Author: Nancy Lubale, CoinTelegraph; Compiler: Deng Tong, Golden Finance

Ethereum rose to $3,972 after the approval of the spot Ethereum exchange-traded fund (ETF), but Ethereum has performed poorly compared to Bitcoin and the broader cryptocurrency market over the past week, falling 10%, leading traders to wonder whether the downtrend in altcoins is over.

Specifically, the price of Bitcoin has fallen 6% in the same period, while the total market value of cryptocurrencies has fallen 5.3%.

A number of market and technical indicators suggest that ETH may experience a deeper correction before attempting another recovery.

ETH//USD daily chart. Source: TradingView

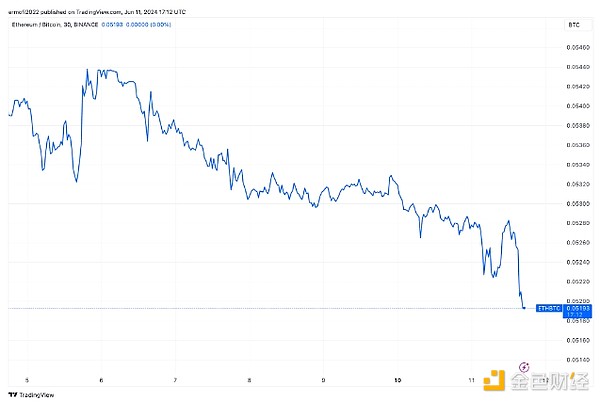

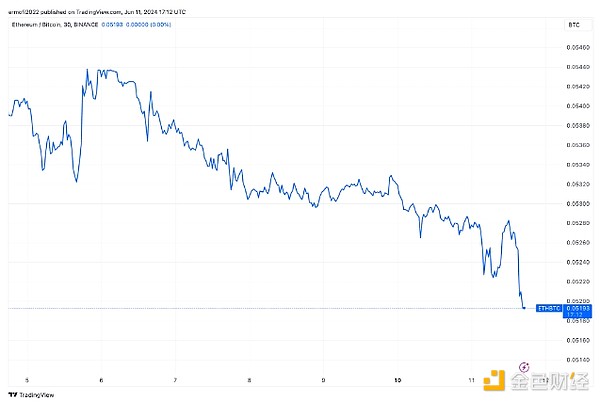

ETH/BTC ratio has trended down over the past week

Ethereum has fallen 10% over the past seven days, underperforming Bitcoin and other top Layer 1 tokens. BTC price has fallen 5.5% in the past week, and the ETH/BTC ratio has fallen 5.21% from 0.055 on June 3 to 0.0513 on June 11, the lowest level since May 20.

ETH/BTC ratio. Source: TradingView

There are a number of reasons for ETH’s underperformance at this point, including factors that are specific to Bitcoin in 2024.The US spot Bitcoin ETF has been largely successful, with nearly $2 billion in capital inflows last week. In addition, the upcoming CPI data and the FOMC meeting’s decision on rate cuts have triggered a notable market correction over the past few months, affecting all cryptocurrency prices, including Ethereum.

In addition, Ethereum’s network activity (specific metric) has declined over the past 90 days.

Data from Glassnode shows that daily active addresses on the Ethereum network fell from 622,963 on March 20 to 458,400 on June 10. That’s a 1.2% drop in the past 48 hours alone.

The number of active addresses on Ethereum. Source: Glassnode

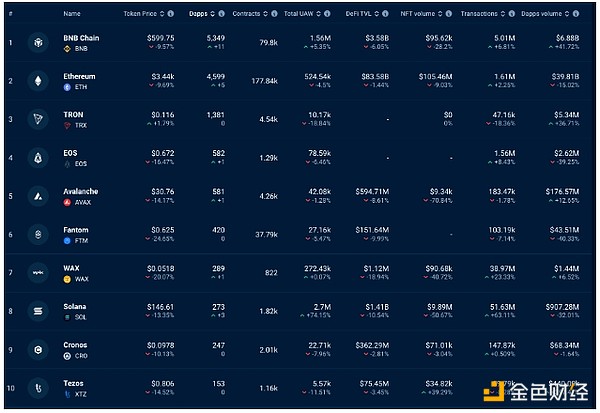

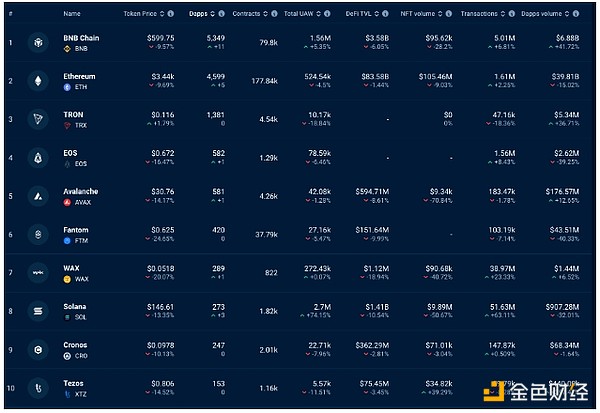

While Ethereum remains the most powerful network in the Layer 1 space, Solana has recently taken market share in this space in terms of on-chain activity. According to DappRaddar, the number of NFTs on Ethereum has fallen by 9% to 105 million in the past 7 days.

The chart below shows that the Ethereum network lags behind Solana and BNB chains in terms of total UAWs. Over 524,000 UAWs have interacted with the protocol, down 4.5% in the past 7 days. This is far lower than the 2.7 million UAWs on Solana, which has grown by 74% in the same time frame.

Top Layer 1 blockchain. Source: DappRadar

The decrease in on-chain activity suggests weakening demand for Ethereum within the ecosystem, depressing its price.

Ethereum Faces Strong Resistance on the Upside

Ethereum’s recent decline has caused it to lose a key support level near the $3,500 demand zone, turning it into a resistance level. Past price action has shown that this area has posed a stubborn resistance for ETH bulls. On April 11, Ethereum fell below this level, resulting in a 25% decline to a low of $2,814 hit on May 2.

Data from IntoTheBlock reinforces the importance of this resistance zone. Its Inside-Outside-Price (IOMAP) model shows that the area is located in the price range of $3,476 to $3,577, after about 2.6 million addresses bought about 1.08 million ETH.

Ethereum IOMAP chart. Source: IntoTheBlock

If this resistance level sees heavy seller activity in the short term, Ethereum’s price is expected to fall further.

Ethereum’s market pattern points to a continued downtrend

After reaching a six-week high of $3,973 on May 27, ETH price retreated as shorts booked profits and the overall cryptocurrency market corrected. Since then, the price has fallen 12% to its current price of $3,511.

Despite the recovery, a long bearish candle is still visible on the daily chart, suggesting the strength of the downtrend.

ETH//USD Daily Chart. Source: TradingView

Ethereum bulls are counting on the psychological $3,400 level for immediate support. A daily close below this level will indicate that bulls are unable to defend it and a drop to $2,840 is expected. Such a move would imply an 18% drop from current levels.

Huang Bo

Huang Bo