Author: @mattigags, @long_solitude Translator: LlamaC

The crypto industry is at a critical turning point. While governments and large enterprises are embracing Bitcoin and stablecoins, the broader crypto space is wavering between the skeuomorphic narrative of the "blockchain world" and the trap of financial degradation, leading to a stalemate in the industry's internal narrative.

The following content explores the evolution of the crypto narrative, building on previous definitions of the vision for Bitcoin, Ethereum, and other crypto assets. We aim to clarify the perceived disagreement between Bitcoin and "other cryptocurrencies," analyze the respective visions of Bitcoin and Ethereum, and speculate on possible future developments. The words "vision" and "narrative" will be used interchangeably in this article because their meanings largely overlap.

Bitcoin as a Standalone Category

To describe the evolving nature of Bitcoin’s narrative, Nic Carter and Hasu categorized Bitcoin visions into the following categories in 2019:

Electronic cash proof-of-concept

Inexpensive peer-to-peer payment network

Censorship-resistant digital gold

Private and anonymous darknet currency

Reserve currency for the cryptocurrency industry

Programmable shared database

Non-correlated financial asset

Nevertheless, a subset of Bitcoin developers continues to push the vision of a programmable shared database (6.), as evident in the surge of Ordinals and Layer 2 development that began in 2023. These developments are largely modeled after innovations already occurring outside the Bitcoin ecosystem, such as the popularity of NFTs and DeFi on Ethereum in 2020 and 2021.

In short, what makes Bitcoin different from other cryptocurrencies is that its popularity relies on narrative recognition rather than technological innovation. It is based on the defensive nature of money and finance, rather than the novel financial and commercial applications that often lead to the so-called "degeneration" phenomenon in the broader crypto space.

Is Bitcoin still the reserve currency in the crypto industry? Given that "most other people in crypto" appear to be under-investing in Bitcoin and that there's no truly trustless way to use it in decentralized finance, we can assume this trend is weakening, with Bitcoin gradually separating from other cryptocurrencies and becoming defined as a distinct category. How has the Bitcoin narrative evolved since 2018? Let's analyze the three narratives that will dominate 2025 and their origins. Michael Saylor's strong debut in early 2021 ushered in the era of Bitcoin as permissionless leverage. Although quickly overshadowed by the NFT craze, (3,3) Ponzi economics, and the overall crypto market surge of 2021, this marked the initial starting point for the financialization of Bitcoin. The post-FTX downturn briefly interrupted Bitcoin's rise as a new asset class, but it didn't halt it. This process culminated in the launch of spot ETFs and the widespread adoption of Microstrategy's financial strategies. A pro-cryptocurrency US government further accelerated market enthusiasm. Whether it's a fringe Pascal's Wager or a high-conviction allocation, Bitcoin is now considered a normal part of a diversified financial portfolio. Once considered an investment quirk, allocating 1-2% of funds to Bitcoin has now become a highly leveraged, highly correlated asset, being bought en masse to compensate for past portfolio misallocations. The extent of Bitcoin's uncorrelation is questionable, as it outperforms only in generally risk-on environments (and underperforms in risk-off environments, such as 2022). Perhaps "eccentric" is a more apt description than "uncorrelated." Saylor's strategy aligns with our thinking. Bitcoin has evolved from a non-correlated asset to a permissionless leveraged instrument. This may not be the future envisioned by early Bitcoin holders, but what is certain is that Bitcoin, packaged as a stock-like financial instrument, has become a major avenue of adoption. Censorship-Resistant Digital Gold (Trusted Neutral Asset) Some argue that Bitcoin is more like gold. Financial opinion leader Ray Dalio is one proponent of the Bitcoin-as-digital-gold vision. While Saylor rides the wave of permissionless leverage, Dalio promotes the idea of Bitcoin as a commodity anchoring a new monetary system. We can debate the extent to which current Bitcoin accumulation is driven more by the acquisition of permissionless leverage than by a genuine belief in Bitcoin as a safe haven. The two are both different and similar. One clear sign is the old saying, "Not your keys, not your coins." In our view, several recent moments have made the vision of digital gold even clearer. One was the collapse of Silicon Valley Bank in 2023 and Bitcoin's subsequent rally. Another was "Liberation Day," Bitcoin's significant strength relative to other asset classes like stocks. Virtue isn't a driver of scalable adoption; greed is. What can be interpreted as greedy behavior at an individual level can translate into a superior monetary system at scale. Permissionless leverage is the means to achieve this new monetary system. Censorship-resistant digital gold is the purest expression of Bitcoin's technological innovation. As the peer-to-peer payments narrative fades, the store of value (SoV) element is often favored by more philosophically inclined investors, though it is likely to take a back seat to Bitcoin's financial attributes. Despite this, there remains a strong belief that every nation will hold its own Bitcoin reserves, consistent with Bitcoin's once-potential technological promise to drive the world monetary order. That said, as Bitcoin accumulates implicit leverage, some could argue that this makes it less attractive to central banks. Perhaps this vision is more aligned with other cryptocurrencies, as it suggests Bitcoin can be scaled beyond its technological purity. The January 2023 trading activity of Ordinals reignited discussion of a more general database approach, furthering the broader idea of Bitcoin's programmable shared database. This also triggered a mini-boom in Bitcoin's Layer 2 (L2) development. By 2024, we might be able to count 50 to 100 L2s (perhaps not as many as today), with varying degrees of relevance to Bitcoin. We can assume its overarching mission is to enable permissionless Bitcoin finance, and how well it achieves this goal is left to the reader's discretion. While this vision is somewhat ancillary to the previous two, it still exists. Ethereum: Circular Arbitrage for the World Computer? Some might argue there's no second place, but by market capitalization, Ethereum is second. As with Bitcoin, we are expanding on our previous research on Ethereum’s vision.

Ethereum’s Vision

https://tokeneconomy.co/visions-of-ether-590858bf848e

This lays the foundation for our narrative:

1. Bitcoin 2.0

2. Decentralized Applications / World Computer

3. Decentralized Autonomous Organizations

4. Crypto Crowdfunding (ICOs & Security Token Offerings)

5. Utility Tokens & Collectibles

6. Open Finance (On-Chain Finance / Decentralized Finance)

Ethereum's narrative is more complex and nuanced than Bitcoin's, largely due to its greater plasticity. For simplicity, we've focused on the categories defined in November 2018 (with one new one added at the end).

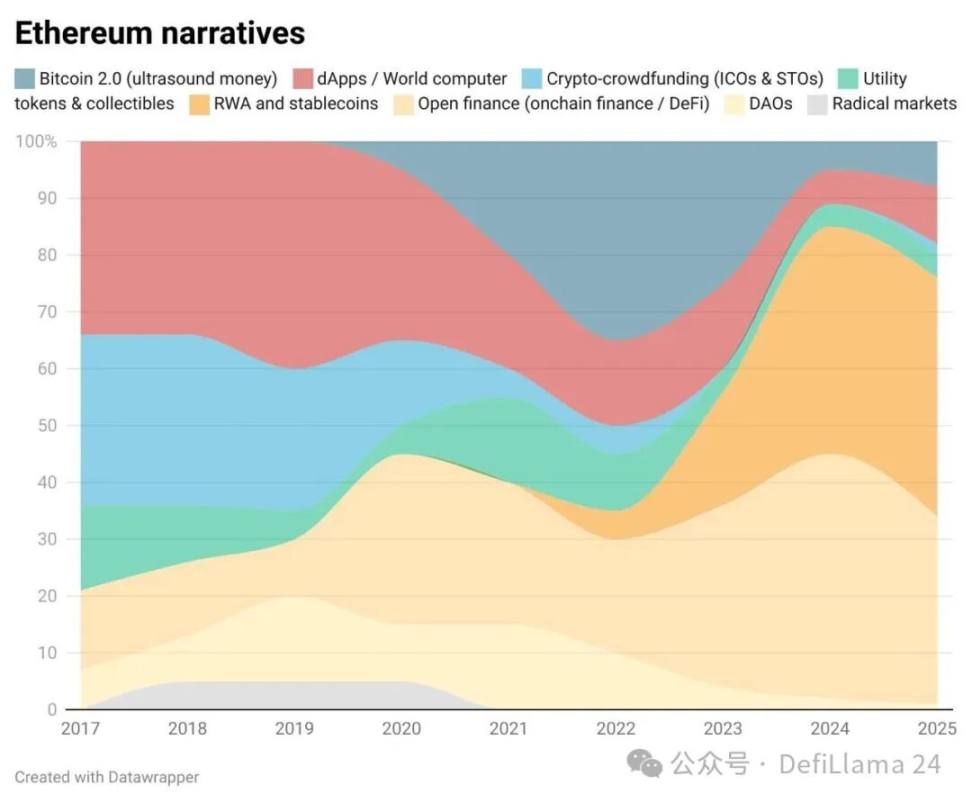

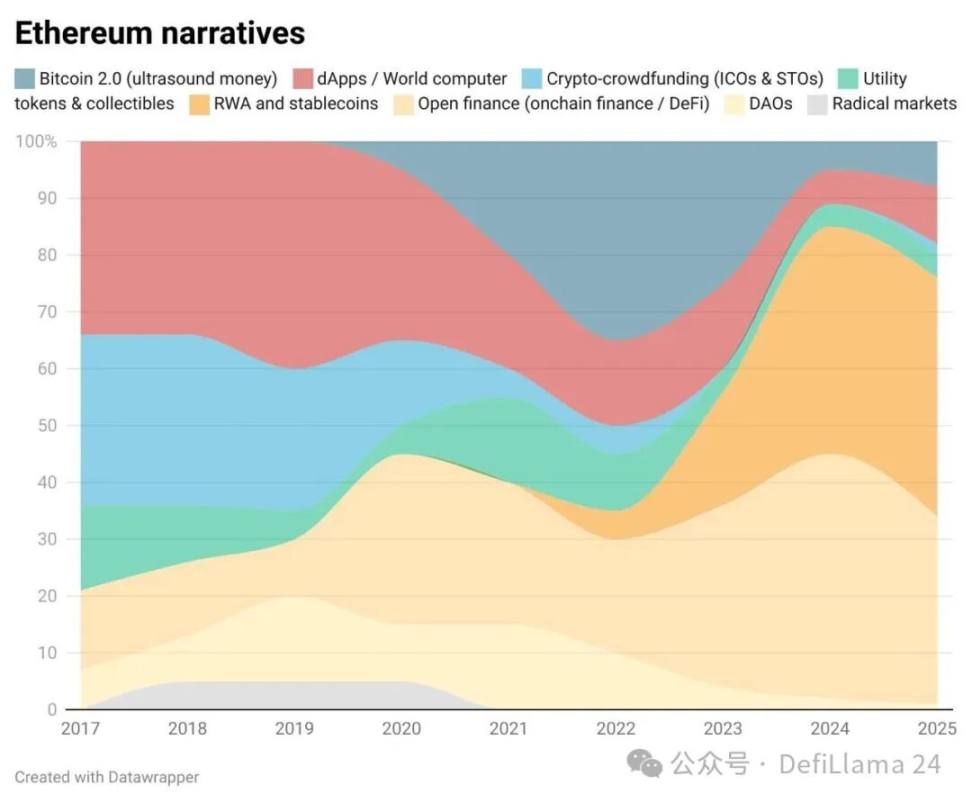

The vision of radical markets has largely faded in crypto circles. The Bitcoin 2.0 vision has been repackaged as "ultrasonic money," but aside from becoming a podcast slogan, it has never truly materialized. Over the years, Ethereum's focus has shifted from abstract technological utopias to the concrete practices of on-chain finance, or DeFi (known as open finance in 2018).

In terms of price and attention, Ethereum reached its peak in 2021. The vision of the pet rock flip also reached its peak around that time. But by 2025, we can say that over the past four years, Ethereum has gone from competing with Bitcoin to (relatively speaking) losing popularity to Solana in attracting new entrants. Even today, it is following in Bitcoin's footsteps as a channel for permissionless leveraged access through Saylor's Treasury Company strategy. Has Ethereum really been relegated to being just a "second best" option? Beyond that, DeFi and the tokenization of real-world assets (RWAs) seem to be narrative opportunities for Ethereum, and the Ethereum Foundation seems to be driving the resurgence of the world computer. 1. Bitcoin 2.0 (Ultrasonic Currency) With Ethereum's transition to Proof-of-Stake (PoS) and the implementation of EIP-1559, the Ethereum community sees an opportunity to create a deflationary token. Unlike Bitcoin's fixed supply, Ethereum's supply decreases over time (due to fee destruction), resulting in a higher monetary premium than Bitcoin. This could be the key to Ethereum's potential to surpass Bitcoin. For a period following the 2022 merger, ETH was indeed deflationary. But this changed abruptly in April 2024 with the Dencun upgrade, which effectively reduced the cost of settling rollups on Ethereum. Since then, ETH's net issuance has continued to grow. For Ethereum to reclaim its narrative as an ultrasonic currency, it needs both growth in the number of Rollups (which it has already achieved) and increased transaction activity on them (which has not yet reached a sufficient level). In other words, it needs to become the backbone of a world computer composed of Rollups, and demand for its block (blob) space needs to increase. 2. Decentralized Applications / World Computer Ethereum's original vision—the world computer—began to fragment in 2021 with the proliferation of Rollups. As the execution layer migrated to Layer 2 networks, Ethereum's role became increasingly blurred. It became clear that the cost of transacting on the mainnet was too high for most users. The world computer (execution) became the world database (data availability and settlement). The fees the world computer earned from selling block space to Rollups were insufficient. As founders and others realized that the monetary premium of their tokens was tied to the fees of the execution layer, we saw a surge in Layer 2 (L2) networks launching. Ultimately, leading DeFi applications also began launching their own blockchains, as owning a customized execution environment was the most advantageous option for them to better serve their users and retain the majority of the revenue. While no longer a world computer per se, Ethereum is now positioning itself as the infrastructure layer for the world computer (composed of L2). To achieve this, it needs to reduce protocol complexity and improve performance through both vertical and horizontal scaling. Cyber Fund calls Ethereum the root chain of the world computer. 3. Decentralized Autonomous Organizations (DAOs) The DAO has become a broad term, meaning many different things (and sometimes nothing at all). It's hard to say whether it's fulfilling its original design goals. Perhaps during the 2021 price boom, people were incentivized to vote, but as the novelty wore off and prices fell, DAOs remained ill-defined organizations, sometimes leading to punitive legal consequences for participants. Some DAOs, like Aave, have fared better than others. In some cases, DAOs have become tools for founders to pursue their own (often dubious) goals under the guise of community governance. DAOs have largely become a buzzword. Perhaps this is a necessary stage for these on-chain organizations to mature, but for now, they remain a persistent presence in the crypto world. 4. Crypto Crowdfunding (ICOs and STOs) Permissionless capital formation remains one of the most influential features offered by cryptocurrencies, and Ethereum in particular. Its scope is vast, encompassing all of Ethereum's legacy and emerging visions—open finance, collectibles, and the world computer. From purchasing the Constitution in 2021, to funding science a few years later, to hosting one of the largest ICOs in history this June, Ethereum has consistently pursued these goals. Security token offerings (STOs) have never truly taken off in most jurisdictions due to unclear terminology. We believe that today's STOs fall into the category of RWAs (Real World Assets), with varying degrees of access to and rights to the underlying assets. We will further elaborate on RWAs below. 5. Utility Tokens and Collectibles Some jokingly say that "useless tokens" are a more apt term than "utility tokens." We can conclude that ERC-20 utility tokens have two primary uses: to increase in value; and to stake to prevent the value from falling. Seriously, the actual utility of a token is to earn higher financial returns (whether native or otherwise) through staking. For example, staking Ethena tokens allows for higher yields on USDe; Pendle has a similar mechanism, using vePENDLE. This mechanism, much like some centralized exchange tokens like BNB, allows you to stake for exclusive access to pre-TGE opportunities. Thus, token utility becomes a barrier to entry through staking, but to this day, staking rarely carries risk (with some exceptions, such as Aave's stkAAVE). While the original "Ethereum's Vision" article lumped utility tokens with collectibles, it quickly became clear that they were on separate paths. In particular, in 2021, NFTs went mainstream with the inclusion of celebrities and brands. While utility tokens haven't experienced similar success, they haven't experienced the same decline as NFTs and may have even performed better to this day. Since the 2021 craze, NFTs have underperformed by any objective standard. We believe this is primarily due to the replacement of non-fungible cultural collectibles with fungible cultural collectibles—memecoins. More recently, collectibles and content have also been launched as fungible ERC20 tokens to cater to trader demand. A small group of people remain convinced that owning NFTs and tokenized creator content can monetize culture. Despite widespread public acceptance in the past few years, on-chain creator culture has never completely disappeared. Perhaps this niche area will grow with the wealth effect driven by Ethereum. Whether this use case can expand to a wider audience remains to be seen. In 2021, the sector suffered a setback as NFT prices reached rock-bottom levels, becoming unaffordable for new entrants. By 2025, on-chain culture was defined by fragmented tokens. 6. Open Finance (On-Chain Finance / Decentralized Finance) In the summer of 2020, Ethereum's dominant narrative hailed ETH as the anchor of a new financial system. This hubris spawned DeFi yield Ponzi schemes, stress-testing the concept. Following the subsequent disillusionment, some DeFi protocols have become important hubs for on-chain liquidity, garnering attention and revenue. TVL is largely used to justify Ethereum’s continued existence against faster, cheaper, and more popular public blockchains like Solana. While the majority of trading volume (both spot and perpetual contracts) is no longer on Ethereum, Aave’s money market TVL has reached an all-time high of over $35 billion, comparable to the value of customer deposits held by the largest fintech companies like Revolut. Until the 2024 US election, DeFi appears to remain a proven but small segment of capital markets. By 2025, as policy changes gain momentum, DeFi concepts and tokenization begin to become fundamental to the regular fintech banking experience, and centralized cryptocurrency exchanges have transformed into new types of banks. 7. Radical Markets This brief narrative, while no longer relevant, cleverly highlights Ethereum’s more socialist leanings compared to Bitcoin. While some of the concepts (like Harberger taxes) are appealing, they’ve largely disappeared from the current narrative, instead being applied to areas like ENS name allocation or Gitcoin funding (via quadratic funding). 8. RWAs and Stablecoins This is a separate narrative we've added ourselves, as stablecoins have been hailed as the only or most prominent product-market fit in crypto for some time (dating back to Stripe's acquisition of Bridge). Some argue that stablecoins fall under the umbrella of open finance, but for the most part, these are exogenous assets issued by centralized entities whose primary users (populations in countries with limited access to US dollars) are distinct from the native on-chain users who use DeFi every day. Early adopters of stablecoins were cryptocurrency traders, followed by populations in developing economies (Southeast Asia and Latin America), and now, it seems, is finally the turn of states and financial intermediaries as they recognize the equivalence of stablecoins to the eurodollar system (stablecoins are repackaged versions of US debt). While the founders (and Blackrock) have been trying to tokenize the world's diverse assets—from stocks to luxury watches, uranium, and real estate—perhaps the biggest beneficiaries of tokenization aren't the niche assets we've long considered, but the largest, most liquid assets (Treasuries and the US dollar). Those that seem least in need of tokenization. Ethereum, demonstrating greater decentralization and maturity than other layer-one blockchains, aspires to become the default choice for issuers of the world's largest assets. Because many of these tokenized products will require some form of KYC or custody, they don't truly fall under the umbrella of Open Finance, but rather exist on a spectrum. By 2025, we can call this vision "crypto simplified to fintech." Recently, we've seen stablecoin issuers (Tether, Circle, Stripe) choose to launch their own blockchains in order to capture the majority of the value and define the user experience. Stablecoins for payments (cheaper, faster) are the single most important use case for cryptocurrency, and we're seeing it accelerating very rapidly.

Other Aspects of Crypto

After we've detailed the development of the most important and established assets—ETH and BTC—we can now look beyond the focus on a single asset and examine other narratives. Below, we'll delve into narratives that have gained traction over a period of one or two cycles.

These narratives may be tied to a specific asset, but they're not limited to any one. These visions evolved over the course of Bitcoin and Ethereum's development, as nothing happens in isolation. Yet, they are identifiable trends encompassing the broader altcoin ecosystem. (Is Ethereum an altcoin? Do major cryptocurrencies even exist? What are they?) Web3 is a broader term for the "world computer," a buzzword that became popular in 2021. The vision of Web3, hinting at a decentralized internet, overlaps somewhat with the NFT craze and can be best summarized by Chris Dixon's abstraction of "Read, Write, Own"—three words that describe three eras of the web. At the peak of the Web3 narrative in 2021, the idea of "ownership" permeated everything—money, finance, social networking, gaming, content, and culture. As prices fell the following year, it seemed that ownership of money (and, by extension, finance) remained fundamental. Perhaps the description and narrative of Web3 is so broad that it represents everything and nothing at once. This is true of many buzzwords. Yet by 2025, aside from Polkadot (which itself has become irrelevant), no one is talking about Web3 anymore. Casinos (memecoins) Perhaps in response to the reshaping of market structure after the frenzy of 2021, cryptocurrency traders accustomed to easy multi-bagger returns need to find new ways to extract capital from the scarce number of new entrants. As arbitrage from private placements to secondary markets disappears under the pressure of an endless supply of VC tokens, memecoins are gaining popularity. Whereas holders once believed in specific visions (like the "world computer"), now they simply need to "believe in something." This roughly equates to believing in nothing beyond price action. To cater to the old expectations of crypto participants for generational wealth, a new narrative emerged. What better way to do that than to buy a token with meme-related graphics, free from the selling pressure of nefarious venture capitalists? This led to the belief that the sole purpose of cryptocurrency was to accumulate wealth through speculative trading of memecoins. The massive profits earned by memecoin creators reinforced this view. However, as memecoin mania reached its peak, the US President launched his own memecoin, inadvertently shaking this belief and opening the door to a different narrative. A faster and lower-cost blockchain. Everyone loves a good comeback story. When most investors looked for the next Solana in the early summer of 2023, they didn't realize that Solana itself was the Solana of the next bull cycle. From the ashes of the FTX crash to a new all-time high two years later, Solana rose like a phoenix from the ashes. In its darkest moments, even the staunchest Ethereum supporters succumbed and jumped on the Solana bandwagon. Leveraging a fast and low-cost memecoin dispenser, the chain gained renown as a business-focused chain and spearheaded new user acquisition. Catering to users became paramount. Decentralization became an undesirable virtue. Following this line of thought, numerous general-purpose L1s emerged: Aptos, Sui, Sei, Berachain. More are to come. Given that perpetual swap exchanges are the most profitable business in crypto, it's no surprise that an L1 specifically optimized for this use case would emerge. dYdX, GMX, Drift, Kwenta, Aevo, and Perpetual Protocol all attempted to outperform one another in user experience and execution efficiency, but few achieved this through their own custom execution environments. Even fewer achieved lasting success. Then came Hyperliquid. To date, Hyperliquid is the only platform capable of delivering execution capabilities similar to those of centralized exchanges, thanks to its proprietary virtual machine and consensus mechanism optimized for the single use case of perpetual contract trading. However, in this story, Hyperliquid's price performance is far more important than any technical details of the protocol. A faster and cheaper layer 1 network remains the key trade-off between success and failure. Decentralized Artificial Intelligence: The crypto market has become adept at observing global narratives and creating tradable representations of them on-chain. Following the launch of ChatGPT in the fall of 2022, the vision of decentralized AI took shape within months. The earliest beneficiaries were compute networks (such as Akash, Render, and similar infrastructure projects). Significant private capital has been raised to support decentralized AI model training, inference, and all related aspects. This was seen as an alternative to the dystopian vision of centralized AGI controlled by Big Tech. The launch of the GOAT token in the fall of 2024 breathed new life into the AI vision. This time, the application was even more intense, as intelligent agents were at the core, expected to accomplish everything. Platform X's feeds were filled with playful agents, appearing more real and relevant than the cold, impersonal decentralized infrastructure of the past. For a while, it was widely believed that intelligent agents would have their own wallets, buy groceries, successfully transact on-chain, and earn money. While this idea seemed premature last year, it may still be possible in the future. After all, besides cryptocurrency, AI seems to be the only enduring trend founders can rely on. In 2008, The New York Times named futarchy one of its buzzwords of the year. By 2024, it was inextricably linked to the US presidential election. Polymarket became a provider of information to traditional financial markets, predicting the election results hours ahead of mainstream news outlets. It felt like one of those moments when cryptocurrencies (Bitcoin, NFTs, stablecoins) went mainstream, when everyone realized their novelty. Interestingly, the form of futarchy that has become popular in crypto is all about trading and speculation, but has made no progress in decision execution (a stark departure from the original vision of futarchy by its founder, Robin Hanson). Perhaps if The DAO had never existed, futarchy could have been realized according to its original vision. Futarchy advocates for the elimination of the role of governance, while The DAO does the exact opposite. With the success of Polymarket, more and more projects are beginning to experiment with futarchy for governance on Ethereum and Solana. Since the articles that inspired this article were published, the total market capitalization of cryptocurrencies has grown from $300 billion to approximately $4 trillion. This is still a long way from the $100 trillion Kyle Samani promised at the time. However, the industry and environment we inhabit today are completely different. We live in a strange future, perhaps not exactly what the industry collectively envisioned in 2018, but still within the visions defined then. As those visions gradually become reality, can we expect at least another 10x increase? Changes are often not obvious while they're happening, only becoming clear in retrospect. From the flashy Ethereum Enterprise Alliance, ICOs, DeFi, and NFT Ponzi schemes, to the rise and fall of FTX, to BlackRock's tokenization of the world, it's been a rollercoaster ride. The crypto industry is filled with stories of unexpected failures and rebirths. The biggest question we face is: will crypto become a derivative of the existing financial system, swallowed by so-called traditional finance, or will it, as once promised, devour the entire financial system? So far, the crypto industry seems overly dependent on the words and deeds of governments and traditional financial institutions, straying from its original revolution. Is this the famous irony of mainstream adoption being indistinguishable from a bubble? Is this a reflection of the old Trojan Horse story? Are we entering a pivotal moment, as Perez sees it, as cryptocurrency moves from the Wild West of the "installation phase" to the more productive and value-dependent "deployment phase"? Or is this just a false moment of adoption, ultimately leading to a new round of disillusionment? Is cryptocurrency a revolution or a reformation? As we've seen, many of these narratives are intertwined or interdependent (Ethereum's ultrasonic currency versus the world computer, Bitcoin's uncorrelated asset versus digital gold). These are mostly flexible memes, not hard-coded visions. They evolve not in isolation but through interaction with each other and the broader community of holders and users, and are not immune to events in the outside world, but rather react to them. We like to quote McLuhan, noting that "nothing is inevitable if we are willing to think about what is happening." We believe, for the most part, that viewing new phenomena through the lens of old, fixed perspectives is a dead end. Crypto is a fundamentally new way to generate and exchange information. While it often has financial attributes, the changes it brings to the world, while perhaps not immediately apparent, will fundamentally alter the way we conduct finance and commerce. The more we interact with Bitcoin and the crypto world at large, the more profound our understanding of these visions becomes. "Fast gets all our attention, slow has all the power." Narratives are fickle.

Joy

Joy