uses the UTXO model instead of the account model used by the EVM, some features need to be redesigned. In fact, UTXO has technical properties that cannot be achieved with the EVM in terms of designing partially signed Bitcoin transactions (PSBT) to enable atomic swaps.

I considered specific criteria when analyzing each market: user experience when exchanging, degree of decentralization, permissioning, and other trade-offs.

Most teams are innovating in PSBT and signature hashes (Sighash). Signature hashes are the mechanism used to sign Bitcoin transaction inputs and outputs. There are six different types of signature hashes, ranging from the most secure but least flexible "Sighash All" to the least secure but most flexible "Sighash None — Anyone Can Pay". Currently popular markets such as Unisat and Magic Eden use "Sighash-Single" to create their PSBT. This means that not all outputs are signed, and transactions may therefore be affected by MEV sniping. Using "Sighash-All" means that all inputs and outputs are fully signed, and any transaction signed in this way can avoid MEV sniping.

There are many other factors to consider when analyzing Dex or Swap, such as liquidity and slippage, market making and taking fees, liquidity provider incentives, trading volume, etc. However, since most of the analyzed markets are still in testing or early release stages, it will take time for these indicators to become relevant.

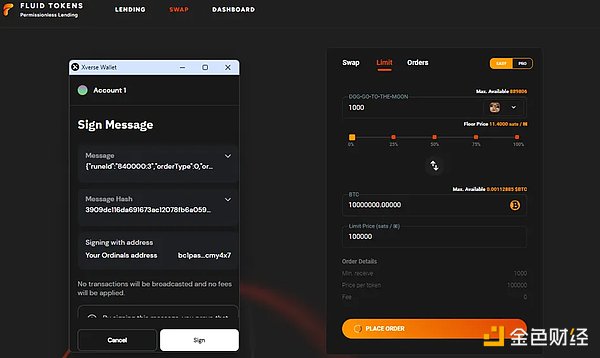

Fluid Tokens is an order book-based decentralized exchange (DEX). Users can currently trade Runes-BTC, and the Runes-Runes feature is coming soon. Fluid is essentially a peer-to-peer trading market. When traders want to create an order (maker), they make an off-chain "commitment" (for example, I want to sell 1,000 $DOG and exchange it for 0.001 BTC). These commitments are published in the order book as limit orders. When a buyer (taker) accepts the order, that is, a market buy or sell, they initiate a PSBT (partially signed Bitcoin transaction), which details all the inputs and outputs promised by the maker. The original maker is then notified (via email or in-app) that their limit order has been matched, and they then sign the PSBT to broadcast the trade to complete the trade.

This trading design is completely permissionless and peer-to-peer. The market is essentially a facilitator for these trades. The trade-off is the round-trip in user experience. The maker makes a commitment, posts a limit order - the taker matches the order and initiates the PSBT - and then the maker signs and completes the PSBT. This friction inherently slows down the trading process and often does not meet the needs of traders to sell quickly. Another potential issue is the manipulation or spoofing of orders, for example, makers create orders that they have no intention of fulfilling in an attempt to manipulate prices. To mitigate this, the Fluid platform currently only allows one maker commitment order per address per trading pair. Therefore, it is not possible to gradually build positions through ladder orders for the time being, but this feature is on the development plan.

All transactions on Fluid are completely permissionless, and thanks to the ability to use "Sighash All" in PSBT, they are also MEV-protected and sniper-proof, meaning that a transaction is only validated if both the maker and taker addresses participate in the transaction. Transactions cannot be "sniped" by third parties, which is a common occurrence on current popular markets like Magic-Eden and Unisat. Fluid prioritizes completely permissionless and secure transactions, at the expense of a less fluid trading experience. Fluid will be launching their marketplace in the coming weeks.

Saturn BTC is an order book-based on-chain trading platform that was originally launched in the summer of 2023 for rare sats (the smallest unit of Bitcoin). They have just launched the Runes trading market. They are focused on creating a smooth trading experience similar to centralized trading platforms. They have a "peer-to-peer" order book where users can place limit orders on the chain to fill the order book, and users can also make market buys and 'accept' existing limit orders in the order book. This user experience is very smooth, especially since users do not need to worry about splitting UTXOs or matching the exact requirements of the orders placed by the maker. This is a significant improvement over the traditional, more cumbersome Runes trading experience on Unisat and Magic Eden. Saturn also has a "swap" feature, but this is not an AMM-style liquidity pool swap. With a swap, users simply market buy the appropriate amount of sell orders in the order book, and vice versa.

To achieve this improvement in trading experience and functionality, especially related to limit orders and the matching engine, Saturn currently requires users to "deposit" funds into a "trading account", which is a multi-signature account signed by the user and co-signed by Saturn. This "trading wallet" will be replaced by a one-time multi-signature in the next version. When a user creates a limit order, they sign a "Sighash None" PSBT, which technically hands control of the tokens/bitcoins involved in that specific order to the Saturn platform and matching engine, in a 2/2 multi-signature manner. Transactions are finalized via "Sighash All" before being broadcast to the memory pool, ensuring protection against sniping. This trading process means that as long as the order remains open, the trader must trust Saturn to handle the specific funds involved. Therefore, the trading experience is not completely permissionless and has some centralized aspects.

Saturn takes an interesting and innovative approach by replicating the smooth trading experience of centralized exchanges directly on the Bitcoin Layer 1 chain. Their platform also offers full charting capabilities provided by Trading View. There is no need to split orders, the platform handles these transactions, and there can be partial fills and multiple wallets in the same trade. Saturn is a very user-friendly and intuitive decentralized exchange with many product improvements and new features in its roadmap.

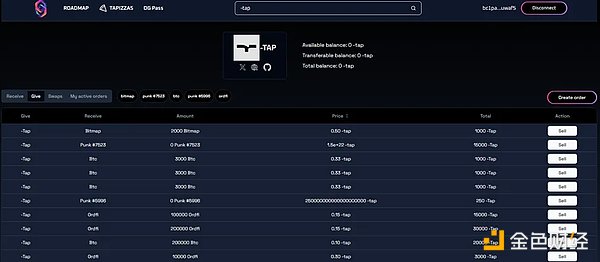

Unitap is a decentralized trading platform (Dex) built for the TAP ecosystem. The TAP meta-protocol enables various DeFi functions and operations to be performed directly on Bitcoin Layer 1, using distributed indexers to assist in calculations and account balances.

Unitap is building a market not only for trading Tap-based assets, but also for Tap to Runes transactions. They are developing a bridge solution from Runes to Tap.

Unitap has designed a completely non-custodial exchange system. Users who wish to sell a token (e.g. $-tap) can create a PSBT using “Sighash Single”, specifying the amount of token they wish to sell and what form (token and amount) they wish to receive in return. The return can be BTC or another Tap or Rune token. This creates a very specific sell order that can take some time to find a match, especially if market liquidity is low. To help overcome this friction, Unitap places this sell order into the market, matching it with all other orders that match the buyer of this specific sell order. For example, if I want to sell some $-tap, I can select that token and click on the “Give” tab. This will open a market with all the buy orders for $-tap, and sellers of other assets who are looking for $-tap in exchange for their assets (see screenshot above). This adds flexibility to the market and helps facilitate the quick sales that traders prefer. Currently, Tap-Tap assets are tradeable, and Tap-Runes and Runes-Tap swaps will be launched in the coming months.

Unitap will also launch its own wallet in the coming weeks, supporting all TAP operations and cross-protocol exchanges such as Tap-Runes or Tap-BRC20.

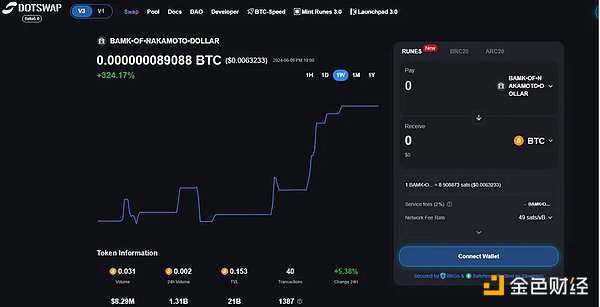

Dotswap is a native AMM-style trading platform based on Bitcoin Layer 1, supporting BRC20, ARC20 and Runes. Its trading experience is very similar to how Uniswap works. Users can already exchange between BRC20/Bitcoin and Runes/Bitcoin, and Runes/Runes exchange is coming soon.

Atomic swaps are completely permissionless and non-custodial, using the “Sighash All” PSBT. Users select how much Bitcoin/token they wish to swap, and receive a corresponding amount of another token in the same transaction. Using Sighash-All means that all transactions are sniper-resistant.

The “trade-off” here is that liquidity pools are custodial. When liquidity providers deposit funds into a liquidity pool, those funds are stored in a multi-signature system, as Bitcoin has no smart contracts to send funds to. Dotswap’s unique MMM (Multi-layer Multi-signature Matrix) custodial scheme was developed in-house and is run in partnership with custodians Safeheron and BitGo. The process of adding and removing liquidity is as simple as expected, similar to the experience of EVM AMMs. Dotswap is the first team on Bitcoin to implement a centralized serializer to protect transaction ordering (and therefore price ordering).

Dotswap has also developed a new Runes Token launchpad that operates similarly to pump.fun on Solana. At launch, participants purchase a specific Runes Token using Bitcoin, with the majority of that Bitcoin used to seed a liquidity pool for that token. As a result, any Rune launched on this platform has an immediately available liquidity pool that users can swap and trade in a completely permissionless manner. Contributors to the launchpad also thereby own their share of the liquidity pool and receive trading fees.

Dotswap has developed a completely permissionless and non-custodial AMM trading platform for traders/swappers to use. Liquidity providers are the ones who assume the trust assumption. To date, Dotswap has seen over $40 million in trading volume. If Dotswap is successful in attracting more liquidity into their pool (via favorable trading fees, liquidity mining, etc.), trading volume should increase.

Ordiswap is an AMM that performs BRC20 or Runes Token exchanges on the chain. Users can exchange, provide liquidity, remove liquidity, and create new liquidity pools on Bitcoin Layer 1. Last year, Ordiswap was the first AMM to appear in the BRC20 field.

When a user initiates an exchange on Ordiswap (for example, exchanging BTC for ORDI), they create a transaction to send their BTC to the Ordiswap liquidity provider. The transaction also includes a script with the details of the exchange. The Ordiswap backend indexer reads this script and sends the user the corresponding amount of ORDI in a subsequent transaction. This means that users must trust the Ordiswap API when signing a transaction to initiate a swap.

Ordiswap uses a set of off-chain servers, oracles, indexers, and Bitcoin nodes to create AMM functionality. Ordiswap's servers update the off-chain balances of participating users and perform periodic settlements on-chain. Currently all swaps are handled by the Ordiswap API. This is slightly less elegant than the solution of using PSBT for atomic swaps, which can complete the entire swap in the same transaction. However, atomic swaps are on the roadmap.

The liquidity pools are once again custodial and are currently in discussions with custodial partners to upgrade security. Their V2 BRC20 swap has been live for two months and has a total trading volume of about $500,000.

Ordiswap also has the potential to become a major AMM on Bitcoin if it can achieve everything they set out to do. This is an ambitious, modular implementation of a Bitcoin exchange. They are currently in the V3 mainnet closed beta. According to reports, testing is going well and they are working on the final details of the exchange mechanism.

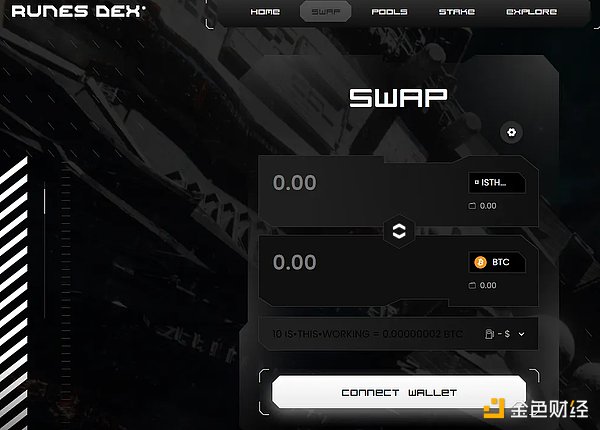

Runes Dex is another recently launched AMM on Bitcoin Layer 1 for Runes-BTC trading. They are well-funded, have a large team, and are growing rapidly. They are currently in the Alpha testing phase on the mainnet. Users can test swapping their local Runes IS•THIS•WORKING. Similar to the aforementioned AMMs, trading on Runes Dex is completely non-custodial and permissionless, but the liquidity pool is custodial. Currently Runes Dex has full control over private keys which are stored in a vault using AWS. Custody partnerships are in the works.

They are also building a launchpad similar to pump.fun, a Runes tracker that takes into account pending transactions in the mempool, and a Runes bridge to bridge memecoins from other chains like Solana to Runes. They are using "Sighash All" in the Dex swap PSBTs, which means every swap is sniper resistant. They plan to have liquidity providers charge fees in Bitcoin. They have also created an automatic UTXO splitter on the liquidity provision side to ensure a smooth experience when swapping. Runes Dex's AMM will be fully live in the coming weeks. Another AMM with potential.

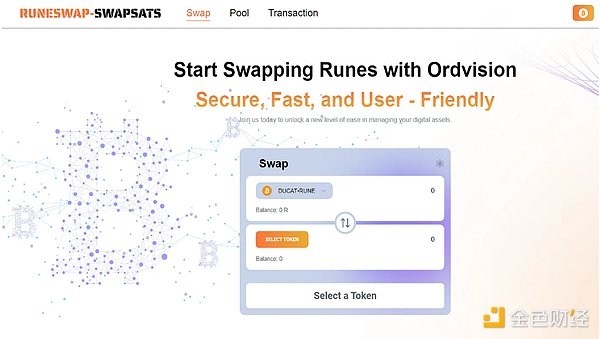

Runeswap is developed by the Swapsats team and is an AMM-style exchange platform for Runes-BTC. The team behind the development of OGsub 10k Ordinals collection Ordinal Eggs. This exchange platform will operate similarly to the exchange mentioned above; providing a permissionless exchange experience, but the liquidity pool is custodial.

As a group of collectors, their philosophy is to build a decentralized exchange platform for their community. Holders of their collections will receive various benefits on the exchange platform, such as reduced transaction fees and revenue sharing from the exchange platform's revenue. They prioritize smooth user interfaces and good user experiences to further foster their community. Currently, the exchange is in the alpha testnet stage, with the mainnet scheduled to go live in the coming weeks.

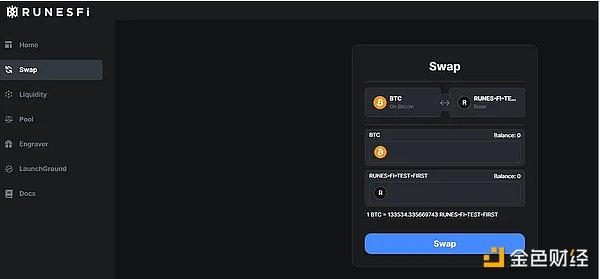

RunesFi aims to become a one-stop infrastructure center for Bitcoin assets. They plan to build a Runes block explorer, a launch platform and incubator, a Runes carver, and most importantly, a decentralized exchange for Runes and BRC20. They are currently in the testnet stage of their exchange, and expect their mainnet product to go live before the end of 2024.

There are a few other DEXs in development that promise more decentralization than those listed above, such as Omnisats and Motoswap (OPNet). I can analyze them when they get closer to launch and more information is available. Unisat recently announced their new BRC20 swap module, which will include liquidity pools, among other things. It is currently in development and expected to be available within 6 months. Magic Eden is also hinting at upcoming swap functionality, although the timeline is unclear.

Building on Bitcoin is challenging, especially if trying to directly replicate the functionality of the Ethereum Virtual Machine (EVM). Bitcoin's UTXO model is different from the EVM's account-based model, and teams that can take full advantage of Bitcoin's unique mechanisms (such as PSBTs, Sighashes, etc.) are more likely to succeed in the long run, rather than teams that simply try to recreate the EVM stack.

Teams currently creating innovative solutions are making tradeoffs on different fronts. For example, in terms of order book DEXs, Saturn prioritized super smooth UX and functionality at the expense of completely permissionless trading. Fluid takes a different approach, prioritizing fully decentralized and non-custodial trading, albeit with some friction in the trading experience. It will be interesting to see which philosophy the market values more.

In the automated market maker (AMM) space, most teams are creating a system that allows traders to trade completely permissionlessly, but with some form of vault, multi-signature, or semi-custodial solution for liquidity pools. This may be an acceptable tradeoff, as most traders don’t care how the liquidity pool is set up, as long as they can swap quickly and permissionlessly. Additionally, providing liquidity to a well-known custodian may even be a more attractive solution, given how many bridges and contracts have been hacked on Ethereum. Currently, Dotswap has an advantage here, as they are the furthest along in terms of development, product offerings, and custody solutions for liquidity providers. However, other teams like RunesDex and Ordiswap are catching up and their products are coming soon.

I am sure there are other teams building that I am not aware of at the time of writing.

JinseFinance

JinseFinanceMagic Eden, a popular NFT marketplace on the Solana blockchain have decided to temporarily halt trading of Bitcoin BRC-20 assets on their platform

Aaron

AaronMagic Eden users can now buy, sell, list, and bid on Bitcoin-based Ordinal NFTs.

cryptopotato

cryptopotatoMagic Eden laid off 22 people as companies across the industry cut staff amid tough times.

TheBlock

TheBlockThe marketplace confirmed that the issue was resolved.

cryptopotato

cryptopotatoAn unresolved issue on the popular NFT marketplace allowed imposter NFTs to be added to high-priced collections like Y00ts and ABC.

Coindesk

CoindeskThe firms have been at odds before and are currently taking different paths regarding enforcement of NFT royalties.

decrypt

decryptMagic Eden said it is waiving its platform fee and introducing a new optional royalty model.

Beincrypto

BeincryptoMagic Eden, a marketplace for Solana-based NFTs, launched MetaShield.

Bitcoinist

BitcoinistNFT strategy game Dragon War has confirmed a partnership with Magic Eden, Solana’s fast-growing NFT marketplace. As part of the ...

Bitcoinist

Bitcoinist