After holding off on policy in July, the debate over whether the Federal Reserve will cut interest rates in September is intensifying. On July 31st, two research reports from China International Capital Corporation (CICC) analyzed the Fed's policymaking from different perspectives, offering two key insights into the market's understanding of the Fed's decision-making logic. CICC macroeconomic analyst Xiao Jiewen and others believe the latest signals suggest the Fed is inclined to remain patient and will not cut interest rates under pressure from Trump. CICC Chief Overseas Strategy Analyst Liu Gang and others point out that the market may have misunderstood the Fed's decision-making premise. A rate cut doesn't necessarily require a decline in inflation; as long as the path of the "one-off" impact of tariffs on inflation is largely determined, the Fed can act. With the United States recently reaching tariff agreements with several countries, this path is becoming increasingly clear, leaving the possibility of a September rate cut alive. These views are not contradictory; rather, they collectively outline the possible path of action the Federal Reserve might take in a complex economic and political environment. Liu Gang, Chief Overseas Strategy Analyst at CICC Research, and others believe that conditions are ripening for the Fed to act. There is a common market misconception that the Fed must wait for a clear decline in inflation data before cutting rates. However, as long as the path of tariffs' impact on inflation is largely established, the Fed can act sooner rather than later. First, the Federal Reserve itself has an inherent need to cut interest rates. Data shows that the current US real interest rate of 1.63% is significantly higher than the natural interest rate of approximately 1%, meaning that monetary policy is constraining the economy. At the same time, economic growth and the job market have shown signs of a mild weakening. Although US GDP grew at an annualized rate of 3% in the second quarter, beating expectations, excluding tariff-induced fluctuations in imports, exports, and inventories, the average growth rate over the past two quarters was only around 1.5%, indicating a definitive slowdown in underlying growth momentum. Second, the path of the impact of tariffs on inflation is becoming increasingly clear. Since July, the United States has reached tariff agreements with several trading partners, including Indonesia, Japan, and the European Union. The final tariff rates implemented have been lower than previously threatened. According to estimates, the effective tariff rate will likely remain at 15%-16% after August 1st, making the transmission path of tariffs to inflation relatively predictable. CICC predicts that this impact will be a one-off, primarily manifesting in the third and fourth quarters. The CPI is expected to reach 3.3% year-on-year by the end of the year, with the core CPI at 3.4%. Therefore, in this situation, the Federal Reserve can cut interest rates. The market's misunderstanding of the Fed is that it must wait until inflation itself "falls" before cutting rates. However, if: 1) the Fed itself needs to cut rates (because growth and employment are weakening modestly, though not urgently; and because financing costs are high, reflected in the real interest rate of 1.63% being above the natural rate of interest of 1%), and 2) the inflationary impact of tariffs is indeed a one-off, then the Fed can act as long as the path of tariffs' impact on inflation is largely determined. Therefore, judging by the current progress in tariff negotiations, a September cut remains a possibility. Of course, the next two months' inflation data, especially employment data, as well as the Jackson Hole annual meeting at the end of August, will be key observation points.

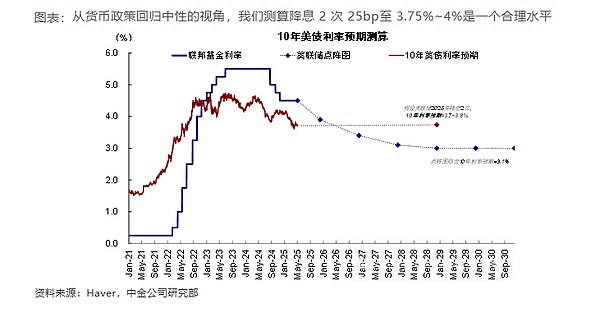

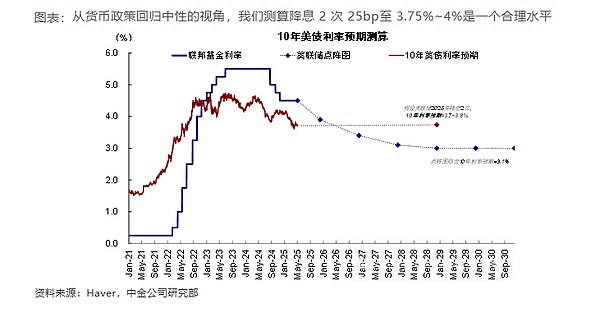

Under the baseline scenario, CICC expects the Federal Reserve to cut interest rates one to two times this year, lowering the policy rate to a range of 3.75% to 4%.

Inflation risks and policy independence may cause the Fed to remain on hold

CICC Research Department Macroeconomic Analyst Xiao Jiewen and others believe that

The core logic is based on the Fed's recent statements and its adherence to policy independence.

At its most recent meeting, the Federal Reserve decided to remain on hold, with Chairman Powell and most officials leaning toward maintaining a tightening stance. They believe that inflation risks posed by tariffs have not been fully resolved, and the labor market remains solid, making the conditions for a rate cut unnecessary. Powell acknowledged that current policy is "moderately restrictive," but argued that this is not sufficient grounds for a rate cut, and that the Fed needs to "remain patient." A more critical factor is the Fed's independence. Facing political pressure for a rate cut, Powell made it clear that the Fed will not adjust its interest rate path. Its policy goals are full employment and stable inflation, not helping governments reduce debt costs. The report emphasizes that the market may be underestimating the Fed's resolve to maintain its independence. The Federal Reserve held its July meeting steady, in line with market expectations. Two board members dissented from holding interest rates steady, but Powell and the majority of officials favored maintaining a tight policy stance. They argued that the inflationary risks posed by tariffs remain lingering, and the labor market remains solid, making a rate cut unnecessary. Powell also emphasized the Fed's independence, suggesting it would not succumb to political pressure. We believe that the inflationary effects of tariffs will become more pronounced in the coming months, making it difficult for the Fed to cut interest rates in September. If Trump continues to escalate tariffs, the timing of a rate cut could be delayed. As for Trump's pressure for a rate cut, we believe the market underestimates the Fed's resolve to maintain its independence.

The interest rate decision is jointly decided by 12 voting committee members. Even if Trump fires Powell, it will be difficult to change the direction of monetary policy.

Snake

Snake

Snake

Snake YouQuan

YouQuan Jasper

Jasper Jasper

Jasper Clement

Clement Kikyo

Kikyo Hui Xin

Hui Xin Aaron

Aaron Jasper

Jasper Alex

Alex