Source: Forbes

Most billionaires got rich by starting their own businesses or inheriting the wealth of wealthy entrepreneurs. However, a small number of current or former American executives have amassed ten-digit fortunes with generous salary packages, and the number of this group is still growing. This year, Forbes found a total of 48 such billionaire workers, a significant increase from 29 last year, setting a new record. With stock prices soaring and executive compensation packages remaining high, this number is expected to continue to climb.

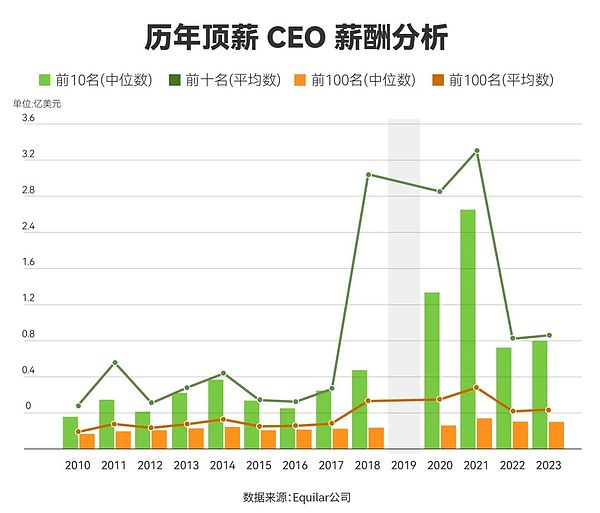

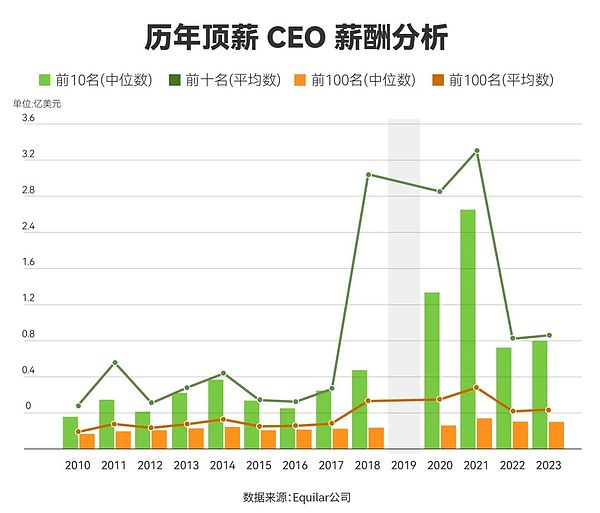

According to data company Equilar, the average annual compensation of the top ten CEOs in the United States soared more than sevenfold from $46 million in 2010 to a peak of $330 million in 2021. While most Americans accumulate wealth through wages, executives' income is usually composed of stock options and equity awards granted in installments (often linked to performance). This phenomenon is becoming more and more common.

According to data from executive compensation consulting firm Semler Brossy, the average equity share of CEO pay packages has risen from 54% in 2012 to 66% in 2023.

As a result, America’s top-paid CEOs have continued to get richer, even as the average pay of the top 10 highest-paid executives has fallen since the pandemic (to a still-enviable $125 million in 2023). At the same time, the shares awarded to many top-paid executives in the past have appreciated significantly, thanks to the continued rise in the stock market (the S&P 500 has risen nearly 370% since 2010 and nearly 25% since 2021).

This “the rich get richer” effect has resulted in more companies today being able to create non-founder billionaires than ever before.

Looking back at 2010, only 7 of the 403 billionaires in the United States were employed, accounting for only 2% of the billionaire group in the United States. Among them, 6 former executives are still on the list this year: Microsoft's Steve Ballmer and Google's Eric Schmidt are still the two richest "employed emperors" at present; in addition, there are eBay's Jeff Skoll and Meg Whitman, medical device manufacturer Stryker's John Brown, and Blackstone's Hamilton "Tony" James. The seventh billionaire executive that year was former Cisco CEO John Morgridge, who has now fallen off the billionaire list.

Fifteen years later, the "working emperors" are still a minority, but their number is growing, and the growth rate is faster than the expansion rate of the entire American billionaire group, which shows that the more than one billion wealth accumulated by these non-founder executives or former executives is not just the result of rising tides. Currently, 5% of the nearly 900 billionaires in the United States are "working emperors", which is higher than the 4% counted by Forbes in February 2024 (when the total number of billionaires in the United States was about 760).

There are 18 newcomers on the list this year, including Alphabet CEO Sundar Pichai, FICO CEO William Lansing, SpaceX President and COO Gwynne Shotwell, former Tesla CTO JB Straubel, longtime Nvidia director Harvey Jones, and former Cantor Fitzgerald chairman and CEO Howard Lutnick (who left to become President Trump's commerce secretary).

The only person who made the list last year but dropped out this year is Lisa Su, CEO of chipmaker AMD, whose company's stock price has plunged nearly 30% over the past year. Meanwhile, Ryan Graves, an early Uber employee who dropped out of the 2024 list, and Bob Muglia, former CEO of Snowflake, a cloud database software company, have rejoined the billionaire ranks and are back on the list.

Here are some of the most well-known "working emperors" who made the list this year

(Wealth as of May 13, 2025)

1. Vasily Shikin

Wealth: $1.9 billion

AppLovin Chief Technology Officer

Born and raised in Russia, Shikin joined the marketing software and mobile game company AppLovin at its inception in 2012 as vice president of engineering. In 2020, he was promoted to chief technology officer and took the company public the following year. Higgins's fortune is the result of a performance-based stock award in 2023 that will only be fully vested if the company's stock price rises sixfold in five years. In the third quarter of 2024, the company achieved this seemingly unattainable goal, and its market value has since soared another 370% to $125 billion amid the market's enthusiasm for AI.

Higgins's stock and options together account for nearly 1% of the company's shares, worth $1.6 billion. He is one of the company's eight billionaires, and his colleague Herald Chen is also a "working emperor."

2. Jon Winkelried

Net worth: $1.9 billion

TPG CEO;

Former Goldman Sachs President and Co-COO

Winkelried joined Goldman Sachs in 1982 and was promoted to president and co-COO in 2006, working side by side with Gary Cohn (later the chief economic adviser to the Trump administration). Three years later, he took 1.5 million shares of Goldman Sachs with him when he retired, which are now worth about $900 million, as Goldman's stock price has soared nearly sixfold since the end of March 2009. In addition, he took away call options for another 1.1 million shares at the time (although Forbes speculates that Winkelried may have diversified his holdings over the years, and a spokesperson declined to comment on his net worth).

In 2015, Winkelried returned to join private equity giant TPG as co-CEO with billionaire co-founder Jim Coulter. In 2021, Winkelried took over as Coulter stepped down as current executive chairman. The two then teamed up with TPG's other billionaire co-founder David Bonderman (who died in December 2024) to lead TPG to go public in 2022. Since its IPO, TPG's stock price has risen more than 50%. Winkelried spent a decade at TPG and received a 5% stake in the company, which is now worth more than $950 million.

3. Larry Culp

Net worth: $1.5 billion

Chairman and CEO of GE Aerospace;

Chairman of GE Healthcare;

Former CEO of Danaher

Culp joined Danaher, the industrial conglomerate founded by billionaire brothers Steven and Mitchell Rales, in 1990 and became president and CEO in 2001. By the time he retired 14 years later, he had driven the company's stock price up more than 500%, earned nearly $230 million (pre-tax) by exercising options and selling the resulting shares, and ultimately still owned 1.7 million shares adjusted for stock splits. Considering that Danaher's stock price has more than doubled since Culp retired, Culp's shares are now valued at nearly $350 million. He also has options to purchase 2.9 million split-adjusted shares (although Forbes speculates that Culp may have diversified his holdings over the years, and a spokesperson did not respond to a request for comment on his net worth).

In 2018, Culp returned as chairman and CEO of General Electric, leading a turnaround of the troubled GE. In 2023, he spun off the healthcare business into GE Healthcare and in 2024 the energy business into GE Vernova, ultimately splitting the bloated conglomerate into three separate public companies. Today, the stock price of the original company (now called GE Aerospace) has almost quadrupled since he took over, making his total stake in the three companies worth more than $400 million.

4. Nikesh Arora

Net worth: $1.4 billion

Chairman and CEO of Palo Alto Networks;

Former president and COO of Softbank;

Former chief business officer of Google

After nearly a decade at Google, Arora moved to Japanese investment giant SoftBank Group in 2014. A year later, he was promoted to president and COO, and was seen by the outside world as a hot candidate to succeed the group's founder, billionaire Masayoshi Son. However, things did not go as planned, and he resigned from his executive position in 2016, but stayed on as an advisor for a year. According to his generous compensation package and separation agreement, although he had only been in SoftBank for a short time, he eventually cashed out at least $360 million (before tax).

He then spent a year doing angel investing, and in 2018 he became chairman and CEO of Palo Alto Networks, a cybersecurity company. Founded in 2005 by Israeli-American entrepreneur Nir Zuk (currently the chief technology officer), the company's stock price soared nearly sixfold during Arora's tenure, helping him and Zuk become billionaires. Over the past two and a half years, Arora has made a cumulative profit of nearly $800 million (before tax) by exercising stock options and selling them for cash, and currently still holds stocks and options worth $340 million.

5. Greg Brown

Net worth: $1.3 billion

Chairman and CEO of Motorola Solutions

Brown is the longest-serving CEO after Motorola co-founder Paul Galvin (died in 1959) and his son Bob Galvin (died in 2011). He joined Motorola in 2003 and was promoted to CEO in 2008. In 2011, he spun off the company's underperforming traditional smartphone business and established an independent listed company, Motorola Mobility Holdings (Motorola Mobility), which was famous for its Razr series. The following year, it was acquired by Google for $12.5 billion (now owned by Lenovo).

Since then, Brown has transformed the reorganized Motorola Solutions into an industry giant with a market value of nearly $70 billion through more than 50 mergers and acquisitions, focusing on the indispensable fields of public safety communications, 911 command center systems and video security. Since he took the helm, the company's stock price has soared more than six times, and Brown has accumulated more than $700 million (before tax) through stock exercise and sale, and currently still holds stocks and options worth $600 million.

6. Joseph Baratta

Net worth: $1.2 billion

Head of global private equity strategy at Blackstone

7. Michael Chae

Net worth: $1.2 billion

Vice Chairman and CFO of Blackstone

Baratta and Chae are two of the five professional manager billionaires at Blackstone. The alternative asset management giant with a market value of nearly $180 billion was co-founded by billionaires Stephen Schwarzman and Peter Peterson (died in 2018).

Baratta joined Blackstone in 1998, moved to London in 2001 to develop European private equity investment business, and took charge of the global private equity department in 2012. Chae joined in 1997 and was in charge of international private equity business. He was promoted to chief financial officer in 2015 and vice chairman in January this year. Blackstone's stock price has risen nearly 15% in the past year, and the value of each of their shares is close to $1 billion.

8. Satya Nadella

Net worth: $1 billion

Microsoft Chairman and CEO

As Microsoft's stock price hits a record high, Satya Nadella, chairman and CEO of the software giant, has joined the ranks of billionaires for the first time. Nadella joined Microsoft in 1992 and took over the reins from Steve Ballmer, the richest professional manager in the United States who retired that year, in 2014. In 2021, he succeeded John Thompson, a senior technology executive and investor, as chairman, who previously succeeded Microsoft founder Bill Gates in 2014. Nadella has led Microsoft to deeply deploy artificial intelligence, investing more than $10 billion in OpenAI since 2019 and leading the company to launch the AI tool suite "CoPilot". Although he only holds 0.01% of the shares of the company with a market value of $3.4 trillion, his wealth has just exceeded the billion-dollar mark, with the cumulative proceeds of more than $600 million (before tax) from stock cashing in the past.

The following is a list of 48 “professional manager billionaires”:

JinseFinance

JinseFinance