Author: Huang Fan

This year, 42 companies have successfully listed on the Hong Kong stock market, with a total fundraising amount of more than HK$105.5 billion. One IPO bell ringing ceremony after another has sent one company after another to the overseas capital market. How to interpret it?

In 2025, the Hong Kong stock market, which had been silent for 4 years,islikea long-lost "spring tide". Since the beginning of the year, IPO waves have come one after another,just likeconstantly stirring up waves on the sea of the capital market.

From January to June, 42 companies have successfully listed on the Hong Kong stock market, with a total fundraising of more than HK$105.5 billion. One IPO bell ringing ceremony after another has sent one company after another to the overseas capital market. The participation enthusiasm of cornerstone investors from all over the world is unprecedentedly high. They not only bring funds, but also bring market confidence. Middle Eastern sovereign funds and Southeast Asian long-term funds have poured in, forming a series of "warm capital currents".

1. What are the causes of this round of Hong Kong stock market spring tide?

The policy dividends brought by the latest reform measures of the Hong Kong Stock Exchange are the main reason. From optimizing the listing threshold to piloting the RMB pricing mechanism, to shortening the approval cycle, each policy is like opening a new "sluice gate", allowing IPO water to flow to Hong Kong stocks faster.

In recent years, the Hong Kong Stock Exchange has continued to reform the listing system, optimize the dual primary listing and secondary listing admission standards, and open up a fast approval "green channel" for high-market-value A-share companies. As a result, the trend of domestic A-share listed companies going to the Hong Kong stock market for secondary listing (including secondary listing and dual primary listing) has become increasingly active, especially since 2025. Leading A-share companies represented by CATL, Hengrui Medicine, and Haitian Flavor Industry have chosen to conduct secondary listings in the Hong Kong stock market. Listing in the Hong Kong stock market not only opens up broader international financing channels for companies, but also helps them enhance their global brand influence.

Taking CATL as an example, it was listed on the main board of the Hong Kong Stock Exchange on May 20, 2025, attracting 23 cornerstone investors including the Kuwait Investment Authority. The IPO raised as much as HK$30.718 billion, becoming one of the largest IPOs in the world this year. On the first day of listing, CATL's stock price opened 12.55% higher, with a market value of HK$1.34 trillion. The company's move is aimed at establishing an international financing platform to support the expansion of its overseas business.

At the same time, with the tightening of US stock market supervision and the rising risk of delisting, Hong Kong stocks have also become a key choice for Chinese concept stocks to return. More and more companies choose to "fly back" to Hong Kong stocks and complete secondary listings, just like "migratory birds returning to their nests." They bring mature businesses and clear profit models to inject stability into the Hong Kong stock market.

In fact, the impact of different types of companies going to Hong Kong for secondary listing has obvious industry differentiation characteristics:

1. New energy and high-end manufacturing

Secondary listing not only enhances the international financing capabilities of leading companies, but also accelerates the process of capacity expansion. For example, most of the funds raised by CATL will be used for the layout of overseas battery factories. Technology-intensive companies can more easily attract international industry chain partners through the Hong Kong stock platform and obtain cross-border mergers and acquisitions and technology cooperation opportunities. In addition, the Hong Kong stock market has a relatively loose valuation for growth industries. In 2025, the average price-earnings ratio of the new energy sector will be 15%-20% higher than that of A shares.

2. Biopharmaceuticals

Hong Kong stock financing is conducive to the internationalization of research and development and overseas mergers and acquisitions of enterprises, and can supplement the insufficient liquidity of A-shares affected by policies. In 2025, the average fundraising amount of Hong Kong-listed pharmaceutical IPOs was 30% higher than that of A-shares. Although Hong Kong stock investors have limited tolerance for innovative drug companies that have not yet made a profit, and some companies "broke the issue price" on the first day of IPO, it does not affect the successful listing of these companies on the Hong Kong stock market.

3. Technology and Internet

Secondary listing in Hong Kong has become the mainstream choice for US-listed Chinese stocks to avoid delisting risks, while retaining the ability to raise funds in US dollars. Internet companies can use the Hong Kong stock platform to expand into emerging markets such as Southeast Asia. Although the liquidity of the Hong Kong stock technology sector is lower than that of the US stock market, with an average daily trading volume of only 1/5 of that of the US stock market, it has also achieved the main goal of "returning".

4. Consumption and Retail

Listing on the Hong Kong stock market helps the internationalization of brands, enhances overseas visibility, and supports cross-border mergers and acquisitions and global channel construction. International capital favors the theme of China's consumption upgrade. In 2025, the proportion of foreign holdings in Hong Kong-listed consumer companies will reach 42%. The requirements of international investors for ESG ratings and high dividend rates have also promoted the continuous self-improvement of these domestic companies.

5. Finance and real estate

The financial industry benefits from the low financing costs and stable valuations of Hong Kong stocks. Compared with A-shares, the financing cost of Hong Kong stocks is 0.8% lower on average. However, mainland real estate companies face great pressure to raise funds in Hong Kong, because the average price-to-book ratio of Hong Kong stocks in 2025 is only 0.3 times. Although it is difficult to achieve efficient refinancing, it also retains a window for listing.

Obviously, in general, whether for the Hong Kong stock market or for domestic companies that go to Hong Kong for IPO, the recent spring tide of Hong Kong stocks has given more opportunities. So what about the majority of investors?

Second, what opportunities does the warm current of Hong Kong stocks bring to domestic investors?

Looking forward to the second half of the year, it is expected that the Hong Kong stock IPO will continue to be a hot trend, and AI chips, biopharmaceuticals, and "Belt and Road" related companies may become the new round of "trendsetters". With the continuous optimization of policies and the continued southward flow of domestic funds, the Hong Kong stock market is ushering in a "golden age". However, how should domestic investors seize this opportunity? 1. Is it a sure win to buy new shares in Hong Kong stocks? When it comes to the IPO boom, domestic investors will definitely think of buying new shares in Hong Kong stocks first, because under the protection of China's issuance mechanism, buying new shares in A shares has long been synonymous with "guaranteed profits". It is difficult to get a new share subscription, and the winning rate is usually only about one in ten thousand. In addition, A shares are still dominated by retail investors. Following the trend and speculating on new shares is one of the "fine traditions" of the A-share market. According to statistics from Eastmoney.com, the average increase on the first day of listing of new shares in the past five years was about 120%. The lucky investors who won the lottery for new shares really made money.

However, Hong Kong stocks are different, because there is no regulation on the pace of IPO issuance, and there is no official guidance on the issue price. Therefore, the issuance of new shares is based on the market, and the issue price is basically in line with the trading price in the secondary market. There is no limit on the increase or decrease in transactions, and the capital participation in the entire market is also dominated by institutions. Therefore, according to data from the Hong Kong Stock Exchange, the average increase on the first day of listing of new shares in the past five years was only 2.1%, and the break-even rate was about 35%.

If investors actively and blindly participate in Hong Kong stock IPOs based on the perception of "new shares are a sure win" established in A-shares, then the final loss of money is not a small probability event.

2. Using the premium of A/H to arbitrage?

According to data from Eastmoney.com, overall, 80% of the secondary listed companies have lower Hong Kong stock prices than A shares, with an average discount rate of 15-20%. The discounts in industries such as semiconductors and securities are more significant, reflecting the differences in liquidity and investor structure between A shares and Hong Kong shares. Many investors immediately think of selling A shares and buying the same H shares. Today, when Hong Kong stocks and Shanghai and Shenzhen A shares have long been connected for trading, such operations seem to be able to arbitrage properly.

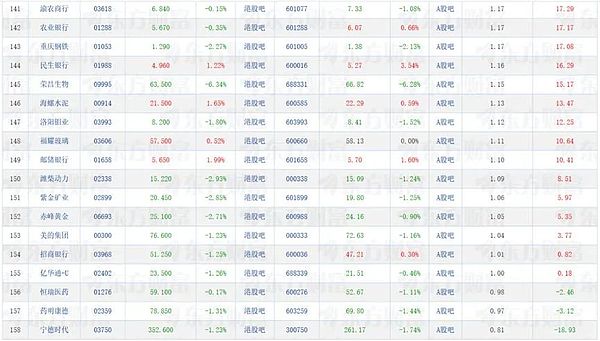

However, historical experience has ruthlessly told us that this is a dead end. Please see the following data:

Data source: Eastmoney.com

Before the free convertibility of capital between RMB and HKD can be achieved, the price difference between A shares and H shares will exist for a long time. From the above figure, ten years after the opening of northbound and southbound transactions between Hong Kong stocks and the Shanghai and Shenzhen markets, the premium between A shares and H shares has not narrowed, but the overall trend is expanding. At the beginning of 2014, the overall stock prices of A shares and H shares were almost the same, but then the premium of A shares relative to H shares gradually expanded, with the highest being 160% at the beginning of 2024 (A shares are 60% more expensive than Hong Kong stocks). The strategies launched by many international investment banks and private banks based on the opening of Hong Kong stocks and A shares to arbitrage by taking advantage of the price difference between the two markets have long since failed.

Looking to the longer term future, how should mainland investors seize the investment opportunities in Hong Kong stocks?

I think the basic principle is: high cost performance is the hard truth!

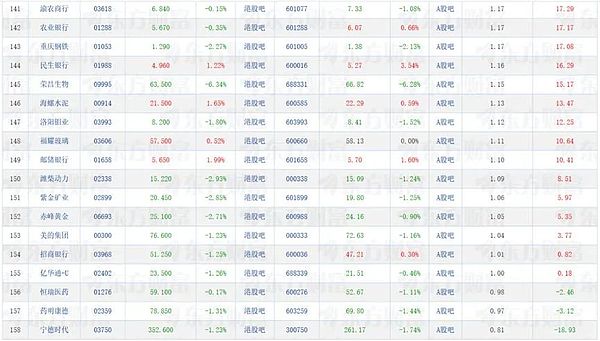

The following is a list of companies with the largest A/H share price gaps. The A-share price of the company with the largest price gap is about three times that of the H-share:

Data source: Eastmoney.com

Obviously, A-shares currently give super-high valuations to the policy dividends of the Science and Technology Innovation Board and the narrative of domestic substitution, while also giving a high tolerance to loss-making and non-profit companies. At the same time, due to their insistence on speculation on new stocks, small-cap stocks, and concepts,

text="">"glorious tradition" and give high valuations to related companies. However, ordinary investors who have participated in the speculation of these A-shares for a long time are rarely winners. Investors in Hong Kong stocks are not too interested in the pricing characteristics of such A-shares.

Hong Kong stocks are mainly participated by institutional investors, and funds come from all over the world. They generally favor large companies with real profitability, good development prospects, and leading companies in various industries.

However, the recent premium of A shares over H shares has narrowed significantly, mainly because the proportion of southbound funds in the Hong Kong stock market has increased, slowly realizing the bold words of domestic analysts who shouted five years ago"cross the Hong Kong River and regain pricing power". The style of Hong Kong stocks is becoming more and more A-share-like; and, as the domestic RMB real interest rate level slowly declines, institutional funds (such as insurance funds) that used to be mainly allocated to fixed-income bonds need to find investment products that can pay high dividends every year to replace them. Therefore, mainland bank stocks listed on the Hong Kong stock market, which pay stable dividends every year and are significantly cheaper than A shares, have become the first choice for these institutional funds to replace bond allocations. Therefore, we have seen that mainland bank stocks have continued to lead the Hong Kong stock market in the past year.

Data source: Eastmoney.com

From the above table, the companies with similar stock prices between Hong Kong and A-share listed companies are domestic industrial, consumer, pharmaceutical companies and hard technology companies. These companies are operating steadily, with large market caps, rich profits, and generous dividends. Some of them even have the "abnormal phenomenon" that the price of H shares is higher than that of A shares. For such companies, if the price of H shares is significantly lower than that of A shares, it is a good opportunity for domestic investors to participate in the long term for the purpose of obtaining dividends.

Overall, the current valuation level of H shares is still about 30% lower than that of A shares. As the Hong Kong Stock Exchange continues to optimize listing rules and expand the scope of Hong Kong Stock Connect, it is expected that more A-share leading companies (especially new energy, pharmaceuticals, hard technology, etc.) will accelerate their listing in Hong Kong, allowing the Hong Kong stock market to better represent the strength of the Chinese economy, and will also provide investors with more opportunities for Hong Kong stock investment targets with higher cost-effectiveness.

Weatherly

Weatherly