Since the beginning of this year, stablecoins have become an absolute hot topic in the financial industry!

On July 19, US President Trump officially signed the National Stablecoin Innovation and Regulation Act (GENIUS Act) (hereinafter referred to as the "Genius Act"), marking the first time that the United States has officially established a regulatory framework for stablecoins.

On July 29, the Hong Kong Monetary Authority issued a series of documents providing specific guidance on the regulatory regime for stablecoin issuers, which will take effect on August 1, 2025. Recently, discussions surrounding the regulatory framework for stablecoins and their impact on the international monetary system have intensified. Driven by both policy and public opinion, the commercialization of global stablecoins has significantly accelerated. However, what exactly are stablecoins? How do they differ from central bank digital currencies (CBDCs)? How should they be developed in China? This article briefly addresses these questions. Similarities and Differences between Fiat Stablecoins and Central Bank Digital Currencies Stablecoins are cryptocurrencies that maintain price stability by pegging to an external asset (such as fiat currency, gold, or a basket of assets). They aim to address the payment challenges of highly volatile cryptocurrencies like Bitcoin. Depending on the anchor, stablecoins can be categorized into various types, including fiat-collateralized, crypto-collateralized, and algorithmic stablecoins. This article focuses on "fiat stablecoins," a subcategory of stablecoins that are pegged 1:1 to a fiat currency (such as the US dollar or Hong Kong dollar).

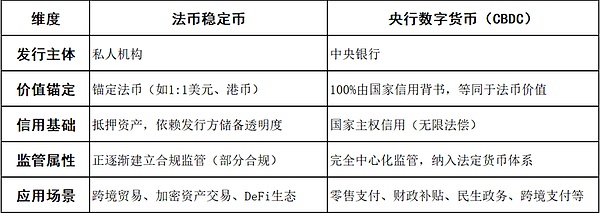

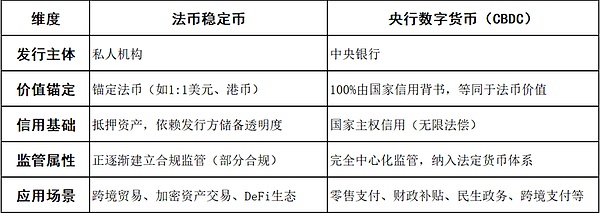

So, as digital extensions of fiat currency, what are the similarities and differences between fiat stablecoins and central bank digital currencies?

As the two core forms of digital currency, fiat stablecoins and central bank digital currencies (CBDCs) have both technical similarities and significant differences in terms of issuers, credit endorsements, and application scenarios.

First, the issuers and credit endorsements of the two are different. Central bank digital currencies are issued by the central bank, 100% backed by state credit, and possess unlimited legal tender (e.g., the digital RMB is equivalent to cash). Stablecoins, on the other hand, are issued by private institutions (such as Tether and Circle) or decentralized protocols, relying on collateralized assets or algorithmic mechanisms for their credibility. Fiat stablecoins are pegged 1:1 to fiat currency and require reserve assets to maintain stability. Secondly, the two differ in their degree of centralization and regulatory systems. Central bank digital currencies, such as the digital RMB, are issued by the central bank. They utilize a fully centralized, two-tiered operating system, are strictly regulated by the central bank, and support controllable anonymity. While fiat stablecoins are more decentralized, they rely on public blockchain consensus mechanisms (such as Ethereum) and support anonymous transactions. Furthermore, while regulatory frameworks are being established in several regions, they are not yet complete. Finally, their stability and application scenarios differ. Central bank digital currencies primarily focus on domestic retail payments (such as consumer spending and government bill payments) and strengthen monetary policy transmission (such as the precise distribution of subsidies). Stablecoins currently focus primarily on cross-border payments, the DeFi ecosystem, and crypto asset trading. Despite this, stablecoins and central bank digital currencies still share some similarities in terms of digital form and efficiency improvement, payment media, and technical means. For example, both exist in digital form, are based on blockchain or distributed ledger technology (DLT), support peer-to-peer transactions and automated settlement, and can significantly improve payment efficiency. Furthermore, both possess transaction medium attributes and support programmability, which can make up for the shortcomings of traditional payment systems.

The Rise of Stablecoins and the Dormancy of Central Bank Digital Currencies

Since stablecoins became the focus of public opinion, the heat has remained high.

The United States passed the "Genius Act" to bring stablecoins under regulation. In fact, another key cryptocurrency bill, the "Anti-Central Bank Digital Currency Surveillance Act," was passed by the U.S. House of Representatives along with the "Genius Act." It aims to protect the financial privacy of Americans and prohibit the Federal Reserve from issuing retail CBDCs without explicit authorization from Congress. From another perspective, the United States' improved regulatory framework for stablecoins essentially restricts central bank issuance of digital currencies, encourages and regulates private issuance, and thus establishes a cryptocurrency strategy that synergizes private stablecoins with national digital asset reserves. This demonstrates its commitment to a market-based approach to promoting digital assets and aims to prevent the potential expansion of central bank control over monetary policy. In other words, dollar-denominated stablecoins remain an on-chain extension of the dollar's hegemony, and the establishment of a regulatory framework is intended to further consolidate the dollar's hegemony. Recent foreign media reports indicate that Bank of England officials are considering shelving plans to create a digital pound due to growing skepticism about the benefits of central bank digital currencies. Bank of England Governor Andrew Bailey recently publicly expressed his concerns and focused on banks increasing their efforts to promote tokenized deposits. Does this change reflect a waning global interest in creating state-led digital currencies with the emergence of stablecoins and other payment innovations? A 2024 survey by the Bank for International Settlements (BIS) showed that 134 countries around the world were exploring central bank digital currencies, 100 of which had entered the experimental or pilot phase, including 13 G20 countries. Global interest in CBDCs continues to grow, with the proportion of central banks exploring CBDCs rising to 94%, and it is expected that as many as 15 CBDCs will be issued by 2030. The International Monetary Fund (IMF) also noted that more than two-thirds of central banks plan to launch retail CBDCs in the short term. The answer is obvious. Mobile Payment Network believes that the rise of stablecoins will not diminish global interest in exploring central bank digital currencies. As the two explore different paths for digital currencies, they simply represent different choices. In early July of this year, the BIS stated in its annual economic report that while the future role of stablecoins remains unclear, their poor performance on the three key tests of "money" (unity, resilience, and integrity) suggests they can only play a supporting role at best. The BIS's criticism of stablecoins' insufficient monetary properties has somewhat cooled the enthusiasm for stablecoins. Whether developing central bank digital currencies or stablecoins, regulatory challenges remain. Central bank digital currencies must protect user privacy while meeting regulatory requirements such as anti-money laundering (AML) and countering the financing of terrorism (CFT). Stablecoins, on the other hand, could foster money laundering and cross-border crime, complicating monetary authorities' efforts to manage exchange rates and capital flows. They also pose practical challenges for regulating decentralized and cross-border operations. Should China develop stablecoins? As public opinion surrounding stablecoins continues to grow, discussions are growing about whether China should develop them. Many industry insiders believe that piloting an offshore RMB stablecoin should be considered first. JD.com Group Chief Economist and Vice President Shen Jianguang has stated that Hong Kong could be the first region in the world to develop the offshore RMB, followed by a global rollout, which would help the RMB secure a place in the next generation of international currency competition. JD.com Group Senior Research Director Zhu Taihui also expressed the same view in an article, stating that developing an offshore RMB stablecoin is a key tool for accelerating RMB internationalization and a crucial means of mitigating the impact of uncertainties surrounding the development of the "Digital Currency Bridge." This approach will not impact mainland China's monetary policy and cross-border capital management. A gradual approach should be adopted in the development process, starting with Hong Kong and gradually expanding to mainland free trade zones and ports, thereby continuously strengthening support for RMB internationalization. Xiao Geng, Chairman of the Hong Kong Institute of International Finance and Professor and Vice Dean of the School of Public Policy at the Chinese University of Hong Kong, Shenzhen, stated at a salon that Hong Kong urgently needs to develop a stablecoin to significantly reduce cross-border transaction costs and support the development of digital finance. He believes that a stablecoin anchored to the RMB is crucial, as it can both mitigate the instability of the US dollar system and create a relatively independent ecosystem without directly impacting mainland China's monetary policy.

Li Yang, academician of the Chinese Academy of Social Sciences and chairman of the National Finance and Development Laboratory, said in his speech that my country should take active actions in the field of stablecoins, promote the internationalization of the digital RMB, and use Hong Kong to develop RMB stablecoins to enhance the international status of the RMB.

Previously, Yang Tao, deputy director of the National Finance and Development Laboratory, wrote in an article that in the short term, my country's stablecoin exploration should focus on RMB stablecoins and occupy a place in the global fiat-collateralized stablecoin market as soon as possible. Its reserve management can correspond to high-liquidity, low-risk assets such as RMB cash, bonds or digital RMB.

Mobile Payment Network believes that while Hong Kong's legislation does not rule out the creation of a RMB stablecoin, offshore RMB stablecoins may become a possibility and contribute to RMB internationalization, but there is no direct relationship between the two. "RMB stablecoin" is a direction that Hong Kong could consider after issuing licenses, but it should not be the focus and direction of discussion in mainland China.

Mobile Payment Network believes that the mainland should continue to pilot and promote the "digital RMB" and accelerate the implementation of the multilateral central bank digital currency bridge and the application of digital RMB cross-border payments.

Currently, the application scenarios of stablecoins are mainly focused on cross-border trade, which overlaps with the application of the "currency bridge" and digital RMB in cross-border payments. Therefore, it is most appropriate for Hong Kong and the mainland to explore separately and form a certain degree of reference and complementarity. Maintaining the mainland's leading position in the research and development of central bank digital currencies, while also maintaining Hong Kong's first-mover advantage in the regulatory system and innovative development of stablecoins, we will study the coordinated development of digital RMB and stablecoins in terms of technology and interconnectivity. On the one hand, we will accelerate the construction of the digital RMB's transaction and settlement system, and on the other hand, we will actively explore the development of RMB stablecoins in the offshore system, so that the two can work together and advance on two tracks.

Catherine

Catherine