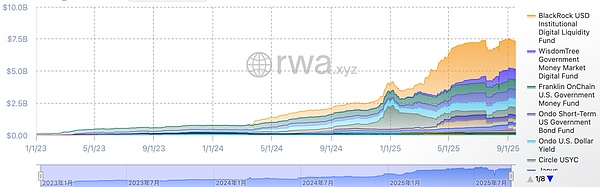

Ondo and other DeFi protocols have launched funds such as OUSG based on RWA tokens backed by government bonds such as BUIDL and WTGXX, maintaining a size of around US$700 million. Why are U.S. Treasuries the most active and largest tokenized sector in the RWA market? There are several main reasons: Overwhelming Liquidity and Stability: U.S. Treasuries have the deepest liquidity in the world and are considered safe assets with virtually no default risk, making them highly trustworthy. Global Accessibility: Tokenization increases the accessibility of U.S. Treasuries, making it easier for overseas investors to participate. Increased Institutional Participation: Large institutions such as BlackRock, Franklin Templeton, and WisdomTree are leading the market through tokenized money market funds and U.S. Treasury products, providing strong investor confidence. Yields: U.S. Treasury yields are stable and relatively high, averaging approximately 4%. Convenience of Tokenization: Although there is currently no regulatory framework specifically for U.S. Treasury RWAs, basic tokenization is still feasible under existing regulations. 3. The U.S. Treasury Bond Tokenization Process So, how exactly are U.S. Treasury bonds tokenized and put on the blockchain? At first glance, this might seem like a complex legal and regulatory framework, but in reality, the tokenization of U.S. Treasury bonds is accomplished in a very simple manner, adhering to existing securities regulations. (Of course, since different token issuance structures vary, only representative methods are described here.) Before explaining the tokenization process, it's important to clarify an important point: the RWA tokens currently issued on the market that are based on U.S. Treasury bonds are not tokenized directly on the Treasury bonds themselves, but rather on the funds or money market funds that use U.S. Treasury bonds as their underlying assets. Traditionally, public asset management funds like US Treasury bond funds are required to appoint an SEC-registered transfer agent. A transfer agent is a financial institution or service company that maintains investor fund holdings records on behalf of the securities issuer. Legally, the transfer agent is the central institution responsible for managing securities registration and ownership, formally maintaining the register of fund investors' shares. The tokenization method used by US Treasury bond funds is straightforward: fund shares are mapped to on-chain tokens, and the transfer agent maintains the official shareholder register through a blockchain-based system. In other words, the proprietary database originally used to record shareholder information is migrated to the blockchain. Of course, because the US lacks a clear regulatory framework specifically for RWAs, holding tokens is not yet 100% legally equivalent to owning fund shares. However, in practice, transfer agents manage fund shares based on on-chain token holdings. Therefore, barring hacking or operational incidents, token ownership is, in most cases, indirectly equivalent to ownership of fund shares. 4. Major Protocols and RWA Analysis Criteria

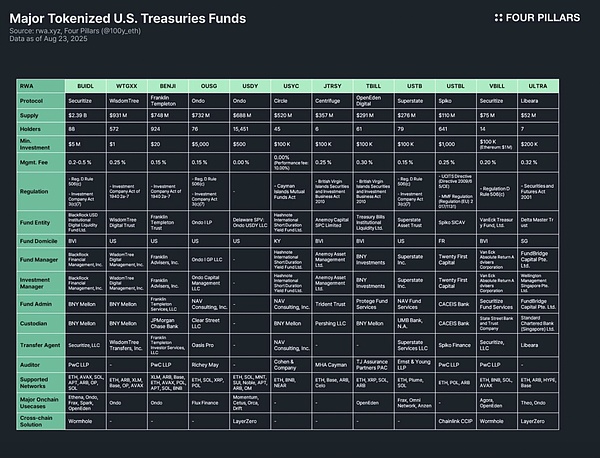

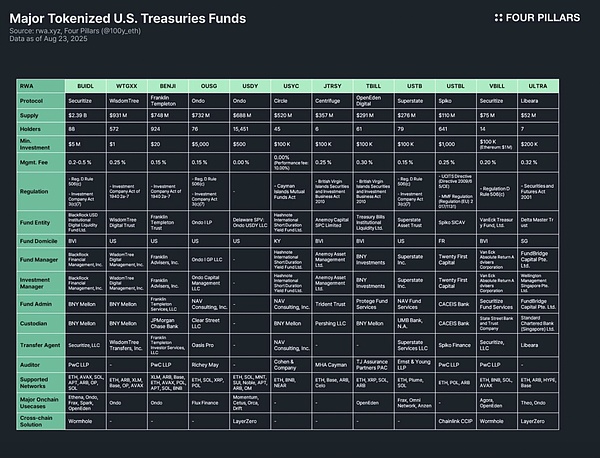

Since U.S. Treasury-backed funds are the most actively tokenized sector in the RWA industry, numerous tokenization protocols have issued related RWA tokens. The table above summarizes the major protocols and tokens, and the report divides their analysis into three parts.

(1)Part I: Token Overview

This part includes an introduction to the protocol for issuing tokens, the issuance scale and number of holders, the minimum investment amount and the management fee. Since each protocol has differences in fund structure, tokenization method and degree of on-chain application, starting with the token issuance protocol can quickly understand its overall characteristics.

If the number of holders is small, it is very likely that investors must be high-net-worth accredited investors or qualified purchasers in accordance with securities laws.

This also means that except for whitelisted wallets, the holding, transfer or trading of tokens will be relatively restricted, and due to the limited investor base, such tokens may not be widely used in DeFi protocols.

(2) Part II: Regulatory Framework and Issuance Structure

This part analyzes which country's regulatory framework the underlying fund follows and the various entities involved in fund management. Among the 12 U.S. Treasury bond fund RWA tokens analyzed, the regulatory frameworks can be roughly divided into the following categories: Regulation D Rule 506(c) & Investment Company Act 3(c)(7) The most commonly used regulatory framework. Rule 506(c) allows public fundraising from unspecified investors, but all investors must be qualified investors, and the issuer must strictly verify the identity of investors through tax records, asset certificates and other materials. The 3(c)(7) exemption clause allows private equity funds to not register with the SEC, requiring all investors to be qualified purchasers and the fund to remain private. Combining the two can expand the investor base while effectively circumventing regulatory burdens such as registration and information disclosure. This is applicable not only to US funds but also to qualified overseas funds. Major funds: BUIDL, OUSG, USTB, VBILL.

applies to SEC-registered money market funds. These funds are required to maintain a stable value, invest only in ultra-short-term, high-credit instruments, and ensure high liquidity. Unlike the aforementioned framework, this model allows for public issuance to ordinary investors. Therefore, the minimum investment amount for tokens is low, making it easier for investors to participate.

Main funds: WTGXX, BENJI.

Applies to open-end funds established in the Cayman Islands, offering flexible issuance and redemption. Cayman funds backed by U.S. Treasury bonds must comply with this law. The initial minimum investment is typically set at over US$100,000.

Main fund: USYC. British Virgin Islands (BVI) Securities and Investment Business Act 2010 (Professional Funds) This is the core legal framework for all BVI investment funds and investment companies. Professional funds are intended for professional investors, not the general public, and require a minimum initial investment of US$100,000. It is important to note that if a BVI fund wishes to raise capital from US investors, it must also separately comply with US Regulation D Rule 506(c). Complying solely with BVI regulations is not sufficient to target US investors. Major funds include JTRSY and TBILL.

Funds established in different countries follow corresponding regulatory frameworks. For example, Spiko USTBL issued in France follows the UCITS Directive (2009/65/CE) and the MMF Regulation (EU 2017/1131); Libeara ULTRA issued in Singapore follows the Securities and Futures Act 2001;

In order to make the above content more intuitive, the translator has organized the above information into a table:

In terms of fund issuance structure, there are seven key participants:

Fund Entity: A legal entity that pools investor funds, usually a US trust or an offshore fund established in the BVI or Cayman Islands.

Fund Manager: The entity that establishes the fund and is responsible for its overall operation.

Investment Manager: Responsible for investment decisions and portfolio management, sometimes the same entity as the fund manager.

Fund Admin: Responsible for back-end affairs such as accounting, net asset value calculation, and investor report preparation.

Custodian: Safeguards fund assets (bonds, cash, etc.).

Transfer Agent: Manages the shareholder register, legally records and maintains the ownership of the fund or shares.

Auditor: An independent accounting firm that conducts external audits of the fund's accounts and financial statements, and is a key link in protecting the rights and interests of investors.

(3) Part III: On-chain Application Scenarios

One of the biggest advantages of bond fund tokenization lies in its potential use in the on-chain ecosystem. Although bond fund tokens are difficult to use directly in DeFi due to regulatory compliance and whitelist restrictions, DeFi protocols such as Ethena and Ondo have already used tokens such as BUIDL as collateral to issue stablecoins or include them in investment portfolios, thereby providing indirect exposure to retail users. In fact, BUIDL was able to rapidly expand its issuance scale thanks to its integration with mainstream DeFi protocols, and has now become the number one product of bond tokens. Cross-chain solutions are also crucial for on-chain applications. Most bond fund tokens will not only be issued on a single network but also distributed across multiple networks, providing investors with more options. Although bond fund tokens do not require as much liquidity as stablecoins (and in fact, they usually do not have that high liquidity), cross-chain solutions are still important because they can significantly improve the user experience and allow investors to seamlessly transfer bond fund tokens between multiple networks. 5. Implications: In a subsequent RWA report, we will conduct a detailed analysis of 12 major US Treasury bond fund RWA tokens. Prior to this, we would like to share some insights and limitations identified in our research. Difficulties in On-Chain Application: RWA tokens do not become freely usable simply because they are tokenized. They remain digital securities and must adhere to real-world regulatory frameworks. Fundamentally, all bond fund tokens can only be held, transferred, and traded between whitelisted wallets that have completed KYC. This barrier to entry makes it nearly impossible for bond fund tokens to directly enter permissionless DeFi. Limited number of holders: Due to regulatory barriers, bond fund tokens generally have a low number of holders. Money market funds accessible to retail investors, such as WTGXX and BENJI, have relatively large holders. However, most funds require investors to be accredited, professional, or high-net-worth individuals, significantly limiting the potential investor base and preventing the number of holders from breaking into double digits. On-chain B2B use cases: Therefore, currently, bond fund tokens have no direct application in retail-oriented DeFi scenarios. Instead, large DeFi protocols often adopt these tokens. For example, Omni Network uses Superstate's USTB for treasury management; Ethena uses BUIDL as collateral to issue the stablecoin USDtb, allowing retail investors to indirectly benefit. Regulatory fragmentation and lack of standards: Bond fund tokens are issued by funds established in different countries and follow widely varying regulatory frameworks. For example, BUIDL, BENJI, TBILL, and USTBL may all appear to be bond fund tokens, but their regulatory frameworks are completely different, leading to significant differences in investor qualifications, minimum investment amounts, and usage scenarios. This regulatory fragmentation increases investment complexity. In the absence of unified standards, DeFi protocols struggle to widely adopt bond fund tokens, limiting their on-chain application. Lack of a dedicated regulatory framework for RWAs: Currently, there is no clear regulatory framework for RWAs. Although the transfer agent in a bond fund token records the shareholder register on the blockchain, on-chain token ownership is not yet legally equivalent to real-world security ownership. Dedicated regulations are needed to bridge on-chain and real-world legal boundaries.

Insufficient adoption of cross-chain solutions: Although almost all bond fund tokens support multi-network issuance, there are still few cross-chain solutions that have been truly implemented. More widespread cross-chain solutions are needed in the future to avoid liquidity fragmentation and improve user experience.

Kikyo

Kikyo