Author: Thejaswini MA Source: Token Dispatch Translation: Shan Ouba, Golden Finance

In 1688, captains would gather in Edward Lloyd’s Coffee House in London, looking for people willing to insure their voyages. Wealthy merchants would sign their names under the details of the ship to become “underwriters” and use their personal wealth to support these high-risk voyages.

The more prestigious the underwriter, the safer the voyage for everyone. The safer the system, the more business it can attract. The logic is simple: provide capital, reduce overall risk, and share profits.

Seeing the new guidance from the U.S. Securities and Exchange Commission (SEC), it is clear that the crypto industry is actually digitizing the underwriting model in those coffee houses - people earn returns by putting their assets at risk, while also making the entire system safer and more trustworthy.

Pledge. Yes, it’s back.

What happened on May 29, 2025?That’s when the U.S. government made it clear that staking won’t get you in legal trouble. First, let’s review why this issue is particularly important right now.

In staking, you lock up your tokens to help keep the network running and earn a steady return.

Validators use their staked tokens to verify transactions, propose new blocks, and keep the blockchain running. In return, the network pays them with newly minted tokens and transaction fees.

Without stakers, proof-of-stake (PoS) networks like Ethereum would collapse.

In the past, you could stake your tokens, but no one knew if the SEC would come knocking on your door one day and say you were conducting an “unregistered securities offering.”

This regulatory uncertainty has left many institutions on the sidelines, watching retail stakers earn 3-8% annual returns.

An Epic Staking Frenzy

On July 3, the Rex-Osprey Solana + Staking ETF went live, becoming the first crypto ETF in the U.S. to offer staking returns. The fund holds SOL through a Cayman subsidiary and stakes at least half of it.

“The first U.S. staking crypto ETF,” Rex Shares announced.

And they’re not alone.

Robinhood launched crypto staking for U.S. users, starting with Ethereum and Solana. Kraken added Bitcoin staking via Babylon Protocol, allowing users to earn returns on the BTC main chain. VeChain launches $15 million StarGate staking program. Even Bit Digital is dumping all Bitcoin mining to focus on Ethereum staking.

What’s Changing?

Two Regulatory Dominos

First, the SEC’s guidance on staking, released in May 2025.

It says that if you stake your own crypto to help run a blockchain, that’s perfectly fine and is not considered a venture investment or a security.

This covers staking alone, delegating your tokens to others, or staking through a trusted exchange, as long as your staking behavior directly helps the network grow. This will remove most staking from the definition of an “investment contract” under the Howey test. This means you no longer have to worry about accidentally violating complex investment laws simply by staking and receiving rewards.

The only red flag here is when someone promises guaranteed profits, especially when mixing staking with lending, or issuing fancy terms like DeFi bundles that guarantee returns or yield farming.

Second, the CLARITY Act.

This is a proposed law in Congress that would clarify which government agencies are responsible for different digital assets. The proposal is designed to protect users who simply run nodes, stake, or use self-hosted wallets from being treated like Wall Street brokers.

The bill introduces the concept of "investment contract assets," a new category of digital commodities, and sets standards for when digital assets are regulated as securities (by the SEC) or commodities (by the CFTC). The bill establishes a process for determining when a blockchain project or token is "mature" and can be transferred from the SEC to the CFTC for regulation, while also setting time limits for SEC reviews to prevent indefinite delays.

What does it mean for you?

Because of the SEC's new guidance, you can now stake cryptocurrencies in the United States with greater confidence. If the CLARITY Act is ultimately passed, the environment for staking and crypto participants will become clearer and more secure.

Of course, staking rewards are still taxed as ordinary income when you earn "sovereign control"; if you sell these rewards later, you will also have to pay capital gains taxes. All staking income, no matter how much, must be reported to the IRS.

Who is in the spotlight? Ethereum

What about the price? Still around $2,500.

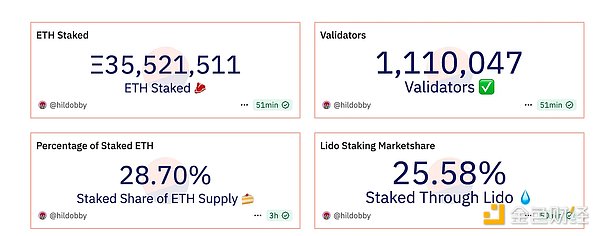

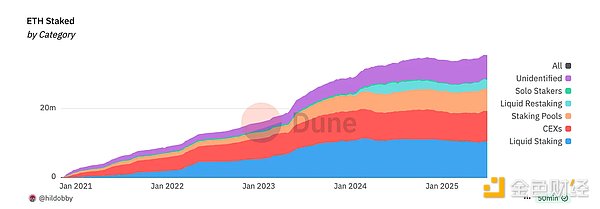

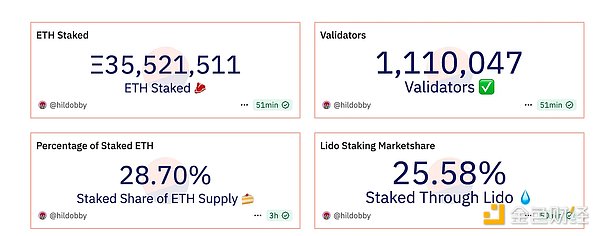

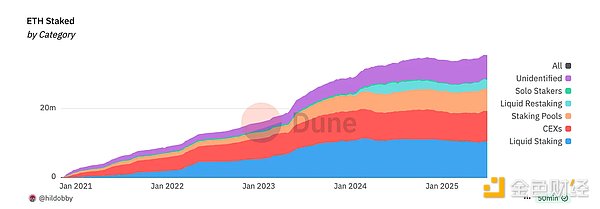

The price performance is not eye-catching, but Ethereum's staking indicators have changed significantly. The amount of ETH staked just hit a new all-time high of over 35 million, nearly 30% of the total in circulation. While this accumulation has been going on for many months, in today’s environment, all of this infrastructure suddenly makes a lot of sense.

What happened in corporate boardrooms?

BitMine Immersion Technologies just raised $250 million to buy and stake Ethereum, with Fundstrat’s Tom Lee as chairman. The company is betting that staking rewards, coupled with potential price appreciation, will outperform traditional corporate money management assets.

SharpLink Gaming doubled down on this strategy, expanding their Ethereum reserves to 198,167 and staking 100% of their holdings. In one week in June alone, they made 102 ETH from staking. Just by locking up, there’s “free money.”

Meanwhile, Ethereum ETF issuers are lining up for staking approval. Bloomberg analysts estimate that there’s a 95% chance that these staking ETFs will receive regulatory approval in the coming months. BlackRock’s head of digital assets called staking “a giant leap” for an Ethereum ETF, and he’s probably right.

If approved, these staking ETFs have the potential to reverse the outflows that Ethereum funds have seen since launch.

Crypto is speaking the language that Wall Street understands

For years, traditional finance has struggled to understand crypto’s value proposition. Digital gold? Maybe. Programmable money? It sounds complicated. Decentralized applications? What’s wrong with centralized ones?

But yields? Wall Street understands yields.

Sure, Treasury yields have rebounded from near zero in 2020, with the 1-year Treasury back around 4%. But a regulated crypto fund that can generate 3-5% annual staking returns with potential upside in the underlying assets? That looks very attractive.

It’s about legitimacy. When pension funds can buy Ethereum exposure through a regulated ETF and earn a return on helping to secure the network, that’s a big deal.

The network effect is already visible. As more institutions participate in staking, the network becomes more secure; as the network becomes more secure, it attracts more users and developers; increased adoption leads to higher transaction fees, which in turn increase staking rewards. It’s a virtuous cycle that benefits all participants.

You don't need to understand blockchain technology or believe in decentralization to appreciate an asset that "pays you for holding it." You don't need to believe in Austrian economics or distrust central banks to understand that this asset is "productive capital." You just need to understand that the network needs security, and security providers should be paid.

Weiliang

Weiliang