Author: Michael Nadeau, The DeFi Report; Translation: Golden Finance xiaozou

With Bitcoin up 45% last month, I’ve seen a lot of talk about whether this is a “local top” or a “full sprint” all the way to the end of the year. These are mostly the instinctive calls of “key opinion leaders” and other market prognosticators and analysts on social media. Of course, no one has a crystal ball to predict the future. But in order to build strong convictions, we like to combine our intuition, experience, and analysis with hard data. This helps us assign probabilities to possible outcomes as accurately as possible.

This is the characteristic of The DeFi Report, our research usually includes:

Macroeconomic analysis

On-chain data analysis

Market sentiment analysis

Fundamental analysis of blockchains and protocols

Crypto-native/characteristic analysis (such as politics, geopolitics, regulation, community and other unique aspects of cryptocurrency as a global asset)

In this report article, we will focus on Bitcoin on-chain data, and attach additional SPX6900 related content at the end of the article.

Our goal is to determine where we are in this cycle. To do this, we analyzed the current key indicators of Bitcoin and compared these indicators with past cycles.

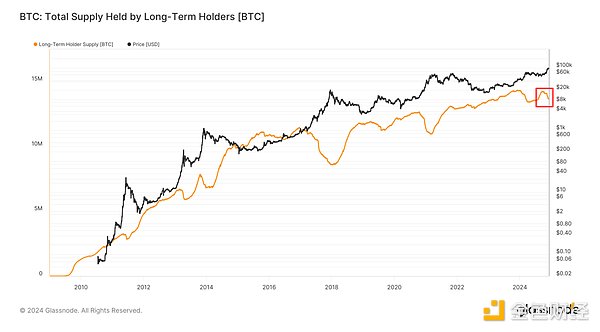

1. Long-term and short-term holders

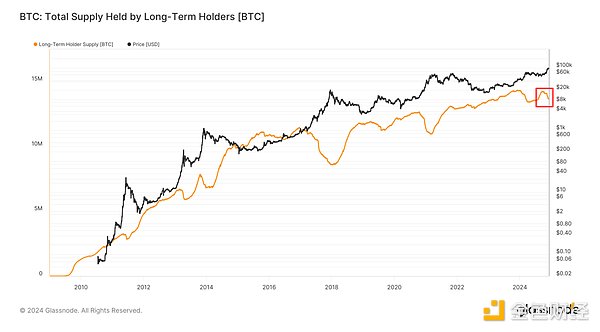

(1) Long-term holders

Let’s first look at the “Smart Money” of Bitcoin.

What is Smart Money doing now? Selling.

Long-term holders took profits in the first quarter of this year, re-accumulated wealth in the summer, and began to profit again after the US election. This is not surprising. After all, Bitcoin rose 45% last month. That’s a 600% increase from the cycle low.

Currently, 69% of Bitcoin’s circulating supply is in the hands of long-term holders. As the bull run continues, we expect to see long-term holders transfer their tokens to short-term holders. So the 69% ratio should continue to decline.

Data Summary:

In the 2021 cycle, the Bitcoin price peaked when 58% of the circulating supply was held by long-term holders.

In the 2017 cycle, the Bitcoin price peaked when 51% of the circulating supply was held by long-term holders.

Conclusion: Smart money is starting to profit. We think this will continue as new money enters the market. For prices to rise, demand (new money) must exceed supply. We think it will.

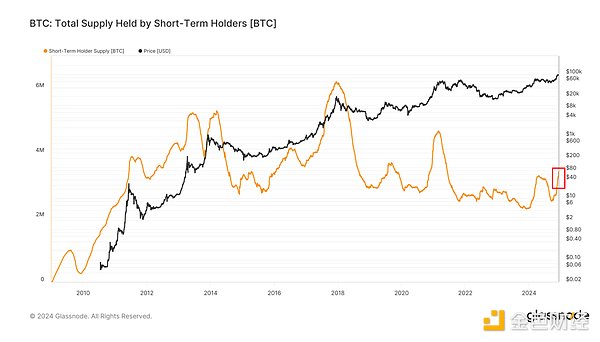

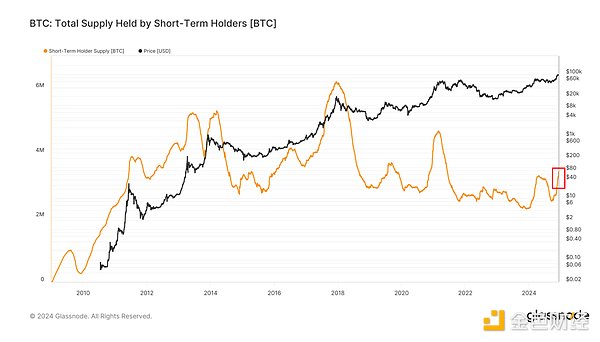

(2) Short-term holders

“New Money” turning to Bitcoin.

Short-term holders are new entrants into the market. In a bull market, we typically see this group trending upward while the number of long-term holders declines. This is exactly what we are seeing today.

Short-term investors chased the market again in the first quarter. Many short-term players exited in the big shakeout this summer. Now we are seeing a new surge of momentum.

Data summary:

Currently, 16.6% of Bitcoin supply is in the hands of short-term holders.

In the 2021 cycle, BTC peaked with short-term holders holding 25% of the circulating supply.

In 2017, when short-term holders controlled 70% of the supply, BTC reached its price peak.

Conclusion: New money is flowing into Bitcoin. Judging from past cycles, there may be more new money flowing in in the future.

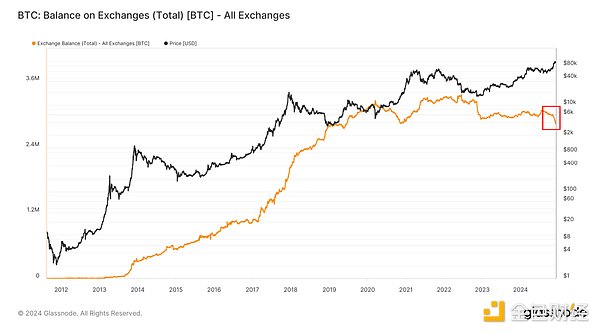

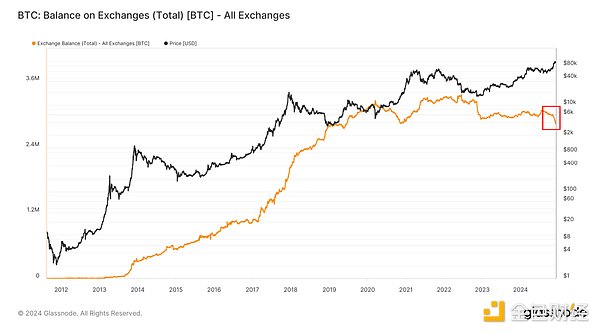

2. Exchanges

(1) Exchange balances

Currently, exchange balances are declining. This is somewhat of an anomaly because as prices rise, we should see tokens entering exchanges. Instead, we see Bitcoin leaving exchanges, presumably in self-custody form.

It is worth noting that this is not the first time we have seen this. At the beginning of the price rally in early 2021, the yellow and black lines diverged in a similar pattern. Later in the cycle, funds eventually returned to exchanges.

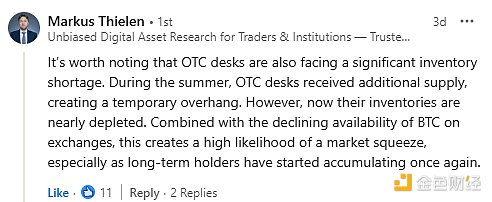

In addition to the fact that Bitcoin balances on exchanges are at their lowest level since 2019, I also heard that OTC desks are short of Bitcoin. Here is a comment from Marcus Theilen, founder of 10x Research, on a recent post of mine on LinkedIn:

Conclusion: Bullish

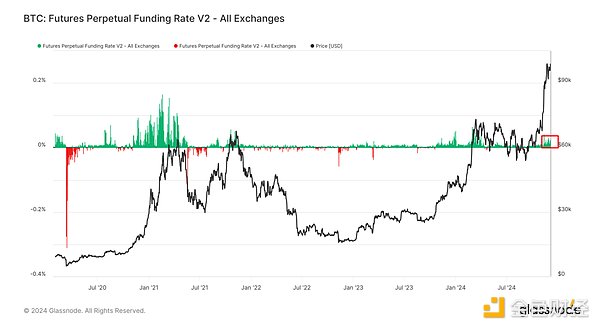

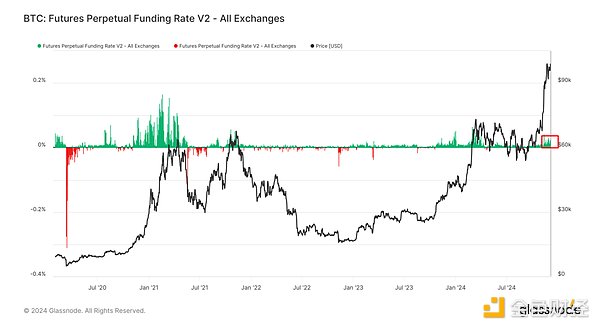

(2) Funding Rate

The funding rate in the futures market can help us understand trader sentiment and momentum. The green line means that longs are paying shorts to keep their positions. The red line means that shorts are paying longs.

Data Summary:

Currently, the funding rate of Bitcoin is 0.012%, and the funding rate was as high as 0.025% when the price of Bitcoin reached $100,000.

In March of this year, the funding rate was as high as 0.07%.

In the 2021 cycle, the funding rate reached a peak of 0.17%.

Conclusion: Historically, today's funding rate level is quite low - considering that Bitcoin is trading close to $100,000. High funding rates indicate excessive leverage and a "house of cards" type of market structure. This is not what we are seeing today. So, bullish.

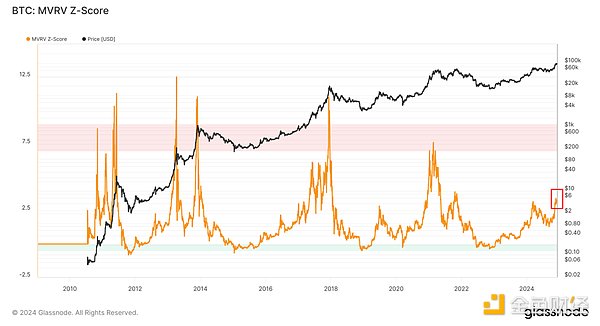

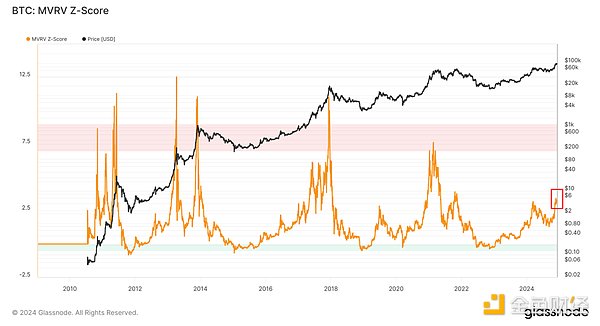

3. Market Value to Realized Value Ratio (MVRV)

MVRV Z-Score helps us understand the relationship between Bitcoin's current market value and "realized value", which is a network cost basis tool. It basically gives us an idea of the average unrealized gains for Bitcoin holders. It has been doing an excellent job of identifying cycle peaks.

Data Summary:

The current MVRV is 3.17. This means the average holder has an unrealized gain of 217%.

The cycle peak in 2021 had an MVRV of 7.5 (a return of 650%).

The 2017 Bitcoin peak had an MVRV of 11 (a return of 1000%).

Let's go deeper and focus on the long-term holder group:

The current long-term holding MVRV is 3.89.

The MVRV in March was 3.76.

The long-term holding MVRV was as high as 12 when the BTC price peaked in the last cycle.

The index was 35 at the peak of the cycle in 2017.

The MVRV of short-term holders is currently 1.26, which indicates that the average return of short-term holders is 26%.

Data summary:

The MVRV in March was 1.45.

It peaked at 1.8 in the 2021 cycle.

In the 2017 cycle, the MVRV was 2.4.

Conclusion: Both long-term and short-term holding MVRV are likely to rise before the end of this cycle.

4. Pi-Cycle Top Indicator

Similar to the MVRV score, the Pi-Cycle Top Indicator has always been a good tool for identifying cycle peaks. It measures momentum by measuring the 111-day moving average (green) and 2 times the 350-day moving average.

When the market is overheated, the shorter 111-day moving average will cross the longer 350-day moving average.

Conclusion: The shorter moving averages have not yet shown a parabolic trend, which indicates that sharp rises and falls may occur at any time.

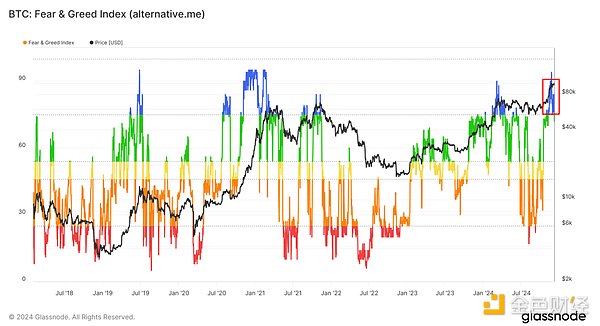

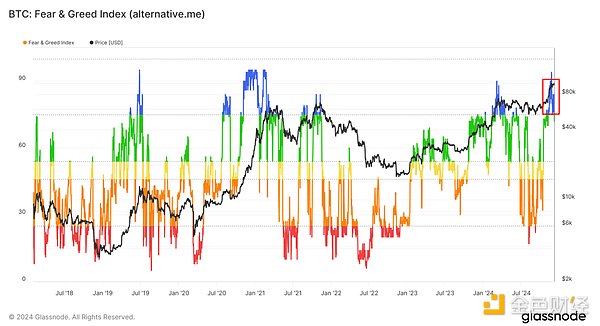

5. Market sentiment

We entered the "extreme greed" period on November 1 and have stayed there ever since. Of course, you have to be afraid when others are greedy.

But there are some nuances to explore here. For example, in early November 2020, we first entered the "extreme greed" period. We stayed there until that cycle peaked in April (a cycle that lasted 5 months (with a few short pullbacks in between) got us into “greed”).

Other off-chain indicators also suggest that the “extreme greed” phase of this cycle has begun. For example, popular crypto YouTube channels still have about half the views they had at the peak of the previous cycle. Coinbase App is ranked #15 (was #1 in the previous cycle).

Finally, I see more people calling for a “local top” than a true “super cycle”. This is not what we typically see at tops. At a true top, the more likely scenario is that few people will call because extreme exuberance will be here — and many market participants think the “new normal” will last.

Conclusion: While there are some signs of exuberance (e.g. pump.fun, Microstrategy, meme coins, AI proxies, NFT returns, etc.), more extreme greed is likely to come. It is human nature to expect volatility.

6. Attached SPX6900 data

Let's look at SPX6900 - a meme coin we mentioned in a previous report article (and hold a small amount). I strongly feel that the trend of meme coins we have seen in this cycle is a prelude to what may happen in the future.

Why?

It is obvious that retail investors prefer meme coins. People like to gamble. There seems to be some "gambling" meaning in trading meme coins. In short, this is my view on meme coins. A gambling game. This is the utility of meme coins. It brings a sense of community and endless dopamine secretion.

There is no doubt that meme coins are attracting new users. I think they are only good for the crypto world and no harm, but at the same time I admit that they are not suitable for everyone. Many meme coins are scams. Many people will lose a lot of money playing this game.

Now, frankly, as someone who has spent thousands of hours covering the crypto markets, my gut feeling about this industry is basically just a "gut feeling". But I wanted to share a sample of my SPX tracking so you can get an idea of some analytical research.

When it comes to meme coins, I mainly look for the following:

Large corps of promoters and social media buzz (mindshare/attention)

Continuously growing community of token holders

Projects that have made big moves, such as sales or mergers, etc.

Market cap of $100M+

Sufficient trading liquidity

Exchange listing (or possible future listing)

Large number of whales (showing high confidence)

Clear tagline

A community making extremely high price predictions

Tradable on Solana (easily accessible via Coinbase, Phantom)

Global markets/addressable interest

SPX6900 seems to fit the bill. Here are some highlights:

Note: Its social media accounts have grown from 9,000 followers to over 50,000 in the last few months. Its largest promotional account (Murad) grew from 110k followers to 550k followers in the same period — spawning several smaller promotional accounts in the process.

Token Holder Growth: It has grown from around 3k token holders a few months ago to 79k today, the fastest growing on Solana (also available on Base and Ethereum).

Resilience: It had multiple 70%+ corrections before going parabolic a few months ago. It’s down about 50% from its peak price of $0.94 per token. It’s been in a range of $0.49 and $0.72 for the past seven weeks.

Whales: SPX has over 44k holders above $10k on Solana alone. That’s almost half as many as WIF and more than half as many as Bonk (both of which have 5x the market cap). It has nearly a third of Pepe’s $100k+ and $1m+ token holders. Pepe's market cap is 13.4 times that of the SPX.

Global Markets: Has simple ideas that anyone can understand. Currently trading on KuCoin (Asia) and Bybit (UAE), Solana, Ethereum and Base DEX.

Mottos: "Turn the Stock Market Around" and "Stop Trading, Go Believe in Something".

Ridiculous Price Predictions: Murad's target is $100 billion. Note that Doge reached $90 billion in the last cycle, dare to dream.

This is my opinion. Please note that I have no relationship with SPX6900 or anyone associated with the project. Investing in cryptocurrencies is very risky. Memecoin is at the far end of the risk curve. The way we query and analyze data may be flawed, and the analysis may be wrong. And SPX6900 may fall to zero soon.

Note that my data source is a private dune dashboard coupled with Holderscan. I am working on more data and hope to share it with you soon.

7. Conclusion

Local top or full sprint to the end of the year?

This is the question we mentioned at the beginning. Everyone wants to know where we will be at the end of the year. I am not a trader, nor someone who pays too much attention to short-term price movements, but I believe it is possible for Bitcoin to go higher from now - perhaps into the $120,000 range before Christmas.

I am not 100% sure of this. I will always look at volatility. But I do think that Bitcoin prices will go higher in 2025.

Of course, we are also watching the broader economic situation. Global liquidity is currently showing some bearish signals. The US dollar index has retreated from the 108 local high, but it is still high. CPI data will be released on December 12th, and the Federal Reserve will hold a rate meeting on December 18th.

As always, please do your own research. Expect a lot of volatility. Don't invest in anything you can't afford to lose.

JinseFinance

JinseFinance