I. What is Tokenization & Tokenized Stocks?

II. Blockstreet's Ecosystem Positioning—Unifying On-Chain Liquidity

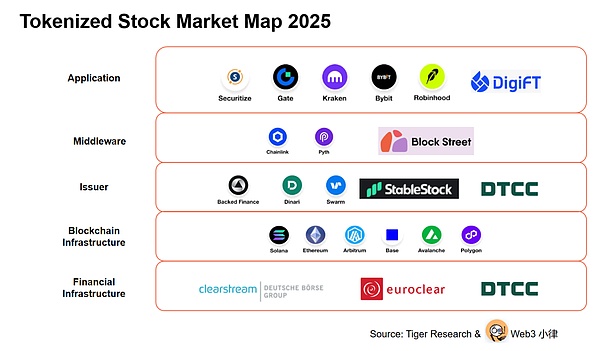

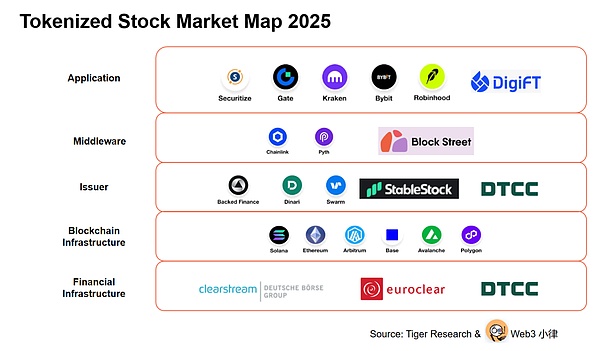

(Tokenized Stock Market Map: How Tokenized Stock is Reshaping Global Finance)

Web3 Lawyer Will:

From the perspective of the on-chain US stock market ecosystem, the entire Stack...

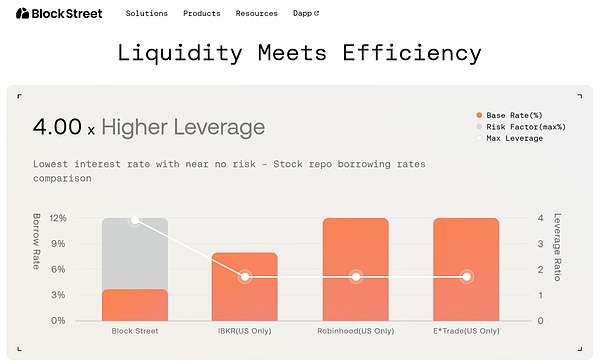

(blockstreet.money)

Blockstreet Hedy:

A. Lending Scenarios

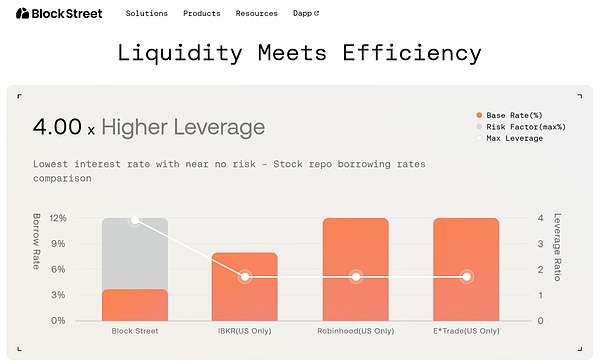

The core pain point of lending business still comes down to the four words "liquidity fragmentation". Once tokens are locked, users seeking to borrow stablecoins face significant losses due to price discrepancies and slippage. Furthermore, the crypto market is not yet truly 24/7, offering only approximately 24/5 effective trading hours. Prices and user experience plummet after US stock markets close. In the event of black swan events, sudden fluctuations of five to ten percentage points are commonplace. If liquidation is triggered at this time, the platform's own inventory may also suffer losses, making the risk uncontrollable. The market maturity and liquidation infrastructure are insufficient to support large-scale on-chain stock token lending. Aave's inaction is a strategic move, waiting for the sector to truly take off. Early small projects attempting P2P stock lending have only a few hundred million dollars in TVL, resulting in a low return on investment and hindering the formation of a leading player. Therefore, we will first focus on "unified on-chain liquidity for US stocks/RWA," with lending only as one of the subsequent scenarios. The ultimate goal is to first solve the liquidity fragmentation, and then build a more robust trading and lending market on this basis. Partners or Blockstreet itself can extend lending functions on top of this liquidity layer, but the pace still needs to "wait for the right opportunity." Returning to the pain points of RWA itself, we found that "making it accessible to users" is only the first step; the more crucial question is "what can users do after buying it?" If it's just adding an on-chain channel, but only allowing holding or selling like traditional brokerages, then it doesn't break out of the Fintech alternative framework and cannot stimulate the original vitality of the crypto world. B. Staking Incentives We recently discussed new ideas with some listed companies: tokens should not merely be a reflection of stocks, but rather a key to unlocking shareholder rights, business scenarios, and subsequent product issuance. For example, holding a stock token of an energy company can simultaneously receive airdrops or computing power discounts from its future on-chain new energy projects; holding tokens of AI concept stocks can enjoy VIP rates when leasing GPUs on-chain. These additional benefits don't necessarily have to be directly provided by large companies, but can be designed by the crypto ecosystem surrounding the token. As long as on-chain data is verifiable and permissions are programmable, "special channels" unavailable to traditional shareholders can be packaged in, creating additional benefits only available to those who purchase RWA. Taking another step forward, we arrive at the native staking and governance rights of the cryptocurrency world. In traditional finance, lending out Nvidia stock for interest involves multiple intermediaries, resulting in slow settlements and high barriers to entry. On-chain, however, smart contracts allow for instant staking and returns, while also enabling participation in DAO voting to influence company or asset pool operational decisions. This "composability" is a continuation of the "shareholder is contributor" narrative from the ICO era. Blockstreet's liquidity layer aims to enable these utilities to be readily monetized and converted, rather than locked onto a single platform or chain. VI. Liquidity is the Core of Tokenized Products Web3 Lawyer Will: Let's return to the core of tokenized products—liquidity. In fact, we see that there are various liquidity demands in the market. The first is the distribution of liquidity based on tokenized financial products such as money market funds and bond funds. After the primary issuance of a single product, secondary distribution requires sufficient buyers (liquidity) to meet investors' needs for asset preservation and appreciation. Blockchain undoubtedly opens up global distribution possibilities for these tokenized financial products. Simultaneously, to achieve T+0 real-time settlement for some tokenized products, market makers may be needed to provide liquidity to bridge the traditional T+3 redemption period. The second type is products like on-chain US stocks. Hedy has already clearly explained the logic behind the liquidity of on-chain US stocks. The third type is a private market that lies between on-chain US stocks and tokenized money market funds and bond funds, such as the private equity pre-IPO market. These markets require both distribution liquidity and trading liquidity. The fourth type is the DeFi liquidity demand created by combining assets on-chain with on-chain DeFi, such as Blockstreet's Everst product, which meets users' stock-staking lending needs. Blockstreet Hedy: Agreed. Regarding money market funds and bond funds, some project teams cleverly package their products as "stablecoin-like/interest-bearing stablecoins" rather than selling them as "tokenized funds." This is because the advantage of stablecoins in the crypto world is their fast capital turnover; people are willing to hold, use, and circulate them—this is a clever marketing strategy. In reality, it represents a traditional financial asset with higher returns and slower redemption. DTCC provides a top-down, top-level standard for tokenization, whether off-chain or on-chain. This will be a more fundamental Chain Agnostic or customized institutional service, signifying that more assets will be compliantly on-chain, especially those with good liquidity in the US. Undoubtedly, Wall Street institutions and listed companies will have greater trust in the Nasdaq and DTCC system. However, in the future, the composability of assets after on-chaining and on-chain liquidity still need to be built. If these massive amounts of capital enter the market, more infrastructure like this on-chain liquidity layer, Transfer Agent, and ATS will be needed to truly complete the final downstream distribution step, and Block Street is completing this crucial step. Blockstreet's initial focus is on the US secondary stock market—specifically, Nasdaq stocks—which boasts the highest liquidity and consensus, prioritizing on-chain depth and cross-ecosystem exchange. However, its asset portfolio will naturally expand further: one end will be fixed assets, such as real estate; the other end will be private assets, including PE equity, private bonds, and pre-IPO equity, which is frequently mentioned today. Pre-IPOs occupy the middle of the "liquidity spectrum": they are more flexible than real estate, but far less readily available with quotes and market makers than secondary US stocks. We believe it will be the next category to be targeted after "secondary market tokenization," and we have already contacted several US-based issuers who are preparing to package their original VC equity into an SPV, issue it on-chain, and build their own supporting trading platform. In the Pre-IPO sector, liquidity remains the biggest challenge. Secondary US stocks at least have existing market makers and arbitrageurs; as long as we optimize on-chain routing, slippage can be reduced. Pre-IPOs, however, have long lock-up periods and lack continuous quotes; the traditional world also lacks deep order books for "transferring" funds. Valuation is even more challenging—each round of VC investment involves different prices and terms, and some information is even confidential. Which round and which price level should be used as the anchor value for the on-chain token? This is a question that issuers must answer during the subscription and trading processes. Some have attempted to use prediction markets to "discover prices" for unlisted equity, such as letting the market predict OpenAI's valuation, but this approach remains somewhat forced. Relatively speaking, leading unicorns, due to their high media coverage and large potential buyers, are more likely to have fair market prices; while mid-tier or smaller unlisted companies, whose pricing is inherently ambiguous, are prone to becoming "valuable but unsellable" after tokenization. It is foreseeable that once leading projects such as ByteDance and OpenAI are launched, strong buyer demand will automatically "bid" out a market price, thus solving the pricing problem. However, for pre-IPO targets with limited brand recognition and wide valuation ranges, how to sort out the shares held by different VCs and the prices of different rounds into a fair value acceptable on the blockchain remains the core challenge that the industry needs to overcome.

VII. In Conclusion

Blockstreet Hedy:

The true significance of asset tokenization lies not in the act of "tokenization" itself, but in how to build underlying liquidity and subsequent underwriting systems—this is the core logic for attracting high-quality assets. Just as Nasdaq and the NYSE attract global issuers and investors with their deep liquidity and mature underwriting capabilities, the potential of the on-chain world also depends on whether it can provide a more convenient trading experience that surpasses traditional infrastructure, rather than simply digitizing assets.

VII. In Conclusion

Blockstreet Hedy:

Despite the large number of issuers, Wall Street generally believes the industry is still in its early stages. Next year, the real focus will shift to building underwriting and trading systems, with listed companies paying more attention to optimizing trading processes and truly unleashing the potential of blockchain as the next-generation financial super-gateway. This process essentially builds blockchain on top of the existing financial hegemony system, rather than starting from scratch. The dollar's hegemony has made traditional finance what it is; now, stablecoins have built a global on-chain payment network, surpassing SWIFT. The payment aspect is already established; the next step must be to introduce real-world assets, providing underlying returns and trading attributes, deeply binding on-chain finance with traditional finance. Apart from BTC and ETH, most native cryptocurrencies have failed to establish a substantial connection with the real world. To establish a new financial order, we must add value at the top of the existing pyramid, rather than engaging in unrealistic restructuring. Wall Street's core advantage lies in attracting global capital; the challenge now is how to maintain its attractiveness as on-chain funds become a significant participant. The stabilization of BTC returns this year demonstrates that relying solely on the returns of crypto assets is insufficient for long-term capital accumulation; the stable return logic of traditional finance must be introduced. Ultimately, we must return to the original purpose of blockchain—inclusive finance and global connectivity. The on-chain virtual world needs the empowerment of real-world off-chain scenarios, with payments and finance being two pillars. The essence of finance lies in achieving efficient value circulation, and the introduction of RWA is key to grounding this circulation system in reality and truly enabling the global on-chain financial market to function smoothly.

Joy

Joy