Author: ChandlerZ, Foresight News

Over the past two years, RWA (Real World Assets) has become the most stable growth theme in the crypto asset market. The scale of US Treasury bonds, corporate bonds, and short-term yield products on-chain continues to expand, and the capital flow structure between DeFi and traditional finance has become predictable again.

A recent report from Standard Chartered Bank predicts that as DeFi becomes increasingly popular in payments and investments, the market capitalization of tokenized RWA (non-stablecoins) will exceed $2 trillion by the end of 2028, far exceeding the current $35 billion. Of this, tokenized money market funds and listed stocks may each account for approximately $750 billion, with the remainder consisting of funds, private equity, commodities, corporate debt, and real estate.

However, as the infrastructure of the first phase gradually improves, the industry faces a common question: where will the space for further expansion come from?

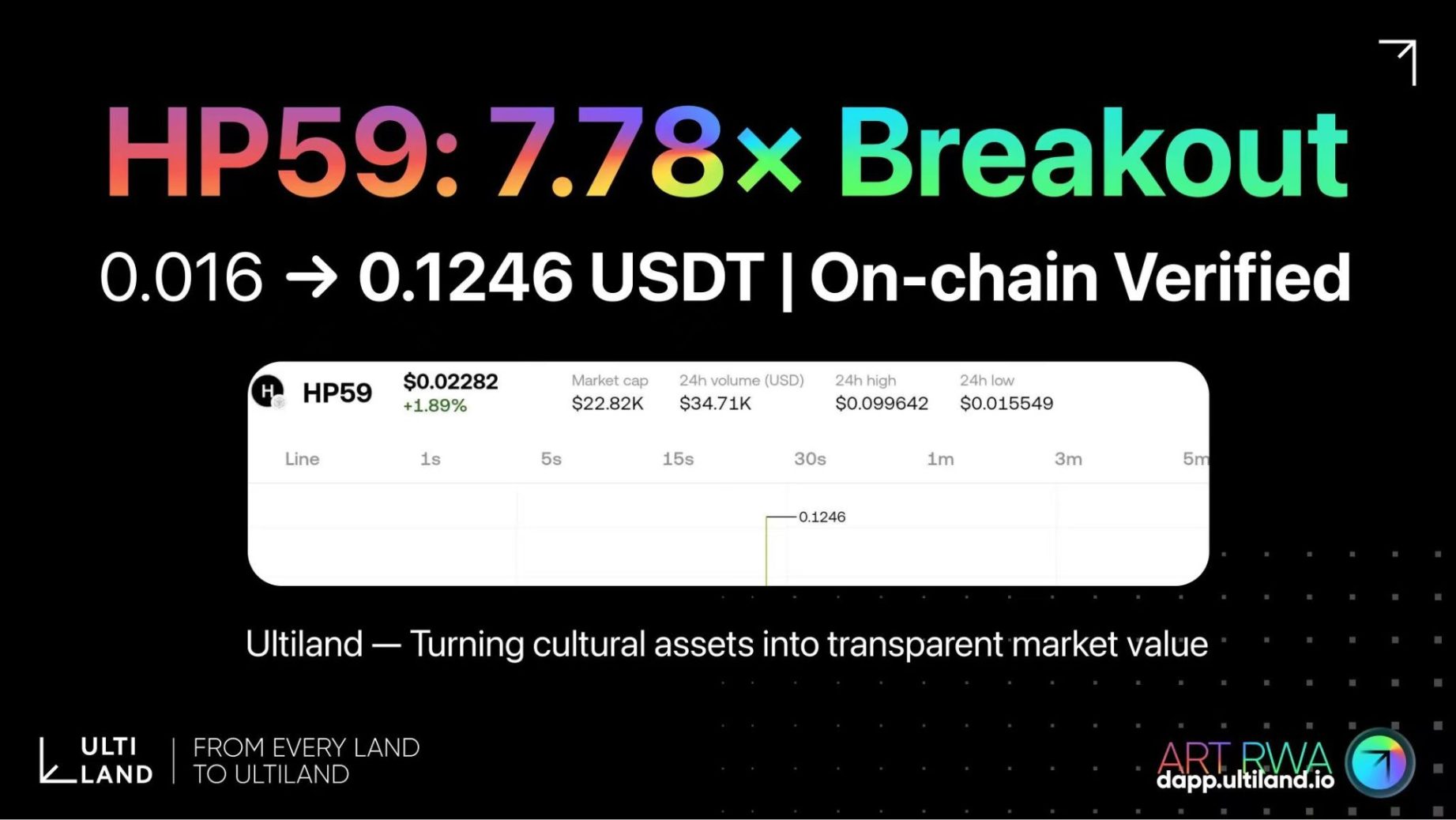

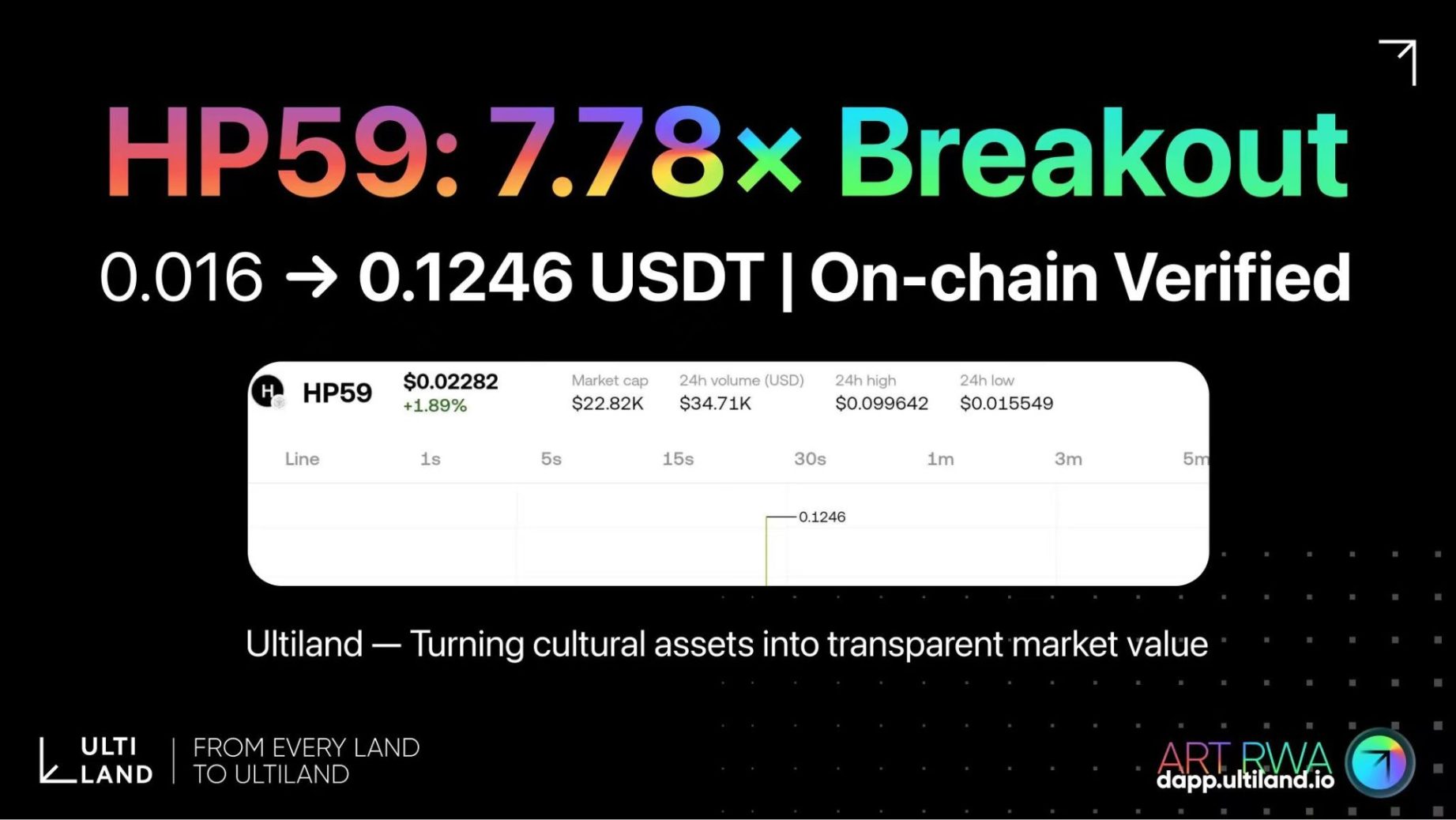

On-chain markets are essentially global liquidity pools, and cultural assets inherently possess cross-regional dissemination capabilities. Under this logic, the on-chain realization of cultural assets becomes possible. It does not rely on a single sovereign system, nor is it limited by the information structure of the traditional art market. Users are no longer merely viewers or collectors, but also participants in the value network. The boundaries between culture and finance are beginning to blur. The emergence of the Web3 creative asset platform Ultiland is based on this change. Ultiland is not positioned as a traditional art NFT platform, but rather as a "cultural asset tool." It starts with cultural assets such as art, IP, and cultural and creative content, establishing an on-chain model for issuance, ownership confirmation, circulation, and financialization, transforming them into asset units with sustainable trading structures. RWA's New Narrative: On-Chain Access to Cultural and Creative Assets RWA's first phase primarily revolves around financial assets such as US Treasury bonds, real estate, and corporate bonds. These products offer clear cash flow and mature valuation models, making them suitable for institutional funds and high-net-worth investors. However, their asset sources rely on offline financial institutions, issuance is subject to regulatory constraints, product homogenization is increased, and yields are significantly affected by macroeconomic interest rate cycles. For ordinary on-chain users, the motivation to participate is largely focused on capturing interest rate spreads, creating a disconnect from the native crypto culture of participation. Meanwhile, globally, cultural, artistic, and IP assets have long been characterized by high value and low liquidity. The cultural and artistic IP market is estimated at around $6.2 trillion, but the circulation efficiency of this massive asset pool is very low, with assets concentrated in the hands of a few collectors, institutions, and platforms. Creators often find it difficult to share in the long-term appreciation of secondary market value, while ordinary users struggle to participate in early value formation. This is a typical mismatch between value and participation, where asset value is concentrated while participation rights are scarce. The expansion of the attention economy and creator economy has made this mismatch even more pronounced. Increasingly, value stems not from stable cash flow, but from community density, reach, and cultural identity. The commercial returns of content, IP, and art projects largely depend on users' willingness to invest time and emotion. The difference between these assets and traditional RWAs is that the latter rely on a yield curve, while the former relies on user structure and participation behavior. In a highly community-driven, globally fluid crypto market, the match between cultural assets and on-chain data is actually higher than that of some traditional financial assets. Therefore, cultural RWAs have the potential to become a new direction for development. The underlying assets still originate from the real world—artworks, IP copyrights, offline performances, or other cultural content—but the value discovery method no longer solely focuses on discounted cash flow, further incorporating narrative strength, user participation, and long-term cultural identity. However, the challenge lies in pricing. Traditional art and IP markets rely on historical transaction records, authoritative institutions, and expert evaluations. This system is friendly to professional investors but extremely opaque to ordinary participants. Cultural value itself is highly subjective and difficult to assess using a single valuation model. Ultiland's approach is to partially delegate the valuation process to the market, allowing on-chain participation, trading depth, and holding structure to contribute to price discovery. Using ARToken and an innovative Meme-like RWA model, it creates a tradable testing ground for cultural assets. It introduces a more open participation layer, allowing cultural value to be re-evaluated with a larger sample size. The change in participation threshold is equally important. High-value art and IP have long been accessible only to a small group of people, with thresholds often in the millions. After assets are split on-chain, they can be offered to a larger user base in smaller segments. This changes the capital structure, not the artwork itself. For the existing market, this means that previously closed value units are being incorporated into a global liquidity pool for the first time; for the incremental market, this structure offers a participation method closer to the capital market and better aligns with the small-amount, frequent, and diversified allocation habits of crypto users. Under this logic, Ultiland's work is not simply about changing how art is sold, but rather an attempt to build a complete on-chain infrastructure for cultural assets. This includes everything from ownership confirmation and issuance to splitting, trading, and finally, using a dual-token economic model to facilitate long-term value transfer. From the perspective of RWA evolution, this is a branch that has emerged following changes in the real-world economic structure. Traditional financial RWAs deal with funds and interest rates, while cultural RWAs deal with attention and recognition. Although they differ in asset attributes, they have the opportunity to be placed within the same market mechanism on-chain. Ultiland's core mechanism: On-chain issuance and value loop of cultural assets. The on-chain transformation of cultural assets requires a clear path. Ultiland's approach starts from the commercial logic of art and IP, supporting the on-chain issuance and lifecycle management of a wide range of real-world assets, including artworks, collectibles, music, intellectual property, physical assets, and non-standard equity. Users can enjoy full-stack services: token minting, asset valuation, decentralized auctions, and AI-assisted creation tools. The value of this type of asset consists of three dimensions: cultural value, financial value, and application value. It attempts to establish a unified expression for these three on-chain and form a sustainable value cycle structure. Ultiland's base layer is ARToken. This is an on-chain unit representing cultural or artistic assets, serving as both an expression of ownership and a form of asset circulation in the market. ARToken supports on-chain issuance of various assets such as artworks, antiques, design works, and IP copyrights, and completes the confirmation of rights, valuation, issuance, and trading processes through its RWA Launchpad. Ultiland's first market-facing case is EMQL, an art RWA project corresponding to a "Doucai (enamel-painted) double-eared flat-bellied vase with intertwined floral patterns" from the Qianlong period of the Qing Dynasty. This unique imperial kiln piece originally belonged to a niche collecting community. Legend has it that it was a token of affection given by Emperor Qianlong to his beloved concubine, commanding an extremely high price. It is currently held in escrow in Hong Kong. Ultiland has split it into 1 million ARTokens on-chain, with a subscription price of 0.15 USDT per token, making this asset, previously confined to a closed market, accessible on-chain. On December 3rd, Ultiland launched its second RWA ARToken, HP59, a token inspired by "Here and There - Spirit Series - No. 59," created by Wu Songbo, the designer of the dynamic sports icons for the 2022 Winter Olympics and a digital media artist. It symbolizes the fusion of nature and spirit, marked by a pheasant soaring above rocks in Taihu Lake, surrounded by bamboo groves and distant pine trees. The token represents harmony, vitality, and eternal tranquility. HP59 reached a high of 7.78 times its initial price after opening.

Another mechanism of Ultiland emphasizes market-driven value discovery.

Summary

According to a report jointly released by Art Basel and UBS, the global art market is projected to reach $75 billion by 2025. Innovations such as NFTs and RWAs allow artists, collectors, and stakeholders to view art as both a cultural product and a financial instrument. Ultiland's position on this path depends on its ability to continuously organize the supply of high-quality cultural assets, maintain a clear value recovery mechanism for creators and investors, and maintain the stability of its token model amidst multiple market fluctuations. If asset issuance can expand from single artworks to IP, entertainment, and the creator economy, the platform will gradually transform from a project provider into an infrastructure provider at the asset layer. Conversely, if the asset side remains limited to a small number of targets, or if token circulation relies too heavily on real revenue, the infrastructure narrative will weaken. In the future, the on-chaining of cultural assets will not replace financial RWAs, but rather coexist with them, forming two asset bands with different risk-return characteristics. The former is more volatile but highly correlated with user participation; the latter offers stable returns but is more institutionally friendly. Ultiland is currently building a platform on the cultural asset side that can support large-scale experiments. If a relatively mature cultural RWA sector emerges in the market in the next few years, then these projects today will likely be seen as early prototypes of infrastructure.

Anais

Anais