Author: Airdrop Reference, Source: Author Twitter @AirdropDaii

One day in 2030, when the size of BlackRock's Bitcoin ETF surpassed the S&P 500 Index Fund, Wall Street traders suddenly realized that the thing they once laughed at as a "dark web toy" is now controlling the throat of global capital.

But all the turning points began in 2025-that year, the price of Bitcoin broke through $250,000 in the hunting of institutional whales, but no one could tell who it belonged to. On-chain data shows that more than 63% of the circulating supply is locked into institutional custody addresses, and the Bitcoin liquidity of exchanges is exhausted to only support three days of trading volume.

The above is a fantasy, let's get back to the present.

A large amount of funds are continuously flowing out of Bitcoin ETFs, and Bitcoin once fell below 80,000. There are two main explanations for this phenomenon: First, the policy side is that Trump launched a tariff war in the United States; second, the capital side is because 56% of short-term holders - hedge funds - arbitrage strategies closed their positions.

However, analysts believe that we are currently in the "distribution stage" of the Bitcoin bull market.

The "distribution stage" of the Bitcoin bull market usually refers to the period before and after the price peaks in the late bull market, when large households ("whales") begin to gradually sell their chips and transfer Bitcoin from early holders to new investors in the market. This stage means that the market has shifted from a crazy rise to the top area, which is a key link in the conversion of bulls and bears.

Without selling suspense, I will give the answer first. The current market liquidity structure has changed.

In the field of cryptocurrency, "OG" is the abbreviation of "Original Gangster" (also often interpreted as "Old Guard"), which specifically refers to the earliest participants, pioneers or long-term core groups in the field of Bitcoin.

In a word, old money is exiting and new money is entering. Among the new money, institutions are dominant.

Below, we will give you a detailed analysis from the aspects of market structure, current cycle characteristics, roles of institutions and retail investors, cycle timeline, etc.

1.Typical market structure: whales distribute to retail investors at the end of the bull market

The typical Bitcoin bull market at the end of the period presents a pattern of whales distributing chips to retail investors , that is, early large holders sell coins to retail investors who enter the market later at high prices.

In other words, retail investors often take over at high prices in a frenzy, and "smart money" whales take the opportunity to sell in batches at high prices to realize profits. This process has been repeated many times in historical cycles:

For example, when the bull market approached its peak in 2017, the net decrease in the Bitcoin balance held by whales indicated that a large amount of chips were transferred out of the hands of whales because a large amount of new demand poured into the market at that time, providing sufficient liquidity for whales to distribute their holdings. For details, see:The Shrimp Supply Sink:Revisiting the Distribution of Bitcoin Supply.

In general, the market structure at the end of the traditional bull market can be summarized as follows: the early big holders gradually sold, the market supply increased, and the retail investors bought in large quantities driven by FOMO (fear of missing out). This distribution behavior is often accompanied by signs such as increased inflows of Bitcoin to exchanges and movement of old coins on the chain, indicating that the market is about to peak and turn.

2.Characteristics of this round of bull market: new structural changes

The distribution stage of this round of bull market (2023-2025 cycle) is different from the past, especially in the behavior of retail and institutional investors.

2.1 Unprecedented institutional participation in this cycle

The launch of spot Bitcoin ETFs and the large-scale purchase of coins by listed companies have made the structure of market participants more diverse, and it is no longer just retail investors who drive the market. The addition of institutional funds has brought a deeper pool of funds and more stable demand, which is directly reflected in the lower market volatility than before. According to analysis, the maximum retracement of the current bull market is significantly smaller than in the past cycle, and the high point callback is usually no more than 25%-30%, which is attributed to the intervention of institutional funds to smooth out the volatility.

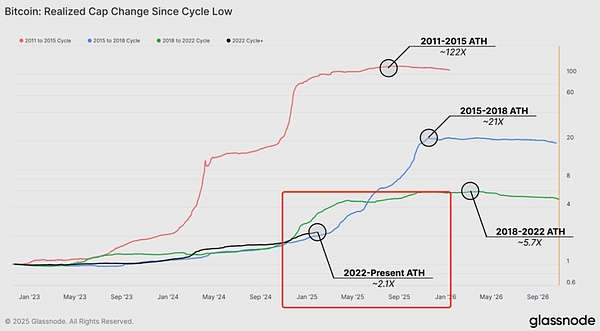

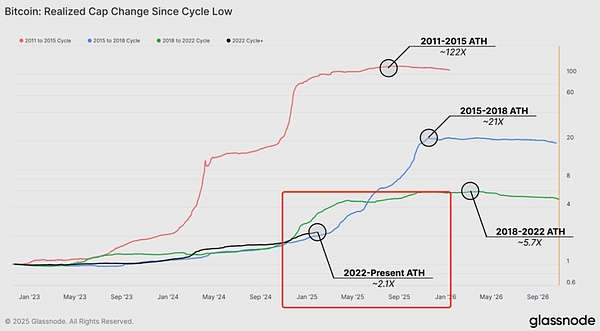

At the same time, the market maturity has increased, the price increase has decreased cycle by cycle, and the trend has become more stable, which can also be seen from indicators such as the growth rate of realized market value (Realized Cap): the realized market value in this round has only expanded a small part of the peak of the previous round, indicating that the enthusiasm has not been fully released (see: Thinking Ahead)

Realized Cap is an important indicator to measure the inflow of funds in the market. Unlike traditional market value (Market Cap), realized market value is not simply multiplied by the current price and the circulating supply, but takes into account the price of each Bitcoin at the last transaction on the chain. Therefore, it can better reflect the actual scale of funds invested in the market.

Of course, the above indicators may also indicate that the market is entering a more mature and more stable development stage.

2.2 Retail investors are also more rational and diverse in this round

On the one hand, senior retail investors (individual investors who have experienced multiple cycles) are relatively cautious and lock in profits earlier after a certain increase, which is different from the previous situation where retail investors chased the price all the way to the top.

For example, data from the beginning of 2025 showed that small holders (retail investors) transferred about 6,000 BTC (about 625 million US dollars) to the exchange in January and began to cash out in advance, while whales only had a small net inflow of about 1,000 BTC during the same period, basically staying put. This divergence means that many retail investors believe that the market has peaked and choose to take profits, while whales (regarded as "smart money") remain silent, obviously expecting higher profit margins.

On the other hand, the investment enthusiasm of new retail investors is still accumulating. Indicators such as Google Trends show that public attention has fallen back and "reset" after the price hit a new high, and the peak of national enthusiasm at the end of the previous cycle has not yet appeared. This suggests that the current bull market may not have entered the final frenzy stage, and the market still has the potential to rise.

2.3 Institutional behavior has become one of the important characteristics of this round

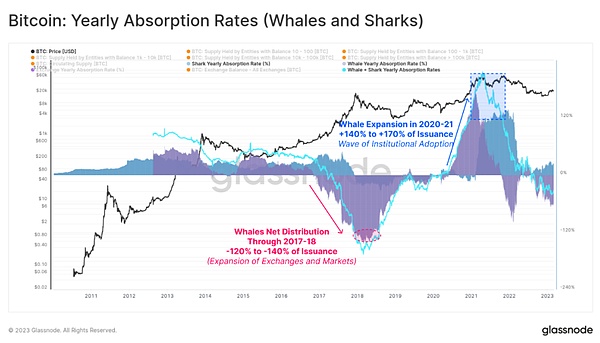

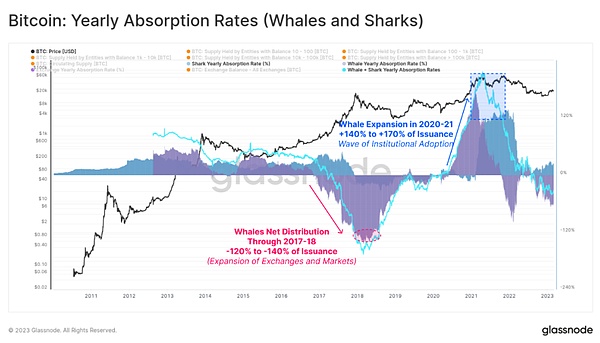

The last bull market in 2020-2021 was the first cycle in which a large number of institutions and listed companies entered the market. At that time, the phenomenon of whale holdings increased instead - new "big players" such as institutions bought a lot, and Bitcoin flowed from retail investors to these whale accounts.

This trend continues in the current cycle: large institutions have purchased a large amount of Bitcoin through channels such as OTC over-the-counter markets, trust funds or ETFs, making traditional whales no longer net sellers, which has delayed the arrival of the distribution stage to a certain extent. This makes the distribution of this round of bull market more moderate and dispersed, rather than the past model of pure retail investors taking over: the depth and breadth of the market have increased, and new funds are sufficient to absorb the chips thrown out by long-term holders.

The Glassnode report pointed out that a large amount of wealth has been or is being transferred from long-term holders to new investors, which is a sign of the maturity of the Bitcoin market - long-term holders have achieved record profits (up to US$2.1 billion in a single day), and new investors have sufficient demand to take over these selling orders, see Bitcoin sees wealth shift from long-term holders to new investors-Glassnode

It can be seen that the interaction between retail investors and institutions in this round of bull market has created a more resilient market environment.

III.Changes in the roles of institutions and retail investors

The following article discusses the impact of OG retail investors and institutions on liquidity

As the structure of market participants evolves, the roles of institutions and retail investors in the allocation stage have also changed significantly.

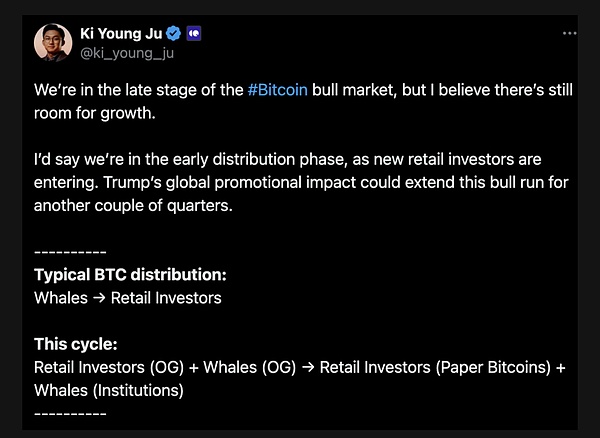

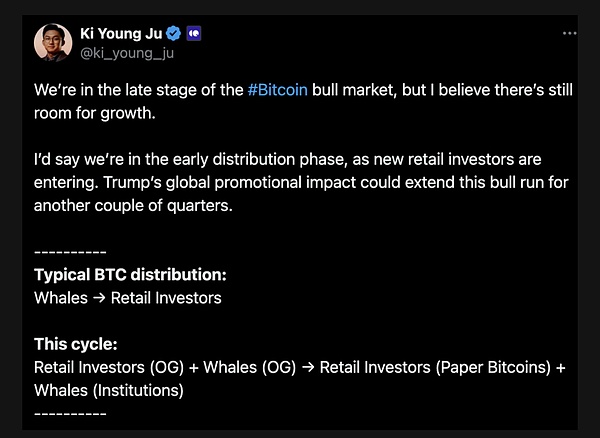

Ki Young Ju, CEO of CryptoQuant, summarized the allocation model of this round as: "Veteran" retail investors (OG retail investors) + original whales > new retail investors (through ETFs, MSTR and other channels) + new whales (institutions).

That is, retail investors and whales who have experienced the early cycle are gradually selling, and the buyers include not only traditional retail investors, but also ordinary investors who enter the market through investment tools such as ETFs, as well as new institutional funds that play the role of whales.

In other words, retail investors and whales who have experienced the early cycle are gradually selling, and the buyers include not only traditional retail investors, but also ordinary investors who enter the market through investment tools such as ETFs, as well as new institutional funds that play the role of whales.

This diversified participation pattern is completely different from the traditional "whales → retail investors" single-line distribution model.

In this cycle, OG retail investors (individual holders who entered the market early) may hold a considerable amount of Bitcoin. They chose to cash out and leave the market at the high stage of the bull market, providing some selling pressure and liquidity to the market.

Similarly, OG whales (early big investors) will also ship in batches to realize several times or even dozens of times the profit. Correspondingly, institutional whales, as new buyer forces, have absorbed these selling pressures in large quantities. They buy through channels such as custodial accounts and ETFs, and Bitcoin flows from old wallets to the custodial wallets of these institutions.

In addition, some traditional retail investors now indirectly hold Bitcoin through ETFs and listed company stocks (such as MicroStrategy's stocks), which can be regarded as a new form of "retail investors taking over".

This role change has a profound impact on market liquidity and price trends.

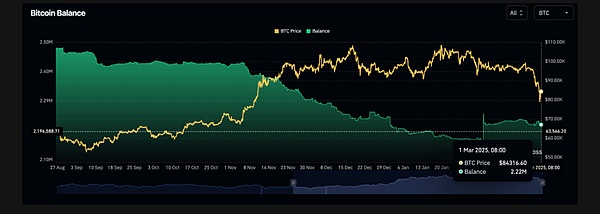

3.1 More Bitcoin is leaving the exchange

On the one hand, the selling behavior of OG holders usually leaves obvious on-chain footprints: more changes in old wallets, large transfers to exchanges, etc.

For example, in this round of bull market, it was observed that some long-term inactive wallets began to become active, and the transfer of coins to exchanges for sale was a sign that old holders began to distribute chips. KiYoung Ju pointed out that the activities of OG players will be reflected through on-chain and exchange data, while the flow of "paper Bitcoin" (such as ETF shares and Bitcoin-related stocks) will only be reflected as on-chain records of custodial wallets during settlement. That is to say, institutional funds buy mostly over-the-counter or through custody, and the direct chain reflects the increase in the balance of the custodian's address, rather than the direct flow of traditional exchanges.

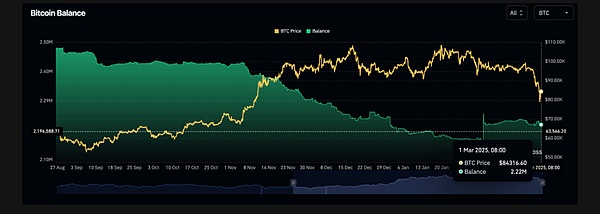

The current exchange's Bitcoin balance is 2.22 million, which is also a reflection of this feature.

3.2 New whales and new retail investors are more resilient

On the other hand, institutional investors, as new whales, not only provide huge buying support, but also enhance the market's ability to bear and liquidity depth under selling pressure.

Unlike the past when retail investors were prone to panic stampede, institutional funds are more inclined to buy on dips and make long-term allocations. When the market pulls back, the intervention of these professional funds can often stabilize prices. For example, some analysts pointed out that the reduced volatility of this round of bull market is attributed to institutional participation: when retail investors sell, institutions are willing to take over to ensure market liquidity, so that the price retracement is much smaller than in the past.

Although the launch of Bitcoin ETFs has brought a lot of incremental funds to the market, some ETF holders (such as hedge funds) may use arbitrage trading as their main purpose, so their funds have high liquidity. The recent large outflow of ETF funds shows that some institutional funds are only engaged in short-term arbitrage rather than full long-term holding. The funding pressure for Bitcoin's recent drop below 80,000 comes from the closing of hedge fund arbitrage strategies.

However, the newly entered retail investors have shown strong resilience. They did not panic sell in every adjustment, but were willing to continue holding. Bitcoin's short-term holder indicators show stronger resistance to declines.

In general, the interaction between OG retail investors + OG whales and new institutional whales + new retail investors has formed a unique supply and demand pattern in the current market:

Early holders provide liquidity, and institutions and new buyers absorb chips, making the distribution process in the later stage of the bull market more stable and traceable.

Fourth,Cycle timeline: historical trends and outlook for this round of bull market

From historical data, the Bitcoin market shows a regular cycle of about four years, and each round includes a complete cycle of bear market-bull market-transition. This is highly related to the Bitcoin block reward halving event: after the halving occurs, the output of new coins drops sharply, and there is often a round of sharp price increases (bull market) in the next 12-18 months, followed by a bear market adjustment near the high point.

4.1 History

Review the timeline of several major bull markets:

The first halving occurred in late 2012, after which the Bitcoin price peaked about 13 months later, in December 2013;

The second halving occurred in 2016, and the bull market peak was close to $20,000 about 18 months later in December 2017;

The third halving occurred in May 2020, and about 17-18 months later, at the end of 2021, Bitcoin experienced two highs (April and November) close to a double peak of $70,000.

It is speculated that the fourth halving in April 2024 may trigger a new round of bull market, and its peak is likely to appear within one to one and a half years after the halving, that is, around the second half of 2025, when the final distribution stage (the end of the bull market) will come.

Of course, the cycle is not a mechanical repetition, and changes in the market environment and the structure of participants may affect the duration and peak of this round of bull market.

4.2 Optimism

Some analysts believe that the macro environment, regulatory policies and market maturity will have an important impact on this round of cycle.

For example, Grayscale's research team pointed out in a report at the end of 2024 that the current market is only the mid-term stage of a new cycle. If the fundamentals (user adoption, macro environment, etc.) remain good, the bull market may continue until 2025 or even longer. They emphasized that the newly launched spot Bitcoin ETF has broadened the channels for capital to enter the market, and the clarity of the future US regulatory environment (such as the potential impact of the new Trump administration) may further boost the valuation of the crypto market.

This means that this round of bull market is expected to be longer than the past cycle, and the rally may span the traditional time window.

On the other hand, there are also on-chain data to support the view of a longer bull market. For example, the growth of real capital inflows (RealizedCap) in this cycle mentioned above has not yet reached half of the high point of the previous round, indicating that the market enthusiasm has not yet been fully released.Some analysts therefore predict that the final high point of this round of bull market may far exceed the previous round, and the high point expectations are often raised to $150,000 or even higher.

4.3 Conservative

However, there are also views that the peak will occur in 2025.

Ki Young Ju of CryptoQuant predicts that the final distribution stage of the Bitcoin bull market (various OG holders and institutions concentrate on shipping to the final receiving funds) will occur in 2025. His judgment is based on the early distribution stage that has already been entered and the observed influx of new retail funds, and he believes that there is no need to turn to a short view too early before the final shipment is completed.

Combining historical patterns and current indicators, it can be inferred that this round of bull market will most likely come to an end in the second half of 2025. At that time, as the price reaches a staged peak, various holders will accelerate the distribution of chips and complete the final distribution process.

Of course, the exact time and height are difficult to predict, but judging from the cycle length (about 1.5 years after halving) and market signs (the degree of retail investor madness, institutional fund movements, etc.), 2025 may become a key year.

V. Conclusion

When Bitcoin transforms from a geek toy to a trillion-level strategic asset, this round of bull market may reveal a cruel truth: The essence of financial revolution is not to eliminate old money, but to reconstruct the gene chain of global capital with new rules.

The "distribution stage" at this moment is actually the coronation ceremony of Wall Street's formal takeover of the crypto world. When OG whales hand over their chips to BlackRock, this is not the prelude to a collapse, but the march of the reconstruction of the global capital map - Bitcoin is evolving from a myth of retail investors getting rich overnight to a "digital strategic reserve" on the balance sheet of institutions.

The most ironic thing is that when retail investors are still calculating the "top escape password", Blackstone has already written Bitcoin into the 2030 balance sheet template.

The ultimate question in 2025: Is this the apex of the cycle, or the birth pain of a new financial order? The answer is hidden in the cold on-chain data - Every transfer record of the OG wallet is adding bricks and tiles to the custody address of BlackRock; the net inflow of each ETF is rewriting the definition of "value storage".

A word of advice to investors who are crossing the cycle: The biggest risk is not to miss the opportunity, but to interpret the rules of the game in 2025 with the cognition of 2017. When "coin holding address" becomes "institutional custody account", when "halving narrative" becomes "derivative of the Federal Reserve's interest rate decision", this century handover has long exceeded the scope of bull and bear

History always repeats itself, but this time it is not the tears of retail investors that appear, but the never-ending on-chain transfer sound of institutional vaults.

This institutionalization trend can perhaps be compared to the evolution of the Web 1.0 era - the Internet, which originally belonged to geeks, eventually fell into the hands of FAANG (Facebook, Apple, Amazon, Netflix and Google) giants.

The cycle of history is always full of black humor.

Joy

Joy