1.Multicoin's latest Solana investment thesis: Solana aims at the Internet capital market

Multicoin Capital participated in Solana's seed round in May 2018, and since then Multicoin Capital has also been investing in Solana's native asset SOL and the broader Solana ecosystem. We have previously published four investment theses on Solana. During that time. The first two versions were released about nine months before the mainnet generated the first block in March 2020. As the Solana network develops, our reference framework for how to think about the Solana network and SOL assets is also evolving. Click to read

2. Pantera: Why we are optimistic about Raydium and buy Ray

Raydium is the leading DEX on Solana, and it is arguably the most attractive asset to investors in the entire market right now. Raydium is a rare combination of both a strong market leadership in a long-term growth space and a clear value-added story, which is not common in DeFi protocols on any other chain. Click to read

3.a16z: The U.S. SEC should take 6 major adjustments immediately

As technology develops, the U.S. SEC must also develop with it. This is especially true in the field of cryptocurrency. New leadership and the establishment of a new cryptocurrency working group provide the agency with an opportunity to take meaningful action and adapt. Click to read

4. AI Agents are blooming everywhere. How to buy at the bottom?

What? Buying at the bottom requires logic? Yes, for ordinary users who are new to the market, "buying at the bottom logic" is very important. Because before the main rising wave of "Spring on the Chain" really arrives, high volatility will be the norm. Next, let's talk briefly about how AI Agents should buy at the bottom? Click to read

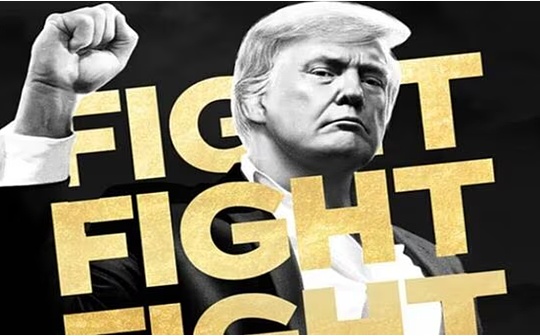

5. Chainalysis: Who is holding TRUMP tokens?

While most wallets holding $TRUMP are retail buyers who are roughly breaking even, about 50 whales have realized profits of more than $10 million at the wallet level. What else can we know by analyzing $TRUMP and $MELANIA on the chain? Click to read

Miyuki

Miyuki