Author: Nancy Lubale, CoinTelegraph; Compiler: Baishui, Golden Finance

Summary

Bitcoin prices are correcting, but strong ETF inflows, high network activity, and whales' accumulation suggest that BTC is expected to break through $140,000.

Spot Bitcoin ETFs have seen net inflows of $2.9 billion in two weeks, continuing past gains.

The decline in exchange balances and the growth in volume Z-values suggest that overall demand is growing.

Bitcoin prices have fallen 1.4% in the past 24 hours. It is trading 6% below its all-time high of $109,000 set on January 20. Nonetheless, some fundamentals, on-chain data, and technical indicators suggest that Bitcoin's upside is not over yet.

Spot Bitcoin ETF inflows mirror BTC's historical rally

Bitcoin's latest rally has been accompanied by strong investor demand for spot Bitcoin exchange-traded funds (ETFs), with net inflows of $2.9 billion in the past two weeks.

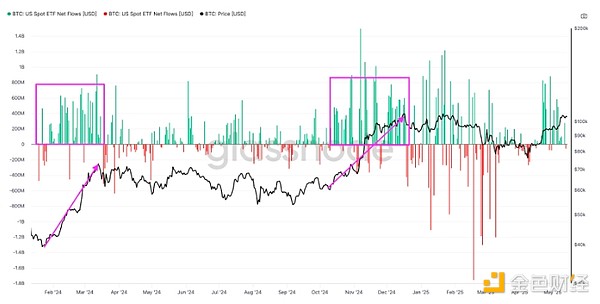

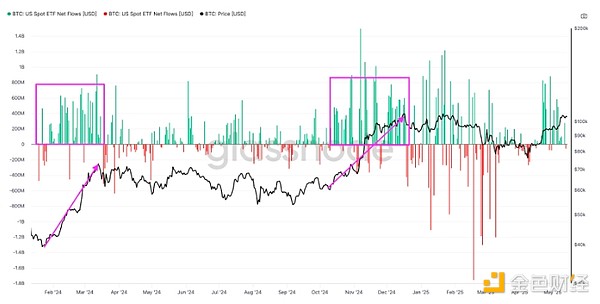

The chart below shows that since the launch of U.S. spot Bitcoin ETFs in January 2024, these investment products have seen net inflows of approximately $8.5 billion between February 13, 2024 and March 13, 2024, and peaked at a single-day inflow of $1.045 billion on March 12, 2024.

Spot Bitcoin ETF fund flow. Source: Glassnode

Similarly, between November 6, 2024 and December 16, 2024, the cumulative daily inflow reached $5.7 billion, which is consistent with Bitcoin's rise from $67,000 to $108,000, a 60% increase over the same period.

If ETF inflows continue, Bitcoin is likely to resume its upward trend and set a new all-time high.

Bitcoin Market Volatility Index: Risk Appetite

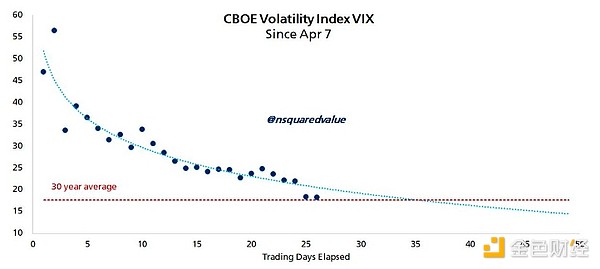

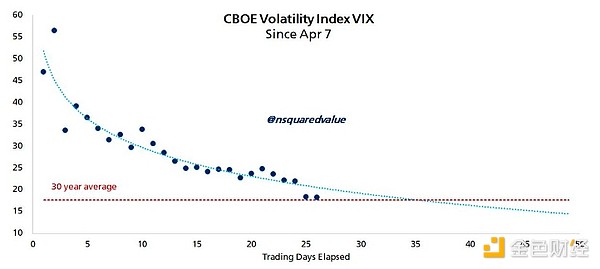

The increase in funds flowing into spot Bitcoin ETFs indicates that risk appetite is high, as evidenced by the decline in the Chicago Board Options Exchange (CBOE) Volatility Index (VIX).The index measures 30-day market volatility expectations.

Bitcoin Network Economist Timothy Peterson emphasized that the VIX index has fallen sharply from 55 to 18 in the past 25 trading days.

A VIX index below 18 means a "risk-on" environment, which is good for assets such as Bitcoin.

“This will remain a ‘risk-on’ environment for the foreseeable future,” the analyst said.

Chicago Board Options Exchange Volatility Index. Source: Timothy Peterson

Peterson’s model tracks with 95% accuracy and predicts a $135,000 price target within the next 100 days if the VIX remains low.

Bitcoin continues to accumulate strongly

The risk-on sentiment is reinforced by the accumulation of Bitcoin whales, who have been accumulating even as prices rise. Glassnode data shows that the Bitcoin Accumulation Trend Score (ATS) is 1 (see the figure below), which indicates that large investors are actively accumulating.

According to Glassnode data, the surge in the trend score indicates that almost all groups have shifted from dispersion to accumulation. This shift is similar to a similar accumulation pattern observed in October 2024, when the price of Bitcoin surged from $67,000 to $108,000, coinciding with the victory of US President Donald Trump.

Bitcoin Accumulation Trend Score. Source: Glassnode

Additional data from Santiment shows that addresses holding 10 to 10,000 BTC have accumulated 83,105 BTC in the past 30 days.

Santiment said in a post on the X social platform on May 13:

“With these large wallets actively accumulating, it may only be a matter of time before Bitcoin breaks through the coveted all-time high of $110,000, especially after the suspension of tariffs between China and the United States.”

Bitcoin 10-10,000 BTC holdings chart. Source: Santiment

Overall, This is a positive sign as continued accumulation indicates bullish sentiment among this group of investors.

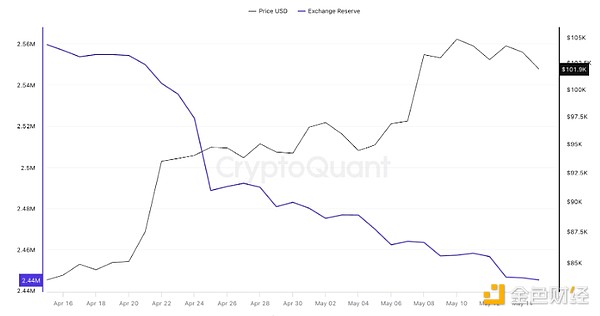

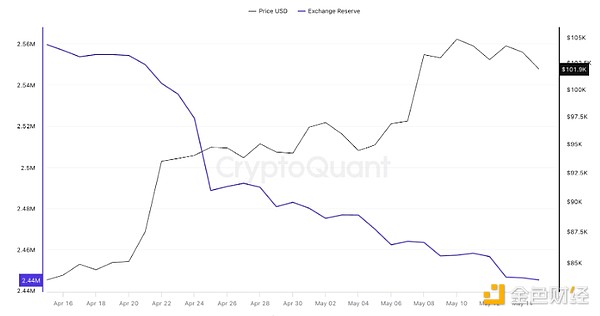

Exchange Bitcoin Balances Decline

On May 15, exchange Bitcoin balances fell to 2.44 million, the lowest level in six years. According to the chart below, over 110,000 Bitcoins have been moved from exchanges in the past 30 days.

Exchanges’ BTC reserves. Source: CryptoQuant

The decline in exchange Bitcoin balances means that investors may be withdrawing their holdings to self-custodial wallets, indicating a lack of willingness to sell in anticipation of future price increases.

Increased network activity

As cryptocurrency investor Ted Boydston highlighted in a May 15th X-section article, Bitcoin’s upside potential is supported by increased network activity.

The Bitcoin Volume Z-score measures the difference between current and average transaction volumes. It is often used to measure network activity and market interest.

The chart below shows that the indicator has risen sharply from negative territory, approaching 1. Rising Z-scores of volume, especially when approaching or exceeding 1, have historically been associated with rising Bitcoin prices.

“This is a good sign for an acceleration in Bitcoin prices,” Boydston commented, adding: “Once the Z-score breaks above 1, Bitcoin should enter a bull market.”

BTC Rounding Bottom Pattern Target Price $140,000

From a technical perspective, Bitcoin prices have formed a rounding bottom pattern on the daily chart (see the chart below). Bulls are currently focused on pushing prices above the dominant pattern neckline at $106,660.

A daily candlestick close above this level would confirm a bullish breakout of the rounding bottom pattern, leading BTC into a price discovery phase with a technical target of $140,000, a 37% upside from current levels.

BTC/USD daily chart. Source: TradingView

The relative strength index (RSI) is at 70 and has a bullish crossover with the SMA, suggesting that the market environment remains favorable for the upside and the price could even break above $140,000.

BTC price has broken out of a bull flag pattern on the weekly chart and a rally to $150,000 is expected.

Davin

Davin